We highly recommend reading the whole article for both existing and new users. The article explains all the most important updates and changes you need to understand to ensure your crypto tax reports are as accurate as possible.

Since Coinpanda was founded in January 2019, our goal has been to create the most easy-to-use tax solution for cryptocurrencies and DeFi. The journey has been both extremely challenging and rewarding up until this day, and we feel very proud of what we have accomplished and how far we have come. However, our motivation is primarily derived from continuous feedback and interactions with our users, which keeps us working late at night and pushing the boundaries for crypto tax reporting and tax compliance for people worldwide.

In January 2022, our team sat together and asked the question:

“How can we offer the single-best crypto tax platform that exists today, and also ensure we have a positive impact on the adoption of crypto and Web3, and help people from all parts of the world achieve financial independence and prosperity?”

Today, we are finally ready to reveal what we have been working day and night on for the past year: Coinpanda v3 – the third iteration of our crypto tax software!

We have a lot of goodies for you today. More specifically, 27 product updates will be covered in this article. We highly recommend reading the entire article to understand better how Coinpanda v3 works and what to consider if you are an existing or new user.

Design and UI/UX

The first thing you might notice is the new design of the Coinpanda platform. The entire website is developed from scratch, and we turned every stone to improve the design and user experience on every page. Coinpanda v3 should feel much faster and easier to navigate than the old site. We hope you like our new design as much as we do!

The design and UI/UX are improved massively, and the new technologies allow us to roll out new features much faster. We have a long list of new features that will be released in the next 2-3 months, which will be covered later in this article.

Dashboard experience

Improving the Dashboard experience has been one of the most requested features for a long time, and we decided to postpone this upgrade until the new site was released. There are, in principle, three different new features to be aware of:

NFT portfolio

All individual NFTs are now visualized on the Dashboard with their image asset so you can quickly get a complete overview of your current NFT portfolio across 100+ blockchains supported with API integration. The Portfolio table also shows the cost basis for each NFT in your current portfolio and provides details for the expected realized gain once you decide to sell or dispose of the NFT.

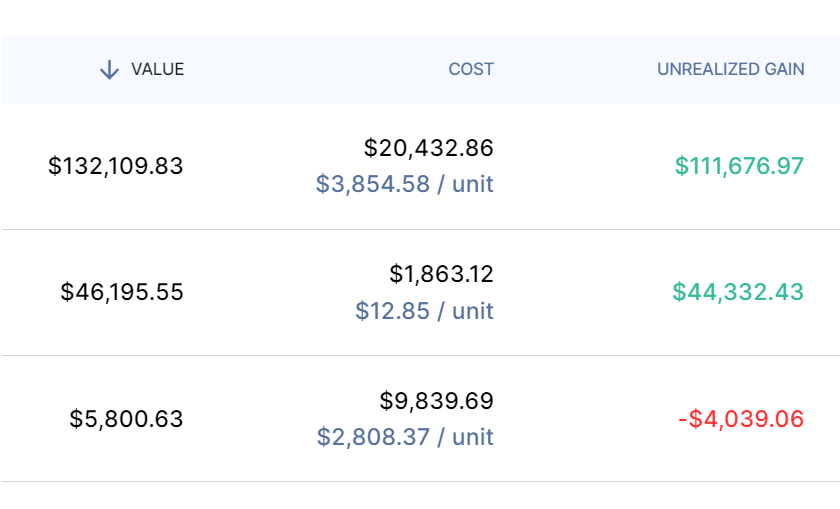

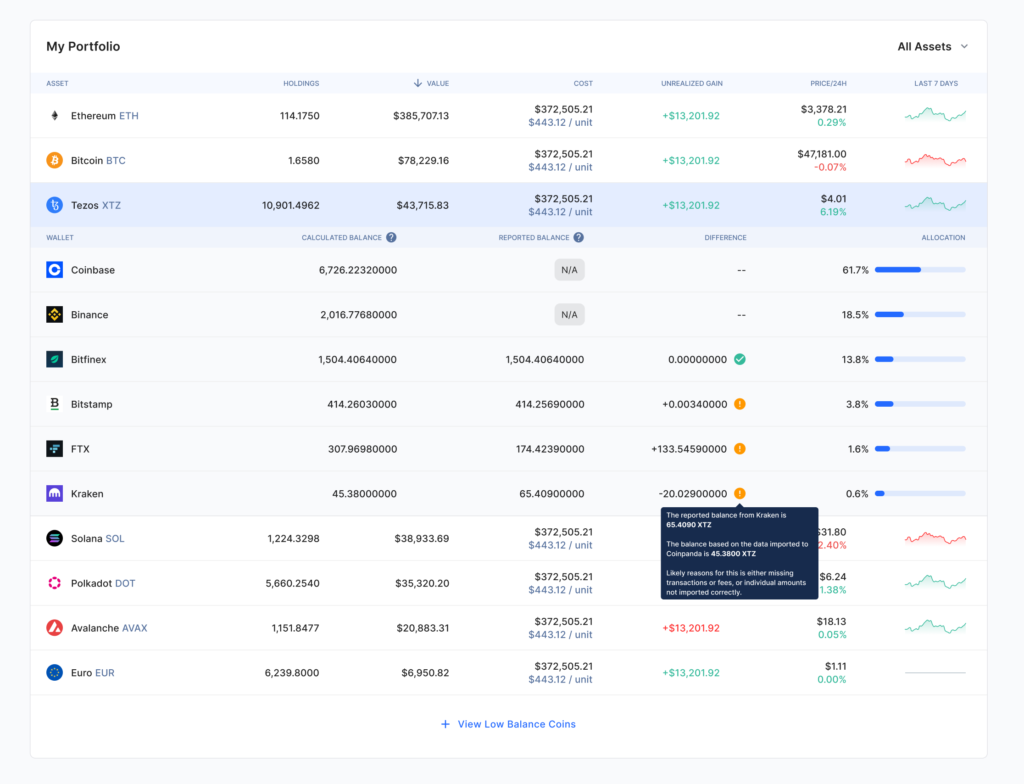

Cost and unrealized gain

Two new columns have been added to the Portfolio table: Cost and Unrealized Gain. The Cost column shows the asset’s total cost basis. The value represents the total price paid in your local currency to acquire the asset. The Unrealized Gain column is calculated as the total cost value subtracted from the current market value. It shows the estimated realized gain if you sell the asset at the current market rate.

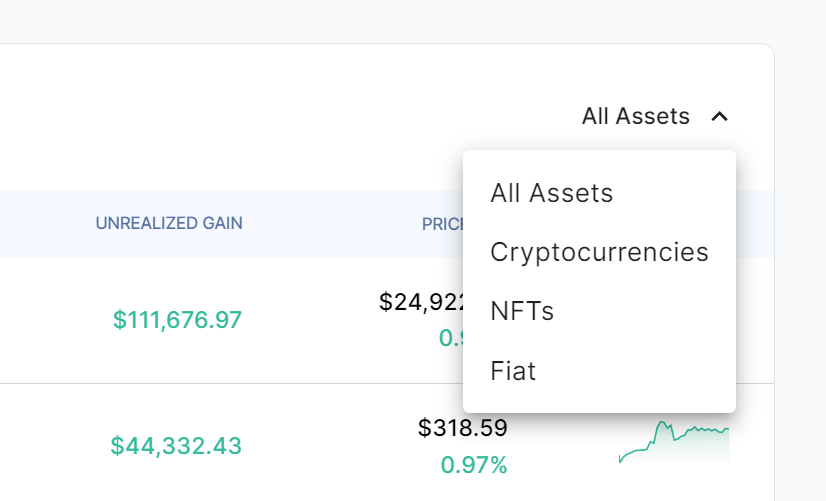

Asset type filter

Another new addition to the Portfolio table is the Asset type filter which lets you filter assets based on type: Cryptocurrencies, NFTs, or fiat. This filter can come in handy in a few different ways. For example, if you want to showcase your NFT portfolio to your friends but hide your other crypto assets, or if you want to check your portfolio balance for accuracy.

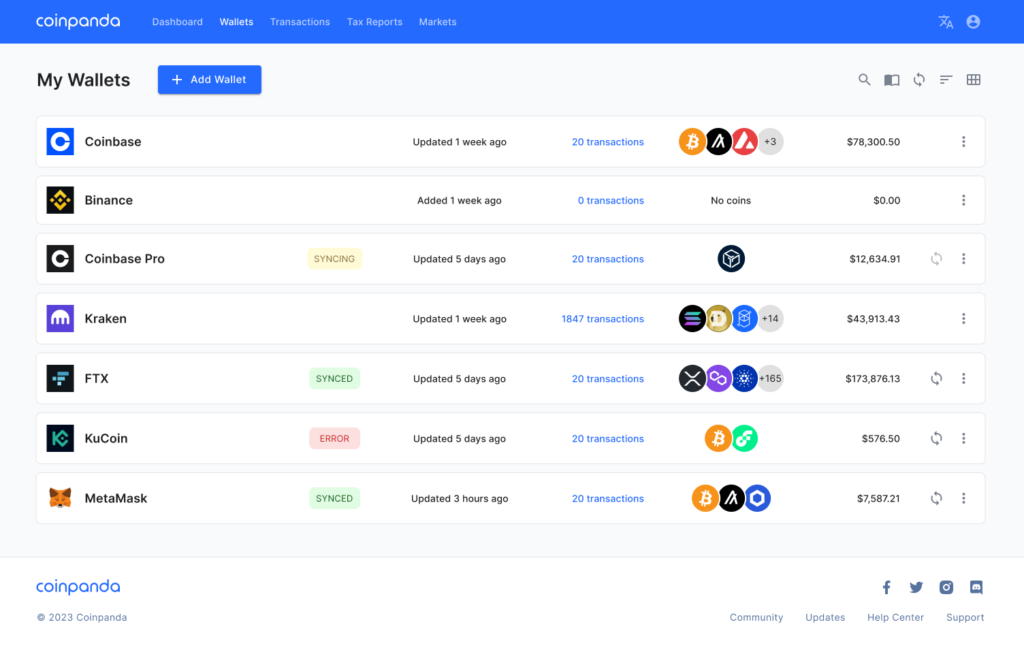

My Wallets

The My Wallets page might look familiar, but there are two new details added to the new site:

- Start sync of all wallets

- Sort wallets by transactions or date added

The sync icon, next to the search icon, will start the API sync of all your wallets. This might save you some time if you have added many wallets and would like to import all your latest transactions with a single button click.

The sort icon on the right side of the sync icon lets you toggle between sorting by the number of transactions or the date added. Sort by the date the wallet was added is the default setting.

Sneak preview

A feature that will be rolled out at the beginning of March is toggling between a grid and a list view of your wallets. The list view provides even more detailed information about your wallets, such as the currencies held and the total value of your assets in each wallet.

See also the end of the article for more sneak previews!

ETA: March 2023

Detailed Wallet

The Detailed Wallet page comes with a few new improvements and features:

- All transactions from each API sync or file upload can be deleted separately. This can be useful if you have imported new transactions in your wallet but don’t quite understand what caused some of your tax numbers to change or experienced some other issues like incorrectly identifying currencies. You can now revert all the changes with a single button click by deleting only the last imported transactions.

- You can download the CSV or XLSX file previously uploaded. This can be useful if you have several files uploaded in the same wallet and want to see which files you uploaded previously.

- Each file upload history has an Import Summary page which shows more details about the imported file. You can also download the file from this page. We will explain this page in more detail later, so keep reading!

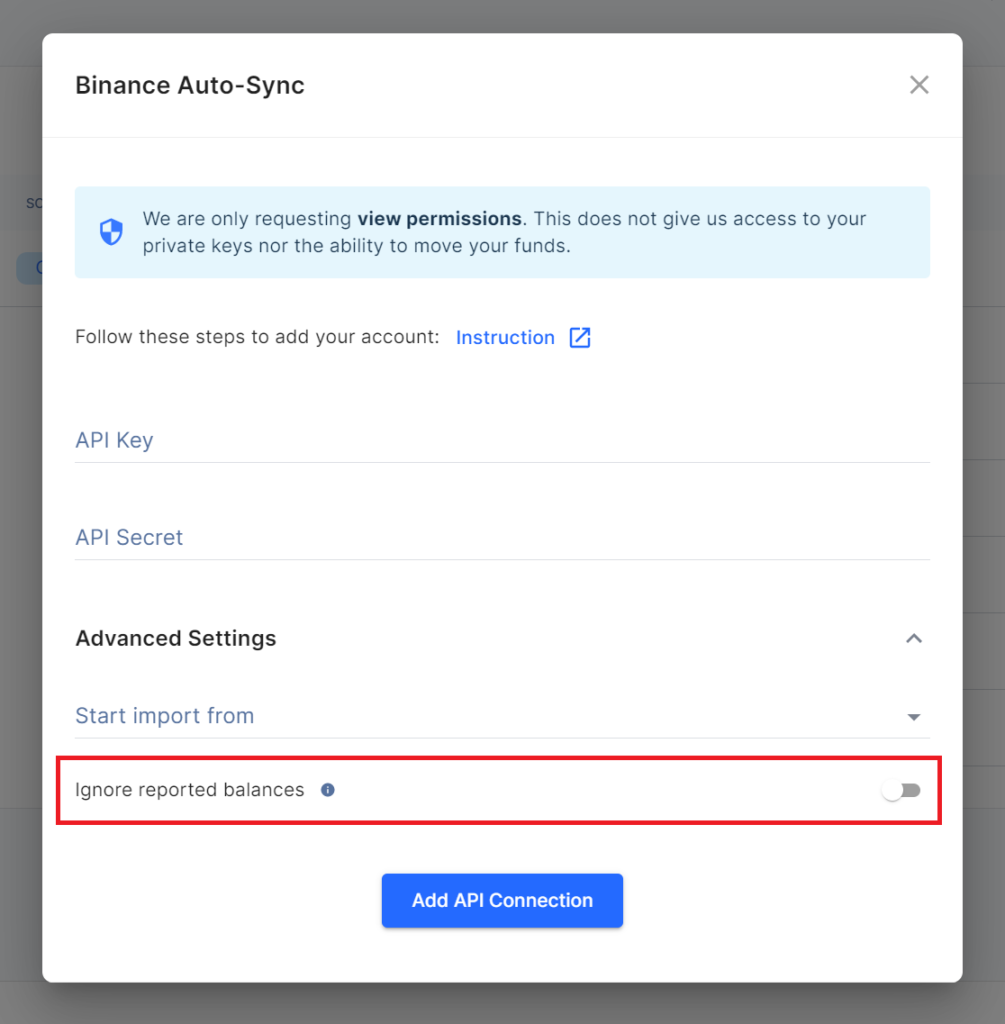

By default, Coinpanda will display your wallet balances from the API on the Dashboard whenever you have configured Auto-Sync for the wallet. However, if you prefer to show instead the balance calculated from the imported transactions, you can enable this from the switch in the API modal.

Multiple addresses per wallet

Managing many wallet addresses for tax calculations can create some headaches. For example, adding 20-30 addresses as separate wallets can easily make it challenging to keep all your wallets synced and up to date. To solve this, we support multiple addresses in the same wallet so that you can more easily organize all your addresses and transactions.

You can also view your wallet balance for each address separately or select any number of addresses to view the aggregated balance. Sounds nice, right?

Import Summary

One challenge with importing transactions by uploading CSV files is that it can be difficult to fully understand which rows in the file were ignored, skipped, or rejected. To solve this, we have created a new page: Import History.

This page breaks down all details from all files uploaded and shows you the exact row numbers and row data that were not imported. You will also see the number of successfully imported transactions and if any transactions were skipped due to duplicates (if they were already imported previously).

We believe this will be a welcoming feature that many users will find valuable. It will also provide our customer support team with an extra tool in the tool belt when helping our customers troubleshoot uploaded files.

Transactions

The Transactions page is the page you will likely spend most of your time on. Troubleshooting transactions can be a daunting but necessary task, so we put our minds together to create the most user-friendly yet advanced Transactions page experience possible.

There is a lot to unpack here:

New transaction labels

To keep up with the ever-changing landscape that is cryptocurrencies, DeFi, and NFTs, we have introduced seven new transaction labels:

- Mint

- Approval

- Expense

- Collateral

- Staking Pool

- Bridge (see separate section)

- Personal Use (Australia only)

Categorizing your transactions can be crucial to ensure the maximum accuracy of your tax reports and to deduct costs that the tax authority in your country allows. Transaction labels also make it easier to track and understand all your transactions better.

Advanced filters

Being able to find any specific transaction(s) can be problematic in the case of having thousands of transactions imported into your Coinpanda account. To simplify this, we have introduced a new filter option called Advanced which gives you a whole list of new filter options:

- Source – filter transactions sent from an address

- Destination – filter transactions sent to an address

- Wallet Address – filter transactions imported from an address

- Transaction Hash – filter transactions by transaction hash

- Transaction Signature – filter transactions by transaction signature

- Description – filter transactions matching the selected description

- Import Type – show transactions imported from API, file upload, or added manually

- Hide Spam and Ignored – enable this to hide transactions marked as Spam or Ignored

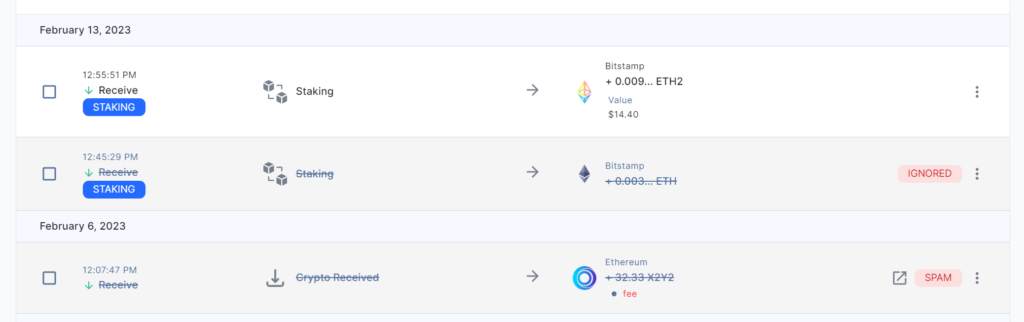

Mark as Spam / Ignore

We now offer two different tags for transactions that you want to ignore in all calculations:

- Spam

- Ignore

The Spam tag can be applied to all incoming Receive transactions not already labeled. For example, you will typically use this tag if you have received worthless spam tokens in your Ethereum or Binance Smart Chain wallet.

The Ignore tag is the same as before and can be applied to all transaction types. All tax and portfolio calculations will exclude transactions tagged Spam or Ignored. You can also hide ignored transactions from the Advanced filter option. Ignored transactions will be shown with grey background color and a pink label to separate them from your other transactions.

Missing Market Price

If Coinpanda does not have prices for a token on a specific day, you will see a red warning with the text “Missing Market Price” on the Transactions page. Clicking the warning will open a modal that gives you two choices:

- Ignore Warning

- Update Value

The first option, Ignore Warning, will simply ignore the warning and hide the warning message. This will not affect any of your portfolio or tax calculations. After ignoring the warning, you can filter for these transactions by selecting the “Ignored Warnings” filter, as seen in the video recording below.

The second option, Update Value, will open a modal where you can manually specify the token’s value. This can be useful if the token has real value and you want to update the value to ensure higher accuracy of your tax calculations. Changing the value will, however, affect your tax calculations, so you should only enter values as close as possible to the actual market value on the day of the transaction. See the next section for more information about how this works!

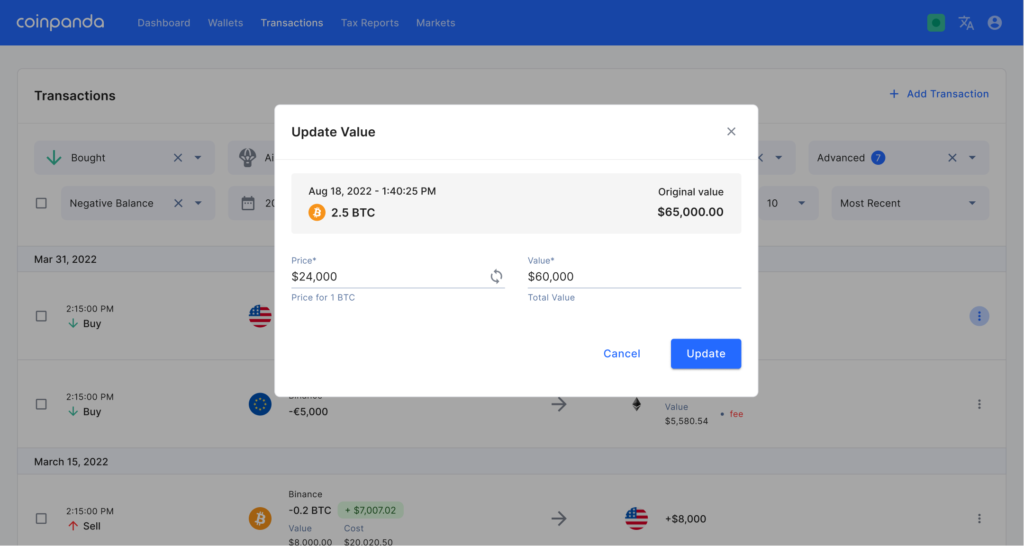

Update Value

The Update Value modal can be accessed in two ways:

- From the “Missing Market Price” modal

- Clicking the “Value” box in the transaction table

This modal will display the date and time of the transaction, the currency and amount, and the original value calculated from prices that Coinpanda has. The original value will show zero for transactions with Missing Market Price warnings when Coinpanda has no price.

You can change the value in either the Price or Value field on the left and right sides. The Price field is the token price, while Value is the total value of the tokens sent or received. You can edit either of the fields, which will yield the same result. Next, click Update to save the modified price, and a recalculation of your transactions will start automatically and consider the updated price value.

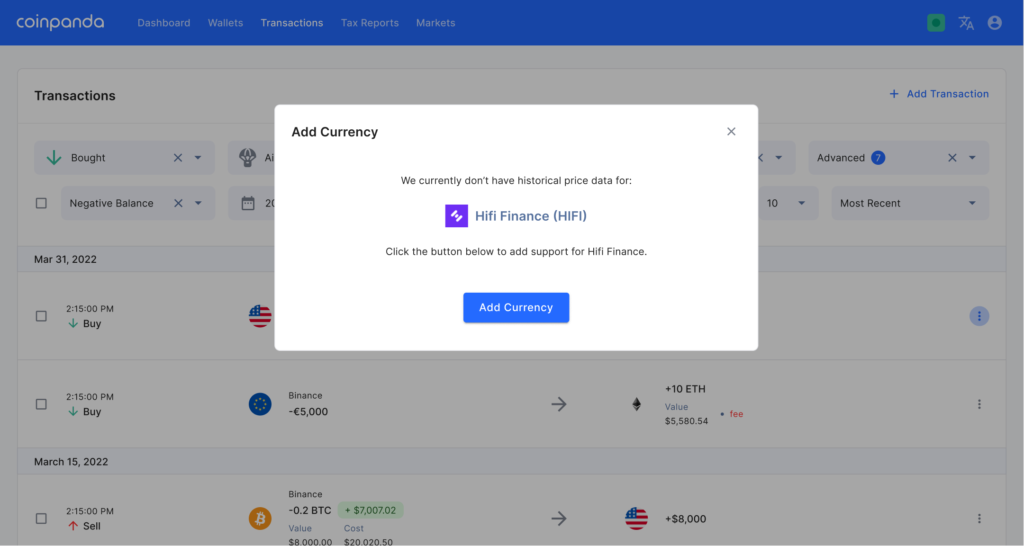

Add Currency

Sometimes you might see a warning with the text “Add Currency” instead of “Missing Market Price”. If you see this, you can fix the missing market price issue automatically by clicking the warning and “Add Currency” in the modal window.

Coinpanda will now start importing price data for the token, which can take up to 24 hours to complete. In this case, you might want to return to Coinpanda the next day and recalculate your transactions to ensure the correct prices are considered. Luckily, you need to do this one time only!

NFTs and DeFi

One of the most important new features of Coinpanda v3 is improved support for NFTs. Deeper integration for NFTs and DeFi has been one of our highest priorities and is something we have worked tirelessly on for over a year now. You might already have noticed that all NFTs are visualized on the Transactions and Dashboard page. As of the time of writing this article, Coinpanda has native NFT support from API sync from a total of 49 blockchains:

- Ethereum and 44 other EVM blockchains

- Cardano

- Solana

- Loopring

- NEAR Protocol

Bridged tokens

One of the new transaction labels is Bridge. When you bridge an asset from one blockchain to another, there might be special tax rules you need to consider. Coinpanda has native support for bridging assets between all 45 supported EVM blockchains, including Ethereum, Avalanche, Polygon, Arbitrum, and Optimism,

As of today, Coinpanda will automatically identify bridged transactions from 77 EVM bridges. You can also manually tag any Send or Receive transaction as Bridge if the tag was not applied automatically after API import. Coinpanda will, by default, consider a bridged transaction as a taxable event where you realize the gains on the token sent. However, you can change this on the Settings page such that bridged transactions are considered non-taxable.

New API integrations

Exchanges

Together with the release of the new site, we have also released API integration with five new exchanges:

- Bitget

- Zaif

- BingX

- CoinZoom

- DigiFinex

Coinpanda supports more than 400 exchanges today, but if you find that we don’t currently support an exchange you have used, please contact us so we can look into adding integration!

In addition to the new exchange integrations, we have also updated previous API and CSV integrations for more than 60 exchanges. We are willing to bet that you won’t find any other crypto tax platform that beats us regarding the number of integrations and the import accuracy!

Blockchains

With Coinpanda v3, more than 100+ new blockchains are now supported with direct API integration:

- NEAR Protocol

- IOTA

- Loopring

- ICON

- NEM

- 40+ EVM blockchains

- 49+ Cosmos ecosystem blockchains

The following blockchain integrations have been upgraded and significantly improved:

- Cardano

- Solana

- Cosmos

- Harmony

- Helium

- Nano

Some of these integrations have been highly requested for a long time, and we are proud to be the first crypto tax platform that supports blockchains such as NEAR Protocol and a total of 45 EVM blockchains.

What is the best way to learn more about the new API integrations?

Sign up for a free account today!

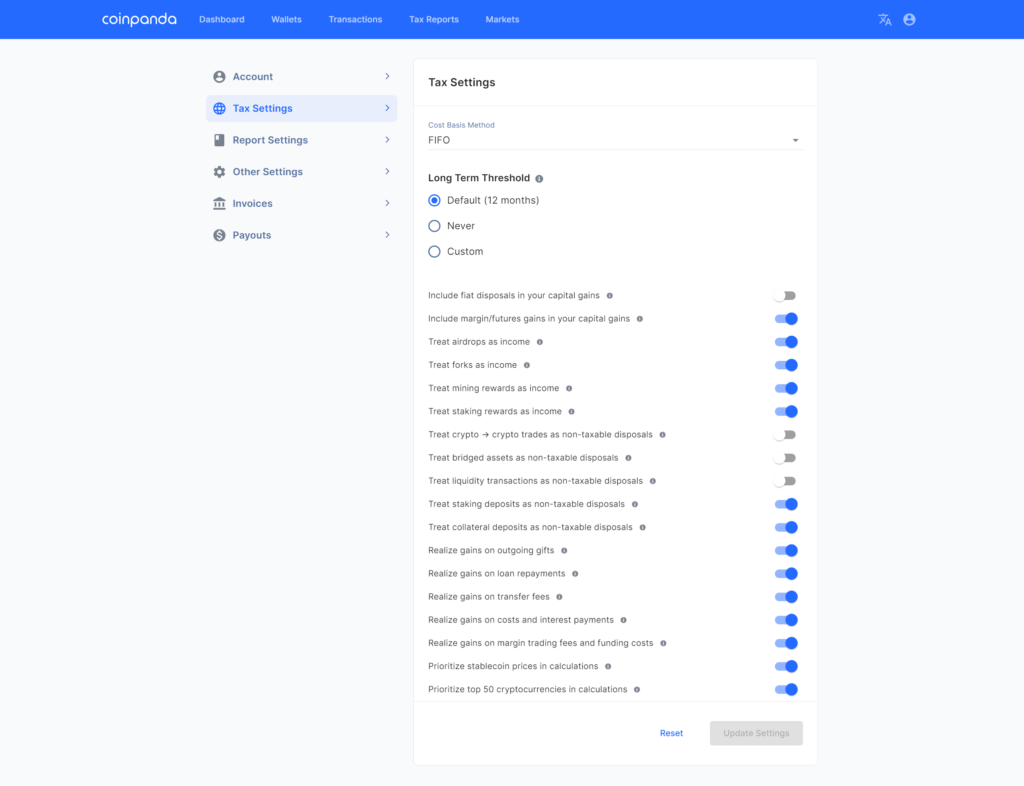

Tax settings

We have introduced 12 new tax settings that you can find on the Tax Settings page. We could write a separate article about these settings. We recommend going to the settings page and reading the tooltip messages to understand better how they can affect your tax calculations.

Generally speaking, we recommend most users not change any of the default settings for their country. You can click Reset to reset the settings back to default if you accidentally changed one or more settings.

We will write a more in-depth help article explaining the different settings later. Keep an eye out for this in the Help Center.

Supported countries

Coinpanda currently supports over 65 countries – probably the most supported countries by any crypto tax solution. In January 2022, we launched direct support for Japan, and with the new site, we are adding Ireland to the list together with Italy, which has been supported since October 2022.

The countries supported with country-specific tax reports include the USA, Canada, the UK, Australia, Italy, France, Ireland, Sweden, Norway, Germany, Austria, Switzerland, Luxembourg, and Japan. In addition to these countries, we also support the majority of countries which allows using the FIFO, LIFO, or ACB cost basis method for calculating capital gains.

Bonus: Sneak previews!

As we started saying at the beginning of the article, we have a lot of new features already underway that will be released very shortly. Here is a list of a few selected highlights coming soon:

Asset allocation breakdown per wallet

Viewing your total asset allocation breakdown on a wallet basis is essential for ensuring your portfolio balance is accurate. This feature will come to the Dashboard page sooner rather than later, allowing you to expand the portfolio row to see a complete breakdown of each unique asset.

ETA: March 2023

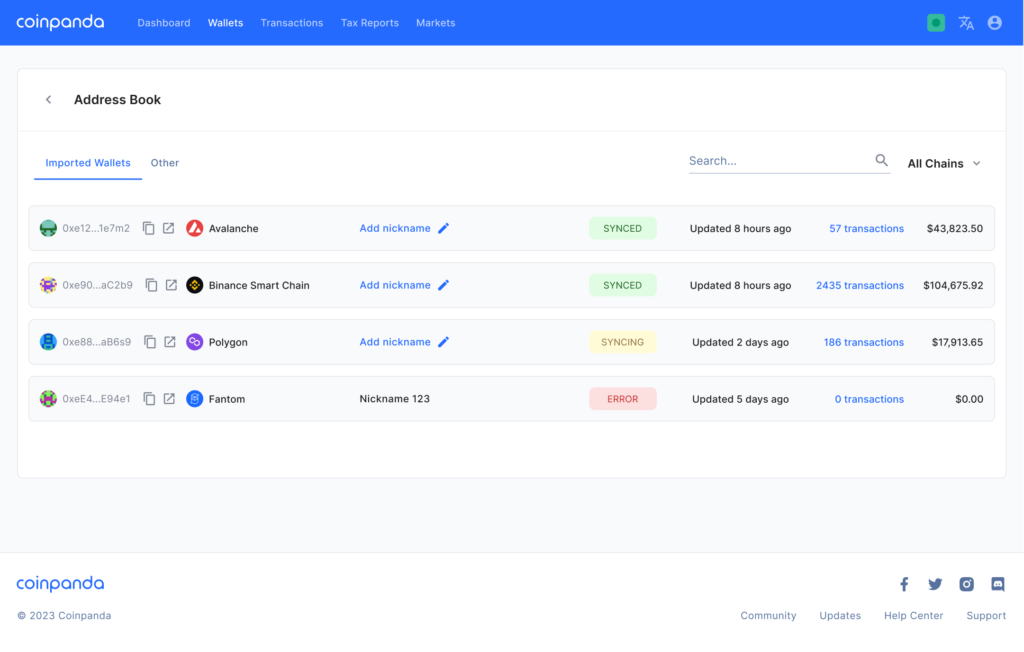

Address book

Have you lost track of all the different wallets and addresses, and where are your outgoing and incoming transactions sent to and received from? With the launch of a new feature – Coinpanda Address Book – this might become a little bit easier.

The new page will let you see a complete list of all your wallet addresses, and you can give each address a unique nickname that will be shown throughout the other pages as well. You can also give nicknames to any address you have sent to or received from.

ETA: March 2023

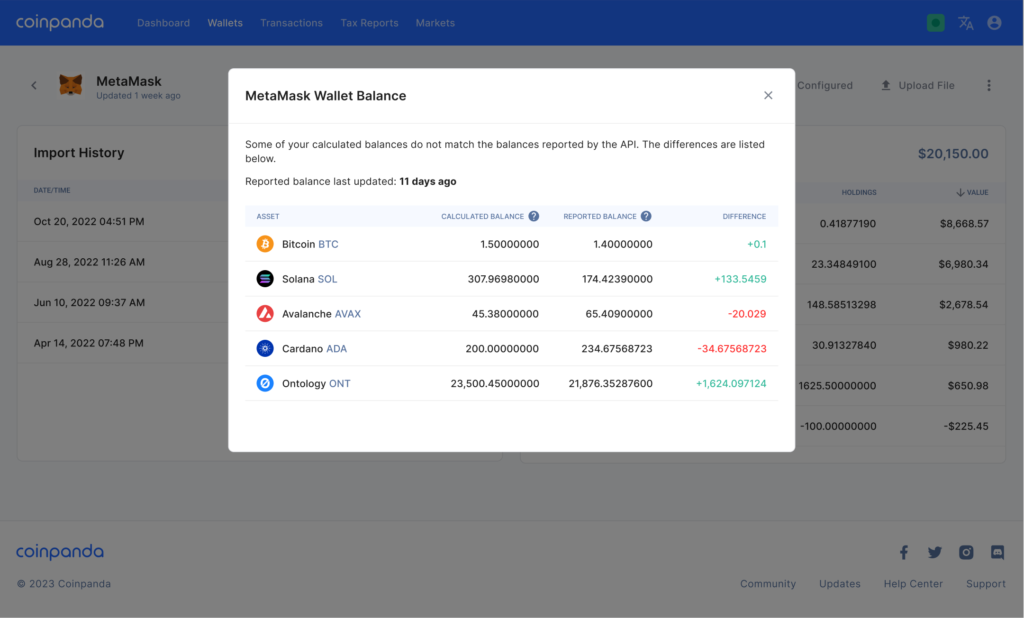

Wallet balance check

Maybe the most frequently asked question we get is about issues related to wallet balance. Yes, we know this can be a challenge, and that’s why we will let you view a complete breakdown showing the difference between the calculated and API-reported balance on a wallet basis.

ETA: March 2023

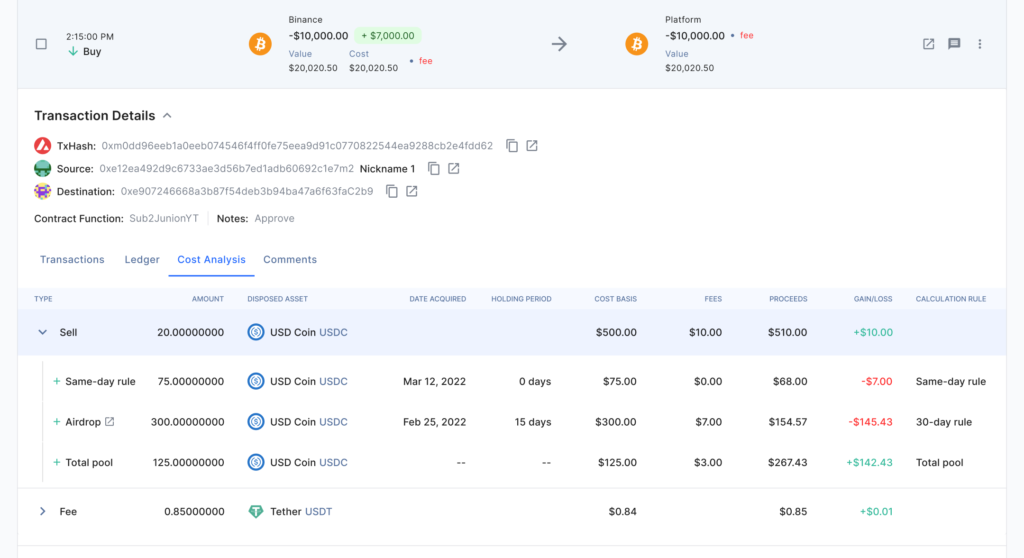

Transaction details

Ensuring the accuracy of tax calculations means that you often need to delve into how the cost basis is calculated. This can be anywhere from an easy, straightforward task, or a complete nightmare if you have thousands of transactions of the same currency. To make cost basis tracking more understandable, you will soon be able to expand any transaction to view all relevant information to that transaction. This will become a beneficial tool for understanding how the cost basis is calculated, and we can’t wait to share this with you!

ETA: April 2023