The Canadian Revenue Agency (CRA) has published a detailed tax guide for the taxation of cryptocurrencies and digital assets such as bitcoin. The CRA treats cryptocurrencies similarly to commodities such that the tax implications are that individuals in Canada need to calculate and report their capital gains when they sell or trade a virtual currency.

In this article, we will explain everything you need to know about calculating cost basis in Canada for your crypto transactions according to Adjusted Cost Base including the Superficial Loss Rule. We will do this in detail by using a few practical examples and easily understandable terms.

How to Calculate Capital Gains

In almost every country today, individuals have to calculate and pay capital gains tax if dealing with cryptocurrencies and other assets. For Canadian individuals, the CRA has clearly defined which type of actions are considered a taxable event:

- if you sell or gift cryptocurrency to someone else

- trading of cryptocurrency (eg. BTC → ETH)

- selling of cryptocurrency in exchange for fiat (eg. BTC → USD)

- paying for goods or services with cryptocurrency

The consequence of this is that most people that have either sold, traded, or dealt with virtual currencies in one way or another, are required to report this to the CRA.

Now, the question is how do you actually calculate these capital gains for your cryptocurrency transactions. The general formula for calculating capital gains is:

capital gains = selling price – purchase price

The selling price is the market value of the cryptocurrency sold on the date of the transaction, and the purchase price is the original purchase cost when you acquired the asset in the past. The purchase price should also include any reasonable acquisition costs like fees and commissions. This is often referred to as the cost basis.

As already mentioned, the cost basis needs to be determined according to rules for Adjusted Cost Base in Canada. In the next Sections, we will explain how this works in more detail, together with what the Superficial Loss Rule is and how it affects the cost basis for cryptocurrencies.

Adjusted Cost Base

To calculate the cost basis according to the Adjusted Cost Base rule, you need to keep track of the total purchase price and your total holdings of each asset at all times. To calculate the cost basis when you sell any cryptocurrency, simply multiply the total average cost with the number of coins sold or disposed of.

cost basis = coins sold * average cost

Now, this might not seem too complicated in and by itself, but the CRA has also put in place the Superficial Loss Rule which can make the calculations a lot more difficult to get done correctly by disallowing capital losses under certain conditions.

The Superficial Loss Rule

Let’s assume that you have bought and sold many different cryptocurrencies during the year. When the end of the year is approaching, you realize that you have significant net capital gains which means you need to also pay capital gains tax. At the same time, you also still own some assets that have fallen in price and are now at a loss.

Now, you might think that if you sell these assets today, you will reduce your net capital gains and pay less tax as a result. Because you want to still hold those assets, you plan to buy back the same coins 1-2 days after selling them. This might sound like a very strategic plan on paper, but unfortunately, it’s not that easy in reality.

The Superficial Loss Rule has been put in place by the CRA to prevent Canadian individuals from taking advantage of the potential tax savings. This rule comes into action when both of the following conditions are met:

- You acquire identical cryptocurrency during the period beginning 30 days before and ending 30 days after the disposal

- You either owned or had a right to acquire the cryptocurrency at the end of that period

If both conditions are met, you are not allowed to claim the capital loss from selling a cryptocurrency.

To get a better understanding of how the Superficial Loss Rule actually works, we will look at a few practical examples in the next Sections.

Example 1

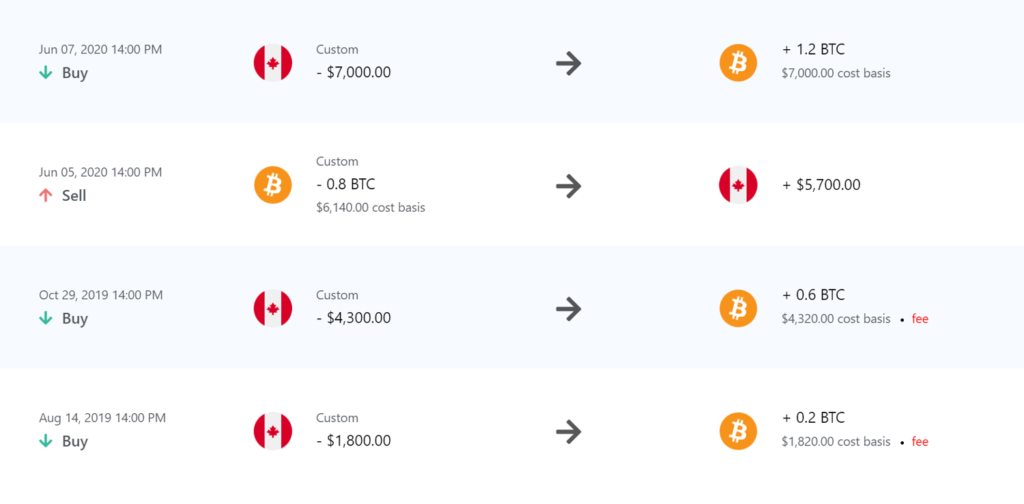

Our fictive character Mark has bought bitcoin on two occasions in 2019, and then later sold all his coins on the 5th of June, 2020. Later that year he bought 1.2 BTC again. All his transactions can be seen in the below table:

| Tx No. | Type | Date | Amount | Price | Fees | Cost Basis | Capital Gains |

|---|---|---|---|---|---|---|---|

| 1 | Buy | 2019-08-14 | 0.2 BTC | $1,800 | $20 | $1,820 | – |

| 2 | Buy | 2019-10-29 | 0.6 BTC | $4,300 | $20 | $4,320 | – |

| 3 | Sell | 2020-06-05 | 0.8 BTC | $5,700 | – | (?) | (?) |

| 4 | Buy | 2020-09-23 | 1.2 BTC | $8,200 | – | $8,200 | – |

For Mark to calculate the capital gains he needs to first find the ACB of his bitcoin holdings prior to the sale on the 5th of June.

Adjusted Cost Base:

1,820 + 4,320 = $6,140

ACB per coin:

$6,140 / 0.8 BTC = $7,675 per BTC

Since Mark sold all his coins, the cost basis is equal to his ACB ($6,140).

The resulting capital gains for Mark are therefore found as:

Capital gains:

$5,700 – $6,140 = ($440)

Mark has now realized a loss of $440 by selling his BTC at a lower price than what he originally paid. Note that the Superficial Loss Rule does not kick in because the first criteria above was not fulfilled: Mark did not purchase BTC during the period starting 30 days before and ending 30 days after the disposal on the 5th of June.

Coinpanda is a cryptocurrency tax software that can help with tax calculations for bitcoin and other cryptocurrencies. This is how the calculations look like if using this software:

Example 2

In this next example, Mark bought 1.2 BTC a few days after first disposing of his holdings. This means that the Superficial Loss Rule has been triggered, and Mark is therefore not allowed to claim the capital loss of $440 as found in Example 1.

| Tx No. | Type | Date | Amount | Price | Fees | Cost Basis | Capital Gains |

|---|---|---|---|---|---|---|---|

| 1 | Buy | 2019-08-14 | 0.2 BTC | $1,800 | $20 | $1,820 | – |

| 2 | Buy | 2019-10-29 | 0.6 BTC | $4,300 | $20 | $4,320 | – |

| 3 | Sell | 2020-06-05 | 0.8 BTC | $5,700 | – | (?) | (?) |

| 4 | Buy | 2020-06-07 | 1.2 BTC | $7,000 | – | (?) | – |

What Mark needs to do is add the capital loss ($440) to the ACB of the BTC bought on the 7th of June, 2020. The ACB for 1.2 BTC bought becomes:

Adjusted Cost Base:

7,000 + 440 = $7,440

ACB per coin:

$7,440 / 1.2 BTC = $6,200 per BTC

We can now summarize our findings below:

| Tx No. | Type | Date | Amount | Price | Fees | Cost Basis | Capital Gains |

|---|---|---|---|---|---|---|---|

| 1 | Buy | 2019-08-14 | 0.2 BTC | $1,800 | $20 | $1,820 | – |

| 2 | Buy | 2019-10-29 | 0.6 BTC | $4,300 | $20 | $4,320 | – |

| 3 | Sell | 2020-06-05 | 0.8 BTC | $5,700 | – | $6,140 | |

| 4 | Buy | 2020-06-07 | 1.2 BTC | $7,000 | – | $7,440 | – |

Compared to Example 1, Mark was not allowed to claim the $440 loss because he bought the same asset (BTC) only two days later which triggered the Superficial Loss Rule.

By using Coinpanda to run the same calculations, we see that the disposal of 0.8 BTC does not realize any capital loss.

Cryptocurrency Tax Software for Canada

It can be very challenging to keep track of all crypto transactions and calculate your capital gains correctly according to the guidance issued by the CRA which also includes the Superficial Loss Rule discussed. That’s why most people use a cryptocurrency tax calculator like Coinpanda to handle this and generate all required tax reports and forms automatically.

Coinpanda is one of the very few tax solutions that support Canada today (at the time of writing). You can sign up for a free account and download your tax reports in under 20 minutes.

Summary

We have in this article explained how capital gains and cost basis calculations for cryptocurrencies should be done in Canada according to guidance released by the CRA. We have also looked at the Superficial Loss Rule and under which conditions you are not allowed to claim a capital loss. Lastly, we looked at two practical examples where we worked out the cost basis and capital gains calculations for our fictive character Mark.

For more information about cryptocurrency taxation in Canada, we recommend that you read our free and in-depth tax guide that is updated regularly:

This guide covers not only how to work out the ACB, but also possible tax implications if you have received cryptocurrency from airdrops, staking rewards, hard forks, or participated in mining activities.

If you are looking for an easy and user-friendly solution to calculate your crypto taxes, we recommend that you check out Coinpanda. This tax solution has in a short time become very popular and has helped generate tax reports for more than 7,500 cryptocurrency investors and traders as of the time of writing this article.

You can easily import all transactions from exchanges like Coinbase and Binance automatically. The software has also full support for the Superficial Loss Rule so that you can file your next tax return with ease and confidence. Click here to read more about crypto tax reports, or sign up for a free account.