In this article, we will break down the most important reasons why you should consider moving from CoinTracker to Coinpanda. We will also explain in more detail how to make the switch to the most accurate tax solution.

Exchange integrations

CoinTracker supports a long list of the most popular exchanges, but there are quite many that are not supported with either API or CSV file upload. CoinTracker has not officially announced the total number of integrations they have, but it seems to be around 100 exchanges supported today. Coinpanda, on the other hand, supports almost all exchanges and blockchains that exist today. At the time of writing, Coinpanda has integration with significantly more exchanges than CoinTracker currently has.

| Tax Platform | Exchanges |

|---|---|

| CoinTracker | 100+ |

| Coinpanda | |

Blockchains and wallets

Similar to exchange integrations, CoinTracker does not support very many blockchains either. The official list by CoinTracker says that they have API integration with only 20 blockchains today. Coinpanda supports more than 120 blockchains today including the most popular like Ethereum, Cardano, Solana, Harmony One, and more.

How many wallets are supported by CoinTracker today is not known. It appears that they have only added support for the most popular wallets like MetaMask and Trust Wallet. Coinpanda supports almost 200 wallets today and new integrations are added each week.

| Tax Platform | Blockchains | Wallets |

|---|---|---|

| CoinTracker | 20 | Unknown |

| Coinpanda | |

DeFi and NFTs

DeFi has skyrocketed in popularity and adoption the past year, and you might be in the situation where you need help with figuring out your taxes for everything DeFi, liquidity mining, and staking! Luckily, both CoinTracker and Coinpanda can help you in this area, but there are some important differences you must be aware of.

Based on feedback from our users and also from what we have observed ourselves, CoinTracker does not always handle DeFi transactions correctly for tax purposes. Especially liquidity mining transactions do not appear to be handled correctly by CoinTracker at the time of writing. CoinTracker also only supports Ethereum and Binance Smart Chain, and not other EVM and L2 chains like Polygon, Avalanche, and Fantom which is supported by Coinpanda.

| Tax Platform | Liquidity mining | Staking | NFTs – EVM chains* | NFTs – Cardano |

|---|---|---|---|---|

| CoinTracker | ||||

| Coinpanda |

When it comes to NFT support, both CoinTracker and Coinpanda support NFTs on Ethereum. However, while CoinTracker seems to only support the ETH and BSC chain, Coinpanda supports also all other EVM and L2 chains including Polygon, Avalanche, and Fantom!

After adding your public address to Coinpanda, you will be able to see all your NFT transactions on the Transactions page including a free preview of the gain/loss for every transaction. As a bonus, Coinpanda has also support for NFTs on Cardano.

Portfolio tracking

Both CoinTracker and Coinpanda have similar functionality when it comes to portfolio tracking. Both platforms let you connect your exchange accounts and wallets using either API keys or your public addresses. The Dashboard pages on both platforms give you a full overview of your portfolio holdings and the latest movements in the crypto market.

While Coinpanda offers a 100% free portfolio tracking feature, ConTracker offers only a paid subscription starting at $14/month but goes up to $99/month if you want all features. Because Coinpanda also supports many more exchanges and blockchains than CoinTracker does, we believe that Coinpanda is the absolute winner when it comes to portfolio tracking.

Customer support

Doing your crypto tax calculations can be both a very challenging and intimidating task, and it’s critical that you get enough support and help so that you are able to generate an accurate tax report. While both CoinTracker and Coinpanda provide similar support features, there are some important key differences you must be aware of.

CoinTracker does not offer live chat for any of its users. Email support is only available to users that have upgraded to the Premium plan which costs $199/year. Coinpanda, on the other hand, offers 100% free support to all users whether they have upgraded their tax plan or not. This is something you must consider if getting the appropriate help and support is important to you.

| Tax Platform | Live Chat | Email Support | Forum Support | Help Center |

|---|---|---|---|---|

| CoinTracker | ($199/year) | |||

| Coinpanda |

Both CoinTracker and Coinpanda have a community forum where you can report bugs and import issues or request new features and integrations. However, from reports we have received, it seems that Coinpanda support staff is much more active in the forum and engaging with users compared to CoinTracker.

Both platforms have an extensive help center with published help articles that explain most of the functionality, how to troubleshoot missing transactions, and how to import transactions from different exchanges and blockchains.

Pricing

Both CoinTracker and Coinpanda have a similar pricing plan structure. How much you need to pay depends on the total number of transactions for a specific tax year. All plans give you lifetime access to download tax reports for the year which you have upgraded. Both platforms have also custom plans for users with a large number of transactions exceeding the lower plans seen in the table below.

| Tax Platform | 25 transactions | 100 transactions | 1,000 transactions | 3,000 transactions | Higher limit |

|---|---|---|---|---|---|

| CoinTracker | $59 | $199 | $299 | $499 (20,000+) | |

| Coinpanda | $49 | $99 | $189 | $389 (20,000+) |

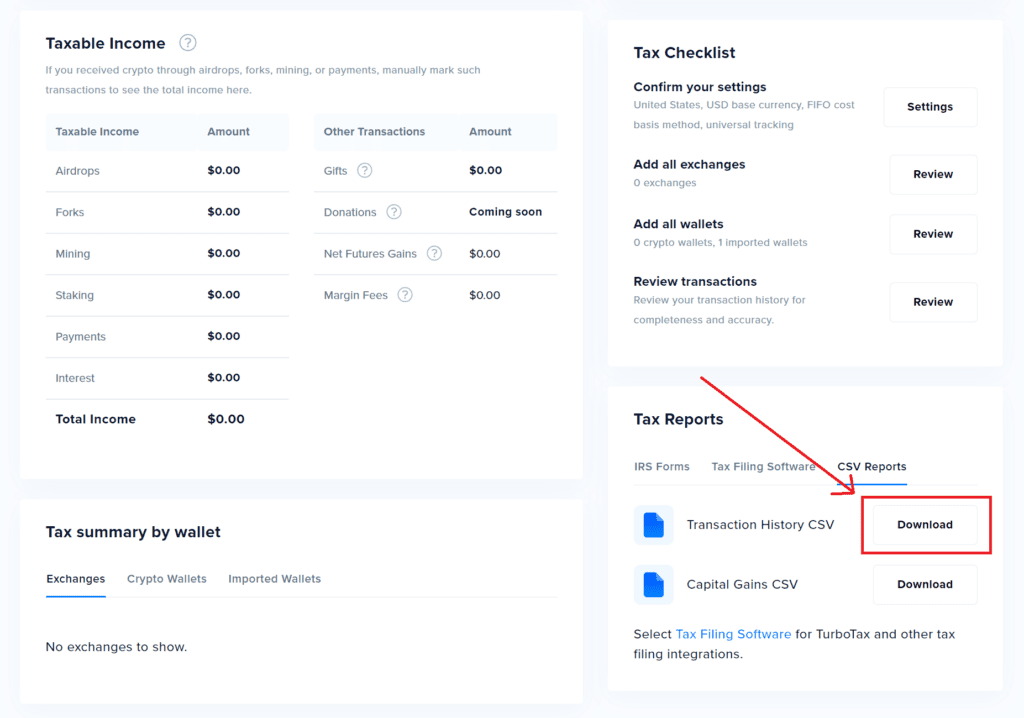

How to switch from CoinTracker to Coinpanda

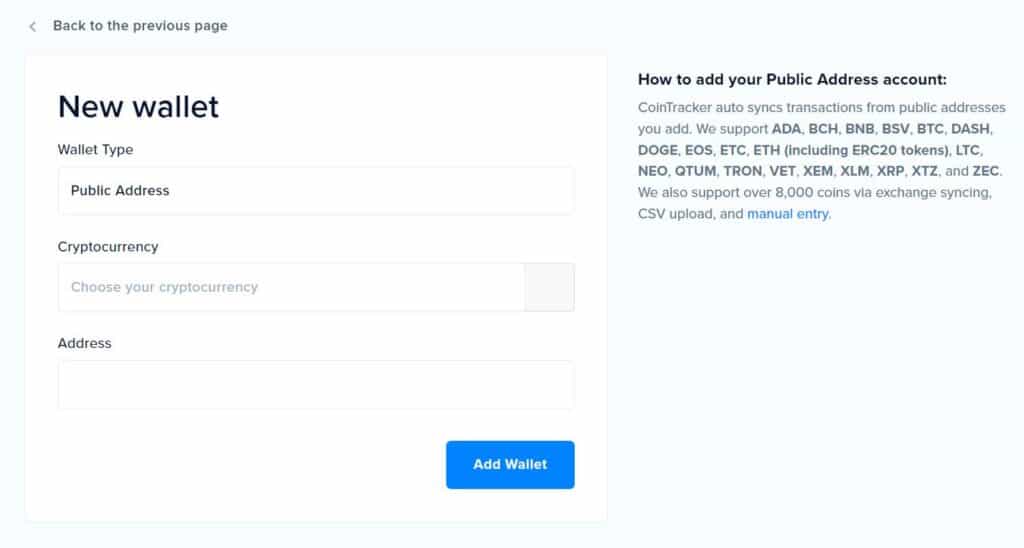

If you are already a CoinTracker user and want to switch to Coinpanda, you have two options:

Method 1

Export a CSV file with your complete transaction history from your CoinTracker account. Next, upload this file to a CoinTracker wallet in your Coinpanda account. Coinpanda will automatically detect and categorize your transactions similar to how they were imported to CoinTracker. All future transactions must be imported using either API import or by uploading CSV files.

Note that CoinTracker does not include transaction tags for margin trading in the CSV file, so this must be tagged manually after importing the file to Coinpanda.

Method 2

Connect your exchange accounts and wallets to Coinpanda and import all your transactions from all years you have traded crypto. This is the recommended method for several reasons:

- No duplicate transactions will be imported

- Makes it much easier to import future transactions and keep all your wallets up to date

- Avoids the possibility of transactions imported wrongly to CoinTracker to be imported in your Coinpanda account

- Easier to debug and troubleshoot the data imported

Our support team is available 24/7 to help you migrate from CoinTracker to Coinpanda – 100% free of charge! If you have questions, please contact our support team and they will guide you through the process.