CRYPTO TAX SOFTWARE FOR ACCOUNTANTS

Crypto tax accountant suite

Easily generate crypto tax reports for your clients with Coinpanda’s crypto tax suite for CPAs and tax professionals.

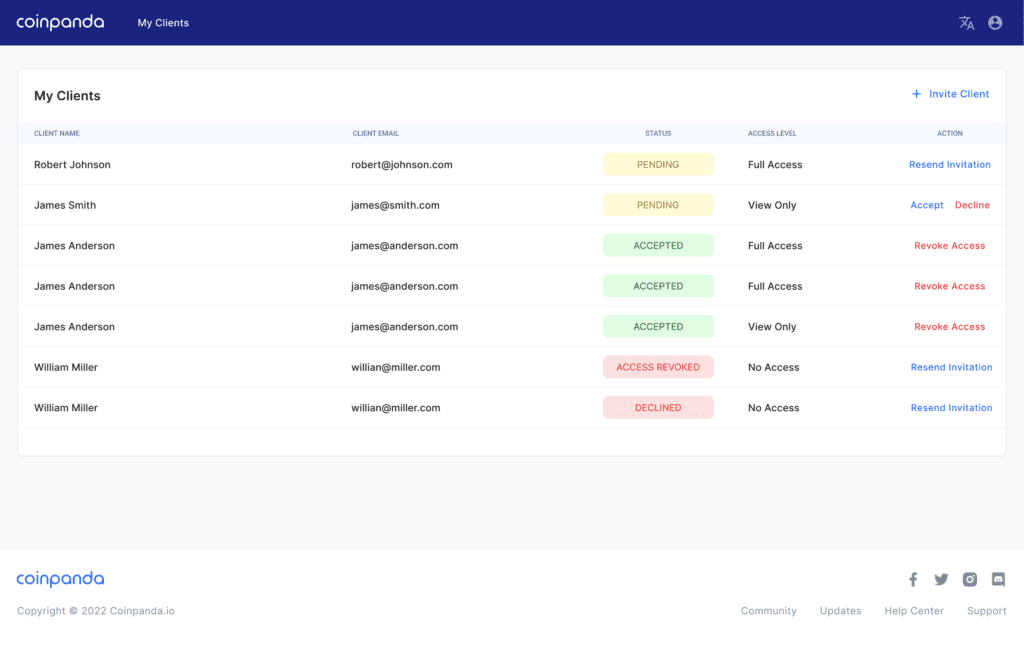

Manage all clients from a single dashboard

800+ exchanges and wallets supported

IRS forms and other country-specific tax forms

Tax reports compliant with the IRS, ATO, HMRC, CRA, and others

Why choose Coinpanda?

- We offer a crypto tax solution recognized as one of the industry-leading platforms globally today. Support for 65+ countries and direct integration with 800+ exchanges and wallets make Coinpanda the best choice for your clients!

- Manage all clients from a single dashboard and utilize the powerful features of our custom-built accountant suite. Easily switch between full or read-only access to your client’s transactions.

- Get access to our premium customer support only offered to accountants and CPAs. Request assistance or report issues directly to our product support specialists.

- Take advantage of our competitive pricing offers available exclusively to accountants.

How it works

Track your clients’ transactions & calculate their taxes automatically in 3 steps.

01

02

03

Invite your clients

Invite and manage all your clients from a unified dashboard. You can also connect with clients already signed up with Coinpanda.

Import data

Your clients can toggle between full or read-only access to their accounts. With full access, you can import, edit and manage all transactions.

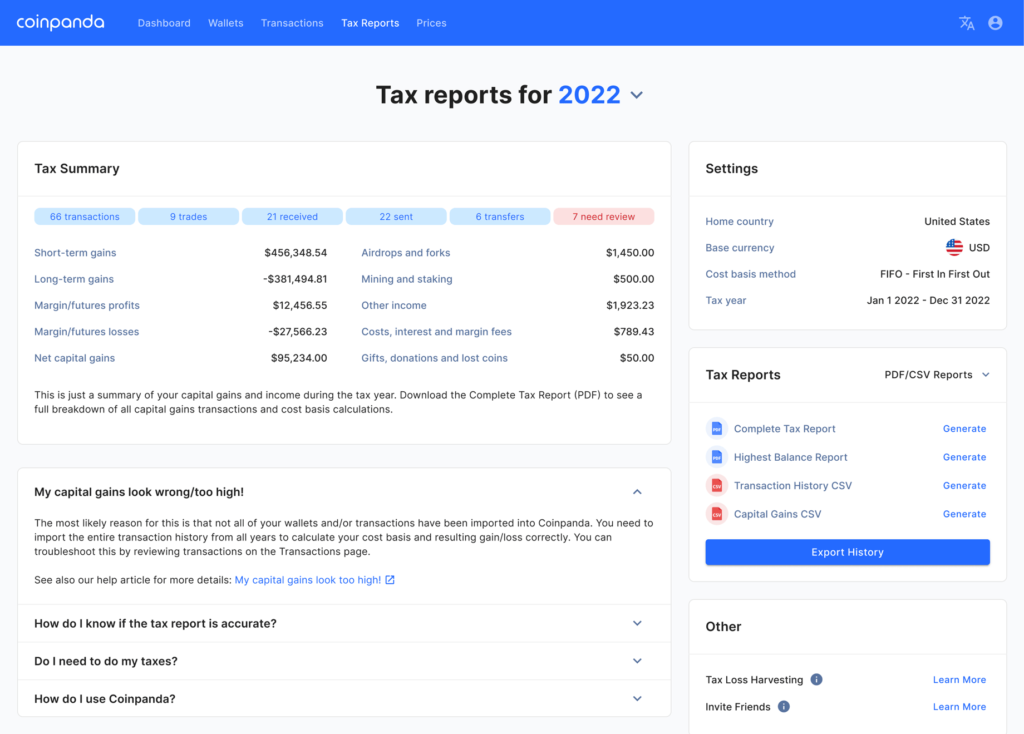

Download tax reports

Automatically generate tax reports and forms compliant with tax authorities such as the IRS, ATO, HMRC, CRA, and many more.

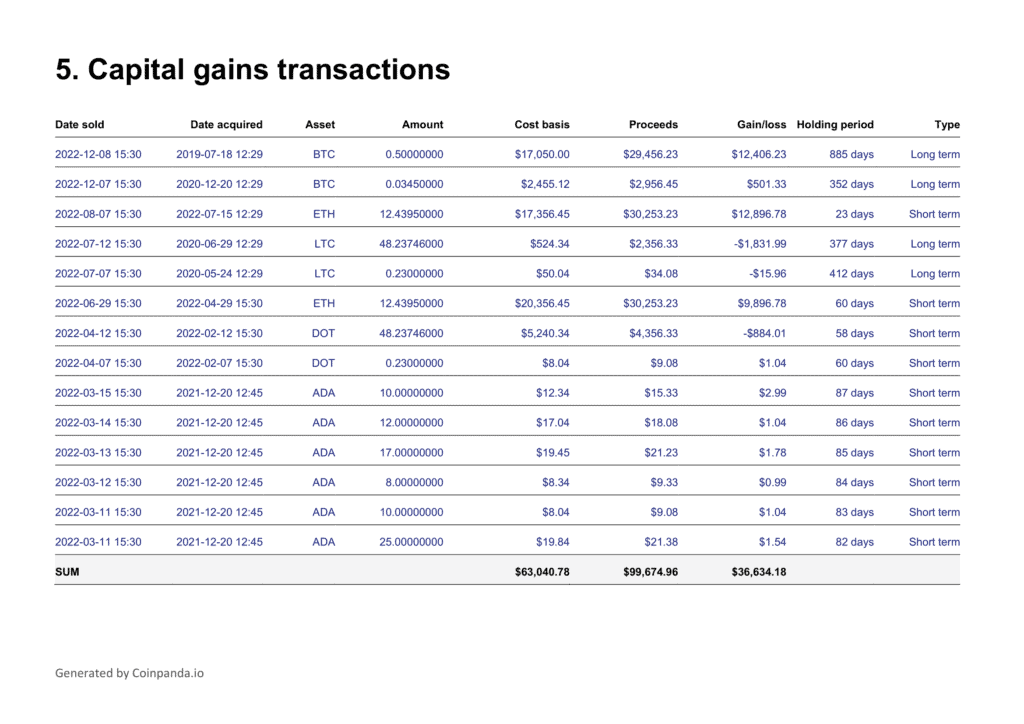

Capital gains report

View all your client’s cryptocurrency transactions and taxable gains in a single report. Get a detailed breakdown of the proceeds, acquisition costs, and long-term and short-term gains for each NFT and crypto asset.

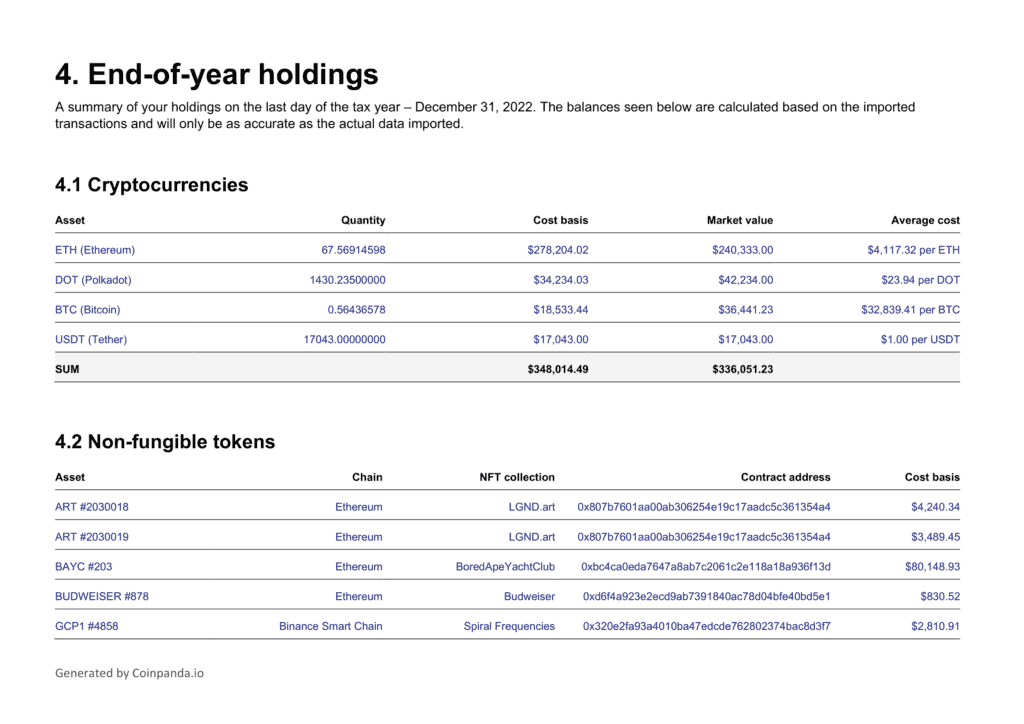

End-of-year holdings

The end-of-year holdings report breaks down your client’s asset allocation, cost basis, and market value on the last day of the tax year for each cryptocurrency, NFT, and fiat currency.

Frequently Asked Questions

Get advice and answers to the tax accountant suite.

Do my clients need to create an account too?

Yes, each of your clients needs to create their free Coinpanda account first. After signing up, your clients can invite you to access their account (and vice-versa) with either full or read-only access. Your clients require no further actions after this.

How do I upgrade my clients’ accounts?

Your clients can upgrade their accounts themselves, or you can upgrade directly when logged in as each client. This ensures that you can seamlessly collaborate with clients who have already subscribed to a paid plan and new users.

Do you offer special pricing offers?

Yes, we offer competitive pricing packages for tax accountants managing multiple clients. To give you the best possible offer, please contact us at accountants@coinpanda.io and include the number of clients you have today.

How do I request help and support?

We highly value all tax accountants we work with, and our goal is to provide the best customer support experience in the industry. In addition to the ordinary support channels, we can offer custom-tailored support based on your needs – free of charge! Please get in touch with us at accountants@coinpanda.io for more information.

Contact us

Any questions about the accountant suite?