With the growing popularity of cryptocurrencies, the question surrounding how the asset class should be taxed becomes something that can’t be ignored any longer. While most people don’t like paying taxes on their crypto gains, the reality is that crypto is not exempted from taxation but is instead treated much similar to shares or stocks. To help Finnish taxpayers understand how they should calculate and report their crypto taxes, Vero has released official tax guidance on the topic of crypto taxation. Read on to learn more about how crypto is taxed in Finland, how much tax you must pay on your crypto gains, and how to report your crypto taxes to the Finnish Tax Administration, Vero.

Just a heads up! This guide is quite extensive due to the complex nature of cryptocurrency taxes. While we recommend reading this guide from A to Z the first time to make sure you don’t miss out on anything important, you can also use the menu navigation on the right side to jump to any specific crypto tax question later.

We are also updating this guide regularly based on the latest tax guidelines and statements from Vero. All updates will be listed below so that you can quickly see if anything has been updated since your last visit:

Latest updates

- August 27, 2022: The first version published

Let’s start with the most important question of all…

Do you pay tax on cryptocurrencies in Finland?

Profits from exchanging or selling cryptocurrencies are taxed as capital income and subject to Capital Gains Tax in Finland. The capital gains tax rate is 30% for capital income not exceeding €30,000 and 34% on the excess above this limit.

How is crypto taxed in Finland?

The Finnish Tax Administration does not view cryptocurrency as similar to fiat currencies such as the euro, nor as legal tender, but is instead considered a type of personal asset that can be traded freely on the open market. The official definition from Vero is that cryptocurrencies are a form of digital value that:

- No central bank or other public authority has been the issuer, and which is not considered legal tender for payment purposes

- Can be used by a person to settle a liability

- Can be electronically transferred, electronically saved, and electronically exchanged

What does this mean for how crypto is taxed in Finland?

Profits from exchanging or selling cryptocurrency are considered capital income for tax purposes and are therefore taxed as Capital Gains Tax. The general rule is that each time you spend or otherwise dispose of a cryptocurrency, you need to pay Capital Gains Tax on the resulting profits.

Income received from mining and staking is usually considered to be earned income for tax purposes and attracts therefore Income Tax rather than Capital Gains Tax.

In the next section, we will look at the current tax rates in Finland.

Tax rates in Finland

Capital Gains Tax

Capital gains from the selling of shares, equities, or cryptocurrencies are generally included in the taxable capital income that is subject to a 30% tax rate on the amount up to €30,000, and a 34% tax rate for any amount exceeding this.

This means that you will pay either 30% or 34% tax on your crypto profits depending on the total amount of capital income you made during the tax year.

| Capital income | Tax rate |

|---|---|

| €0 – €30,000 | 30% |

| €30,000+ | 34% |

Income Tax

All Finnish taxpayers are generally taxed on their worldwide income. This means that even if you are employed by an international company or working as a freelancer, you still have to pay personal income tax according to Finnish tax regulations. Finland also operates with a progressive tax system much similar to its neighboring Nordic countries which implies that the tax rate goes up with the total taxable income.

There are three types of personal income taxes in Finland:

- National taxes

- Municipal taxes

- Church taxes

The national taxes have a tax-free allowance of €19,000 for the 2022 tax year. Above this limit, you pay anywhere between 6% and 31.25% depending on your total income amount.

| Taxable income over | Taxable income not over | Tax on column 1 | Tax on excess |

|---|---|---|---|

| €19,200 | €28,700 | €8.00 | 6% |

| €28,700 | €47,300 | €578.00 | 17.25% |

| €47,300 | €82,900 | €3,786.50 | 21.25% |

| €82,900 | €11,351.50 | 31.25% |

The municipal tax rate, on the other hand, is levied at a flat rate rather than a progressive tax rate. The municipal tax is determined by each individual municipality and varies between 16.5% and 23.5%.

Lastly, we have the church tax applicable for all members of the Evangelic Lutheran, Orthodox, or Finnish German church. The church tax is also levied at a flat tax rate and the applicable rate depends on where you live in Finland. The rates vary between 1.0% and 2.1%.

How to calculate capital gains in Finland

When you exchange a cryptocurrency for euros, US dollars, or another cryptocurrency, you are generating either a capital gain or capital loss on the currency that is sold. To find the gain or loss, we need to determine both the sales price (proceeds) and the purchase price (cost basis) of the cryptocurrency sold. The selling price is simply the value of the cryptocurrency sold at the time of the transaction in euros. The purchase price should be determined using an accounting method such as First-in First-out (FIFO) or Last-in First-Out (LIFO).

You can also add any trading or brokerage fees to the cost basis that were associated with the transaction. This means that trading fees are fully deductible against your profits.

The general formula for calculating capital gains is:

capital gains = selling price – purchase price

Let’s look at an example to better understand how to calculate profits and losses from transactions with cryptocurrencies.

Example 1

Leo bought 0.2 BTC for €7,500 in December of 2021. Two months later, in February of 2022, he buys 0.3 BTC for €10,000. Leo owns now 0.5 BTC which he has paid a total of €17,500 for.

In March of 2022, Leo decides to sell 0.4 BTC while keeping 0.1 BTC as a long-term investment. He sells 0.4 BTC and receives €20,000 in exchange. His transactions can be seen in the table below:

| Type | Date | Amount | Price | Cost Basis | Profit/Loss |

|---|---|---|---|---|---|

| Buy | 2021-12-10 | 0.2 BTC | €7,500 | €7,500 | |

| Buy | 2022-02-08 | 0.3 BTC | €10,000 | €10,000 | |

| Sell | 2022-03-15 | 0.4 BTC | €20,000 | (?) | (?) |

The first thing Leo needs to do is to calculate the acquisition price of the 0.4 BTC sold using the FIFO method: €7,500 + 0.2 / 0.3 * €10,000 = €14,167.

Since we know the sales price was €20,000, we can find the resulting capital gains directly: €20,000 – €14,167 = €5,833.

The resulting table will look like this:

| Type | Date | Amount | Price | Cost Basis | Profit/Loss |

|---|---|---|---|---|---|

| Buy | 2021-12-10 | 0.2 BTC | €7,500 | €7,500 | |

| Buy | 2022-02-08 | 0.3 BTC | €10,000 | €10,000 | |

| Sell | 2022-03-15 | 0.4 BTC | €20,000 | €14,167 | €5,833 |

Leo needs to report the gain of €5,833 in his tax return for 2022 which he will file in 2023.

The deemed acquisition cost method

If you are not able to establish the original purchase price due to various reasons such as losing access to your trading history, the Finnish Tax Administration offers a solution called the deemed acquisition cost method. In essence, this allows you to deduct a fixed percentage of the sales price instead of the purchase price:

- Cryptocurrencies held less than 10 years: the deemed acquisition cost equals 20% of the selling price

- Cryptocurrencies held for more than 10 years: the deemed acquisition cost equals 40% of the selling price

Keep in mind that it is likely you will be asked to provide proof that you no longer have access to the original transaction history if you use the deemed acquisition cost method when reporting your crypto taxes.

Is buying cryptocurrency taxed in Finland?

Buying cryptocurrency does not trigger Capital Gains Tax if a fiat currency is used as means of payment. However, if you are buying cryptocurrency with another cryptocurrency, you must calculate and report the capital gains made on the currency that is sold.

Buying cryptocurrency with fiat currency

Buying cryptocurrency using fiat currency as payment is not a taxable event in Finland because no cryptocurrency has been sold, exchanged, or otherwise disposed of. This means that as long as you are using a fiat currency as means of payment, whether it be euros, US dollars, or another fiat currency, you do not need to worry about paying any taxes.

Buying crypto and paying with another crypto

Purchasing one cryptocurrency with another cryptocurrency is considered equal to exchanging two cryptocurrencies for another and is a taxable event according to the Finnish Tax Administration. As an example, if you have bought litecoin with bitcoin you need to calculate the gains or losses on the BTC that was sold in the transaction.

Is selling cryptocurrency taxed in Finland?

Selling cryptocurrencies is always treated as a taxable event since disposing of a cryptocurrency generates either a capital gain or a capital loss. Which currency you received in return, whether it’s another cryptocurrency, stablecoin, or fiat currency, does not change this.

Selling cryptocurrency for fiat currency

Selling a cryptocurrency is always a taxable event from Vero’s perspective. You need to calculate the purchase price of the currency sold and then subtract this from the sales price. You have made a gain if the sales price exceeds the purchase price. On the other hand, if the sales price is lower than the purchase price, you have made a loss.

Selling crypto for another crypto

Selling crypto for another crypto is similar to buying crypto for another crypto and is therefore a taxable event that attracts Capital Gains Tax on the profits.

Crypto mining taxes Finland

In the latest crypto guidance, the Finnish Tax Administration makes it clear that mining income is usually considered earned income for tax purposes. This means that you need to pay Income Tax on all the income generated from proof-of-work mining similar to your ordinary employment income. To determine the value of the mining income, you can use either the daily or monthly average price of the cryptocurrency from reputable exchanges. Keep in mind that you should use either consistently in all your calculations!

You are also allowed to deduct any directly related mining expenses from the earned income. Such costs can include increased electricity costs and the acquisition cost of mining hardware. How much of the original acquisition cost you are allowed to deduct depends on how you are intending to use the hardware:

- 25% of the original cost if the equipment is used infrequently for mining purposes

- 50% of the original cost if the equipment is used regularly for mining purposes

- 100% of the original cost if the equipment is used primarily for mining purposes

Taxes on crypto staking rewards

While mining rewards are considered as earned income, staking rewards from locking up your already owned cryptocurrency is considered capital income and is therefore subject to Capital Gains Tax rather than Income Tax.

Vero argues that this is due to the fact you are earning additional capital from capital that you already possess. Here is a statement about the tax treatment of staking rewards from the crypto tax guidance:

(…) taxation is based on the idea that you are receiving income because you own virtual currency previously. What you own previously is seen as your capital. Accordingly, the amount added to it is capital income.

Vero

How are airdrops taxed in Finland?

There is no specific mention of how cryptocurrency airdrops are taxed in the guidance from the Finnish Tax Administration, but given that airdrops share many similarities with staking rewards, it is our belief that the most correct way to report an airdrop is to consider it as capital income rather than earned income.

We will update this guide with more information later if Vero publishes updated guidance that includes also the tax treatment of airdrops.

Other crypto transactions

By now it should be clear how buying, selling, and trading cryptocurrency is taxed in Finland. We have also touched upon mining, staking, and airdrops which most Finnish crypto investors need to consider when working out their taxes. However, there are also other ways to interact with cryptocurrencies that may or may not trigger a taxable event.

Tax on hard forks

A hard fork usually occurs when the miners of a proof-of-work blockchain don’t agree about a proposed update to the protocol such that a blockchain split occurs as a result. After the split, all users who owned coins on the original chain will own an equal amount of coins on the new chain. One of the most talked about forks was when Bitcoin Cash forked from the bitcoin network in 2017.

Vero has made an official comment about the taxation of crypto hard forks in the latest guidance. The tax agency makes it clear that the acquisition cost of the original currency remains unchanged, while the newly created coins take on a cost basis equal to €0.00. This means that you are not paying any taxes simply from receiving cryptocurrency as a result of a blockchain hard fork.

Keep in mind that when you decide to sell the coins in the future, you will pay Capital Gains Tax on the full amount since a zero cost basis is considered in the capital gains calculations.

Gifting cryptocurrency

Generally speaking, gifting cryptocurrency is not a taxable event from Vero’s perspective. You can therefore gift cryptocurrency to either a friend, spouse or another family member without having to pay any taxes yourself.

If the receiver of the gift either exchanges, sells or otherwise disposes of the gifted coins within one year, the original purchase price from the donor should be considered when calculating the capital gains or losses. While not explicitly stated in the tax guidance, it is our interpretation that in the case of disposing of the coins after more than one year, the current market rate at the date of the gift should be taken into account rather than the original purchase price.

There are many nuances to consider when it comes to gifting and taxes, so our recommendation is to contact Vero directly if you have either gifted or received a gift of significant value and you are not exactly sure how this should be considered for tax purposes.

Receiving salary in a cryptocurrency

Being paid in cryptocurrency, either as a salary from employment or in exchange for services as a freelancer, is taxed similarly to being paid in euros or another fiat currency. This means that from a tax perspective, there is no practical difference in what type of currency you receive your compensation – the income amount will be taxed as income in all cases.

To calculate the income amount in euros at the time of receipt, you can use cryptocurrency prices from any reputable exchange – or let Coinpanda handle all the calculations automatically for you!

How to calculate crypto taxes in Finland

If you are a Finnish taxpayer and have transacted with cryptocurrency during 2022, you need to calculate the realized gains and income from all transactions. There are essentially two different ways to go about this – either manually or using a crypto tax calculator.

Let’s look at both methods:

Calculating your crypto taxes manually

Here are the steps you must take to calculate your crypto taxes manually:

- Download the transaction history from all exchanges where you have bought, sold, received, or sent any cryptocurrency. This includes also transactions from or to your own wallets.

- Calculate the cost basis for every individual transaction where cryptocurrency is disposed of

- Calculate the proceeds and resulting capital gains for all transactions that are considered taxable disposals by Vero

- Identify all transactions subject to income tax by Vero

- Summarize the calculations to find the total taxable amount during the financial year

Calculating your crypto taxes using crypto tax software

The best option for most people in Finland is likely going to be using cryptocurrency tax software to automatically do the required calculations. If you want to save both time and money, here is how you can use Coinpanda to sort out your crypto tax situation and generate all the required tax reports automatically:

1. Sign up for a 100% free account

It is 100% free to create a Coinpanda account and you don’t need to enter any credit card information to get started. The free plan lets you explore and use all features for free.

Sign up with Coinpanda for free now!

2. Connect all your exchange accounts and wallets

Coinpanda supports more than 500+ exchanges, wallets, and blockchains today. You can easily import all your transactions by connecting your exchange accounts with API keys or by uploading a CSV file with the transaction history. If you find that Coinpanda does not support an exchange you have used, reach out to us so we can add the integration – usually within a few days.

3. Wait for Coinpanda to crunch all the numbers

Get yourself a cup of your favorite beverage and wait for Coinpanda’s sophisticated calculation engine to crunch all the numbers for you. Coinpanda will automatically calculate the cost basis, proceeds, capital gains, and taxable income for all your transactions! This might take anywhere from 20 seconds to 5 minutes depending on how many transactions you have.

4. Check for any reported warnings

Coinpanda will automatically display a warning if it appears that one or more transactions are missing such that the cost basis calculations will not include the total purchase price. If you see any warnings, you should first double-check that you have in fact connected all your wallets and exchange accounts.

Do you still see any warnings? Fear not! We have written an extensive list of help articles that will guide you through the entire process of making sure your crypto tax reports are as accurate as possible. If you still need any help, the best way to get in touch with our customer support and tax experts is through the Live Chat.

5. Download your tax reports and tax forms

When you have successfully imported all transactions, the final step is to download the tax reports you need to file your taxes in Finland. Coinpanda’s tax plans start at $49 and you have lifetime access to all reports after upgrading.

Crypto tax deadline in Finland

The tax year in Finland runs from January 1 to December 31 each year. Your crypto taxes should be reported in your annual tax return where you also report ordinary income from employment.

There are essentially four different filing deadlines for the 2021 tax year. Which date applies to you is stated in your tax return. The different deadlines for 2021 are:

- April 1st, 2022

- May 10th, 2022

- May 17th, 2022

- May 24th, 2022

How to report crypto taxes in Finland

When you are done calculating your crypto taxes, it is time to report your taxes together with your ordinary income in the annual tax return. You have the option to file your taxes either online or by using paper forms. We will focus on filing online using the MyTax online platform in this guide. Let’s go through the process step by step.

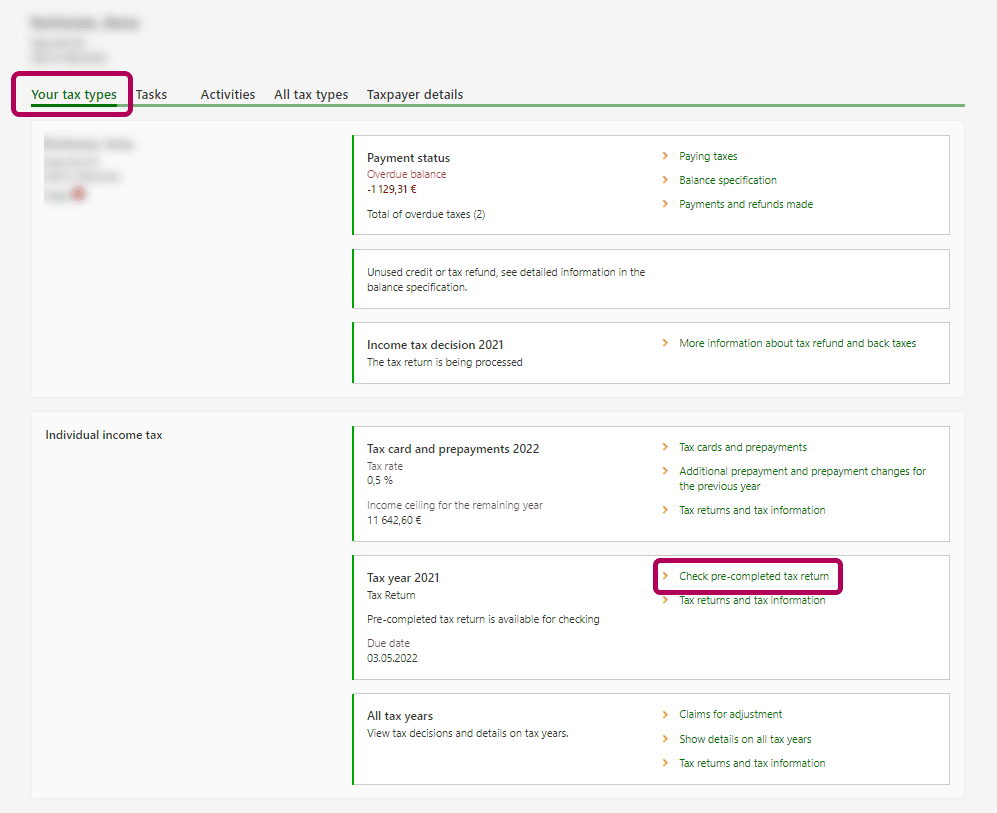

After logging in to the MyTax platform, navigate to the Individual income tax section and select the year you want to report your crypto taxes. You should select Tax year 2021 if you are reporting your taxes for 2021. Next, select Check pre-completed tax return.

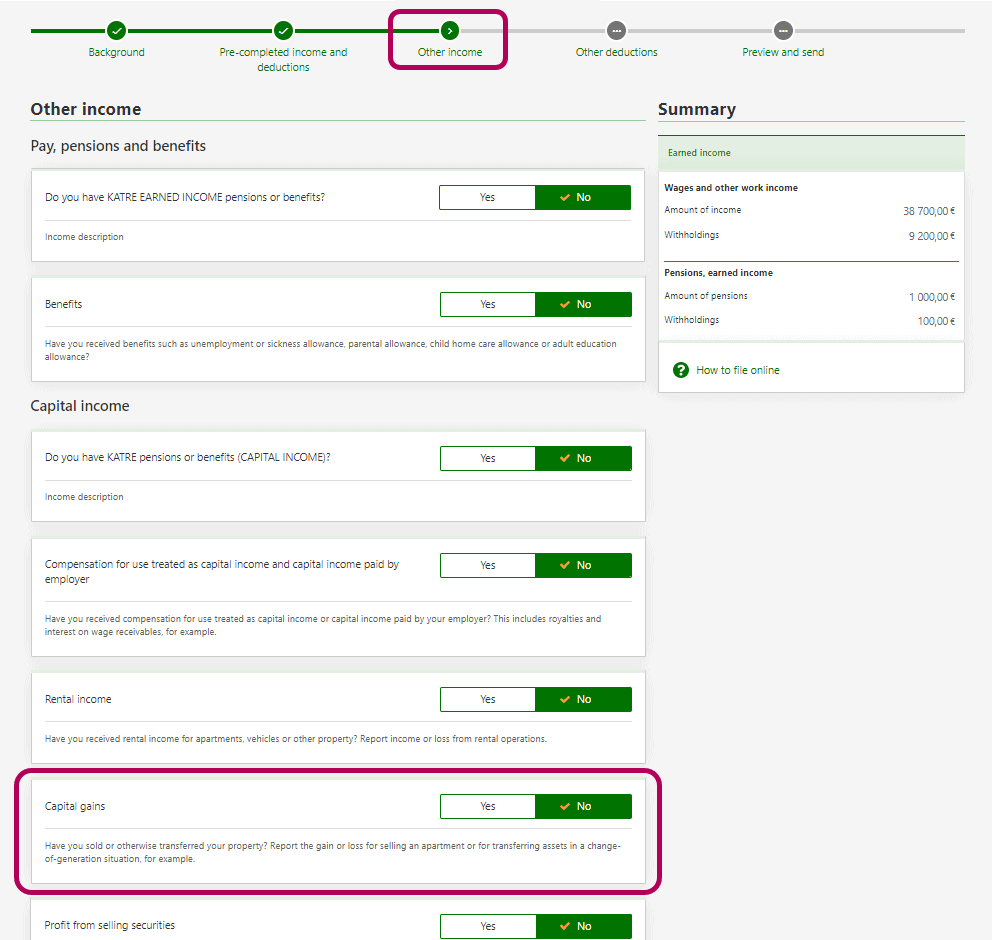

Click Correct on the new page that appears and navigate to the Other income section at the top if this is your first time declaring your crypto taxes. Scroll down to where it says Capital income and select Yes in the box for Capital gains.

After selecting Yes, click on Add new transfer and select Virtual currencies and you will see the page in the image below.

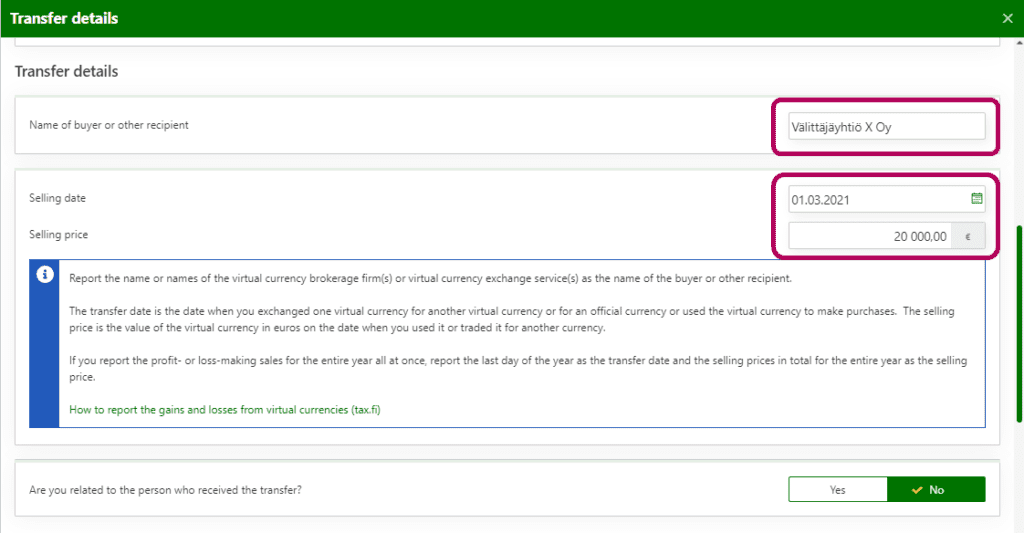

You can now enter all details for all the capital gains transactions you made in 2022. If you instead want to enter the entire year’s selling totals rather than each individual transaction, you can do this by following these steps:

- Enter January 1st, 2021 as the Acquisition date – even if you had acquired crypto over several years that was sold. Enter December 31st, 2021 as the Selling date.

- Enter the total sales price in the Selling price field for all transactions that resulted in a gain. Remember that gains and losses must be reported separately as two transactions, so you need to enter only the selling price for the transactions resulting in a gain when reporting your gains and vice-versa for your losses.

- Enter the total acquisition cost of all cryptocurrencies sold during the year that resulted in a gain in the Acquisition price field.

- Expenses directly related to your purchases can be entered in the Property acquisition costs field. Correspondingly, enter expenses from your sales in the Selling costs field as necessary. NB! If you have generated your crypto tax reports using Coinpanda, all fees will already be included in the acquisition cost so you can leave these two fields empty.

- At the bottom of the capital gain calculation, click the Add file button, and then select Attachment regarding virtual currencies as the type. Select the PDF file exported by Coinpanda, or your own PDF file if you have calculated your crypto taxes manually.

As already mentioned, if you have made transactions that generated both gains and losses, you need to enter two separate calculations into the fillable fields in MyTax. You should enter one calculation for the transactions that resulted in a gain and one for those that resulted in a loss.

Which records may Vero ask for?

Keeping good records of your transactions involving cryptocurrencies is important for all people who have bought or sold cryptocurrency at some point. Not only is this required in case you get audited, but you will also need a complete history of your transactions to calculate your profits and losses that you must report in your annual tax return.

As a general rule, these are the details you need to keep records of for all transactions:

- The date of the transaction

- Which cryptocurrency was part of the transaction

- Type of transaction

- How much was bought, sold, or exchanged

- The value of the cryptocurrency in euro at the time of the transaction

- Exchange records and other relevant statements

- Wallet addresses you possess the private keys of

You should periodically take backup of these records from all exchanges you have traded on since many exchanges keep these records for a limited time only – or the exchange itself may cease to exist in the future. You can also use a cryptocurrency tax app like Coinpanda to generate a report with all this information automatically.