Cryptocurrencies such as bitcoin and ethereum have been growing in popularity in all corners of the world during the last years – with India being no exception. While the Indian government has changed its stance on cryptocurrencies several times in the past, the question regarding how cryptocurrencies are taxed seems to finally come to a close as of 2022. In this complete tax guide for India, you will learn everything you need to know about how crypto is currently taxed in India, how much tax you must pay on your crypto gains, and how to report your crypto taxes to the Income Tax Department (ITD) in India.

Just a heads up! This guide is quite extensive due to the complex nature of cryptocurrency taxes. While we recommend reading this guide from A to Z the first time to make sure you don’t miss out on anything important, you can also use the menu navigation on the right side to jump to any specific crypto tax question later.

We are also updating this guide regularly based on the latest tax guidelines and statements from ITD. All updates will be listed below so that you can quickly see if anything has been updated since your last visit:

Latest updates

- August 29, 2022: The first version published

Let’s start with the most important question of all…

Is cryptocurrency taxed in India?

Yes – according to the updated Finance Bill of 2022, profits from transferring cryptocurrencies are now taxed at a 30% flat income tax rate. While the new rules are effective from April 1, 2022, a conservative approach is to consider the new tax rules also for the current AY 2022-23.

How is crypto taxed in India?

Prior to 2022, the Indian government did not take an official stance on how to define cryptocurrencies and crypto assets in general. It was therefore rather unclear how Indian taxpayers should report their activity with cryptocurrencies, and how much tax they should pay on their profits – if any taxes at all.

However, this is now changed after the release of the Finance Bill, 2022 which was published earlier in 2022. In Chapter 3 of the bill, the term virtual digital asset is defined as the following:

- Any information or code or number or token (not being Indian currency or foreign currency), generated through cryptographic means or otherwise, by whatever name called, providing a digital representation of value exchanged with or without consideration (…)

- A non-fungible token or any other token of similar nature, by whatever name called

- Any other digital asset, as the Central Government may (…) specify

The majority of all cryptocurrencies that exist today will fall under this definition – if not all – and be taxed in the same way. This includes also non-fungible tokens (NFTs) which have seen a huge increase in popularity and demand during 2021 and 2022.

So how exactly is crypto taxed in India? Virtual digital assets are viewed as a class of capital assets in the Indian tax code different than stocks, equities, and bonds. All cryptocurrency transfers are subject to taxation in India according to the new finance bill.

With the new regulation, two different taxes apply for cryptocurrency transfers in India. The first tax is a 30% flat income tax that is effective from April 1st, 2022. The second tax is a 1% Tax Deducted at Source (TDS) tax which is effective from July 1st, 2022.

The definition of a cryptocurrency transfer is defined in the Income-tax Act, Section 2, (47) as:

- The sale, exchange, or relinquishment of the asset, or

- The extinguishment of any rights therein, or

- The compulsory acquisition thereof under any law

Income tax rates in India

As it stands today, Indian taxpayers can opt for either the old tax regime or the new regime with lower tax rates. Certain exemptions and deductions that were allowed in the old tax regime are not applicable in the new regime, so deciding which tax system you should opt for may depend on your own personal situation.

Assuming that you will opt for the new tax regime, you will pay anywhere between 0% and 30% tax on our total income. Much like many other countries, India has adopted a progressive tax rate system so that the amount of tax is calculated for different tax bands – or tax slabs. You will therefore need to apply the applicable tax rate only for the amount that falls in each tax band, and not apply the same rate for your entire income.

The personal income tax rates for AY 2022-23 for the new tax regime are as follows:

| Income Tax Slab | Tax rate |

|---|---|

| ₹ 0 – ₹ 2,50,000 | 0% |

| ₹ 2,50,001 – ₹ 5,00,000 | 5% |

| ₹ 5,00,001 – ₹ 7,50,000 | 10% |

| ₹ 7,50,001 – ₹ 10,00,000 | 15% |

| ₹ 10,00,001 – ₹ 12,50,000 | 20% |

| ₹ 12,50,001 – ₹ 15,00,000 | 25% |

| Above ₹ 15,00,000 | 30% |

Note that the Income Tax rates in the table above do not apply to cryptocurrency transfers in general. As already mentioned, cryptocurrencies and all other virtual digital assets are taxed at a flat rate of 30% in addition to the 1% TDS tax.

How to calculate capital gains in India

The basis for all capital gains calculations is the sales price (proceeds) and the purchase price (cost basis) of the cryptocurrency transferred or sold. For example, if you sell 0.1 BTC and receive ₹ 2,00,000 in return, the sales price is equal to ₹ 2,00,000.

The general formula for calculating capital gains is:

capital gains = selling price – purchase price

But what about the purchase price? The purchase price is what you originally paid for the currency sold. If you have bought a cryptocurrency on several occasions in the past, you need to determine which units are being sold first. Most countries use the First-in First-out (FIFO) accounting method which implies that the earliest acquired units are sold first. However, to the best of our knowledge, the Income Tax Department of India has not made any official statement yet regarding which accounting method should be used for cryptocurrencies, but we assume that FIFO is the preferred cost basis method unless specified otherwise.

Example 1

Rajesh bought 0.2 BTC for ₹ 4,00,000 in December of 2021. Two months later, in February of 2022, he sells 0.1 BTC for ₹ 2,50,000.

Rajesh must now calculate the cost basis of the 0.1 BTC sold this way:

Cost basis = 0.1 / 0.2 x ₹ 4,00,000 = ₹ 2,00,000

Since we already know the sales price, we find the resulting gains this way:

Capital gains = ₹ 2,50,000 – ₹ 2,00,000 = ₹ 50,000

Of the ₹ 50,000 in profits, he needs to pay 30% flat income tax which equals ₹ 50,000 x 30% = ₹ 15,000.

This was a simplified example and did not take into account the 1% withholding tax (TDS) that Indian crypto exchanges will most likely deduct when you convert cryptocurrency to Indian Rupee.

We are keeping a close eye on the development surrounding cryptocurrency taxation in India and will update this guide regularly when new guidance or statements are released from either the Indian government or the Income Tax Department.

Is buying cryptocurrency taxed in India?

The answer is that it depends. Buying cryptocurrency with fiat currency such as INR or USD is not taxed since no cryptocurrency is transferred from a tax perspective. However, buying one cryptocurrency and paying with another cryptocurrency means that one cryptocurrency is sold and is therefore subject to the 30% flat income tax if you made a profit.

Buying cryptocurrency with Indian Rupee

Buying cryptocurrency with Indian Rupee is not a taxable event. This is because the transaction is not seen as a cryptocurrency transfer since no cryptocurrency is exchanged, sold, or otherwise disposed of. If you have only bought crypto with INR or another fiat currency, you do not need to worry about any taxes.

Buying crypto and paying with another crypto

Purchasing one cryptocurrency with another cryptocurrency is a taxable event since the crypto asset sold is viewed as a transfer from the ITD’s perspective. This means that you need to calculate the realized gains for each transaction – Coinpanda can help you with that!

Is selling cryptocurrency taxed in India?

Yes – selling cryptocurrency or any other virtual digital asset as defined in the Finance Bill is taxed in India. Which currency you receive in exchange, whether it’s Indian Rupee, US dollar, or another cryptocurrency, does not change this.

Selling cryptocurrency for Indian Rupee

If you have sold a cryptocurrency and received INR in exchange, you need to calculate the cost basis and sales price of the currency sold to find the realized gains. If the sales price exceeds the cost basis, you will have made a profit which you must pay the 30% flat income tax on. On the other hand, if the sales price is lower than the cost basis, you have made a loss that does not incur any taxes.

Selling crypto for another crypto

Selling crypto for another crypto is similar to buying crypto for another crypto and is therefore a taxable event and you need to pay the 30% flat income tax on the profits.

Crypto mining taxes India

The Finance Bill does not mention specifically how rewards from cryptocurrency mining should be taxed. No other guidance or statements have been released previously either, so it’s not clear from a legal perspective how the Indian government or ITD wants to tax crypto mining rewards.

Until more guidance has been issued, it’s reasonable to assume that mining rewards are taxed as ordinary income at the time you receive the coins in your wallet. In this case, you will pay tax on your mining rewards according to the progressive income tax rates rather than the 30% flat income tax rate.

Staking rewards and airdrops

Similar to mining rewards, the Finance Bill does not mention anything about how cryptocurrency airdrops or staking rewards are taxed. It is therefore uncertain how such transactions should be considered for tax purposes, and we can only hope that the Indian government will provide more clarity regarding these matters in the near future.

However, the general opinion among tax professional today seems to be that both staking rewards and airdrops should be considered personal income for tax purposes. In this case, you will pay tax according to the progressive tax rates and your tax slab.

Receiving cryptocurrency as a gift

If you have to pay tax for being gifted cryptocurrency depends primarily on two factors:

- The value of the cryptocurrency gifted

- Your relation to the person whom you received the gift from

All gifts received in the same tax year valued below ₹ 50,000 are considered tax-free. Gifts valued above this limit are taxed according to your ordinary income tax rates up to a maximum of 30%. However, it’s not entirely clear whether cryptocurrency gifts are taxed as ordinary income or according to the 30% flat income tax rate.

If you received the gift from a direct family member, such as your parents or grandparents, the gift is considered tax-free independent of the value. While there is no specific mention of this in the Finance Bill, we can only assume that the tax-free gift law also applies to cryptocurrencies as it stands today.

Cryptocurrency losses India

Until recently, it was not clear whether or not you were allowed to use cryptocurrency losses to offset your gains, but this has now been clarified in the new Finance Bill.

Unfortunately for Indian tax payers, the current tax rules do not allow offsetting your gains with your losses or carry your losses forward to future years. This is what the new Finance Bill states in Section 115BBH:

Finance Bill, 2022

- (a) no deduction in respect of any expenditure (other than cost of acquisition) or allowance or set off of any loss shall be allowed to the assessee under any provision of this Act in computing the income referred to in clause (a) of sub-section (1), and

- (b) no set off of loss from transfer of the virtual digital asset computed under clause (a) of sub-section (1) shall be allowed against income computed under any other provision of this Act to the assessee and such loss shall not be allowed to be carried forward to succeeding assessment years

The only cost you are allowed to claim is the actual cost of acquiring the cryptocurrency – typically referred to as the cost basis.

Can the ITD track my crypto?

Yes – the Income Tax Department in India may very well track your cryptocurrency related transactions and the amount of crypto assets you hold on exchanges and in wallets. Tax authorities have access to this information through Know-your-customer (KYC) policies enforced by cryptocurrency exchanges, with local exchanges in India being no exception to this.

There exists also several global initiatives that enforce private companies to share data about their customers to tax authorities around the world as part of fighting money laundering and other criminal activities. Tax authorities can also use blockchain analytic tools to track the movement of crypto assets between exchanges and wallets and thus gain insight into Indian taxpayers’ private cryptocurrency holdings.

How to calculate crypto taxes in India

If you are an Indian taxpayer and have transacted with cryptocurrency during 2021 or 2022, you need to calculate the realized gains and income from all transactions. There are essentially two different ways to go about this – either manually or using a crypto tax calculator.

Let’s look at both methods:

Calculating your crypto taxes manually

Here are the steps you must take to calculate your crypto taxes manually:

- Download the transaction history from all exchanges where you have bought, sold, received, or sent any cryptocurrency. This includes also transactions from or to your own wallets.

- Calculate the cost basis for every individual transaction where cryptocurrency is disposed of

- Calculate the proceeds and resulting capital gains for all transactions that are considered taxable disposals by the ITD

- Identify all transactions subject to income tax by the ITD

- Summarize the calculations to find the total taxable amount during the financial year

Calculating your crypto taxes using crypto tax software

The best option for most people in India is likely going to be using cryptocurrency tax software to automatically do the required calculations. If you want to save both time and money, here is how you can use Coinpanda to sort out your crypto tax situation and generate all the required tax reports automatically:

1. Sign up for a 100% free account

It is 100% free to create a Coinpanda account and you don’t need to enter any credit card information to get started. The free plan lets you explore and use all features for free.

Sign up with Coinpanda for free now!

2. Connect all your exchange accounts and wallets

Coinpanda supports more than 500+ exchanges, wallets, and blockchains today. You can easily import all your transactions by connecting your exchange accounts with API keys or by uploading a CSV file with the transaction history. If you find that Coinpanda does not support an exchange you have used, reach out to us so we can add the integration – usually within a few days.

3. Wait for Coinpanda to crunch all the numbers

Get yourself a cup of your favorite beverage and wait for Coinpanda’s sophisticated calculation engine to crunch all the numbers for you. Coinpanda will automatically calculate the cost basis, proceeds, capital gains, and taxable income for all your transactions! This might take anywhere from 20 seconds to 5 minutes depending on how many transactions you have.

4. Check for any reported warnings

Coinpanda will automatically display a warning if it appears that one or more transactions are missing such that the cost basis calculations will not include the total purchase price. If you see any warnings, you should first double-check that you have in fact connected all your wallets and exchange accounts.

Do you still see any warnings? Fear not! We have written an extensive list of help articles that will guide you through the entire process of making sure your crypto tax reports are as accurate as possible. If you still need any help, the best way to get in touch with our customer support and tax experts is through the Live Chat.

5. Download your tax reports and tax forms

When you have successfully imported all transactions, the final step is to download the tax reports you need to file your taxes in India. Coinpanda’s tax plans start at $49 and you have lifetime access to all reports after upgrading.

Crypto tax deadline in India

There are two important time periods to be aware of that are relevant for filing your taxes.

- The financial year (FY): Same as the fiscal year which runs from April 1 to March 31 the following year

- The assessment year (AY): The time period during which you have to report and pay your taxes for the previous financial year

The most recent financial year ran from April 1, 2021 to March 31, 2022, and is often simply referred to as FY 2021-22. Similarly, the current assessment year for the previous FY is often referred to as AY 2022-23.

The tax deadline for reporting your crypto taxes as part of the AY 2022-23 is July 31st, 2022. However, if you are subject to a tax audit for the previous FY, the tax deadline is October 31st, 2022 instead.

How to report crypto taxes in India

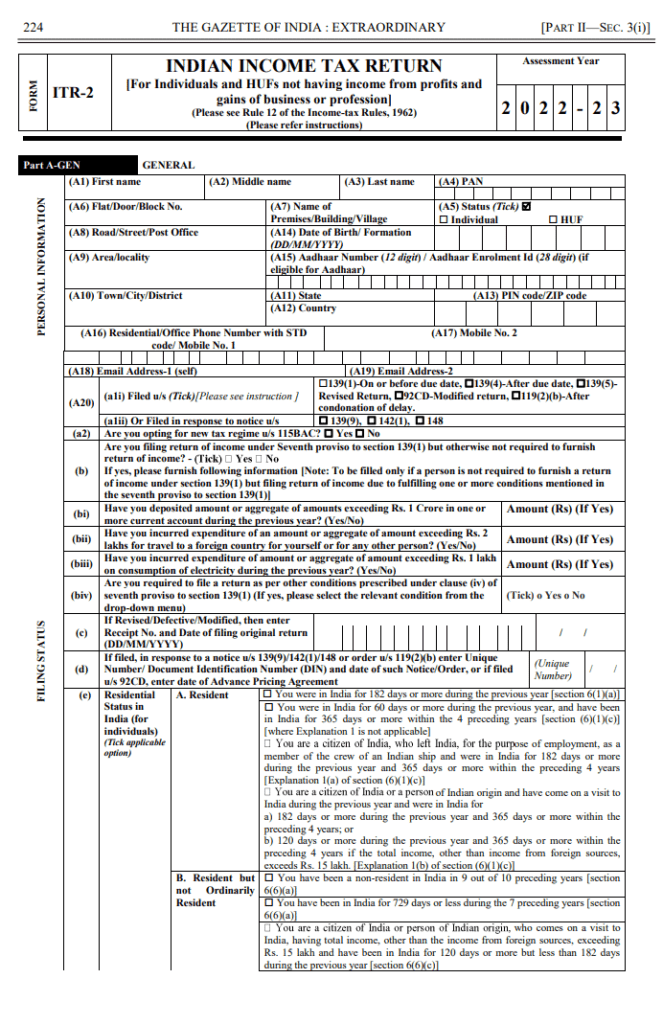

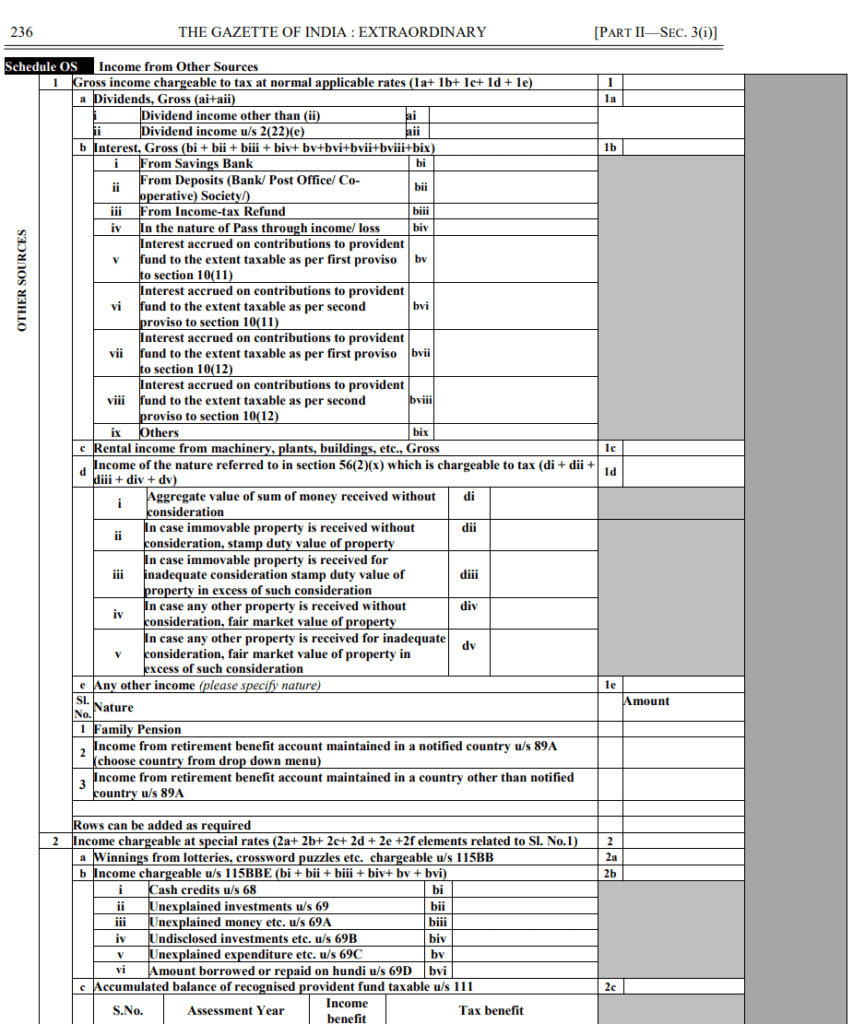

The Finance Bill of 2022 states clearly that cryptocurrency profits are subject to the 30% flat income tax rate from April 1, 2022. Since this date is outside the current AY 2022-23 which covers the financial year from April 1, 2021 to March 31, 2022, it’s not entirely clear if you should pay the 30% flat tax on the profits made during the FY 2021-22. However, a conservative approach is to report your AY 2022-23 taxes according to the rules defined in the new Finance Bill.

The AY 2022-23 ITR forms don’t have any designated lines or boxes for cryptocurrency profits, but you can use the ITR-2, Schedule OS form to report your cryptocurrency profits. We highly recommend consulting with a local tax advisor in India for how to report your crypto taxes for AY 2022-23 since the current rules are so vague.

For the AY 2023-24, it is expected that the updated ITR forms will include a designated section or box where profits from cryptocurrency activity should be reported. We also expect that the ITD will release an updated guidance clarifying the many nuances related to how cryptocurrencies are taxed.

Which records do I need to keep?

Keeping complete records of your crypto transaction history is not only important in case you get audited by the Income Tax Department in the future, but also because you need these records to calculate your cryptocurrency profits and losses in the first place. As a general rule, most tax authorities around the world require you to keep the following records of all your transactions for a minimum of several years:

- The date of the transaction

- Type of transaction (trade, staking, airdrop, etc)

- The cryptocurrency bought or sold

- How much was bought, sold, or exchanged

- The value of the cryptocurrency in INR at the time of the transaction

- Exchange records and other relevant statements

You should periodically take backup of these records from all exchanges you have traded on since many exchanges keep these records for a limited time only – or the exchange itself may cease to exist in the future. You can also use a cryptocurrency tax app like Coinpanda to generate a report with all this information automatically.