Not exactly sure how crypto is taxed in South Africa or if you need to pay tax on your crypto profits? In that case, we will answer all your questions about crypto taxes in this guide! Read on to learn more about how crypto is taxed in South Africa, how much tax you must pay on your crypto gains, and how to report your crypto taxes to the South African Revenue Service (SARS).

Just a heads up! This guide is quite extensive due to the complex nature of cryptocurrency taxes. While we recommend reading this guide from A to Z the first time to make sure you don’t miss out on anything important, you can also use the menu navigation on the right side to jump to any specific crypto tax question later.

We are also updating this guide regularly based on the latest tax guidelines and statements from the South African Revenue Service. All updates will be listed below so that you can quickly see if anything has been updated since your last visit:

Latest updates

- August 29, 2022: The first version published

Let’s start with the most important question of all…

Do you pay tax on crypto in South Africa?

Yes – profits from both cryptocurrency investing and trading are taxed in South Africa, but it’s unclear whether the gains should be taxed as Capital Gains Tax or as Income Tax at this point.

If SARS considers you to be an investor and that your profits attract Capital Gains Tax, you will pay a fixed rate of 18% tax on your net gains. However, if you are considered to be a trader instead, your gains will be subject to progressive Income Tax rates between 18% and 45% depending on your total taxable income.

How is cryptocurrency taxed in South Africa?

From a legal perspective, SARS views cryptocurrencies and other crypto assets as a digital representation of value not issued by a central bank. This means that crypto assets are not considered equal to fiat currencies such as the South African Rand, euros, or US dollars, but are instead considered to be an asset or trading stock for tax purposes according to a document published on June 23, 2021.

What makes crypto taxation in South Africa complicated is that SARS is only one of many entities that play a role in how crypto assets are treated legally and for tax purposes in the country. It is the South African Reserve Bank (SARB) that is the governing entity for the legal status of crypto assets, and SARS is simply leaning towards the official statements from SARB when it comes to how South African taxpayers must report activity related to cryptocurrencies and how the asset class is taxed in general.

So now the question becomes – do you pay Capital Gains Tax or Income Tax on your crypto assets? Well, the answer is that it’s not entirely clear at this point. The following statement is published on the SARS’s website:

Following normal income tax rules, income received or accrued from crypto assets transactions can be taxed on revenue account under “gross income”. Alternatively such gains may be regarded as capital in nature, as spelt out in the Eighth Schedule to the Act for taxation under the Capital Gains Tax (CGT) paradigm.

South African Revenue Service

As you might understand now, it’s not clear whether profits from cryptocurrencies should actually be taxed as personal income or as capital gains. However, most South African tax consultants appear to be of the opinion that for most people, profits from investing in and trading cryptocurrencies should be reported as capital gains rather than personal income. This is also in line with the majority of other countries in the world today. While we highly recommend consulting a tax advisor if you are not sure how to report your crypto taxes, we will for the sake of this article assume that cryptocurrencies attract Capital Gains Tax.

Also, a new policy on crypto assets is currently being reviewed by SARB but it’s unclear when this new regulation will come into effect. The actual contents of the proposed policy are also unclear at this point, but we are keeping a close eye on the development and will update this guide when any news is released from either SARS or SARB.

Is SARS tracking crypto transactions?

Yes – the South African Revenue Service has been granted a wide range of authorities that provide the tax agency with the required legal collection power to request financial data from third parties such as cryptocurrency exchanges.

This applies to both exchanges and third parties in and outside of South Africa. If you have opened an account and provided KYC information to an exchange provider such as VALR, Binance, or Coinbase, it is quite likely that SARS will have information about your investment and trading activity.

Tax rates in South Africa

The two main types of taxes that South African taxpayers need to consider are Capital Gains Tax and Income Tax. Let’s look at both in more detail.

Capital Gains Tax

The current Capital Gains Tax rate in South Africa for the 2023 tax year is 18%. Each individual is also entitled to an annual exclusion of R40,000 so that you only pay tax if your total capital gains during the tax year exceed this limit. After subtracting the annual exclusion from your total capital gains, 40% of the amount is taxed as ordinary income according to your income tax rate, while the other 60% is taxed as capital gains at a fixed rate of 18%.

Personal Income Tax

Income tax is the normal tax you pay on what is considered taxable income. There are several types of income that will be classified as taxable income:

- Income from employment, bonuses, fringe benefits, etc

- Profits or losses from a business or trade

- Investment income (eg. interest and foreign dividends)

- Profits or losses from rental

- Pension income

South Africa has a progressive tax rate system where the rates vary between 18% and 45% depending on your taxable income. Each person is also entitled to a tax threshold and a tax rebate. For people below 65 years of age, the tax threshold and tax rebate are R91,250 and R16,425 respectively for the current tax year. This means that you are only liable for paying income tax if you earn more than R91,250 during the period 1 March 2022 – 28 February 2023.

The progressive personal income tax rates for the 2023 tax year are as follows:

| Taxable income (R) | Tax rate |

|---|---|

| 1 – 226,000 | 18% |

| 226,001 – 353,100 | 26% |

| 353,101 – 488,700 | 31% |

| 488,701– 641,400 | 36% |

| 641,401 – 817,600 | 39% |

| 817,601 – 1,731,600 | 41% |

| 1,731,601+ | 45% |

Investor vs Trader

The most important thing SARS will look at when deciding how your crypto profits should be taxed, is whether you are considered to be an investor or trader. As a general rule, as an investor, you pay Capital Gains Tax on your profits, while as a trader, your profits will be subject to Income Tax according to the progressive tax rates.

So what constitutes a trader and investor? There are mainly two questions SARS will look at when deciding this:

- How frequently are you buying and selling cryptocurrencies?

- What was your intention in acquiring the different cryptocurrencies?

The more frequently you are trading will increase the chance of being viewed as a trader rather than an investor. And similarly, if you sell the crypto assets reasonably shortly after first acquiring them, you will most likely not be considered an investor from the SARS perspective.

On the other hand, if your main purpose for investing in cryptocurrencies is to hold the assets for several years as a long-term investment, and you are not participating in activities such as margin or futures trading, DeFi liquidity mining, or other ways to make a quick buck, you will most likely be considered an investor and therefore only pay Capital Gains Tax on the profits.

Calculate capital gains in South Africa

Now that we have covered how crypto is taxed in South Africa, the next question becomes how do we actually calculate the profits and losses?

As a general rule, all transactions where a cryptocurrency is exchanged for ZAR, other fiat currency, or another cryptocurrency may result in a capital gain or capital loss. To find the gain or loss, we need to determine both the sales price (proceeds) and the purchase price (cost basis) of the cryptocurrency sold. The selling price is simply the value of the cryptocurrency sold at the time of the transaction in ZAR. The purchase price should be determined using the First-in First-out (FIFO) accounting method. Using the FIFO method, the earliest acquired coins are being sold first if you have bought the same crypto asset on several occasions.

SARS also clarifies that any directly associated expenses such as trading fees can be claimed when calculating the profits and losses. If you are using Coinpanda to calculate your crypto taxes, all trading fees will automatically be included in the calculations and deducted from your realized gains.

The general formula for calculating capital gains is:

capital gains = selling price – purchase price

Let’s look at an example to better understand how to calculate capital gains from transactions with cryptocurrencies.

Example 1

Martin bought 0.2 BTC for R125,000 in December of 2021. Two months later, in February of 2022, he buys 0.3 BTC for R170,000. Martin owns now 0.5 BTC which he has paid a total of R295,000 for.

In March of 2022, Martin decides to sell 0.4 BTC while keeping 0.1 BTC as a long-term investment. He sells 0.4 BTC and receives R340,000 in exchange. His transactions can be seen in the table below:

| Type | Date | Amount | Price | Cost Basis | Profit/Loss |

|---|---|---|---|---|---|

| Buy | 2021-12-10 | 0.2 BTC | R125,000 | R125,000 | |

| Buy | 2022-02-08 | 0.3 BTC | R170,000 | R170,000 | |

| Sell | 2022-03-15 | 0.4 BTC | R340,000 | (?) | (?) |

The first thing Martin needs to do is to calculate the acquisition price of the 0.4 BTC sold using the FIFO method: R125,000 + 0.2 / 0.3 * R170,000 = R238,333.

Since we know the sales price was R340,000, we can find the resulting capital gains directly: R340,000 – R238,333 = R101,667.

The resulting table will look like this:

| Type | Date | Amount | Price | Cost Basis | Profit/Loss |

|---|---|---|---|---|---|

| Buy | 2021-12-10 | 0.2 BTC | R125,000 | R125,000 | |

| Buy | 2022-02-08 | 0.3 BTC | R170,000 | R170,000 | |

| Sell | 2022-03-15 | 0.4 BTC | R340,000 | R238,333 | R101,667 |

Martin needs to report the gain of R101,667 in his tax return for 2022 which he will file in 2023.

Is buying cryptocurrency taxed in South Africa?

Whether you are considered an investor or trader for tax purposes, buying cryptocurrency with South African Rand or other fiat currencies is not a taxable event in South Africa. However, if you are buying cryptocurrency with another cryptocurrency, this will be seen as a crypto disposal and is therefore a taxable transaction.

Buying cryptocurrency with fiat currency

As long as you are buying cryptocurrency and paying with a fiat currency such as ZAR, EUR, or USD – you are not taxed on the transaction. This is because no crypto asset has been disposed of which is what SARS considers to be a taxable event.

Buying crypto and paying with another crypto

Buying, exchanging, or swapping one cryptocurrency for another cryptocurrency is taxed in South Africa since you are disposing of a crypto asset. This includes also buying cryptocurrency with stablecoins since such crypto assets are considered equal to any other cryptocurrency for tax purposes.

Is selling cryptocurrency taxed in South Africa?

Yes – selling cryptocurrency will always be considered a taxable transaction by SARS in South Africa. Whether you have received a fiat currency or another cryptocurrency in return for the crypto asset sold, you need to calculate the realized gains and pay tax on the profits.

Crypto mining taxes South Africa

Cryptocurrency received from mining operations is subject to Income Tax at the time of receipt – that is when the coins became available in your wallet. You can use cryptocurrency prices from reputable exchanges to determine the value at the time of the transaction. Here is what SARS mentioned specifically about crypto mining in the document published in 2021:

Such income is subject to normal tax. The person may be liable to register as a provisional taxpayer if the total taxable income received exceeds the tax threshold for the financial year.

SARS

You pay therefore Income Tax on the rewards you receive, but also Capital Gains Tax when you sell the coins in the future and if the price has appreciated. If the price has depreciated, you can claim a capital loss and use the loss to offset other gains. Keep in mind that this assumes you are considered to be an investor rather than a trader for tax purposes.

Taxes on crypto staking rewards

Due to the lack of tax guidance on the topic of cryptocurrency taxes from SARS, it is currently not clear how staking rewards should be taxed in South Africa.

Considering how staking rewards are taxed in other countries and the nature of how such rewards are generated, the most likely outcome is that SARS will tax staking rewards as personal income and therefore subject to Income Tax.

How are airdrops taxed in South Africa?

Airdrops are typically given to people as part of a marketing stunt or to spread awareness when a new blockchain or token is created. If you hold cryptocurrency on an exchange or in your own wallet, chances are that you have received one or several airdrops in the past.

From a tax perspective, no specific mention of how airdrops should be taxed can be found on SARS’s website. However, most countries consider airdrops as personal income for tax purposes, so the safest approach is to report the value of the airdrop as income in your annual tax return.

Other crypto transactions

Tax on hard forks

There is no specific mention of how cryptocurrency hard forks should be considered from a tax perspective by the South African Revenue Services, but we can lean towards the regulation in other countries to get a better idea of the likely outcome.

Because a cryptocurrency created from a blockchain split will usually have zero value at the time of creation, hard forks are generally speaking considered tax-free in most countries. However, there are certain exceptions to this in the case where the coins became available to you at the time they were trading on one or more exchanges. In such cases, the coins you received may hold a non-negligible value at the time of receipt and should therefore be reported as income in your tax return. In other words, the most important thing to consider is the value of the forked coins at the time they became available in your wallet or exchange account.

We will update this guide later if SARS addresses the topic of cryptocurrency hard forks in its crypto tax guidance specifically.

Gifting cryptocurrency to another person

Gifting cryptocurrency to a friend or family member is considered equal to selling cryptocurrency by the SARS. This means that you need to calculate the realized gains and pay tax on the profits. Any losses can similarly be used to offset other gains.

Keep in mind that it’s still not clear whether your gains will be subject to Capital Gains Tax or Income Tax at this point in time. However, if you are considered to be an investor for tax purposes, we can assume that the gains are subject to Capital Gains Tax.

Being paid in cryptocurrency

Have you received your employment income or other benefits as cryptocurrency? In this case, you can’t avoid paying taxes even if SARS is not directly tracking your account balances. Whether you are being paid in Rand or a cryptocurrency, you are still required to pay Income Tax according to the progressive tax rates on the amount received.

To calculate the income amount in Rand at the time of receipt, you can use cryptocurrency prices from any reputable exchange – or let Coinpanda handle all the calculations automatically for you!

How to calculate crypto taxes in South Africa

If you are a South African taxpayer and have transacted with cryptocurrency during 2022, you need to calculate the realized gains and income from all transactions. There are essentially two different ways to go about this – either manually or using a crypto tax calculator.

Let’s look at both methods:

Calculating your crypto taxes manually

Here are the steps you must take to calculate your crypto taxes manually:

- Download the transaction history from all exchanges where you have bought, sold, received, or sent any cryptocurrency. This includes also transactions from or to your own wallets.

- Calculate the cost basis for every individual transaction where cryptocurrency is disposed of

- Calculate the proceeds and resulting capital gains for all transactions that are considered taxable disposals by SARS

- Identify all transactions subject to income tax by SARS

- Summarize the calculations to find the total taxable amount during the financial year

Calculating your crypto taxes using crypto tax software

The best option for most people in South Africa is likely going to be using cryptocurrency tax software to automatically do the required calculations. If you want to save both time and money, here is how you can use Coinpanda to sort out your crypto tax situation and generate all the required tax reports automatically:

1. Sign up for a 100% free account

It is 100% free to create a Coinpanda account and you don’t need to enter any credit card information to get started. The free plan lets you explore and use all features for free.

Sign up with Coinpanda for free now!

2. Connect all your exchange accounts and wallets

Coinpanda supports more than 500+ exchanges, wallets, and blockchains today. You can easily import all your transactions by connecting your exchange accounts with API keys or by uploading a CSV file with the transaction history. If you find that Coinpanda does not support an exchange you have used, reach out to us so we can add the integration – usually within a few days.

3. Wait for Coinpanda to crunch all the numbers

Get yourself a cup of your favorite beverage and wait for Coinpanda’s sophisticated calculation engine to crunch all the numbers for you. Coinpanda will automatically calculate the cost basis, proceeds, capital gains, and taxable income for all your transactions! This might take anywhere from 20 seconds to 5 minutes depending on how many transactions you have.

4. Check for any reported warnings

Coinpanda will automatically display a warning if it appears that one or more transactions are missing such that the cost basis calculations will not include the total purchase price. If you see any warnings, you should first double-check that you have in fact connected all your wallets and exchange accounts.

Do you still see any warnings? Fear not! We have written an extensive list of help articles that will guide you through the entire process of making sure your crypto tax reports are as accurate as possible. If you still need any help, the best way to get in touch with our customer support and tax experts is through the Live Chat.

5. Download your tax reports and tax forms

When you have successfully imported all transactions, the final step is to download the tax reports you need to file your taxes in South Africa. Coinpanda’s tax plans start at $49 and you have lifetime access to all reports after upgrading.

Crypto tax deadline in South Africa

The tax year in South Africa runs from March 1 to February 28 the following year. Your crypto taxes should be reported in your personal tax return where you also report ordinary income from employment.

The deadline for filing your personal tax return is October 24, 2022, for the 2021-2022 tax year.

How to report crypto taxes in South Africa

After calculating your capital gains and income for all transactions during the tax year, the last step is to report your crypto taxes in your personal tax return before the October 24 deadline.

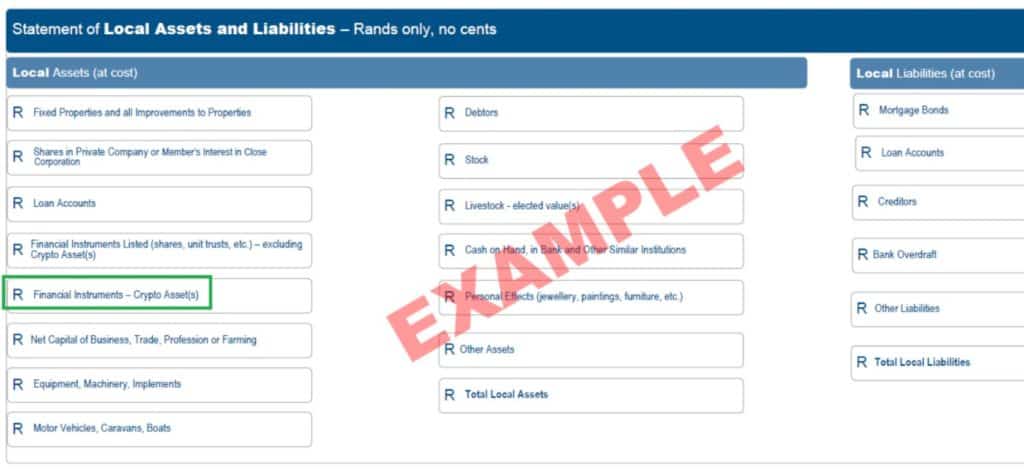

The easiest way to file your taxes is using the online portal eFiling. After logging in to the portal, you will see two sections mentioning crypto assets. You will need to report whether or not you have made any disposals of crypto assets, the number of disposals made during the tax year, and the resulting capital gains from the disposals.