Cryptocurrencies such as bitcoin and ethereum are taxed in almost all countries today, with Sweden being no exception. If you are living in Sweden or you are a Swedish taxpayer, there are some important tax rules to be aware of that differ from most other European countries today. In this complete tax guide, you will learn everything you need to know about how crypto is taxed in Sweden according to tax rules from Skattverket, how much tax you need to pay on your crypto profits, how to declare your profits and losses on the K4 tax form, and how to use a crypto tax calculator to generate all the tax reports you need.

Just a heads up! This guide is quite extensive due to the complex nature of cryptocurrency taxes. While we recommend reading this guide from A to Z the first time to make sure you don’t miss out on anything important, you can also use the menu navigation on the right side to jump to any specific crypto tax question later.

We are also updating this guide regularly based on the latest tax guidelines and statements from Skattverket. All updates will be listed below so that you can quickly see if anything has been updated since your last visit:

Latest updates

- August 26, 2022: The first version published

Let’s start with the most important question of all…

Are cryptocurrencies taxed in Sweden?

Cryptocurrencies such as bitcoin and ethereum are considered capital assets and attract Capital Gains Tax in Sweden. For the 2022 tax year, capital assets are usually taxed at a fixed rate of 30%.

You might also need to pay tax on crypto received as income such as mining or staking rewards.

In the next section, we will look closer at how crypto is actually taxed and viewed from a legal perspective in Sweden.

How is crypto taxed in Sweden?

The Supreme Administrative Court in Sweden made it clear in 2018 that bitcoin and other cryptocurrencies are not considered similar to foreign currencies, shares, or equities from a tax perspective. Instead, cryptocurrencies are viewed as other assets and are therefore taxed according to Chapter 52 of the Swedish Income Tax Act.

Bitcoin kan inte vara en s.k. personlig tillgång, vilket innebär att omkostnadsbeloppet ska beräknas enligt den s.k. genomsnittsmetoden och att 70 procent av en förlust får dras av (52 kap. 3 och 5 §§ IL).

Skatteverket

What does this mean in practical terms for Swedish taxpayers? Two important considerations are:

- The cost basis of the disposed asset should be calculated using the average cost method

- Only 70% of the losses can be used to offset other gains

The general rule is that each disposal of cryptocurrency results in either a gain or loss. But what is a disposal in this context?

- Selling cryptocurrency for Swedish kroner

- Selling cryptocurrency for another fiat currency (USD, EUR, etc)

- Exchanging one cryptocurrency for another (ex: BTC → ETH)

- Paying for goods or services with cryptocurrency

- Making a loss from trading futures

In each of these cases, you need to first work out the initial purchase price (cost basis) and also the proceeds for each individual transaction. After calculating all your gains and losses (we will explain how to do this later!), you need to report your crypto taxes in Section D of the K4 tax form using either a paper form or Skattverket’s online portal.

Your net gains from cryptocurrency, after deducting 70% of the losses, are taxed as Capital Gains Tax in Sweden.

Next, we will look at the current tax rates in Sweden to better understand how much tax you must actually pay on your crypto gains.

Tax rates Sweden

There are essentially two types of taxes that Swedish taxpayers need to consider, namely Employment Income Tax and Capital Gains Tax.

Capital Gains Tax

All Swedish residents are taxed on capital gains from assets including bank savings, equities, dividends, real estate, and cryptocurrency. For most people, capital gains are taxed at a fixed rate of 30%.

Employment Income Tax

The income tax in Sweden consists of two types of taxes:

- National income tax

- Municipal income tax

The national income tax kicks in only for income exceeding 540,700 kr for the 2022 tax year, while the municipal income tax varies between the different municipalities in Sweden.

| Taxable income | National income tax | Municipal income tax (*) |

|---|---|---|

| 0 – 540,700 kr | 0% | 32% |

| 540,700 kr+ | 20% | 32% |

* Rate equals the average municipal tax rate.

How to calculate gains and losses

So far in this guide, we have learned that each disposal of a cryptocurrency is considered a taxable event in Sweden. But how do we actually go about calculating the gains and losses?

First, we need to determine both the sales price and purchase price of the asset sold or disposed of. The selling price is simply the value of the cryptocurrency sold at the time of the transaction in Swedish kroner. The purchase price, on the other hand, should be determined using the average cost method as mentioned earlier.

The purchase price (cost basis) should also include any trading fees that you paid when purchasing the cryptocurrency. If you have received cryptocurrency from mining, staking, or similar, you should consider the fair market value of the crypto at the time of receipt.

The general formula for calculating realized gains is defined as:

realized gain = selling price – purchase price

If you are not able to establish the purchase price, a conservative approach is to consider the value to be zero. However, this means that you need to pay tax on the full amount, and therefore more tax than you actually should.

Let’s look at two examples to better understand how to calculate the realized gains from crypto trades.

Example 1

Johan bought bitcoin on two occasions in 2022: 0.3 BTC bought for 100,000 kr in February and 0.2 BTC bought for 80,000 kr in March. Now, Johan owns a total of 0.5 BTC which he has paid 180,000 kr for.

In April of 2022, he sells 0.4 BTC and receives 150,000 kr. Using the average cost method, we find the cost basis of the BTC disposed of this way: 0.4 / 0.5 * 180,000 kr = 144,000 kr.

Next, the resulting gains are calculated as: 150,000 kr – 144,000 kr = 6,000 kr.

This amount should be reported on Section D of the K4 tax form when Johan reports his taxes the next year. Since all realized gains are taxed at a fixed rate of 30%, Johan will need to pay 6,000 kr * 30% = 1,800 kr in taxes in 2023.

Example 2

Viktor has been trading different cryptocurrencies since the beginning of 2022. In this example, we will look at the transactions with Solana and bitcoin specifically.

We assume that he has five transactions in total during 2022. First, he bought 1.2 BTC for 480,000 kr and 0.6 BTC for 240,000 kr in January. Later in February, he exchanged some of his BTC for SOL on two occasions. Then finally he sold all of his SOL for 250,000 kr in April. His transactions can be seen in the table below:

| Type | Date | Amount | Price | Cost Basis | Profit/Loss |

|---|---|---|---|---|---|

| Buy | 2022-01-14 | 1.2 BTC | 480,000 kr | 480,000 kr | – |

| Buy | 2022-01-20 | 0.6 BTC | 240,000 kr | 240,000 kr | – |

| Trade | 2022-02-08 | 0.2 BTC → 80 SOL | 1 BTC = 420,000 kr | (?) | (?) |

| Trade | 2022-02-10 | 0.3 BTC → 140 SOL | 1 BTC = 380,000 kr | (?) | (?) |

| Sell | 2022-04-05 | 220 SOL | 250,000 kr | (?) | (?) |

First, we find the total cost of the 1.8 BTC purchased as 480,000 kr + 240,000 kr = 720,000 kr. His average cost is therefore 400,000 kr per BTC. We can now find the cost basis of the BTC disposals in February:

- Cost basis 0.2 BTC sold: 0.2 * 400,000 kr = 80,000 kr

- Cost basis 0.3 BTC sold: 0.3 * 400,000 kr = 120,000 kr

Next, we need to establish the selling price (proceeds) for the same transactions:

- Selling price 0.2 BTC sold: 0.2 * 420,000 kr = 84,000 kr

- Selling price 0.3 BTC sold: 0.3 * 380,000 kr = 114,000 kr

The selling price of the BTC sold also becomes the purchase price of the SOL acquired which we need to calculate the gains when selling SOL later:

- Acquisition cost 220 SOL bought: 84,000 kr + 114,000 kr = 198,000 kr

Now that we know both the purchase price and selling price of all transactions, we find the resulting gains and losses directly this way:

- Profit/loss 0.2 BTC sold: 84,000 kr – 80,000 kr = 4,000 kr (gain)

- Profit/loss 0.3 BTC sold: 114,000 kr – 120,000 kr = -6,000 kr (loss)

- Profit/loss 220 SOL sold: 250,000 kr – 198,000 kr = 52,000 kr (gain)

The resulting table will look like this:

| Type | Date | Amount | Price | Cost Basis | Profit/Loss |

|---|---|---|---|---|---|

| Buy | 2022-01-14 | 1.2 BTC | 480,000 kr | 480,000 kr | – |

| Buy | 2022-01-20 | 0.6 BTC | 240,000 kr | 240,000 kr | – |

| Trade | 2022-02-08 | 0.2 BTC → 80 SOL | 84,000 kr | 80,000 kr | 4,000 kr |

| Trade | 2022-02-10 | 0.3 BTC → 140 SOL | 114,000 kr | 120,000 kr | -6,000 kr |

| Sell | 2022-04-05 | 220 SOL | 250,000 kr | 198,000 kr | 52,000 kr |

Viktor will need to report the gains and losses separately on K4 when he files his taxes in 2023. Because only 70% of the losses can be used to offset the gains, the total taxable gain becomes 4,000 kr + 52,000 kr – 70% * 6,000 kr = 51,800 kr.

Of this amount, Viktor needs to pay 30% tax which equals 15,540 kr.

Is buying crypto taxed in Sweden?

To understand if buying cryptocurrency is considered a taxable event we need to first clarify which currency is used to purchase the cryptocurrency. The general rule is that buying crypto with fiat is not taxed while buying crypto with another crypto is a taxable event and attracts capital gains tax.

Buying cryptocurrency with fiat currency

Acquiring a cryptocurrency and paying with fiat currency is not taxed in Sweden.

You don’t need to worry about any taxes for transactions involving fiat currencies as means of payment for acquiring another cryptocurrency, but you should keep good records of all the transactions in order to calculate the cost basis correctly when selling the coins in the future.

Buying crypto and paying with another crypto

Buying cryptocurrency using another cryptocurrency as payment is a taxable event in Sweden similar to most other countries since one cryptocurrency is being disposed of.

Is selling crypto taxed in Sweden?

Selling cryptocurrency, whether the currency received as payment is a fiat currency or another cryptocurrency, is considered a disposal and is therefore a taxable event.

Selling cryptocurrency for fiat currency

Selling a cryptocurrency in exchange for fiat currency is taxed in Sweden – no matter if the received fiat currency is Swedish kroner, US dollar, or euro. What matters is that each disposal of a cryptocurrency is considered a taxable event.

Selling crypto for another crypto

Selling crypto for another crypto is similar to buying crypto for another crypto and is therefore considered a taxable event that attracts Capital Gains Tax.

Taxes on crypto mining rewards

In line with most European countries, mining of bitcoin or other cryptocurrencies is not a tax-free event in Sweden either. Mining income is considered equal to employment income for tax purposes – as long as Skattverket considers you to be carrying on mining as a hobby and not as a professional, or näringsverksamhet. There are different tax rules that kick in if you are considered to be carrying out a professional mining business.

Skattverket goes on to say that in the majority of cases, cryptocurrency mining will be considered to be a hobby and not a business activity. If you make a profit from mining, the income amount should be reported on the T2 tax form instead of the K4 tax form where you report gains and losses from trading.

Note that if your expenses exceed your total mining income, you are not allowed to use the loss to offset other income. However, you can carry the loss forward to future years and offset your mining income this way.

Taxes on staking rewards

The taxation of staked cryptocurrency is a rather complex tax topic because there are so many different ways you can earn interest or staking rewards by depositing your coins to a decentralized staking pool or on a centralized exchange. While Skattverket has not published guidance that goes into all relevant details about staking, they did in fact release a statement regarding Ethereum 2.0 in December of 2021.

In this article, Skattverket explains that earning staking rewards by participating as a node in the Ethereum network is considered equal to earning interest from your own assets and is therefore not considered a taxable disposal – in other words, no capital gains tax if you deposit ether into an ETH 2.0 staking pool!

Staking av ether i Ethereum 2.0 kan jämställas med en deponering av ether och medför därför ingen kapitalvinstbeskattning.

Skattverket

However, keep in mind that you need to report the received staking rewards as income on the date the coins became available to you – typically when you received the staking rewards in your wallet.

The article only mentions staking of Ethereum 2.0, but we can assume that the same tax rules should be considered also for other cryptocurrencies.

Are crypto airdrops taxed?

Skattverket does not mention specifically how cryptocurrency airdrops are taxed on their website, but the general assumption by most Swedish tax professionals seems to be that airdrops are not taxed at the time of receipt since an airdrop does not involve doing an effort in order to receive the coins.

While not taxed at the time of receipt, you will still need to pay capital gains tax when you sell the coins at a later time. In this case, you should use a zero cost basis since you did not pay anything to acquire the coins.

Other types of crypto transactions

So far in this guide, we have explained how the most typical ways people use and interact with cryptocurrencies are taxed according to Skattverket in Sweden. However, cryptocurrency is a fast-paced industry and there are many other ways to either receive or send cryptocurrencies not already mentioned.

To answer this, we will look closer at how other transaction types are taxed next.

Tax on hard forks

There is no specific mention of how cryptocurrency hard forks are taxed on Skattverket’s website, but it’s likely that forks are considered equal to airdrops since they are of similar nature. With this assumption in mind, you will not pay any tax on the date you received the forked coins, but you will pay capital gains tax on the full amount when you sell the coins at a later date in the future.

Gifting cryptocurrency

The gift tax was removed completely on the 1st of January, 2005 in Sweden. Since gifting cryptocurrency is considered equal to gifting any other type of asset, all cryptocurrency gifts are completely tax-free as long as you did not receive something in return from the person who received the gift.

Receiving salary in a cryptocurrency

Being paid in cryptocurrency, either as a salary from employment or in exchange for services as a freelancer, is taxed similar to being paid in SEK or another fiat currency. This means that from a tax perspective, there is no practical difference in what type of currency you receive your compensation – the income amount will be taxed as income in all cases.

To calculate the income amount in Swedish kroner at the time of receipt, you can use cryptocurrency prices from any reputable exchange – or let Coinpanda handle all the calculations automatically for you!

How to calculate crypto taxes in Sweden

If you are a Swedish resident and have transacted with cryptocurrency during 2022, you need to calculate the realized gains and income from all transactions. There are essentially two different ways to go about this – either manually or using a crypto tax calculator.

Let’s look at both methods:

Calculating your crypto taxes manually

Here are the steps you must take to calculate your crypto taxes manually:

- Download the transaction history from all exchanges where you have bought, sold, received, or sent any cryptocurrency. This includes also transactions from or to your own wallets.

- Calculate the cost basis for every individual transaction where cryptocurrency is disposed of

- Calculate the proceeds and resulting capital gains for all transactions that are considered taxable disposals by Skattverket

- Identify all transactions subject to income tax by Skattverket

- Summarize the calculations to find the total taxable amount during the financial year

Calculating your crypto taxes using crypto tax software

The best option for most people in Sweden is likely going to be using cryptocurrency tax software to automatically do the required calculations. If you want to save both time and money, here is how you can use Coinpanda to sort out your crypto tax situation and generate all the required tax reports automatically:

1. Sign up for a 100% free account

It is 100% free to create a Coinpanda account and you don’t need to enter any credit card information to get started. The free plan lets you explore and use all features for free.

Sign up with Coinpanda for free now!

2. Connect all your exchange accounts and wallets

Coinpanda supports more than 500+ exchanges, wallets, and blockchains today. You can easily import all your transactions by connecting your exchange accounts with API keys or by uploading a CSV file with the transaction history. If you find that Coinpanda does not support an exchange you have used, reach out to us so we can add the integration – usually within a few days.

3. Wait for Coinpanda to crunch all the numbers

Get yourself a cup of your favorite beverage and wait for Coinpanda’s sophisticated calculation engine to crunch all the numbers for you. Coinpanda will automatically calculate the cost basis, proceeds, capital gains, and taxable income for all your transactions! This might take anywhere from 20 seconds to 5 minutes depending on how many transactions you have.

4. Check for any reported warnings

Coinpanda will automatically display a warning if it appears that one or more transactions are missing such that the cost basis calculations will not include the total purchase price. If you see any warnings, you should first double-check that you have in fact connected all your wallets and exchange accounts.

Do you still see any warnings? Fear not! We have written an extensive list of help articles that will guide you through the entire process of making sure your crypto tax reports are as accurate as possible. If you still need any help, the best way to get in touch with our customer support and tax experts is through the Live Chat.

5. Download your tax reports and tax forms

When you have successfully imported all transactions, the final step is to download the tax reports you need to file your taxes in Sweden. Coinpanda’s tax plans start at $49 and you have lifetime access to all reports after upgrading.

Tax form K4 Sweden

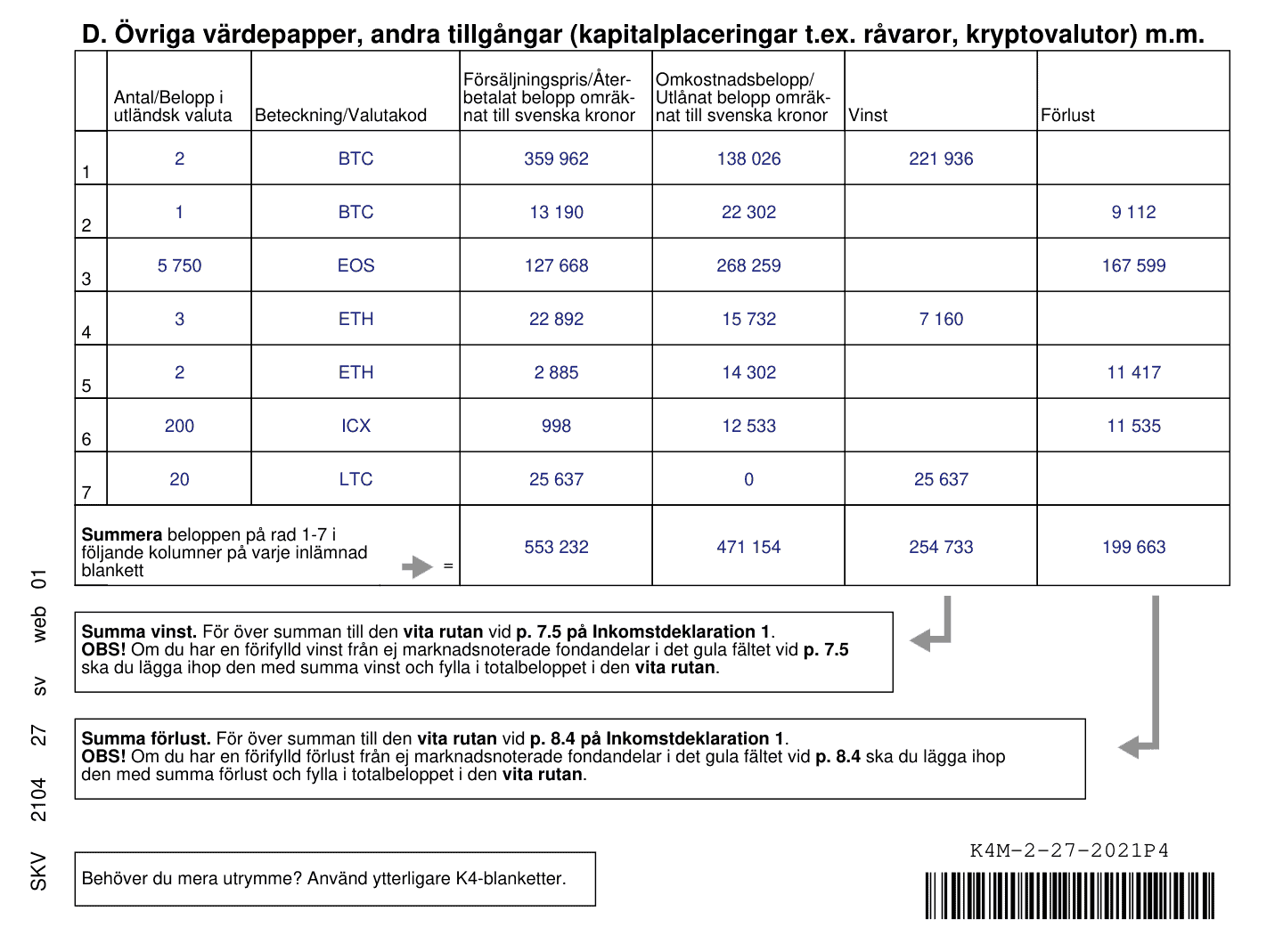

All profits and losses should be reported on the K4 tax form. It’s important to note that gains and losses must be reported separately. There are six columns that must be filled out in Section D of K4:

- Antal/Belopp i utländsk valuta: The number of coins/tokens that were disposed of

- Beteckning/Valutakod: Ticker symbol such as BTC, ETH, etc

- Försäljningspris: The total sales price or proceeds received from disposing of the cryptocurrency

- Omkostnadsbelopp: The total acquisition cost or cost basis of the cryptocurrency disposed of

- Vinst: Total gains summarized for each individual cryptocurrency

- Förlust: Total losses summarized for each individual cryptocurrency

Coinpanda can generate the K4 tax form completely automatically for you – all you have to do is connect all your exchange accounts and wallet addresses and Coinpanda will take care of the rest!

Below is an example of Section D of the K4 tax form exported directly from Coinpanda.

Sweden tax deadline

The tax year in Sweden runs from January 1 to December 31 each year. Your crypto taxes should be reported in your annual tax return where you also report ordinary income from employment.

For the 2022 tax year, the filing deadline is May 1, 2023.

Which records may Skattverket ask for?

There are two reasons for having good records of all your crypto transaction. Firstly, you need the complete history of all transactions to calculate your profits, losses, and income correctly. Secondly, you are required to provide proper documentation of all transactions if you get audited by Skattverket after filing your taxes.

As a general rule, these are the details you need to keep records of for all transactions:

- The date of the transaction

- Which cryptocurrency was part of the transaction

- Type of transaction

- How much was bought, sold, or exchanged

- The value of the cryptocurrency in SEK at the time of the transaction

- Exchange records and other relevant statements

- Wallet addresses you possess the private keys of

You should periodically take backup of these records from all exchanges you have traded on since many exchanges keep these records for a limited time only – or the exchange itself may cease to exist in the future. You can also use a cryptocurrency tax app like Coinpanda to generate a report with all this information automatically.