If you have received staking rewards, swapped ADA for other tokens or NFTs, interacted with DeFi on Cardano, or other ways dabbled in the Cardano ecosystem, you will most likely need to report capital gains on your Cardano transactions in the annual tax return. In this complete Cardano tax guide, we will explain everything you need to know about calculating and reporting your Cardano taxes and how to use Coinpanda to get your taxes sorted easily!

These are the topics we will address in this article:

How to do Cardano taxes

There are essentially five steps you must do to generate crypto tax reports for Cardano:

- Sign up for a free Coinpanda account

- Connect your Cardano wallet(s)

- Review the imported transactions

- Make manual corrections (if required)

- Export your tax forms

Next, we will examine the different steps in more detail and explain how Coinpanda imports all different transactions from Cardano.

January 12th, 2024

Our third iteration of the Cardano API integration has been released today. The latest integration’s biggest update is full DeFi support for token swaps, LP tokens, and liquidity operations across the 11 most used protocols.

This update is a big step towards becoming the Cardano ecosystem’s most complete and accurate portfolio tracker and tax software. If you encounter any bugs or issues or have suggestions for how we can improve the integration, please create a post in our forums.

How to connect your Cardano wallet

The first step to doing your Cardano taxes is to import the complete transaction history to Coinpanda. This step is quite easy since Coinpanda has an API integration with Cardano, so all you need to do is add your public wallet address to import all transactions. If you are not already a Coinpanda user, you can first sign up for a 100% free account.

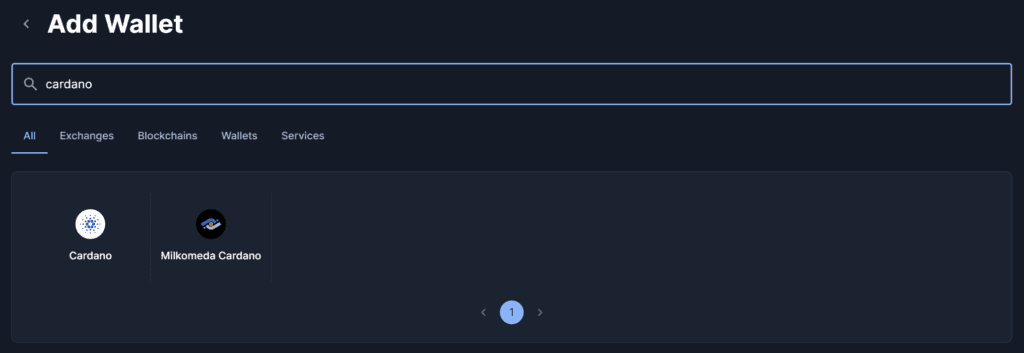

Once your account is set up, go to the Wallets page, search for Cardano, and click the Cardano icon to create a new wallet.

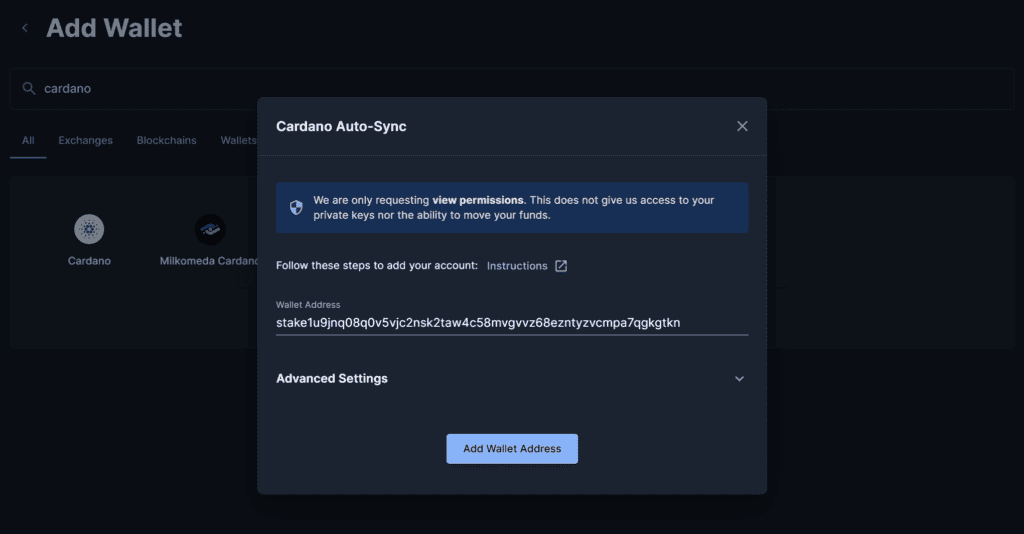

Once the modal is open, enter your public wallet address and click Add Wallet Address.

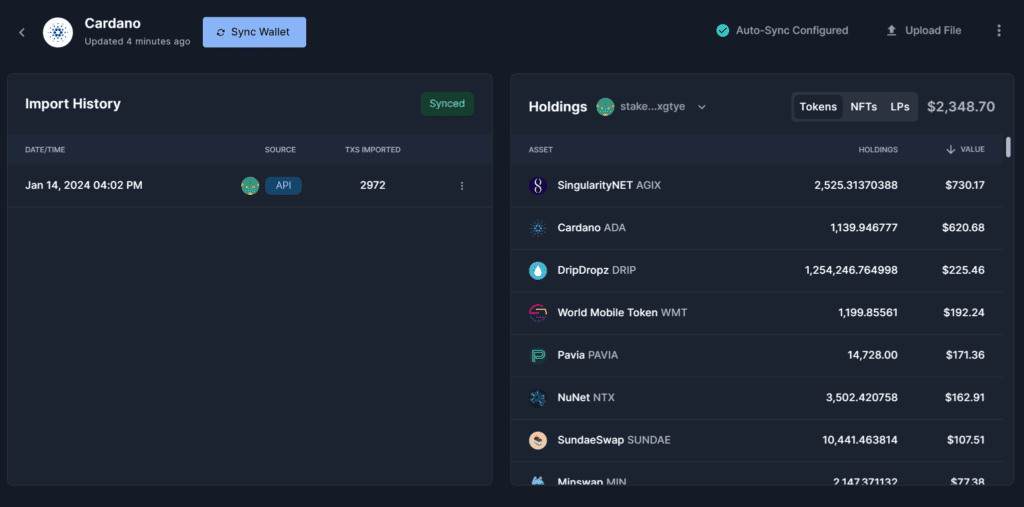

After adding your wallet address, click the Sync Wallet button to start the import process. This can take anywhere from five seconds to 10 minutes, depending on the number of transactions Coinpanda needs to import. Once completed, you will see a status message displaying the total number of transactions imported.

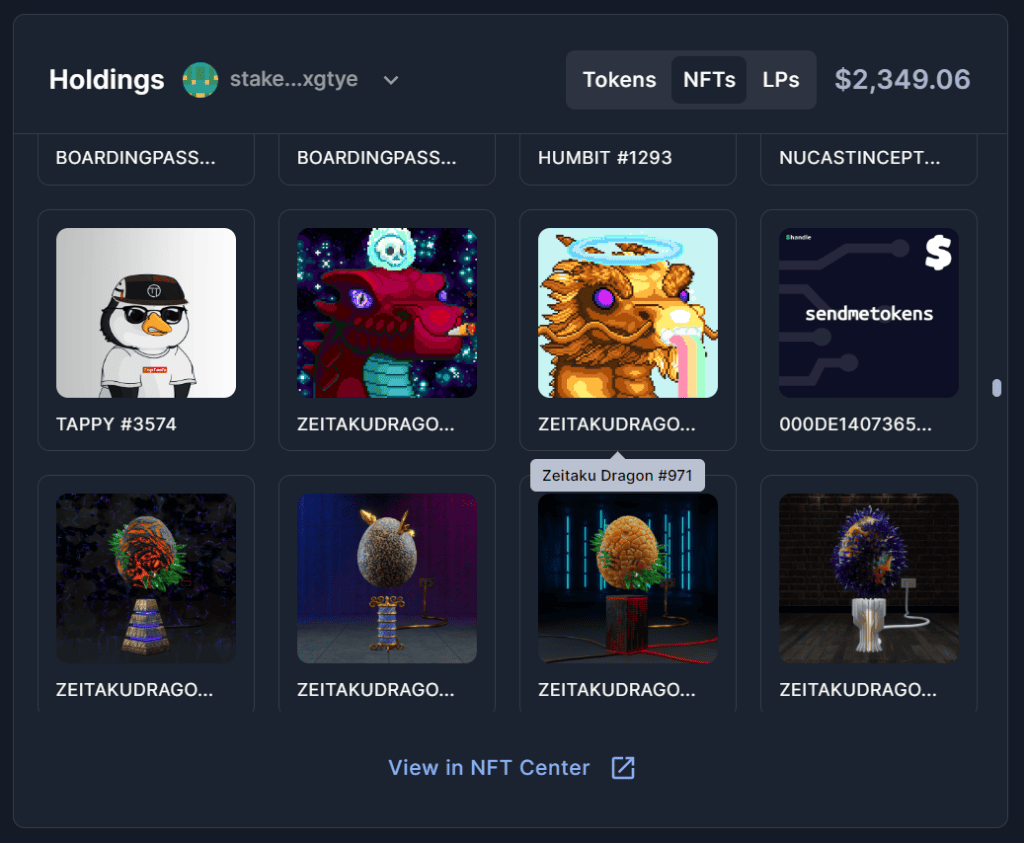

You might also notice that the Holdings window in the image above displays three tabs: Tokens, NFTs, and LPs. The new wallet holdings section was part of the new DeFi integration released in November 2023 and lets you now get a more in-depth glance at your portfolio holdings.

The NFTs tab lets you view all your NFTs visually, and the NFT Center provides even more details, such as the acquisition cost and date of all your NFTs.

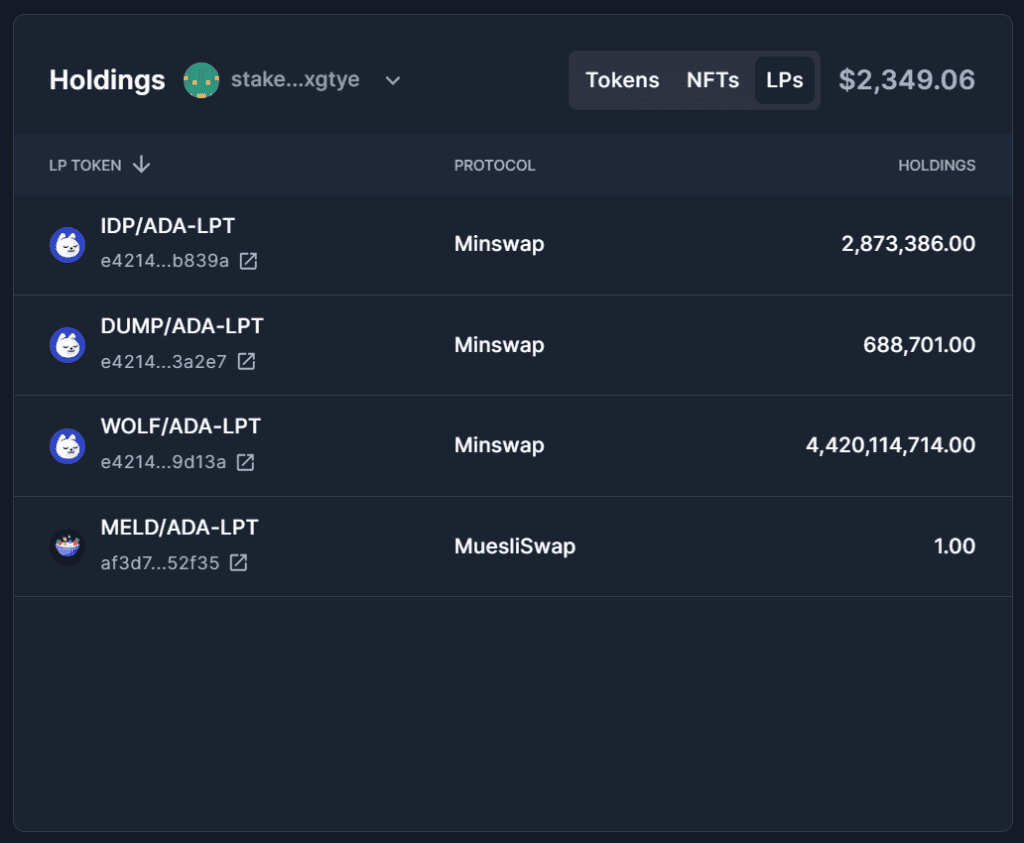

The LPs tab shows an overview of all the protocols and pools to which you have provided liquidity. You can also view the LP token on Cardanoscan directly by clicking the icon button next to the contract address.

Cardano tokens

Similar to Ethereum and other L1 blockchains, many tokens on Cardano can be traded on centralized exchanges or swapped on a decentralized exchange (DEX) such as Minswap or SundaeSwap. You might even have received some tokens in your wallet as an airdrop that you were unaware of.

Importing all transactions, including Cardano tokens, to a crypto tax platform like Coinpanda is crucial to ensure your tax reports are as complete and accurate as possible. Luckily, Coinpanda makes this very easy by automatically importing and identifying all tokens without requiring manual corrections. This includes both tokens sent and received and tokens swapped on decentralized exchanges.

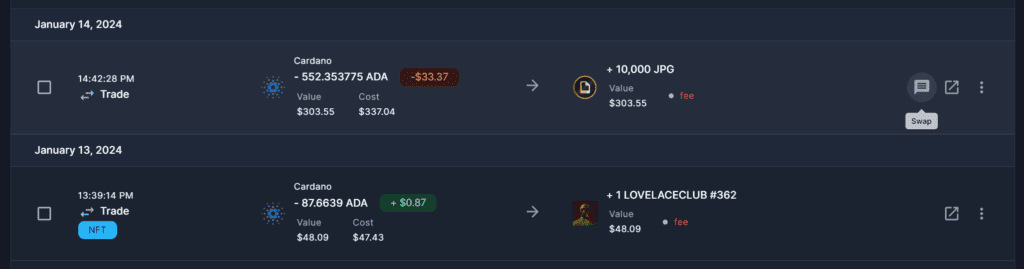

The image below shows an example of two token transactions imported to Coinpanda.

One challenge with Cardano tokens is that a large number of the tokens are not listed on any price aggregator site such as CoinGecko. Because of this, you might see a Missing price warning for some transactions. This means that Coinpanda does not recognize the token or that no price data exists on this date. To fix this, you must either edit the value manually or ignore the warning and leave the value as zero.

NFTs on Cardano

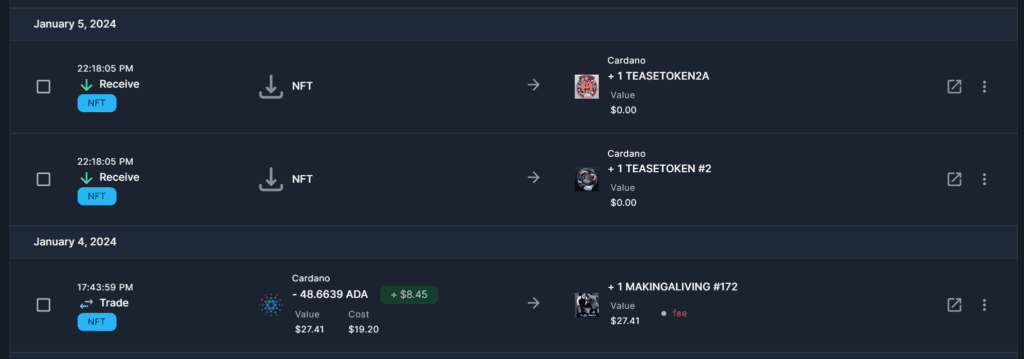

Non-fungible tokens (NFTs) have become hugely popular lately, and NFTs on Cardano are no exception. Marketplaces like CNFT allow users to place bids and offers for NFTs in the Cardano ecosystem. Minting, buying, or selling NFTs are generally taxable events, and such transactions must be accounted for when working out your total gains and losses during the tax year.

Coinpanda was one of the first crypto tax platforms to add support for NFTs in 2021 and is still today, at the time of writing this article, the only platform that fully supports NFTs on Cardano. Similar to tokens discussed in the previous section, all NFT transactions will be imported automatically from API by adding your public wallet address. This includes minting new NFTs, buying or selling NFTs on a marketplace, or NFTs sent to or from your wallet.

Coinpanda will fetch the NFT metadata during import and display the NFT image on the Transactions page. This makes it easy to track and verify all transactions imported, and you can also see a free preview of the capital gains for every NFT transaction without upgrading your Coinpanda tax plan.

The image above shows a few examples of NFT transactions on Cardano. If you have received an NFT from an airdrop or a free mint, the market value and cost basis will be zero since there are no official prices for NFTs except for the prior trading history. The same applies to NFTs sent – the value displayed will be zero. If a Send transaction is a disposal or otherwise a taxable event, you should change the value manually so that the resulting capital gains will be calculated correctly.

How to fix issues with NFTs not identified correctly

Unfortunately, there are some limitations with the current Cardano API, making it challenging to identify which tokens are NFTs. This means you might see an NFT not labeled correctly, or vice versa normal tokens labeled as NFTs.

However, this can easily be fixed by reporting the issue to Coinpanda customer support, who will update this internally in our system. When updated, you must re-import your transactions from API so that the tokens can be identified and tracked correctly. Please follow these steps to report such issues most effectively:

- Go to the Cardano token topic in the Coinpanda forum

- Reply to the topic and include both the token address and a link to Cardanoscan

Our support staff will then look into the specific token, make the necessary adjustments in our system, and report back when the update is completed.

Token swaps

As of January 12th, 2024, token swaps on all DEXes are now fully supported. In fact, Coinpanda is the first and only portfolio tracker and tax software to have DeFi support for the entire Cardano ecosystem. The 11 most popular protocols are supported today:

- Minswap

- MuesliSwap

- WingRiders

- VyFinance

- SundaeSwap

- Spectrum Finance

- TeddySwap

- CSWAP DEX

- Astarter

- Genius Yield

- MeowSwapFi

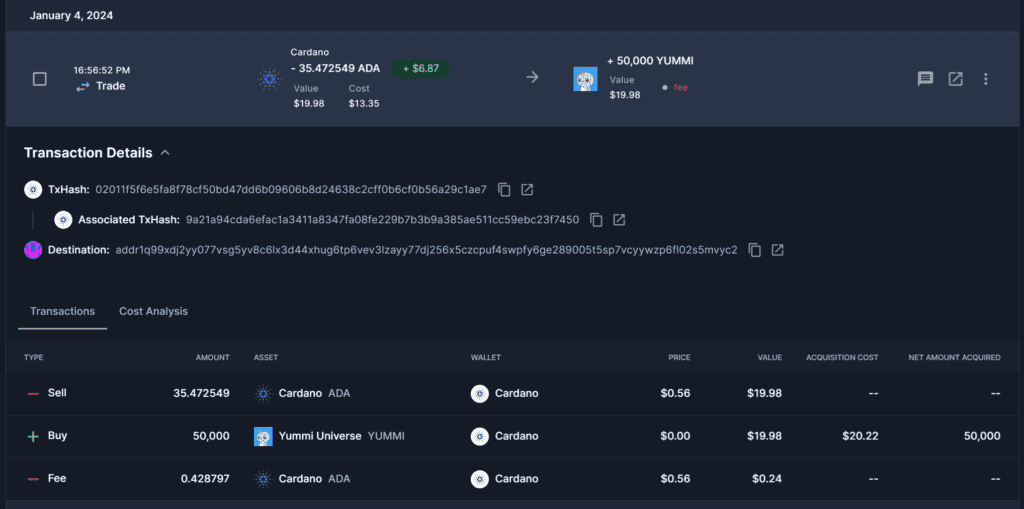

You can view all token swaps by filtering for ‘Swap’ in the description filter from the ‘Advanced’ filter menu. By clicking the transaction row, you can also view more information about the swap, such as both transaction hashes involved in the swap.

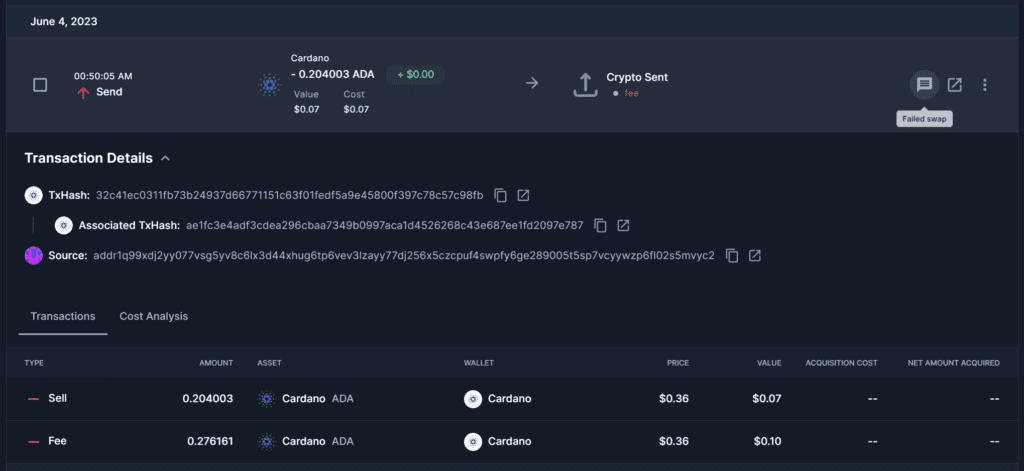

Failed token swaps are also imported automatically and will be shown with the description ‘Failed swap’ as seen in the image below. Similarly to successful swaps, you can filter for failed swaps by selecting ‘Failed swap’ in the description filter.

Liquidity pools and LP tokens

Together with token swaps are now also add/remove liquidity operations fully supported across all 11 protocols. All LP tokens from all protocols will be automatically identified, also when no metadata has been added to the Cardano token registry.

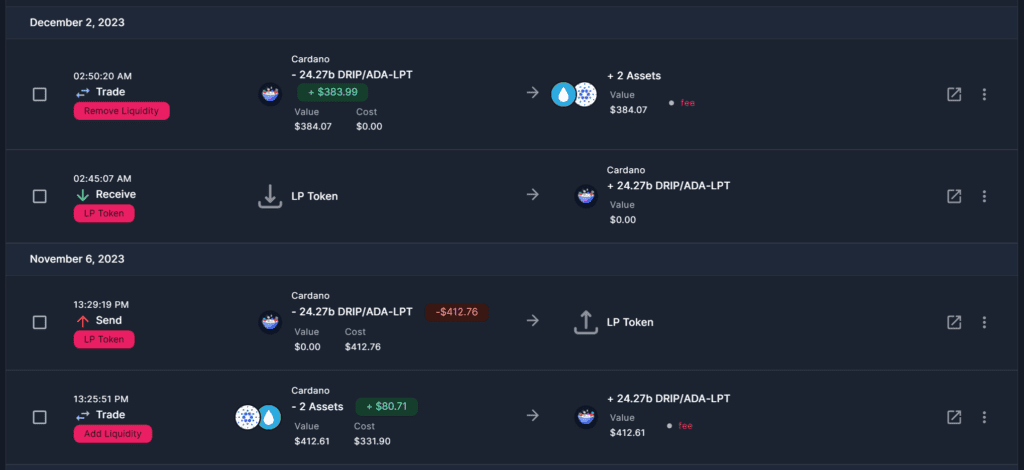

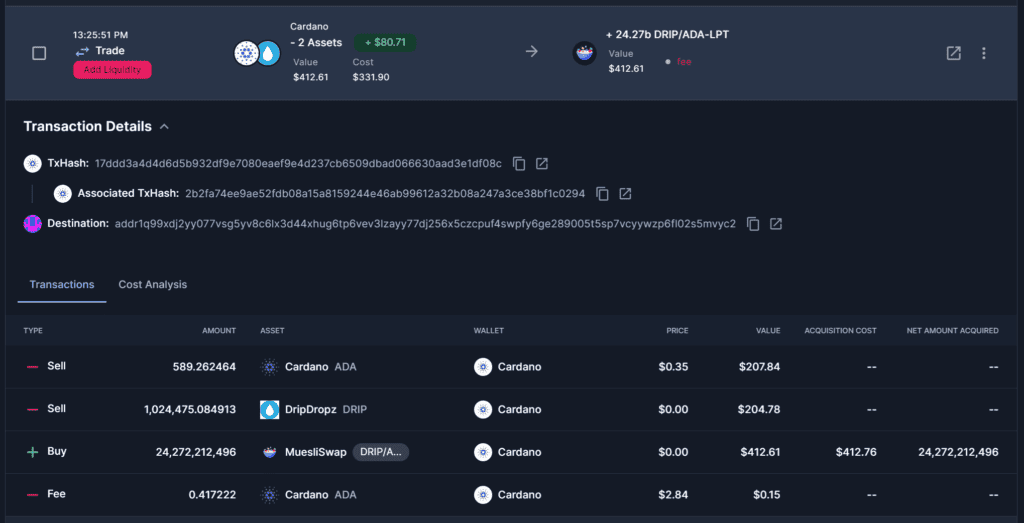

The below image shows typical LP token transactions:

- Cardano (ADA) and DripDropz (DRIP) have been deposited to the DRIP/ADA pool on Minswap, and an LP token is received in return

- The LP token has been staked for accruing interest before it’s unstaked on December 2

- Finally, the liquidity is withdrawn from the pool, and ADA and DRIP are returned to the wallet in exchange for the LP token

Like token swaps, clicking the transaction row lets you view more details, such as the transaction hash of both transactions involved in the add/remove liquidity operation.

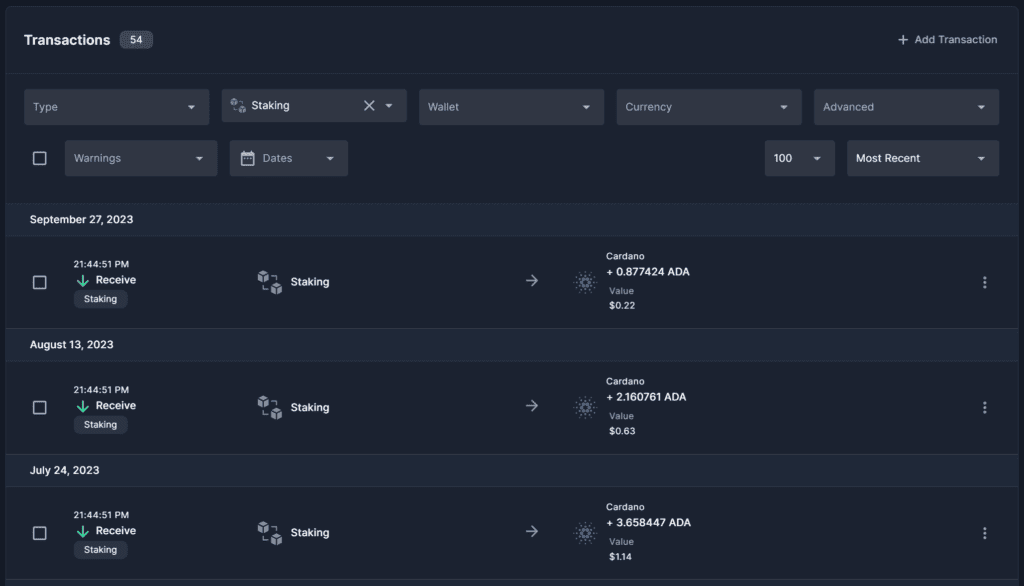

Cardano staking rewards

Coinpanda will import all staking rewards received in your wallet automatically. Whichever wallet you use for staking Cardano does not change this since all transactions recorded on the blockchain will be imported.

You can see all staking rewards on the Transactions page directly. The tax report will include all staking rewards in the income summary, so you know exactly what to report in your tax return and how much you need to pay in taxes.

Public keys

Public keys in Cardano wallets are used for managing your individual public addresses. Instead of adding each unique address separately to Coinpanda, you can add the public key directly and thus have only a single Cardano wallet in your Coinpanda account.

Luckily, Coinpanda supports all different Cardano public key formats. Not only that, but we also support address formats from all eras, including Byron. This means that whether you are using Daedalus, Yoroi, Adalite, or any other Cardano wallet, all you have to do is add your address or public key to your Coinpanda account, and all transactions will be imported automatically.

If you are not familiar with all Cardano address formats, here is an unofficial (and incomplete list) of all address formats supported today:

| Address type | Format | Is public key? | Coinpanda supported |

|---|---|---|---|

| Byron | DdzFF…oBRM5 | ❌ | ✅ |

| Shelley | addr1…cxndx | ❌ | ✅ |

| Stake key | stake1…lu78s | ✅ | ✅ |

| Daedalus | acct_…uu2y8 | ✅ | ✅ |

| Yoroi | ca195…b8a22 | ✅ | ✅ |

| xPub | xpub1…r328c | ✅ | ✅ |

Cardano stake keys will always start with ‘stake’, such as stake1uymh7uuay80t… for example. By adding a stake key address, Coinpanda will import all transactions associated with this address.

Ensure accurate Cardano tax reports

Here are the most important steps you must take to ensure your Cardano tax reports are as accurate as possible:

Connect all exchanges and wallet addresses

The single most important step is to make sure you have connected all your exchange accounts and wallet addresses to Coinpanda. This is a critical step for several reasons, but the main reason is that Coinpanda needs your transactions from all exchanges and wallets to identify internal transfers and track the cost basis correctly. Without all transactions imported, Coinpanda cannot correctly identify transactions sent between your own accounts and which transactions are taxable disposals.

Verify the wallet balance

After connecting your wallets to Coinpanda, we recommend verifying the wallet balance of all your Cardano wallets. This can be done directly from the Wallet page, where you will see a yellow icon if the calculated balance differs from the reported balance. If you don’t see any warning icon, the wallet balance matches, and all transactions have most likely been imported correctly.

Internal transfers

By default, all Send transactions not identified as internal transfers will be treated as disposals and realize the gains or losses. After connecting all your exchange accounts and wallets, you should ensure that all transactions between your wallets are identified as such. There are several ways to do this, but one way is to filter for Receive or Send to see only the transactions not identified as internal transfers. Next, you can either mark the transaction as an internal transfer, or you need to connect another wallet or exchange account if you forgot this earlier.

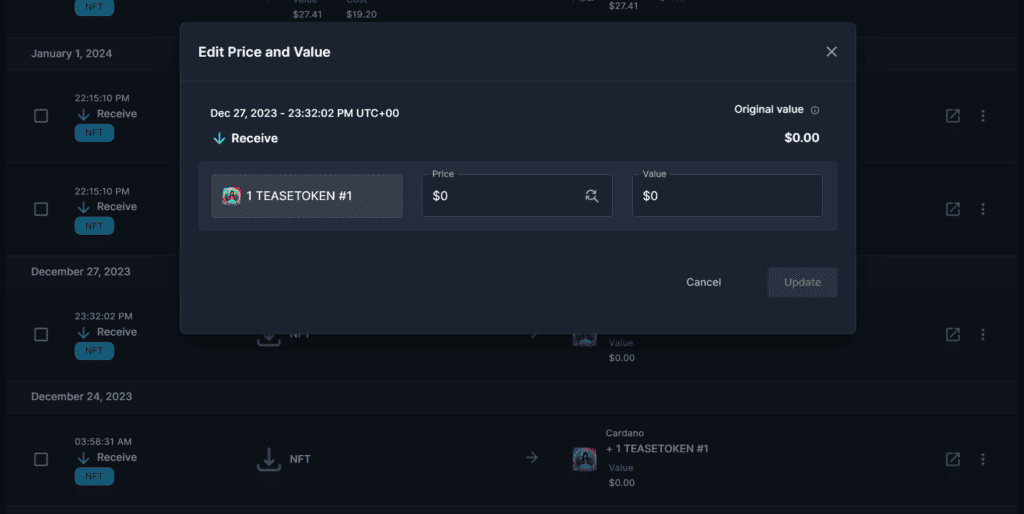

Token and NFT values

The last crucial step is to verify that all tokens and NFTs are valued correctly to avoid paying more taxes than required when the assets are disposed of in the future. As mentioned earlier, many Cardano tokens don’t have official market rates, so you might need to update the value manually. This can be done on the Transactions page by clicking the Value box and entering the token value on the day of the transaction.

Try Coinpanda for free

Coinpanda is one of very few crypto tax software solutions that can do tax calculations for the Cardano ecosystem correctly today. All you need to do is add your Cardano wallet address to your Coinpanda account, wait for all transactions to be imported automatically, and verify that tokens and NFTs are tracked and identified correctly.

You can sign up for a 100% free account or read more about how the software can help you report your crypto taxes. Coinpanda supports over 65 countries today, including the US, Canada, Australia, the UK, and almost all other European countries.