Capital gains report

Export a complete capital gains report in PDF format. See a gain/loss breakdown of each transaction you have ever made.

Mining, staking & income

Generate reports for all your income, such as mining, staking, airdrops, and interest. We also support donations and lost/stolen coins.

DeFi, NFTs & metaverse

We support DeFi on all blockchains, including Ethereum, Solana, and Cardano. Import all your NFT transactions from OpenSea with the click of a button.

Futures & margin trading

Have you traded futures or derivatives on Binance, Bybit, KuCoin, or Phemex? Coinpanda calculates profit/loss for all your futures and margin trades automatically.

International tax forms

Easily generate region-specific tax forms such as IRS Form 8949 and Schedule D. Coinpanda supports more than 65+ countries today.

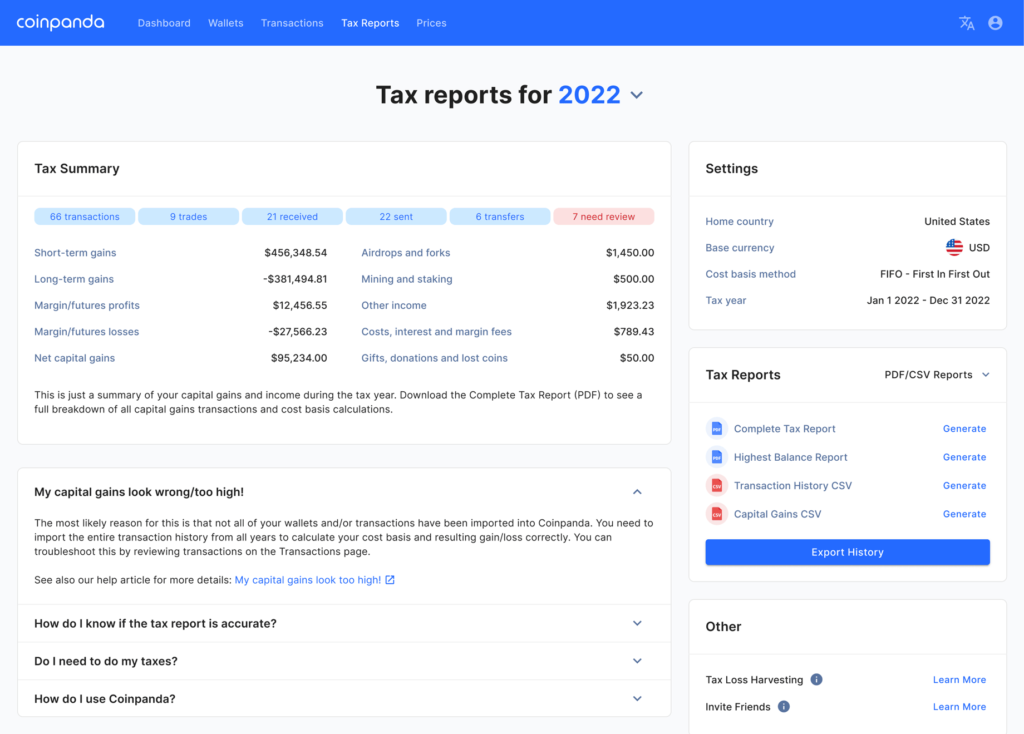

Accurate & complete tax reports

Coinpanda was developed to make reporting crypto taxes quick, easy, and accurate. All generated tax reports and forms comply with local tax laws and authorities such as the IRS, HMRC, ATO, and CRA.

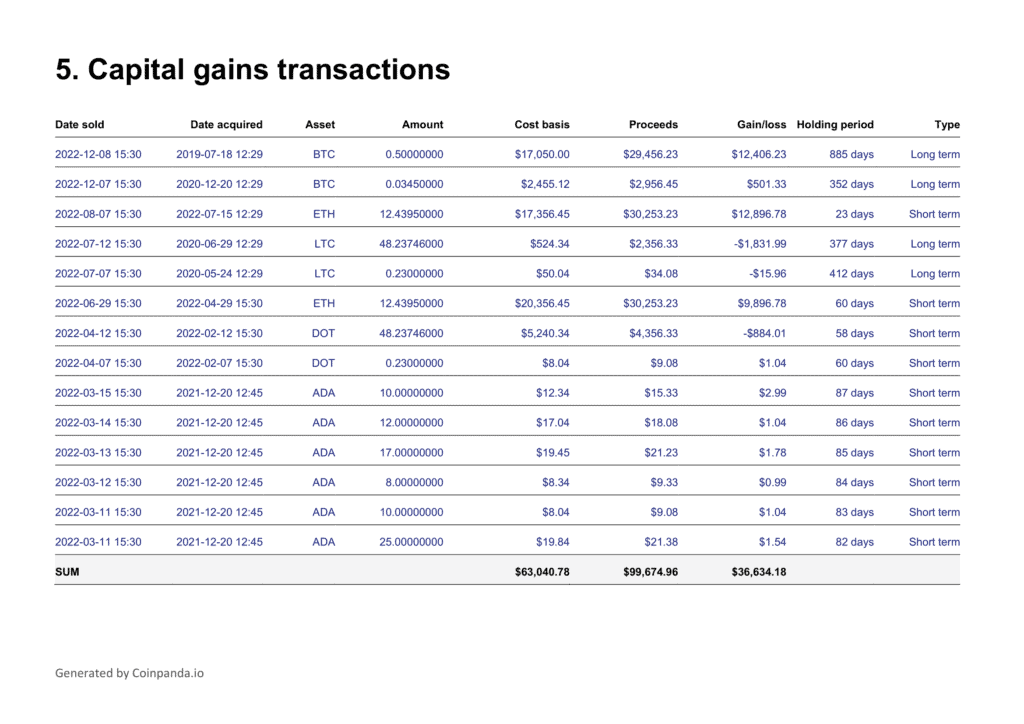

Capital gains report

View all your cryptocurrency transactions and taxable gains in a single report. Get a detailed breakdown of your proceeds, acquisition costs, and long-term and short-term gains for each NFT and crypto asset.

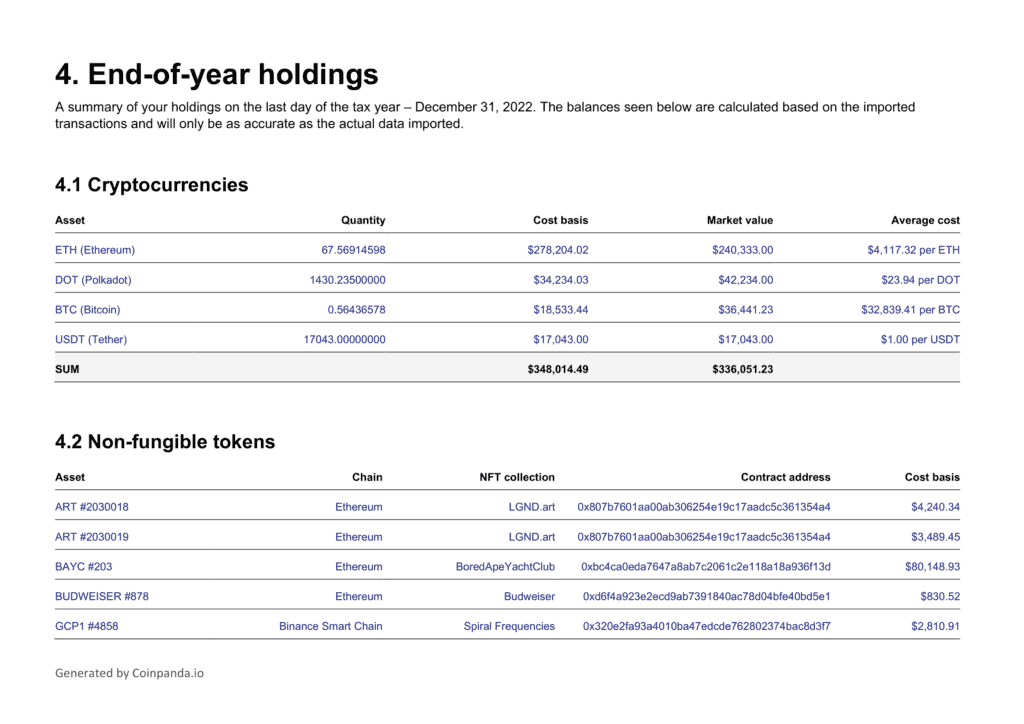

End-of-year holdings

The end-of-year holdings report breaks down your asset allocation, cost basis, and market value on the last day of the tax year for each cryptocurrency, NFT, and fiat currency.

Crypto taxes in 65+ countries

Coinpanda can generate country-specific tax reports for almost all major jurisdictions.

We also support the following countries:

Argentina

Belgium

Brazil

Bulgaria

Chile

Colombia

Czech Republic

Estonia

India

Iceland

Latvia

Lithuania

Luxembourg

Malta

Mexico

Peru

Philippines

Portugal

Romania

Singapore

Slovenia

South Korea

The Netherlands

Turkey

Coinpanda supports more than 65 countries. The list above includes only the most common ones.