CRYPTO PORTFOLIO TRACKER

Track your crypto portfolio like a professional investor

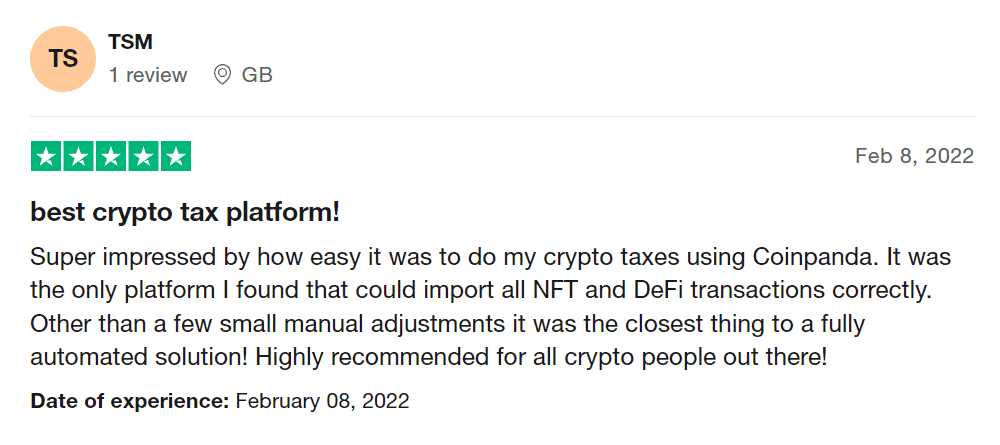

Sync automatically all transactions from more than 800+ exchanges and wallets. Coinpanda supports futures, staking, DeFi, and NFTs.

50,000+ cryptocurrencies

800+ integrations

Free forever

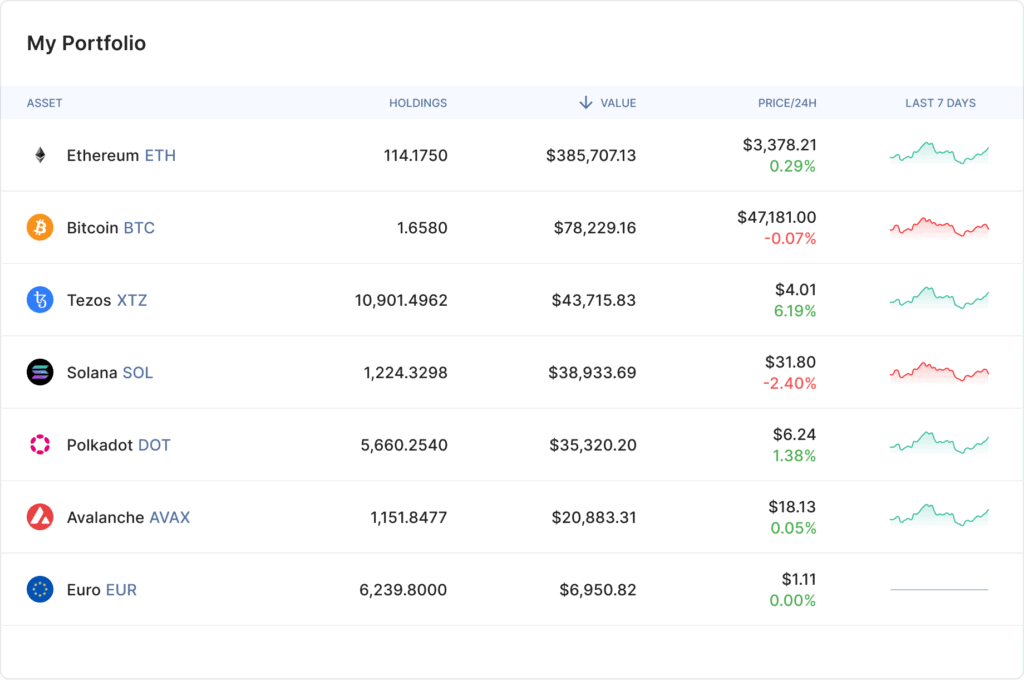

Your personal dashboard

Gain full insight into your portfolio’s value and performance from your dashboard. Track your gain/loss over time, and learn more about your cost basis and the potential for reducing your tax liability.

Free portfolio tracker

Coinpanda keeps track of your transactions across all major exchanges and wallets.

Analytics

See how your portfolio performs over time. Gain insight into your trading activity and habits.

Search Tool

Use our powerful & built-in search tool to find transactions for specific coins, exchanges, or wallets.

Margin Trades

Track all your margin trades from Binance, Bybit, KuCoin, Phemex, and other exchanges.

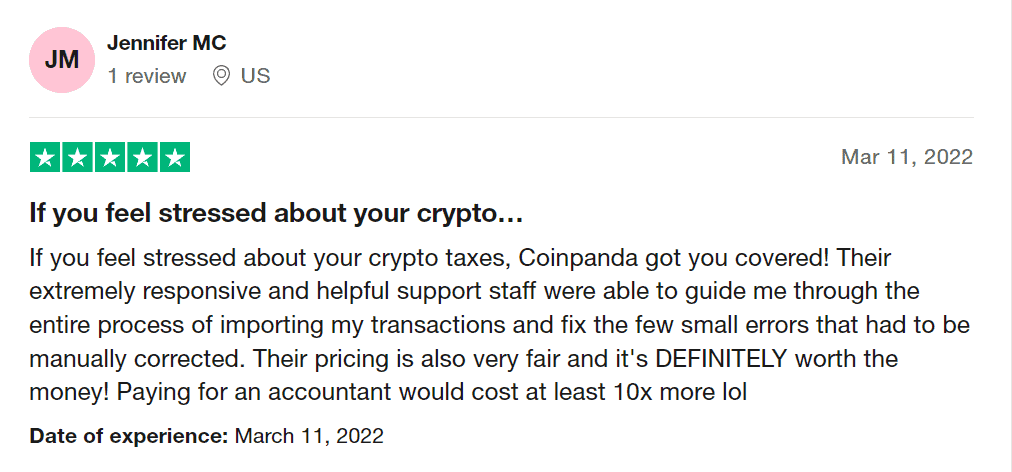

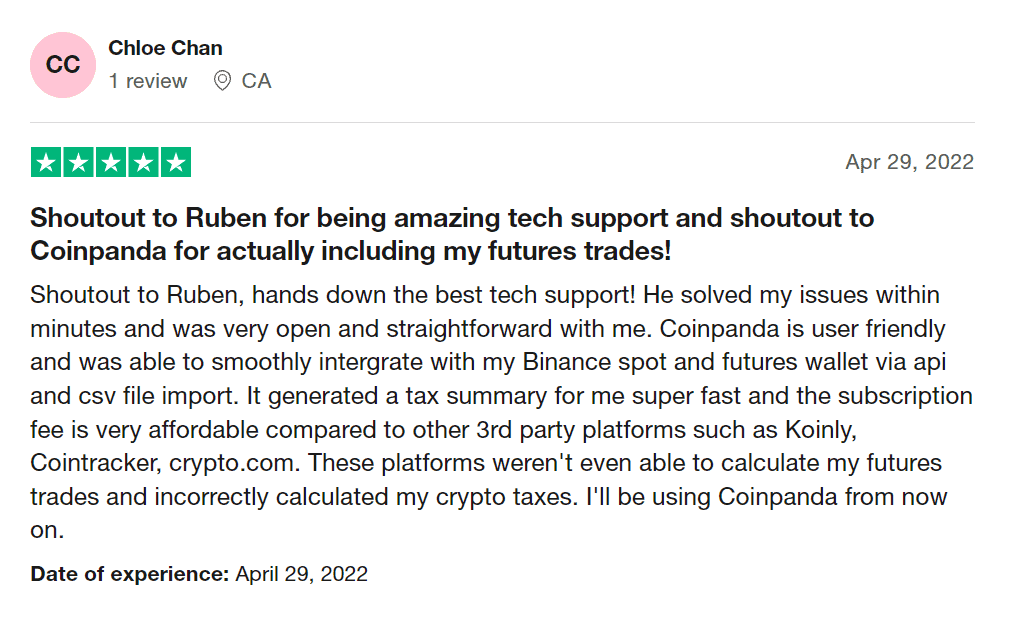

Support

We know reporting taxes is not fun. That’s why we offer 24/7 free support to guide you through the process.

Tax Preview

Gain insight into the tax impact of every trade before you make them with our sophisticated trade preview tool.

Tax Reports

Automatically generate tax reports for capital gains and income. Export local tax forms like Form 8949 and Schedule D.

Tax Reduction

Pay less tax with our powerful tax-loss harvesting tool designed to reduce your tax bill.

Cost Basis

Calculate your cost basis with FIFO, LIFO, HIFO, or ACB cost basis method.