In January 2022, we launched the first version of the Coinpanda Tax Accountant Platform to a selected few users. Since then, the accountant platform has undergone a lot of changes and improvements which we will explain in more detail in this article.

Getting Started

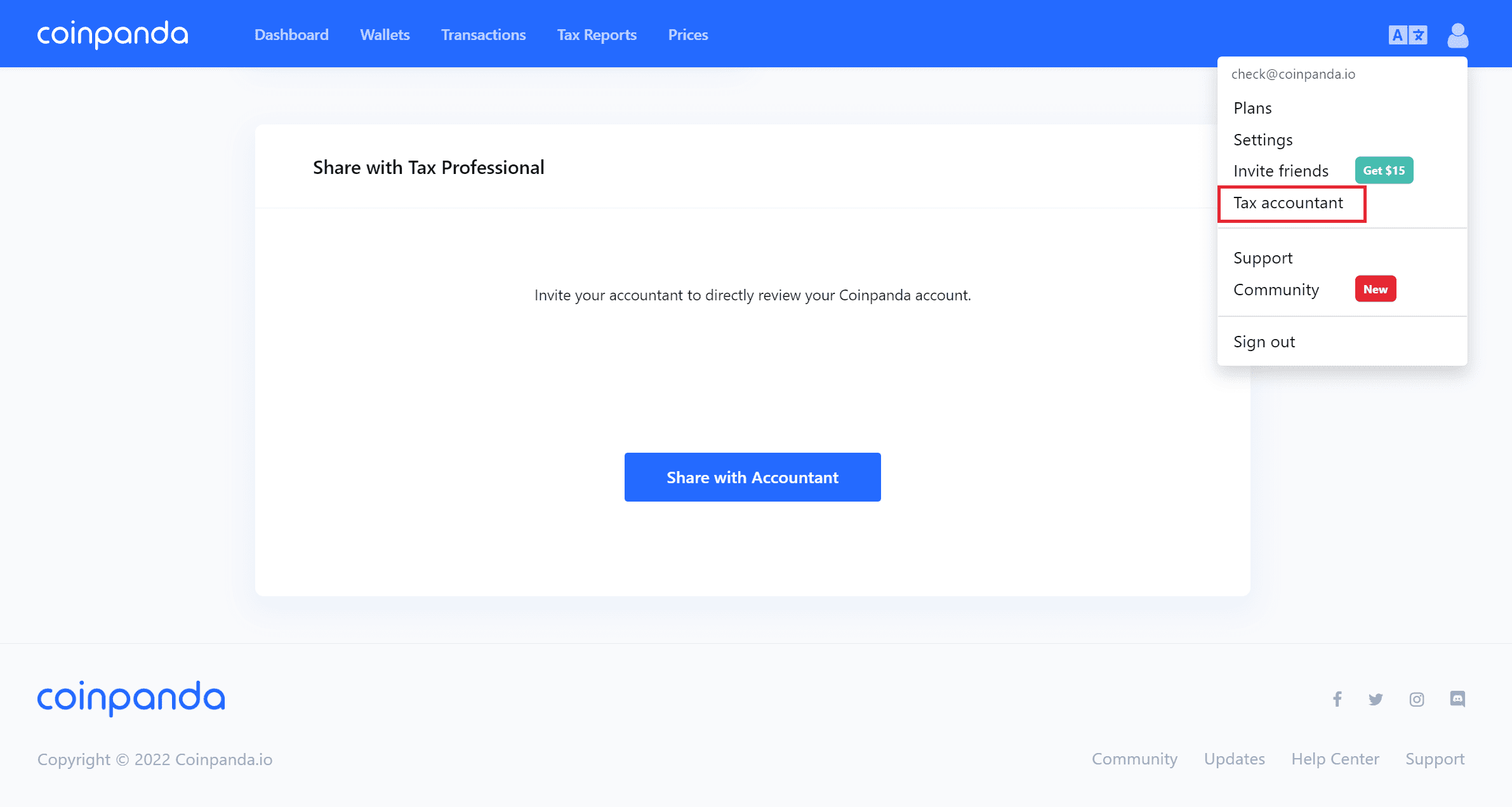

The first step to getting started with the tax accountant platform is to share your account with your accountant or CPA. You can easily invite your accountant from the Tax Accountant page this way:

- Navigate to the Tax Accountant page when logged in

- Click the “Share with Accountant” button

- Enter your accountant’s email address

If your accountant has already signed up with Coinpanda, he or she can accept the invite from their Accountant Dashboard directly and get instant access to view your transactions, wallets, and tax reports. If your accountant does not already have a Coinpanda account, he or she can easily create a new account from the invite link included in the email.

This is what the tax accountant page looks like when you are not currently sharing your Coinpanda account with an accountant or CPA:

View and Full Access

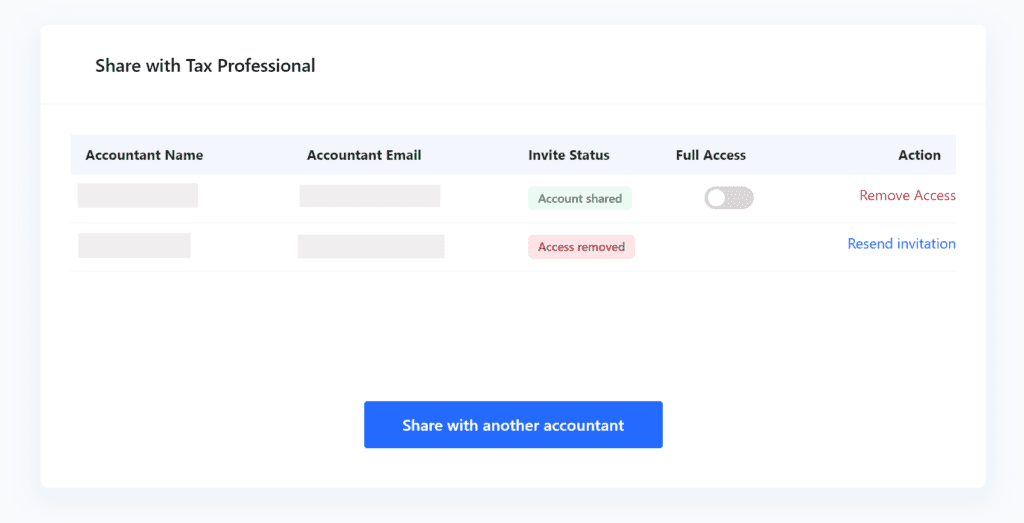

When your accountant has accepted the invitation, you will see a green label with the text “Account shared” on the Tax Accountant page. This means that your accountant can view all your wallets, transactions, and tax reports.

By default, only view access is granted to the accountant. This is shown with the deactivated, grey toggle button in the “Full Access” column. However, if you want to grant your accountant full access to your account so that he or she can add wallets, add API keys, upload CSV files, or manage your account in a similar way as you would, then all you have to do is click the toggle button to activate the setting for full access.

When the toggle button setting is on, your accountant will have full access to your account similar to what you have. This means that your accountant can import, update, and delete transactions imported to Coinpanda before generating your tax reports. This has been a highly requested feature from both our users and accountants already using Coinpanda for their clients, and we are proud to have released this feature today!

For Accountants

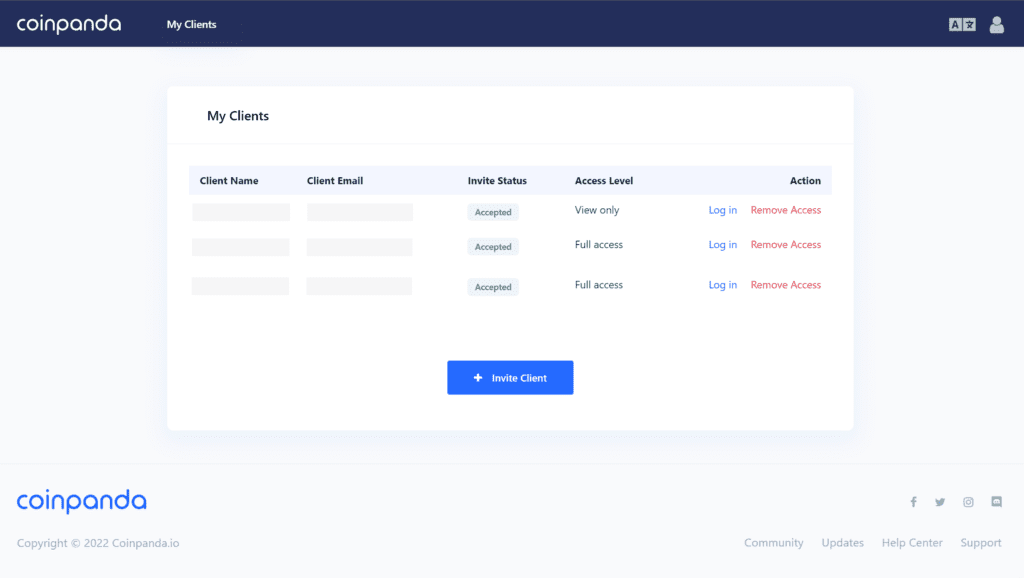

For accountants, we have a separate login that will take you to the Accountant Platform. After signing up or logging in, you will be taken to the “My Clients” page where you can manage all your individual clients. To invite a client, simply click the “Invite Client” button and fill out the form to send an email invite.

When one or more clients have accepted the invitation to share their Coinpanda account with you, you will see their name and email in the window and a green label with the text “Accepted”. In the Access Level column, you will see either “View only” or “Full access” depending on the access level your client has given.

To view one of your client’s accounts, simply click the “Log in” button and a new tab will open in your browser. You can easily see which client you are logged in as from the blue window at the top of every page.

If you want to switch clients, simply click the “Switch Client” button and select the client that you wish to be logged in as. Please note that you can only be logged in as one client at the same time in the same browser.

If you want to remove access from one of your clients, just click the “Remove Access” button and the client will be removed. This will not affect your client’s account in any way other than you will no longer be able to log in as him or her.

Frequently Asked Questions

Does my accountant have full access to my account?

By default, your accountant will have read-only access to your account. If you want to give your accountant full access so he or she can import transactions and manage your account similar to how you can, you will need to change the toggle button setting on the Tax Accountant page.

Which tax reports can my accountant download?

Your accountant can download all the different tax reports and forms supported by Coinpanda. Today, we support tax reports for more than 65+ countries including the US, Canada, Australia, the UK, Germany, Japan, France, Norway, and Sweden. See this page for a full list of the tax reports supported by Coinpanda today.

Can my accountant upgrade my plan?

In order for you and your accountant to get access to the tax reports and forms, you will need to upgrade your account to a paid tax plan if you have more than 25 transactions in the tax year. Both you and your accountant can upgrade your account. Please discuss with your accountant if he or she will purchase the tax plan on your behalf, or if you should purchase the tax plan yourself.