In this article, we will look into how you can calculate staking income from Cosmos for tax purposes. We will be addressing aspects such as income tax, capital gains tax, and how to calculate your Cosmos staking taxes using two different methods. If you’re seeking a clearer understanding of the possible tax implications of Cosmos staking, this article will answer all the questions you may have about this topic.

How Cosmos rewards are taxed

Rewards from Cosmos staking are usually considered as income for tax purposes, calculated at their fair market value in the local currency at the time they are received. Moreover, Cosmos staking rewards may also be liable for capital gains tax if they’re sold for a profit later on, with the exact tax rates dependent on personal income levels and the current tax regulations in your country.

Income tax

Understanding that rewards from crypto staking activities are generally deemed as income forms the basis for the tax implications related to Cosmos staking. In most legal jurisdictions, including the United States, tax agencies consider cryptocurrency staking rewards as taxable income when these rewards are credited to the wallet. This implies that when you accumulate ATOM (Cosmos’ native cryptocurrency) via staking, the equivalent value of those rewards in your local currency (like USD, EUR, and so forth) on the day of receipt should be declared as income in your tax filing for the subsequent year. In many cases, the precise tax liability will depend on your overall income bracket and the distinct tax thresholds in your country or jurisdiction.

Capital gains tax

However, it’s equally important to factor in the impact of capital gains tax when participating in Cosmos staking. Suppose you choose to dispose of your staked ATOM rewards later. If the coin’s value has appreciated since you initially received them, you must pay capital gains tax on the difference. The relevant capital gains tax rates vary from country to country and may, in some regions, depend on your total capital gains or the duration for which you owned the cryptocurrency prior to selling. For example, if you’re based in the U.S., you may be subject to long-term capital gains rates if you held onto the ATOM for more than a year before deciding to sell, offering potential tax benefits compared to a quicker sell-off.

How to calculate Cosmos staking taxes

Generally, there are two methods to determine your staking income from Cosmos. You can do it by hand (the difficult way) or use cryptocurrency tax software to simplify and automate the process. Next, we will explain both approaches.

Calculate manually

Calculating income from Cosmos staking manually involves three steps:

- Export a complete history of all staking rewards transactions

- Calculate the Fair Market Value of each transaction

- Summarize the values to find the total income

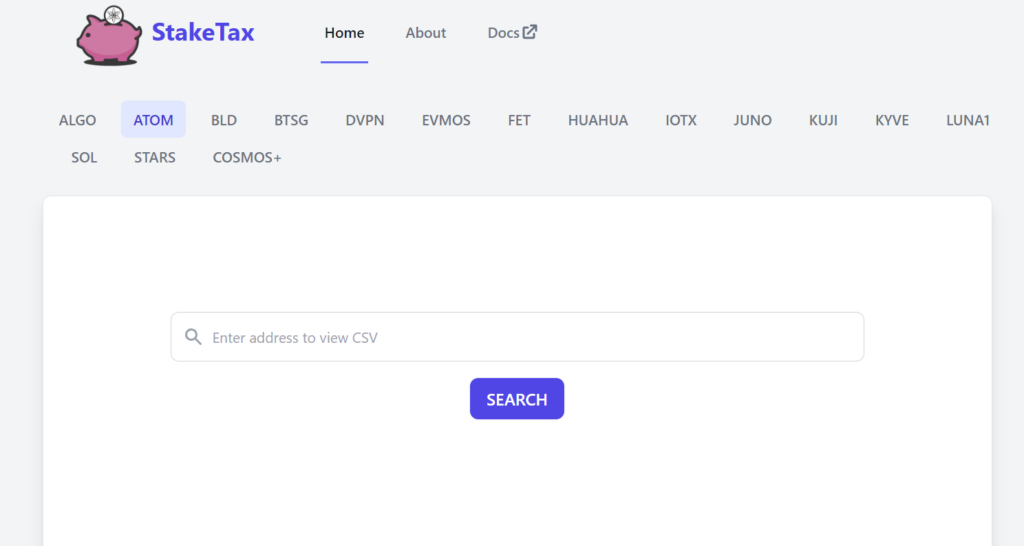

To complete the first step, we recommend using StakeTax. This website lets you view and export all transactions from a long list of popular blockchains, including Cosmos. StakeTax also supports staking transactions for Cosmos and other Cosmos-based blockchains

First, you need to find your wallet address. Depending on which wallet you are using, you will most likely find your address after logging in to the wallet. All Cosmos addresses start with ‘cosmos1‘.

The image below shows the welcome screen on StakeTax. Select first ‘ATOM‘ in the tab menu, enter your address, and click ‘SEARCH‘. StakeTax will now start to import the transactions and prepare the data so that you can download a CSV file in the next step.

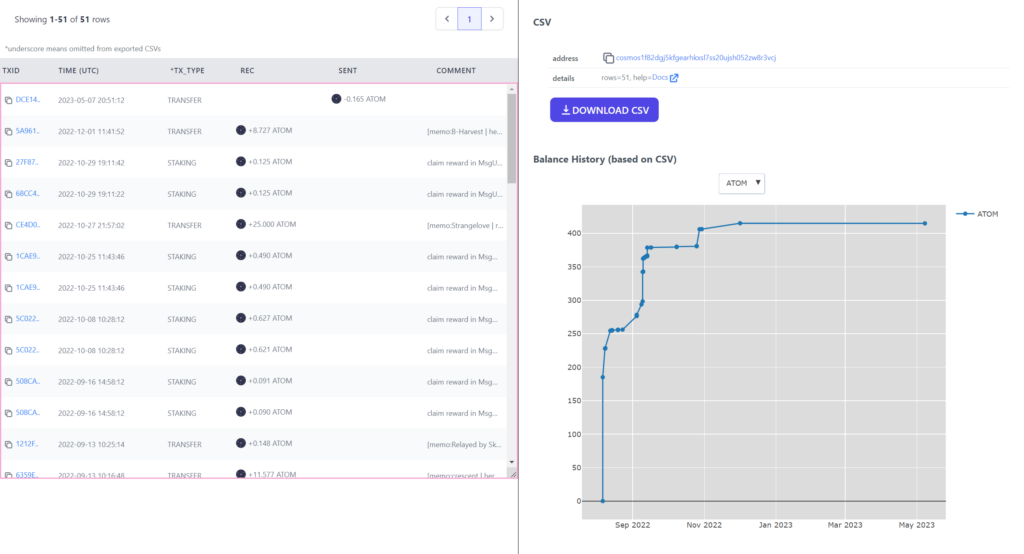

After StakeTax has successfully completed the import and parsing of transactions from your address, you will see a page similar to the image below. You can first view all transactions to make sure it looks correct, and after that, click ‘DOWNLOAD CSV‘ and select ‘Coinpanda‘ to download the transactions as a CSV file.

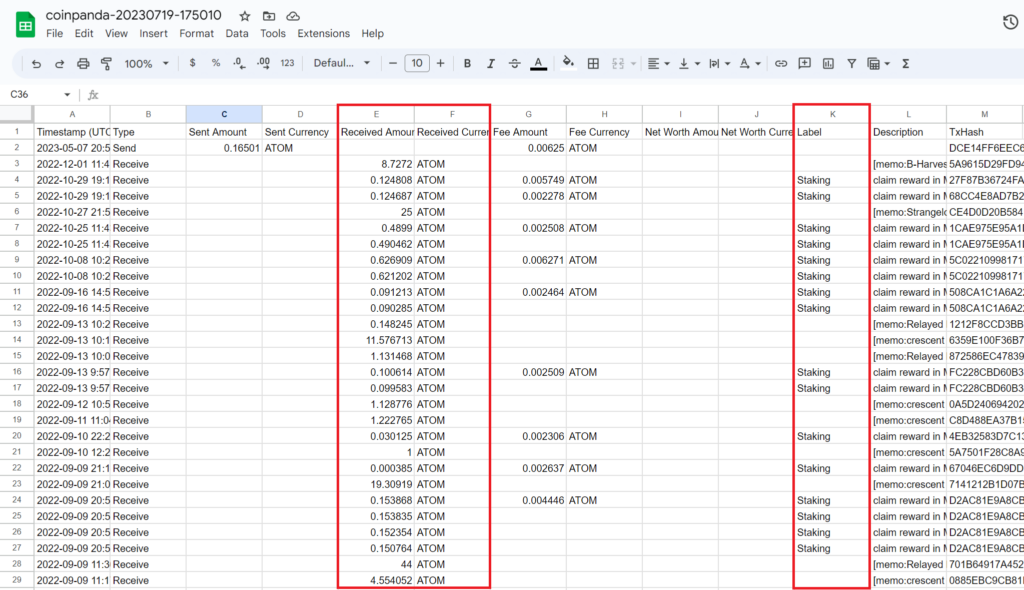

After exporting the file, you can open it in a spreadsheet editor like Google Sheets. Column K with the name ‘Label‘ will have the value ‘Staking‘ for all transactions that are staking rewards received in your wallet. Columns E and F show the currency name and amount, so based on this, you can now calculate the value in USD amount (or the currency you report taxes in) for all staking rewards received. The last step is to summarize the values for all days in the tax year to find the total income amount you should report in the tax return.

Using crypto tax software

For most users, using cryptocurrency tax software is most likely the best option. Coinpanda can automatically track and import all transactions, including staking rewards, from Cosmos and 300+ other blockchains supported.

You can sign up for a free account first, add your Cosmos address, and Coinpanda will automatically import all the transactions and do all required calculations in just a few minutes.

After you have connected all your wallets and exchange accounts, you can download all the required tax reports and documents that you need for filing your taxes. If you are above the free limit, you can upgrade to a paid plan starting from $49.

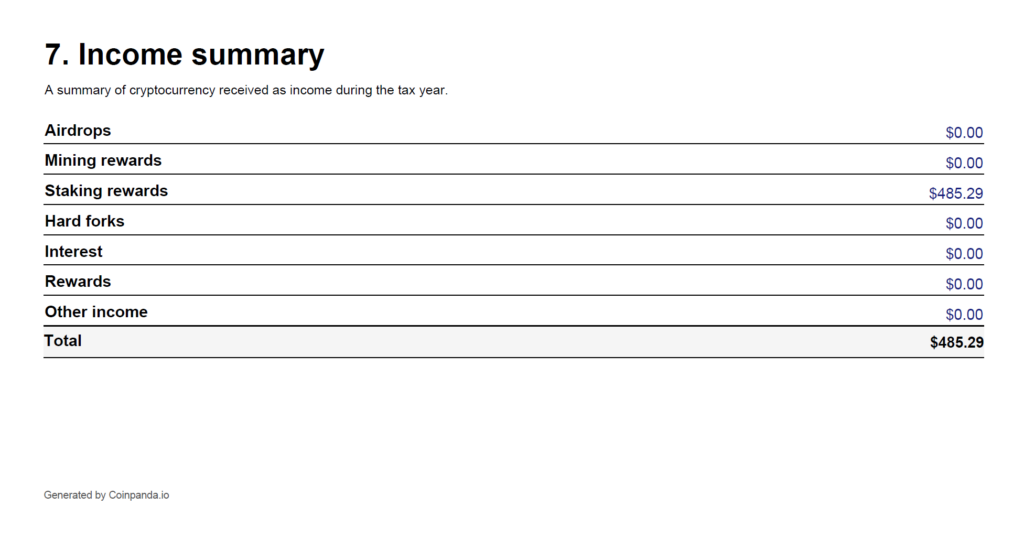

The image below shows the Income summary section from the Complete Tax Report, where the total taxable income amount from all transactions is shown. Typically, this is the income you should report in your tax return. The tax report also includes a table of all transactions considered taxable income, which can be sent to your tax accountant or used in case of an audit.

Tips for minimizing Cosmos staking taxes

An effective approach to potentially lessen your tax burden from staking Cosmos could be carefully considering the timing of selling your earned ATOM rewards. In certain jurisdictions, like the United States, a lower tax rate applies to long-term capital gains (on assets owned for more than a year) than short-term capital gains. Thus, you could qualify for this lower tax rate by maintaining ownership of your ATOM rewards for a period exceeding a year before deciding to sell. In other countries, such as Germany, long-term capital gains may even be entirely exempt from taxation.

Another worthwhile tactic is to leverage tax loss harvesting, which entails selling your cryptocurrencies that have lost value since the date you acquired the coins. Any unrealized losses from staking rewards might cancel out or reduce your capital gains from other activities, such that selling these assets could lower your total tax obligation. Nonetheless, it’s crucial to be mindful of potential regulations like wash-sale rules applicable in some countries like Canada and the UK, which forbid selling crypto assets at a loss specifically for the intention of claiming a loss and repurchasing identical crypto assets within a set timeframe.

Additionally, maintaining detailed records of every staking transaction is crucial. Although it may not directly decrease your taxes, having a good record-keeping habit can ensure correct income reporting and prevent you from paying more taxes than necessary. Several cryptocurrency tax software options can help with this by connecting your wallet and exchange accounts and tracking all your transactions without any manual work required.