Today, many new investors wonder what a cryptocurrency trading bot is and if it can really help them. Humanity has advanced technology high enough so that simple algorithms that thrive on data have completely revolutionized multiple industries today. One of them, the finance industry, has radically changed in the past decades as a result. Not only did the internet and new microchips help increase trading accessibility and speed, but they also changed the means of trading. Therefore, we no longer have to phone our broker and tell him which stocks to buy or sell.

You probably already know how the finance industry looks like in 2022, but did you know that 80% of all trading in global markets is algorithmic today? Coded trading bots manage positions for new and professional traders alike, leaving them with additional free time. Naturally, the situation in legacy markets applies to this sector as well, providing us with a plethora of cryptocurrency trading bots to assist us.

In this guide, we will explain exactly what trading bots are, why people use them, and how you should choose one. Additionally, we will provide you with an informational list consisting of the eight best cryptocurrency trading bots in 2022. After reading this guide, you will be ready to completely automatize your trading experience and increase your chance of having much more success in the markets. So first, let’s start by explaining what trading bots actually are.

What Are Trading Bots?

Trading bots work similarly to modern trading execution software. If you were to download and use a trading execution program, the app would connect to your exchange account via an Application Programming Interface (API) and provide you with all the functionalities necessary to trade. The only difference with trading bots is that the program automatically executes trades on your behalf via market data.

The way cryptocurrency trading bots execute orders can massively differ based on how they are programmed. One type can rely on traditional technical analysis methods such as Ichimoku clouds, Bollinger bands, or even something as simple as trend lines and Fibonacci retracements. Another type of trading bot could potentially function by reading order flow data, market sentiment, or a group of data points that is completely abstract.

It may take significant technical expertise to develop a trading bot, but someone that knows how to code can create new programs with ease. Therefore, we see a lot of individual users who create bots for their own trading purposes and needs. But most of the time, you’ll encounter a program that is designed by a team of developers who work together in a company. Nevertheless, do not be fooled that companies always deliver a better product than solo developers. Sometimes, even lone market participants have a better way of automatizing trades compared to large companies.

Why Use Trading Bots?

One question does remain. Why should an investor use bots when they can trade on their own? Well, there are quite a few reasons why a cryptocurrency trading bot can be superior. In the end, we are after all talking about a piece of software faster than any human brain. If successful, the program can do a lot more than just execute profitable trades.

Save time and energy

To be specific, the number one aspect that bots solve is time. Investors often refuse to call themselves traders, but should they really? After all, an investor is an active participant in the market. The sole difference is that he or she ‘trades’ on longer timeframes. On the other hand, a trader is usually someone who trades much more frequently. Therefore, he is forced to execute his positions on lower timeframes such as 5, 10, or 15 minutes depending on his style. This trading style results in a lot of time being spent staring at charts, managing trades, or planning your next move. Such trading is both exhaustive and tiresome, leading to most new traders leaving the industry for good after some time.

Must this really be the case? As previously mentioned, modern AI networks and computer software are faster than humans. On that account, it is possible to fully support your trading activities by utilizing these products and services. By doing so, you save a lot of time. And if the algorithm trades better than you, then you ensure higher profitability as well.

Efficiency

Traders inherently lack the ability to multitask when trading on lower timeframes. Therefore, you cannot catch every entry point or trading setup, especially across multiple assets and asset classes. Another important point to keep in mind is that algorithmic trading relies on market data. Since you cannot have huge amounts of market data on your own, your capabilities are severely restricted. And since market data can entail a lot of information, which the trading bot relies on, the software you are using will be more accurate than you ever could be! This is especially the case for cryptocurrency investors who trade in a 24/7 market. You would have to practically never sleep to achieve the efficiency of an average trading bot.

But how do you pick a good cryptocurrency trading bot? How do you even know what to look for in an automatized trading software? To help you in this quest, we present you with a short guide in the section below. Hopefully, this will also assist you in making a decision that suits you personally with the help of our top 8 best crypto trading bots selection.

Choosing the Perfect Crypto Trading Bot

Before you read our educational list of the top 8 best cryptocurrency trading bots, it is important to first discuss which features are important. Since no trader is equal, various individuals will have different trading strategies, risk appetite, position sizes, and other important aspects. To successfully pick a cryptocurrency trading bot, you must first consider your own needs to select a software that suits you. The following sections entail some of the most important aspects that you need to consider before deciding which trading bot that best suits your needs.

Ease of use

The primary purpose of a trading bot is to help you efficiently execute orders. But how can the software help you if it is too difficult to use? Before you even discover the results of a trading bot you must first use it, so the ease of use should be your primary concern. Otherwise, how will you automatize your trading if the program is too difficult to utilize?

To determine if an app is good or not, you need to take a good look at its user interface. For the best results, the trading bot should have a minimalistic design that prevents you from getting any headaches. If the interface is not clean, why should you even use it? A trading bot that requires multiple inputs, configurations, settings, and other kinds of options before you can start trading is usually too difficult to use for beginners. The bot is supposed to trade instead of you, not vice versa. Therefore, the software should have a low number of inputs if you do not have sufficient technical knowledge.

In your search, you will notice that a lot of open-source customized trading bots created by independent developers will be harder to use. Often, the developers are also the traders who created a custom solution for themselves. On that account, the solution will be better suited for that single person as he or she knows exactly what to do. Some may create a trading bot that is easy to use for beginners, but such instances are rare.

Companies that work on developing and ultimately selling their trading bots will most likely better suit you. Since they are made to be massively utilized by all kinds of people, these trading bots will be more user friendly. Often, they will provide several levels of useability depending on your skills. For example, a beginner may choose to lock the advanced features and only trade using a small selection of options. Therefore, he will start simple and learn how the app works step by step.

Strategy

When explaining what a cryptocurrency trading bot does and why people use them, we mentioned various strategies often utilized by bots. You can look at a trading bot like a regular trader. He has his own set of skills, trading strategies, size limits, risk limits, and other aspects. On that account, it is important to realize that each trader is different. One may specifically deal with basic trading techniques like horizontal support lines, trend lines, and Fibonacci retracements. Another one may exclusively trade Ichimoku clouds and RSI. And a different trader will only look at the order book and market sentiment and so on.

But unlike a trader, a bot will usually support all of these trading strategies. However, that is not always the case. If you are interested in one specific strategy that you deem the most profitable or one that you best understand, then it is natural that you use a bot that supports that particular strategy.

Apart from technical analysis (TA), there are other things that you should also consider. TA may be important, but it is not the most important aspect behind trading. When entering the market, one’s objective is to consistently stay in profit. And how does a trader achieve that? He focuses on his position size, the amount of risk he takes, his entry points, and trading setups. Of course, there are many more things to consider, but these should suffice for the basics. With that in mind, it is extremely important that a bot considers all of these things before trading. What use is a bot when it risks most of your capital and loses it in a single trade?

Just like human traders, bots should focus on consistently making profits over a long period of time. If the bot spends the entire day scalping on the 5-minute timeframe, it is very unlikely that you will remain profitable. At the end of the day, the goal of brokers and the overall market is that you place huge orders with high leverage as many times as possible. Why? Because these risky positions will more often than not result in the trader giving his hard-earned money back to the market. There is a severe difference between what a trader is told to do and what he should do, all because there is a major conflict of interest between each side of the market.

Price

Last but not least, we have the price of a cryptocurrency trading bot. If you are a trader who successfully reaps profits day by day, the price will not present a problem for you. But then again, if you need a bot to trade better than you this is probably not the case. On that account, the cost of automatized trading software is extremely important when choosing a solution. First, you have to understand that the pricing of a bot greatly varies and can be divided into two categories: Lifetime and monthly licenses.

A lifetime license means that once you pay for a bot, you will own it forever. You will have access to all of the latest features, newest updates, technical support, and more. These bots are usually pricier since you have unlimited access to them. You may see a bot cost anywhere between $500 to $5,000, if not more. But if the trading bot is helpful, why not? You can save both time and money by using a trading bot, so a large one-time payment should not be a problem at all. But again, that only matters if the trading bot is a high-quality one. Otherwise, it is dubious to waste your money on untested products that promise too much but deliver nothing in return.

A monthly license is usually a better option for beginners. Why? Because you can pay $50 or $100 to use a cryptocurrency trading bot for one month and see if it works out. Paying $50 for a single month is a far better option than paying $2,000 in one go for something that does not work.

However, your license is severely constrained. You only have access to the bot and all that it offers while the license lasts. Therefore, you are forced to renew your subscription to the trading bot on a monthly, or sometimes even yearly, basis. For example, a $100 per month trading bot might sound attractive at first. But after a year your license will total to $1,200. After two years, you will spend $2,400 and so on. So you are not paying just $100, you are actually spending far more money. But just as with the lifetime license, you will not waste money as long as the trading bot is profitable for you. This shows just how important it is to consider the price carefully before making a decision.

The Best Crypto Trading Bots

Now that you become an expert at how crypto trading bots work and what their benefits are, it is time for you to discover the most popular platforms and apps today. In the section below, we will provide you with a list of the top 8 best cryptocurrency trading bots in 2022. Make sure to remember what you previously learned and take it into consideration for each trading bot you read about below.

Top 8 Best Cryptocurrency Trading Bots

The best bitcoin and cryptocurrency trading bots in 2022 are:

So, let’s start with the first one!

Mudrex

Created in 2018, Mudrex is a cryptocurrency trading bot that offers algorithmic trading to its users. With their headquarter based in San Francisco, the platform was founded by a group of experienced traders, designers, and developers. Mudrex managed to raise $150,000 in a seed round in 2019, with Y Combinator as the main investor. Since then, numerous other VC firms have also invested in the crypto trading bot.

The platform only executes your trades through an API and cannot in any way control or transfer your funds. This way, the safety of your assets is ensured even in the case of a hack. To attract users to its platform, Mudrex created a set of innovative features that makes it easier to trade cryptocurrencies. One such feature is a simple user interface, designed to be simple enough even for the newest traders.

Users can create their own bots and strategies on Mudrex and they do not need to have any prior coding knowledge. In fact, the platform offers an intuitive trading strategy builder that helps you create, test, and deploy different trading strategies. The builder even comes with a backtesting engine that tests the efficiency of your bot. Well, how does one create a trading bot with no coding skills? Simple! You simply drag and drop prebuilt concepts and mechanisms to configure your bot in the best way possible.

At the time of writing, Mudrex offers more than 200 indicators and candle patterns which you can automatically add to your strategy. Additionally, creators can earn money by publishing great trading bots on the platform.

All in all, Mudrex is a great platform for those who are trying out cryptocurrency trading bots for the first time. The platform may not have the largest selection of features, but it has a simple user interface that allows you to seamlessly navigate and develop bots in no time.

Supported exchanges

Binance, Bybit, Deribit, OKEx, BitMEX, Coinbase Pro

Pricing and plans

Free Trial: $0

Premium Plan: $16 per month

Cryptohopper

Cryptohopper is one of the most popular cryptocurrency trading bots on the market. It is cloud-based and supports users of all skill levels. The main feature is that Cryptohopper seeks to be all-inclusive, therefore it caters to all traders by having a simple and minimalistic interface. But minimalistic does not mean limited. In fact, this trading bot has a wide range of features available even for more advanced traders.

Furthermore, the team is confident enough in their product that they allow you a free trial to test Cryptohopper out first. If it proves itself to be a helpful trading tool, you can purchase a monthly license starting from $19. For more features and support, users can upgrade to $49 monthly or an even more advanced $99 monthly license.

Cryptohopper supports numerous leading crypto exchanges, allowing you to easily connect the two with the help of a simple API key. At the time of writing, the trading bot supports Binance, Coinbase Pro, Kraken, Bitfinex, Huobi, and KuCoin to mention a few. Of course, the developers plan to include support for more exchanges as time goes on.

You have access to both a free marketplace for signals as well as paid signals. Regarding strategies, you can access more than 30 indicators and 90 candle patterns. As for the cryptocurrencies themselves, Cryptohopper offers more than 75 coins and tokens for users to automatically trade.

The company was formed by two successful day traders in 2017 and operates in the Netherlands. According to the founder, they created the trading bot to remove all emotions and human patterns that traders traditionally have. Therefore, they can now trade solely based on algorithms, programmed strategies, signals, candle patterns, and more.

Cryptohopper also prides itself on a professional and 24/7 customer support team. Traders can contact customer support at any time to deal with any potential issues. For beginner traders, the company also created a video library called the Cryptohopper Academy. With this, users can learn how to use the app as well as how to effectively trade.

Supported exchanges

HitBTC, OKEx, KuCoin, Bitvavo, Bitpanda Pro, Huobi, Poloniex, Kraken, Bittrex, Bitfinex, Coinbase Pro, Binance, Binance US

Pricing and plans

Pioneer: Free

Explorer: $19 per month

Adventurer: $49 per month

Hero: $99 per month

Bitsgap

Bitsgap is another popular app within the crypto trading community. It launched in 2018 as an algorithmic all-in-one trading platform. Aside from a trading bot, users can also use the exclusive Bitsgap dashboard through which they can simultaneously trade on around 30 cryptocurrency exchanges, with access to more than 10,000 trading pairs.

Just as many similar solutions, Bitsgap focuses on providing a simple interface through which traders can utilize their bot. They can use numerous trading strategies over multiple timeframes, including a special arbitrage service that checks for price differences for certain trading pairs. The unique dashboard helps you with arbitrage opportunities as the user can manually buy a token at one exchange and instantly sell it at another exchange at a higher price.

The platform is highly secure and can be downloaded to your desktop or smartphone. Users also have the option to use Bitsgap directly through their web browser. If willing, a trader can set up multiple defense parameters to secure their account. For example, Bitsgap supports two-factor authentication and email confirmation upon login. Additionally, all users customize permissions for their API keys. But in the end, the app only requires access to your trading history, trading permission, and balance. At all times, your funds remain on the exchange itself.

License prices are relatively cheap. Users can decide between three accounts that offer different trading volumes, bots, tools, etc. The first package costs $19 per month and offers 2 bots with a monthly volume of up to $25,000 without any arbitrage opportunities. The second package includes 5 bots, $100,000 monthly trading volume, and arbitrage for $44 per month. In the end, satisfied customers can pay $100 per month for all features, including unlimited trading and 15 crypto bots. For first time users, Bitsgap offers a limited 14-day free trial.

Supported exchanges

Binance, Bitfinex, OKEx, Huobi, HitBTC, Bittrex, KuCoin, EXMO, Kraken, CEX.io, LiveCoin, Poloniex, Bitstamp, Coinbene, ZB, CoinEx, Gemini, Gate.io, Liquid, LBank, TheRock, BiBox, Bit-Z, DDEX, BigONE, Bithumb

Pricing and plans

Basic: $19 per month

Advanced: $44 per month

Pro: $110 per month

3Commas

Compared to other trading bots, 3Commas is considered as a premium platform. The trading bot is for more advanced users who seek to save time and simultaneously hone their skills. However, the user interface is also simple enough to use for a beginner to master it.

The team’s main goal when developing the platform was to minimize losses. On that account, most of the trading bots available on this platform utilize risk strategies in order to limit your exposure to losses. But do not worry, 3Commas also looks to maximize your profits whenever possible, taking risks only when it is warranted.

According to 3Commas, more than 33,000 traders use their platform today. As a result, the platform exchanges more than $10 million in daily trading volume. Users have access to some of the most popular crypto exchanges, such as Binance, Coinbase Pro, Bitfinex, Huobi, and many more platforms.

Similar to Bitsgap, users can simultaneously trade on multiple exchanges at the same time. The platform is available to multiple devices and can be accessed directly in your web browser as well. Besides automatizing your trades, 3Commas also helps you learn what kind of mistakes not to make and how to prevent losses more effectively.

The key features behind this cryptocurrency trading bot is an easy to use interface with detailed analytics and statistics. Besides picking default bots, you can also customize your own trading bots according to your strategy. Apart from a trading bot, users can also analyze and backtest portfolios, as well as monitor other trader’s portfolios that have previously performed well in the market. There is also a social trading feature where users can copy other traders and profit from their success.

Depending on the type of account you buy, there will be different features at hand. 3Commas offers three types of accounts paid for on a monthly basis. Respectively, they cost $29, $49, and $99 per month. Like other platforms, the 3Commas cryptocurrency trading bot also offers a limited free trial.

Supported exchanges

Binance, Binance US, Bitfinex, BitMEX, Bitpanda Pro, Bitstamp, Bittrex, CEX.io, Coinbase Pro, Deribit, Gemini, HitBTC, Huobi, Ionomy, Kraken, KuCoin, OKCoin, OKEx, Poloniex

Pricing and plans

Starter: $29 per month

Advanced: $49 per month

Pro: $99 per month

Quadency

Quadency is both a cryptocurrency trading bot and a digital asset management tool. The platform is built for not only retail traders but for institutional traders as well. The Quadency platform offers a huge number of features, including pre-configured trading bots, advanced charting, market statistics, and portfolio analytics. Together, these features form one of the best trading platforms in the market.

While Quadency offers access to only a limited number of crypto exchanges, they are still the ones with the highest liquidity and number of trading pairs. At the time of writing, the trading bot supports automatic trading on Binance, Bitfinex, Coinbase Pro, Kraken, and KuCoin to mention a few.

Led by a team of highly experienced traders and developers, Quadency was founded in 2018 in the United States. With their extensive partnerships, the founders managed to integrate several leading trading tools and services such as Messari and TradingView. This means a user can use Quadency to check the latest Messari reports and analytics for a better view of the crypto market.

Out of all the platforms on this list, Quadency probably has the cleanest looking trading interface. With a minimalistic design, the trading bot offers you both preconfigured and customized strategies. All trading is based on Quadency’s own Algorithmic Execution Framework, which promises fast trading speeds and accurate predictions. By doing so, the team caters also to institutional traders who seek the very best.

Users can sign up for Quadency by creating a free Lite account. The free account can be used for an unlimited time, but the features are very restricted. For example, a trader can only have a monthly trading volume of $10,000 while using only one trading bot at a time.

The first paid account license costs $49 per month, or $39 per month when paying for an entire year. Called the Pro account, this license features up to $100,000 in monthly trading volume. The user can utilize 10 bots at a time and 100 backtests per day. The Unlimited license is aimed at more serious traders demanding unlimited capacity for monthly trading limits, daily backtests, and the number of bots running simultaneously. This license costs $99 per month, or $79 per month when paying for an entire year.

There is also an institutional account that provides custom features for institutional and professional traders. However, you must contact the Quadency team to learn more about the details of this plan and pricing details.

Supported exchanges

Binance, Binance US, Bitfinex, Bittrex, Coinbase Pro, Coineal, Gemini, HitBTC, Kraken, KuCoin, Liquid, OKEx, Poloniex

Pricing and plans

Lite: Free

Pro: $49 per month

Unlimited: $99 per month

HaasOnline

HaasOnline is an advanced cryptocurrency trading bot that supports some of the best exchanges in the crypto market. As the name implies, the platform provides an online interface where users can manage and automatize their crypto trades. The platform boasts to own a locally hosted, privacy-oriented, and high-performance trading server used for the trading bot. Moreover, traders can also access HaasOnline Cloud, a cloud-based trading platform that is available anywhere at any time. The cloud version is easy to set up and runs 99.9% of the time.

To help developers, the team created HaasScript. It is one of the most advanced coding languages for writing cryptocurrency trading scripts today. With more than 600 commands, users can write complex algorithms on their own. For users who do not know how to code, HaasScript offers a drag-and-drop builder through which traders can visually design their bot. There is no coding language knowledge needed to make a bot at all.

In this list, HaasOnline supports the largest number of cryptocurrency exchanges. The platform recently added Bitpanda Pro, Bybit, and FTX. It also supports all Binance platforms, Bitfinex, BitMEX, Bitstamp, Bittrex, and at least ten more exchanges. This makes it one of the best options for traders that truly wish to manage positions on almost all platforms.

The main problem with HaasOnline is that it does not offer any free trial at all. They also only offer 3 months, 6 months, and 12 months long licenses that require a one-time payment. Another downside is that HaasOnline only supports Bitcoin as the payment method.

At current prices, the Beginner account costs 0.047 BTC which translates to around $530 per year. Other available plans are the Simple account which costs 0.083 BTC per year, and the Advanced account which costs 0.134 BTC per year. The accounts provide 10 and 20 active bots for the first two tiers respectively while the Advanced account also offers an unrestricted number of bots.

Moreover, only the Simple and Advanced accounts support HaasScript. But all of them receive access to free technical support, unlimited trades, and no fees. Upon finishing their plan, users can also renew their license at a 40% discount if they choose to continue using the trading bot.

Supported exchanges

Bitpanda Pro, Bybit, FTX, Binance, Binance US, Bitfinex, BitMEX, Bitstamp, Bittrex, CEX.io, Coinbase Pro, Deribit, Gemini, HitBTC, Huobi, Ionomy, Kraken, KuCoin, OKEx, Poloniex

Pricing and plans

Annual plans:

Beginner: 0.047 BTC

Simple: 0.083 BTC

Advanced: 0.135 BTC

Shrimpy

Shrimpy is a smart social trading platform for cryptocurrency investors that makes trading less complicated with the help of automatized trading strategies. The platform helps you create custom index funds and automatize portfolio rebalancing. Users can also follow other people’s strategies.

Software engineers Matthew Wesly and Michael McCarty created Shrimpy in 2018 with the intention to turn crypto traders profitable with the help of algorithmic trading. The company is based in San Francisco and raised an undisclosed amount in a funding round in 2018, in which Oriza Ventures and Plug and Play participated.

At its core features, Shrimpy provides crypto trading bots created by the community, portfolio rebalancing, and custom index fund creation. In the past couple of years, the platform became a highly attractive choice for traders of all sorts. According to the team, Shrimpy had more than $1 billion in total volume and currently processes more than 120,000 trades every single day.

To foster a close community, Shrimpy urges its users and bot creators to become ‘social leaders.’ Every user has a public account that provides various details such as daily, weekly, and monthly performance. Moreover, users earn $4 per month for every follower they have, rewarding those that have been the most productive and efficient with developing crypto trading bots.

Ensuring maximum security, Shrimpy encrypts each API key provided by users with the help of FIPS 140-2 validated hardware security models. This protects the confidentiality and integrity of the user’s API keys. To make automatized trading even more secure, the platform only reads the data provided from APIs and executes trades. On that account, it is impossible for Shrimpy to move your assets without your direct order.

The cryptocurrency trading bot platform has partnered with several cryptocurrency companies and exchanges. These include HitBTC, OKEx, KuCoin, Kaiko, CoinStats, and CoinApi.

Supported exchanges

KuCoin, Binance, Binance US, Bittrex, Coinbase Pro, Kraken, Poloniex, Gemini, Bibox, BitMart, Huobi, HitBTC, OKEx, Bitstamp, Bitfinex

Pricing and plans

Hodler: Free

Professional: $19 per month

Stacked

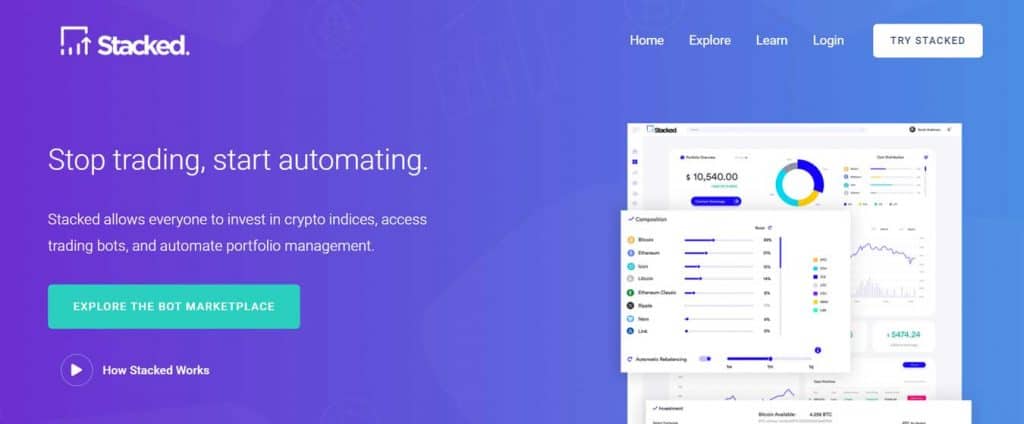

Stacked is a project that makes it easy for everyone to invest in crypto with the help of trading bots. The platform attempts to make trading simple with the help of bots created by some of the best traders today. On that account, both bot creators and customers can benefit from the power of algorithmic trading.

Founded in 2019 by Joel Birch, Stacked is headquartered in Chicago and offers more than just trading bots. In fact, users can also manage their portfolio with the help of pre-built indices and automatic rebalancing.

With the help of pre-built crypto indices, investors can properly structure their portfolio more easily. That way, one can instantly create a balanced portfolio of digital assets that ensures stabilized risk. Users have the ability to invest in any of the offered vetted indices that feature a full performance history. Additionally, you can instantly derisk by moving any percentage of the portfolio into stablecoins. This feature is entirely free and requires no subscription.

As for bots, users can tap into a wide range of automatized trading strategies created by some of the best traders in the space. All bots feature real and detailed performance history to showcase their profitability. To use them, all you have to do is connect your exchange account to Stacked and you are ready to start.

Stacked makes it possible for you to even personalize the existing crypto trading bots. For example, you can change the risk and leverage used for trading if you are more risk-averse. You also have extra control as it is possible to set a stop-loss or take-profit order at any time.

However, Stacked Beta works with only a few cryptocurrency exchanges at the moment, including BitMEX, Binance, FTX, and Bybit. Nevertheless, the developers plan to include other exchanges in the future as well, such as OKEx, KuCoin, and Coinbase.

Supported exchanges

BitMEX, Binance, FTX, Bybit

Pricing and plans

Pre-built indices: Free

Trading bots: Determined by the author. Prices range anywhere from $99 to $250.

Conclusion

A cryptocurrency trading bot is an incredibly helpful tool that can save time, maximize trading efficiency, and effectively reduce risk. As they only rely on technical analysis strategies, statistics, and other forms of data, trading bots are completely void of human emotions. Traders are inherently prone to making bad decisions as a result of mood swings, fear, and other aspects related to human emotions and psychology. Therefore, algorithmic trading represents the ‘cold killers’ of financial markets. And as we mentioned at the start of this guide, 80% of modern financial markets use trading bots as of today.

After completing this guide, you have now a better idea of what cryptocurrency trading bots are and how they work. Moreover, you have also learned what exactly makes a trading bot useful, and how they can save you time and increase your trading efficiency. To give you a better idea of how the best and most popular solutions work, we also listed the top 8 cryptocurrency trading bots in 2022.

After learning more about Mudrex, Cryptohopper, Bitsgap, 3Commas, Quadency, HaasOnline, Shrimpy, and Stacked, you will have a better grip on what these professional trading tools offer, how much they cost, and how you can improve your trading. We encourage you to do your own research, and also to look for other great trading bots so that you can finally leverage technology in this ever-growing cryptocurrency sector and become a successful trader. Remember, trading bots are not only about consistently making profits, they are also created for saving time. So download a new platform today, pick your settings, and sit back and enjoy while an algorithm trades for you!