Still in its infancy, the world of decentralized finance (DeFi) is a tricky and mysterious place waiting to be explored. As digital assets continue to evolve and produce new mechanisms that allow a seamless and decentralized experience, so do its use cases. On that account, a new subsector of the cryptocurrency industry awakened in 2020.

What is DeFi?

At its core, DeFi is a completely decentralized financial ecosystem developed with the help of blockchain technology. Compared to cryptocurrencies, DeFi can be seen as an additional layer that turns traditional financial instruments into decentralized ones.

Apart from payments, we now have access to several tools that require no centralized entity or individual. These include borrowing and lending, monetary banking services, and decentralized exchanges.

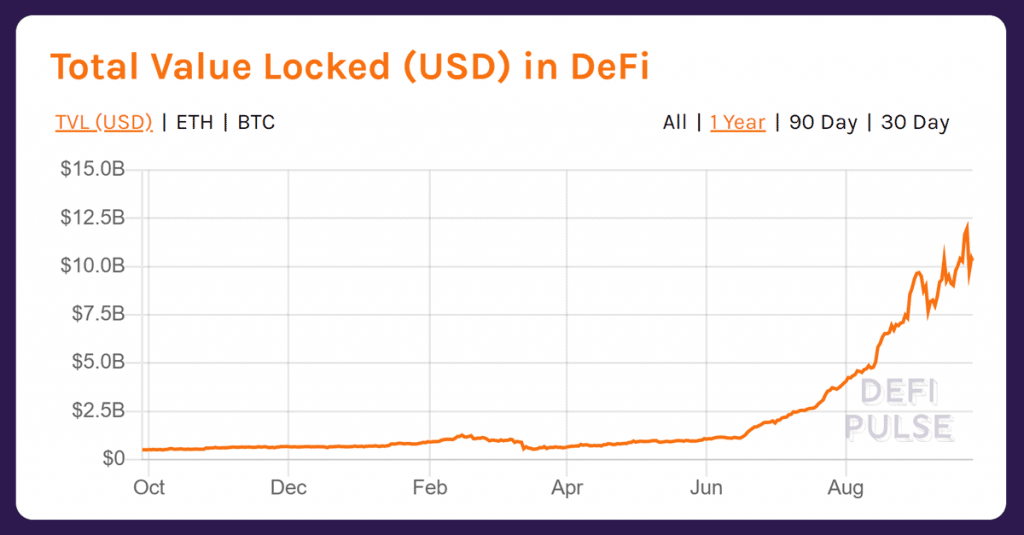

In 2020, the young sector experienced a complete revival. According to information from leading data aggregator DeFi Pulse, the DeFi sector grew almost ten times its size in the span of only three months. In June, users started massively adopting DeFi platforms leading to exponential growth. By the end of August, the number of collateralized assets increased from $1 billion to almost $10 billion.

How is this possible? Thanks to the smart contract ecosystem of Ethereum and new decentralized oracle solutions, developers successfully achieved in creating stable and user-friendly solutions. Both enthusiasts and investors have already heard of popular decentralized exchanges and lending protocols such as Uniswap and Aave. However, these platforms represent only the tip of the DeFi iceberg. There are many use-cases in DeFi and more innovations are created every single day. To present a better picture of how the new market works and what it offers, we will list five types of massively utilized DeFi projects that revolutionized the industry.

Uniswap – The #1 DeFi marketplace

Uniswap is a decentralized exchange with an automatic market maker (AMM) launched in November 2018. The Uniswap protocol can be viewed as a precursor to modern platforms and DeFi as a whole. Developed by Hayden Adams, the protocol is built upon the concept of decentralized exchanges that ETH co-founder and developer Vitalik Buterin proposed in 2017.

The open-source Uniswap protocol stood at the spotlight of this year’s DeFi bull run. It completely removed the necessity for traditional centralized exchanges that relied on order books. Instead, Uniswap’s AMM essentially provided a platform where users trade with other users instead of trading with the exchange. Moreover, it offers two highly sought tools that provide both freedom and passive income.

First, users have the ability to trade by swapping tokens. To trade, users provide Uniswap with one token which gets swapped with Ether. Then, Uniswap’s AMM trades the swapped Ether for the desired token. How does this provide freedom exactly? As previously mentioned, users trade with Uniswap’s AMM AKA smart contract, not with an exchange. Likewise, users provide liquidity for the tokens. This results in a completely decentralized financial environment where the community controls the protocol. Moreover, users have the freedom to list any token they wish. There are no listing requirements as seen on centralized exchanges.

Secondly, Uniswap offers a secure platform for users wishing to provide liquidity. Liquidity providers, yield farmers, or simply farmers are a group of users who provide liquidity in the form of assets to a protocol. In return, they receive a percentage of the fees other users spend on token swaps. This causes a symbiotic relationship where both yield farmers and protocols enjoy the opposite entity’s service. While Uniswap benefits from having higher liquidity for certain token pairs, liquidity providers earn money for essentially ‘borrowing;’ their assets.

On September 21, Uniswap is the leading protocol in the DeFi sector. Users locked $1.9 billion in collateralized assets. The decentralized exchange hosts almost a billion dollars more of liquidity compared to other leading protocols.

Simply put, Uniswap is the leading decentralized marketplace for the Ethereum network.

Aave – Decentralized borrowing and lending

Much like Uniswap, Aave can also be considered a decentralized financial ecosystem. However, Aave focuses on decentralizing financial instruments usually utilized in legacy finance. At the start of 2020, the Aave protocol established itself as the leading solution for the borrowing and lending sector.

Neither borrowers nor lenders require any KYC or AML documents in this trustless system. In practice, Aave works in the way that lenders provide funds to liquidity pools from which users borrow assets. To protect both sides, pools set aside reserves that protect users against high volatility. In the case that liquidity significantly decreases, reserves ensure that lenders can exit the pool with their funds.

On the other hand, borrowers receive funds by providing collateral higher than the amount they wish to borrow. In most times, borrowers have to follow a 50 to 75% collateralization ratio to successfully borrow assets. Otherwise, Aave will liquidate their assets.

While Aave works similarly to other projects that market themselves as token-swapping or yield farming protocols, there is a distinct feature that makes it different, flash loans.

In essence, flash loans are a type of loan where users require no collateral to receive them. Aave revolutionized the digital borrowing and lending sector with one simple trick. To uphold the terms of a loan, users only had to pay it back in a given time. If the Aave protocol gave the loan in a specific block, the user had to pay it back by the time a new block is mined.

It is highly difficult to effectively use flash loans without losing assets. However, there are certain use cases where flash loans are more applicable. These loans reach peak efficiency when used for arbitration, swapping collateral deposits, and refinancing loans.

Yearn.Finance – A consortium of DeFi products

Yearn Finance is one of the most experimental DeFi projects in the sector. Singlehandedly developed by blockchain enthusiast Andre Cronje, the protocol served as an inspiration to many other coders. The main developer, who previously conducted code reviews for other projects, decided to create a platform with a more accessible interface to the average user as he thought that most DeFi platforms were too complicated.

To achieve this, Cronje focused on two problems: safety and user experience. The first version of Yearn.Finance required the developer to manually transfer tokens to the most-rewarding liquidity pools, he created a smart contract that would automatize the process. Thus, Cronje created the yToken. The native token had the objective of reading APR returns and moving assets to pools with the highest returns. As more people adopted Yearn.Finance, the smart contract got ‘smarter’ at delivering assets to better pools, resulting in even higher rewards.

Besides the yToken, which Cronje refers to as an APR oracle, there are also other products. The Yearn Finance ecosystem consists of many services, including Vaults, Earn, Zap, and Cover.

Vaults are essentially a community-based yield hunting program. The sub-platform adopts strategies to deploy the best yield farming rewards. Shortly put, vaults use any possible asset as liquidity and collateral. Moreover, it manages collateral in a specific fashion to prevent defaults. Additionally, users can borrow stablecoins in the Vault and employ them for farming.

Earn is a similar feature that acts as a yield aggregator for lending platforms. If a user deposits stablecoins such as USDC, DAI, USDT, TUSD, or sUSD, Earn will auto lend the assets at the highest possible lending rate. The feature lends the assets on platforms such as Aave, Dydx, and Compound.

Zap is the Yearn. Finance equivalent of token swapping. As Cronje notes, Zap enables users to quickly ‘zap’ into DeFi tokens. The feature converts one token into another at minimal gas fees. The fee efficiency is made possible as ‘zapping’ only requires one contract interaction. Therefore, a user only needs to convert token X for token Y. On other platforms, users are forced to swap token X for token B which then becomes converted to the desired token Y.

yInsure, also called Cover, is a pooled coverage system that protects investors against smart contract risk by providing insurance. It is a financial instrument for insurance which requires no KYC. The feature consists out of Insurer Vaults, Insured Vaults, and Claim Governance. While Insurer Vaults are liquidity pools that provide insurance, Insured Vaults are the assets that are being insured. Claim Governance allows insured users to deploy claims by staking yiUSDT assets. With these assets, users vote for governance issues.

The Yearn.Finance DeFi ecosystem is regarded as being the most successful in DeFi. With a developer-oriented and user-friendly community, the project quickly rose to become a leading platform. With a starting trading price of around $40, the native YFI governance token swiftly reached a record high of $43,275. This price action made it the highest-valued asset in the cryptocurrency sector.

Where is DeFi now?

At the time of writing, the sector of decentralized finance is estimated to be worth $9.4 billion. Despite recent price fluctuations in the cryptocurrency market, it still holds investor interest to a stable size. Four projects in DeFi have more than a billion dollars in collateralized assets, while ten have more than $100 million. With an abundance of platforms for various real use cases, the sector is expected to grow even higher with more adoption and interest.

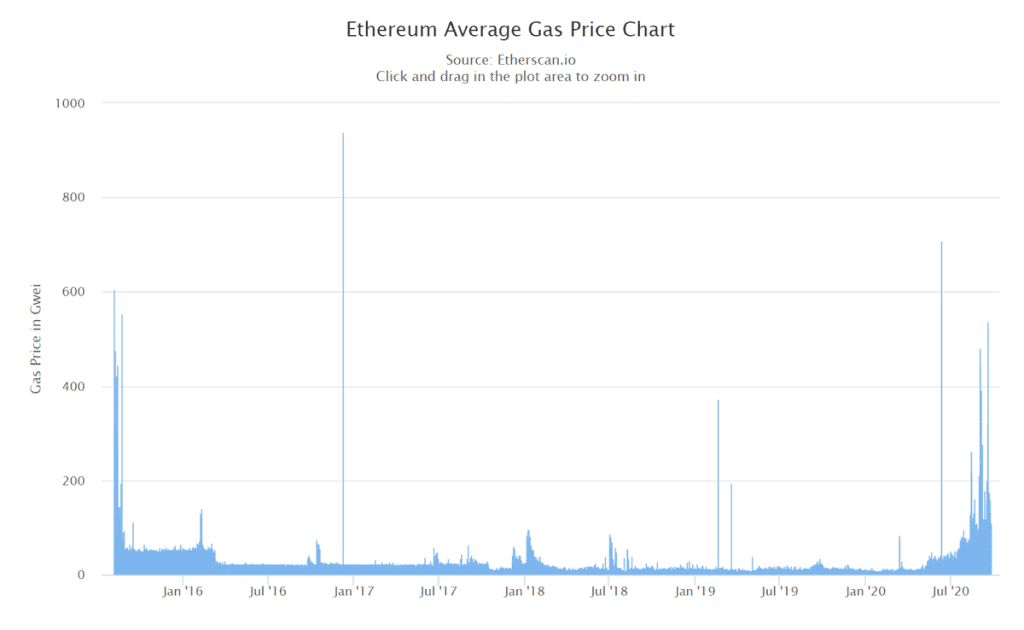

However, the sector deals with a significant problem, Network congestion. According to data from Etherscan, the average gas fee for Ethereum transactions saw an exponential rise starting May 2020. At the time, gas fees cost 30 gwei on average. Months later, fees continued rising reaching 100 gwei at the end of July. By the end of August, gas fees cost up to 300 gwei on average. During some days, users dealt with fees as high as 450 gwei.

Dollar-wise, users paid between $30 and $40 per transaction late-August. Therefore, traders and liquidity providers who utilized protocols such as Uniswap greatly suffered. Fees made it economically inefficient to be a liquidity provider for small-portfolio holders.

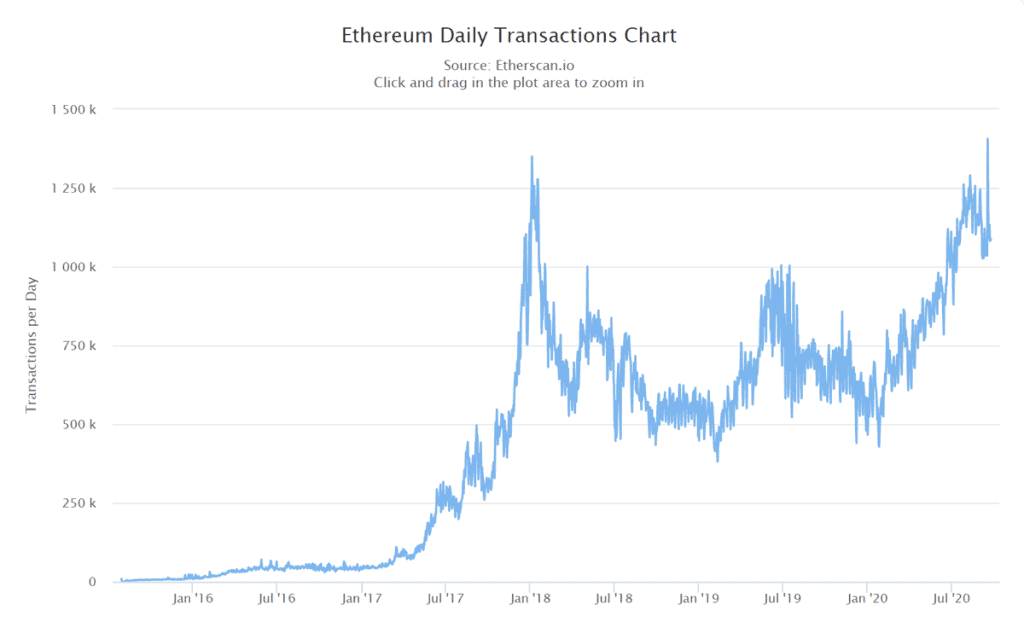

Besides prices, time also became an issue. Another set of data from Etherscan showed that the number of daily transactions reached a new all-time high in September. During the last big bull run, daily transactions on the Ethereum network averaged at 1,250,000 transactions per day. In August 2020, daily Ethereum transactions have already reached previous highs. On September 17, users managed to reach a new record with a new all-time high. The network saw 1,406,016 transactions on that day, marking it the highest activity Ethereum had since its creation. While the new record might have been bullish for the network, it was absolutely bearish for the users on Ethereum. During days with abnormal high traffic, transactions would require several hours to be confirmed. Therefore, the network on which the entire DeFi sector relies reached a bottleneck.

For future sustainable growth, DeFi would need to either migrate to a different ecosystem or fix Ethereum’s scalability issue. With slow transactions and high fees, the sector basically reached a top. The long-awaited Ethereum 2.0 would solve all of its previous iteration’s scalability issues. However, ETH 2.0 is still years from being fully developed.

DeFi in the future: The CeDeFi threat

Besides a congested network, the sector of decentralized finance has another great threat. As the rise of DeFi showed that investors had significant interest in decentralized financial instruments, centralized exchanges (CEXs) were left behind. With more than $10 billion in collateralized assets at its peaks, DeFi took an enormous amount of liquidity away from CEXs.

To combat this, certain exchanges tried to integrate DeFi applications by combining them with their existing platform. In September, Binance was the first exchange to announce its interest in bridging the gap between decentralized and centralized finance. With CEO Changpeng Zhao coining the term CeDeFi, a new threat was born. During the exchange’s World of DeFi summit, Zhao announced a fund worth $100 million. Its goal? Connect CeFi and DeFi. This was the start of a brand new Binance-based ecosystem on which developers could build DeFi applications.

Together with the Binance Smart Chain, the exchange’s new blockchain network, Zhao created a serious competitor for DeFi. In a blog post, the exchange denied that it would compete with DeFi or that it disrupted the CEX ecosystem. One section specifically reads:

For some people, the emergence of DeFi represents a shift away from centralized blockchain platforms. This could be interpreted as a threat to services such as Binance. We beg to disagree. For us, DeFi is an opportunity to offer better solutions to the blockchain world.

Binance

Far from the truth, there is more to the situation than the naked eye can see. Centralized exchanges showed their greed in the past months by listing unaudited and anonymous projects. One example was Binance listing SushiSwap, a highly controversial project. When the project flopped and the community ostracized Binance for listing it on launch day, CEO Zhao only had one answer.

“If we don’t list new (decentralized finance) DeFi coins, traffic goes to other exchanges, and we become … obsolete. We provide access to liquidity, we don’t force you to buy. All coins are high risk, especially DeFi.”

Changpeng Zhao, Binance CEO

In the now-deleted tweet, Zhao acknowledged that Binance will no longer follow its historic listing requirements.

What does this exactly mean for DeFi? The sector will see more and more pressure from centralized entities wishing to profit on the hype. DeFi became what it is today because of its decentralized aspect. An oxymoron like CeDeFi is not viable neither for blockchain enthusiasts nor investors seeking to profit. For long-term growth and potentially retail-adoption, the world of decentralized finance would need to protect itself. If DeFi were to collapse right now due to external market factors, centralized entities would similarly to vultures surround DeFi and transform it into something more centralized.