Dipping your toes into the world of Ethereum staking? Great! But along with the exciting potential for rewards, there’s a less glamorous side you need to understand: taxes. In this comprehensive guide, we will unravel this complicated subject in a friendly, easy-to-understand manner. So, are you ready to learn everything you must know about calculating Ethereum staking taxes? Let’s dive in!

Key takeaways

- Ethereum staking rewards are taxed as income at their fair market value upon receipt and may also be subject to capital gains tax if sold for a profit later.

- You can calculate Ethereum staking taxes manually or use a cryptocurrency tax software to automate the process.

- Depending on your staking method (solo staking, pooled staking, or using centralized exchanges), the process of reporting for tax purposes may vary.

- There are several tax reduction strategies like holding onto staking rewards for over a year to qualify for lower capital gains rates, and utilizing tax-loss harvesting.

What is Ethereum staking?

Ethereum staking is a process where users participate in the validation of transactions on the Ethereum blockchain and help secure the network. This is the core of the Proof of Stake (PoS) consensus mechanism used by Ethereum since The Merge in 2022. Users who stake their Ethereum (ETH) tokens effectively lock up their cryptocurrency in a smart contract, offering it as a ‘stake’ to the network. They act as validators by staking their tokens, confirming transactions, and adding new blocks to the Ethereum blockchain.

In a nutshell, Ethereum staking provides a dual role. On the one hand, it secures the Ethereum network by making it more expensive for malicious actors to attack due to the financial risk involved. On the other hand, it incentivizes users through staking rewards. The Ethereum network automatically distributes newly created ETH tokens to validators as a reward for their work so that Ethereum holders will generate passive income. The number of rewards received is generally proportional to the amount of Ethereum staked. However, participating in staking does come with its own set of risks and requirements, including the potential for penalties if validators do not act honestly or if their node is not performing as expected.

How is Ethereum staking rewards taxed?

Ethereum staking rewards are typically taxed as income at their fair market value in local currency at the time of receipt and may also be subject to capital gains tax if sold at a profit at a later date, with the specific tax rates dependent on individual income and local tax laws.

Income tax

In most jurisdictions, Ethereum staking rewards are treated as taxable income. The exact tax rate can vary significantly depending on the tax laws in your country. In general, however, staking rewards are usually considered similar to mining rewards or other forms of cryptocurrency income for tax purposes. This means that when you receive ETH as a staking reward, it will be treated as income at its fair market value at the time of receipt in most cases. The income is then subject to income tax rates, which may depend on your tax bracket if you pay taxes to a country with progressive tax rates.

Capital gains tax

Unfortunately, taxation does not end at income tax. If you later sell or convert the staking rewards into fiat or another cryptocurrency, you may also have to pay capital gains tax. If the Ethereum price increases between when the staking rewards are received and sold, the price difference will be considered a capital gain in most countries. On the other hand, you might be able to claim a capital loss if the price decreases. Therefore, it is important for all individuals who participate in Ethereum staking to maintain detailed records of all transactions to ensure accurate and compliant tax reporting.

How to calculate Ethereum staking taxes

Running your own validator

Solo staking by running your own validator is considered the gold standard of Ethereum staking and offers the maximum rewards. Two of the downsides, however, are that it requires a bit of technical knowledge to set it up, and 32 ETH tokens are the minimum amount you need to deposit to qualify as a validator.

Regarding taxes, there are essentially two ways to calculate your staking income from Ethereum if you are running your own validator. You can do it manually (the hard way) or use cryptocurrency tax software to automate the entire process. We will look at both methods in this section.

Jump to each section directly:

Calculate staking income manually

Calculating income from Ethereum staking manually involves three steps:

- Export a complete history of all staking rewards transactions

- Calculate the Fair Market Value of each transaction

- Summarize the values to find the total income

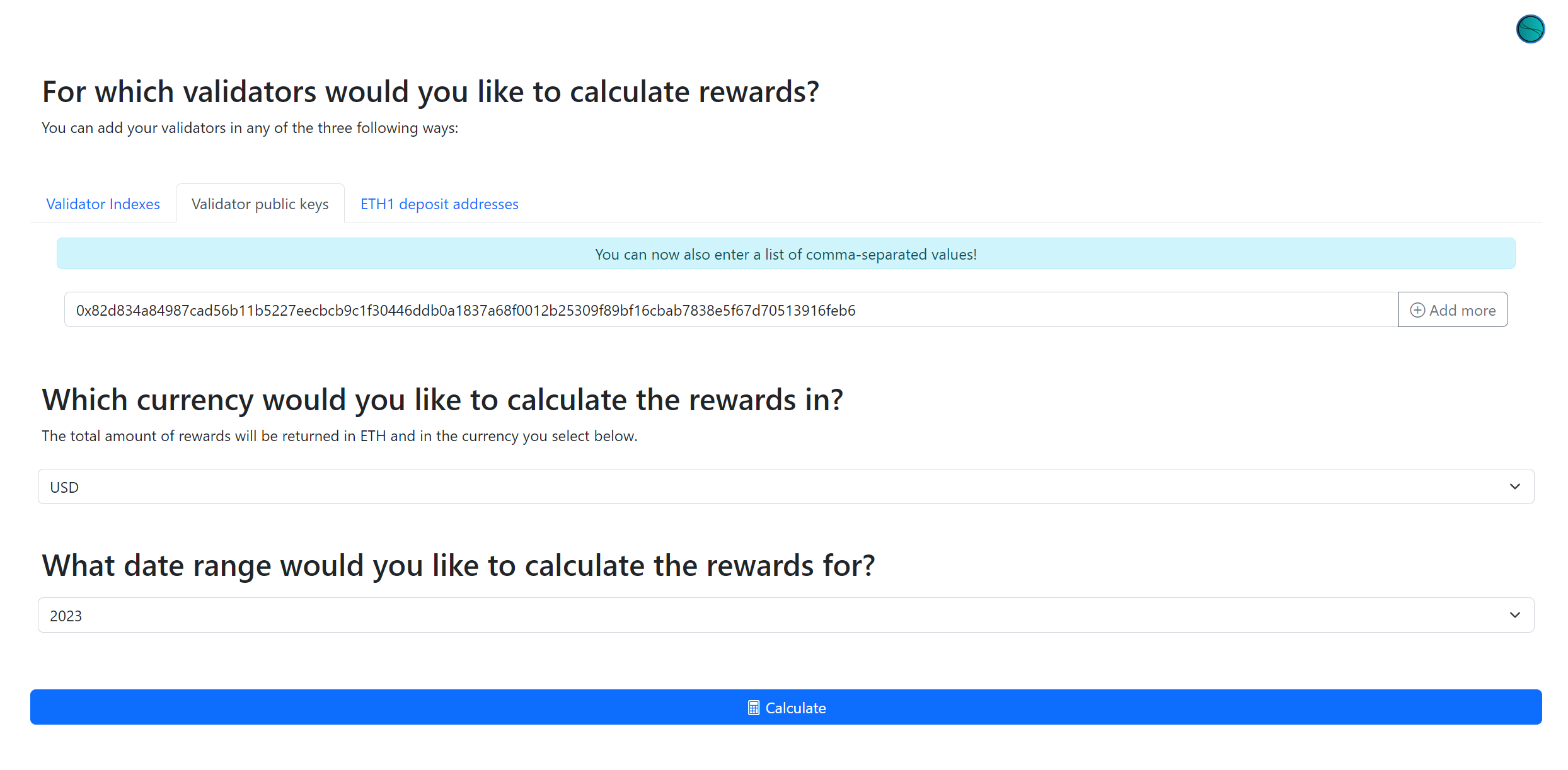

To complete the first step, we recommend using EthStaker.Tax. This simple but powerful tool lets you enter any validator address and export all staking reward transactions quickly and easily.

All you need to do is enter your validator address, either as the ‘validator index‘ or as the ‘validator public key‘, and then click ‘Calculate‘ to generate a CSV file with all staking transactions. You can also specify a different currency than USD if you report taxes in another currency, such as EUR, GBP, etc.

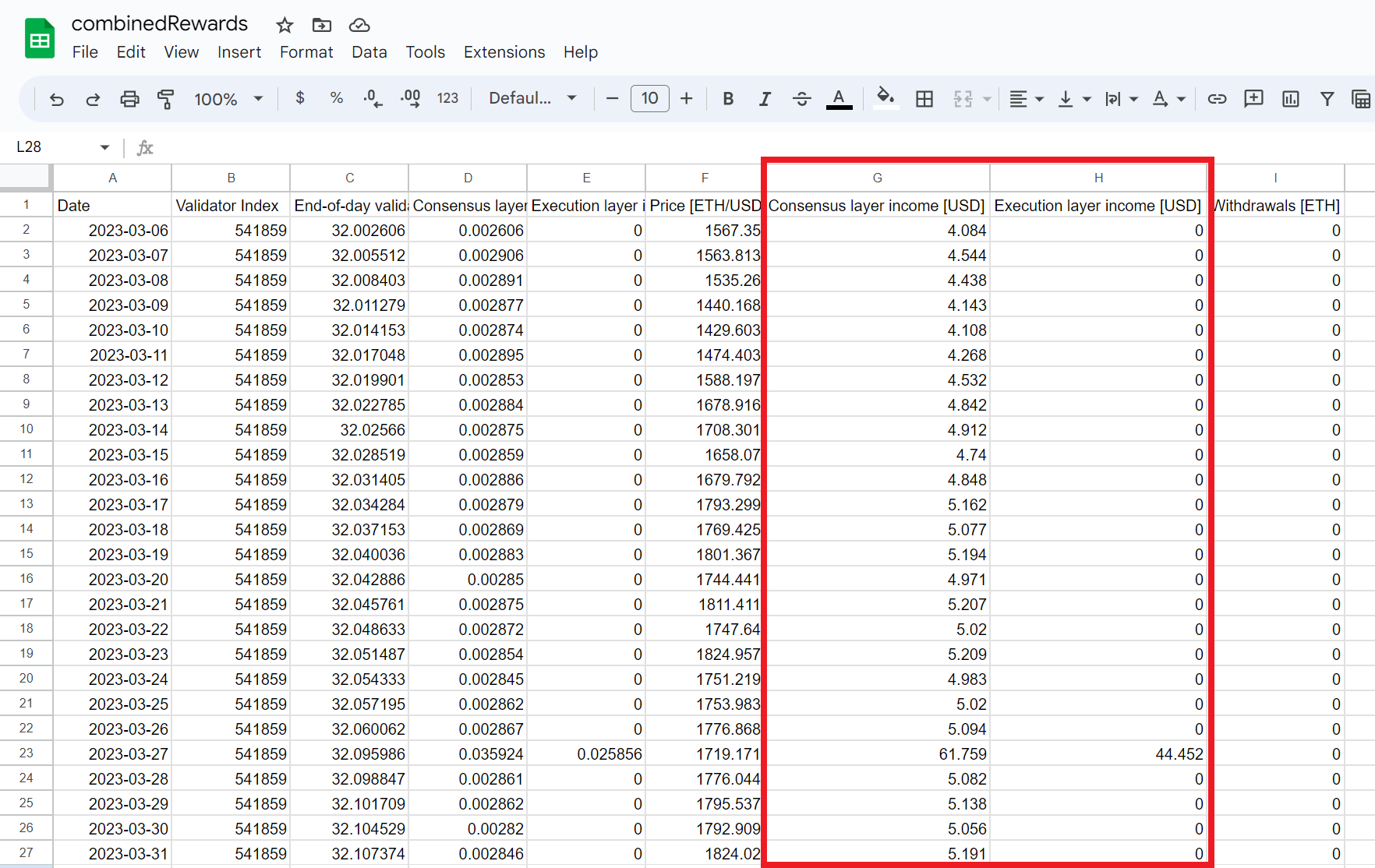

After EthStaker has successfully completed the import and parsing of transactions from your address, you can click the button at the bottom of the page to download the CSV file.

After downloading the file, we recommend opening it in Google Sheets or a similar editor. Columns G and H show your income calculated in your local currency for each day of the tax year. From these columns, you can now summarize the values for all days to find the total income amount you should report in the tax return.

Using crypto tax software

Although the manual method explained above will be sufficient for most users, an even simpler automated way is to let Coinpanda do the entire process for you. Coinpanda is one of the few crypto tax solutions that can import transactions from the Ethereum Beacon Chain with API, so let’s see how this works.

Start creating a free account, then go to the Wallets page and click ‘Add Wallet’. After that, search for ‘Ethereum’, select ‘Ethereum Beacon Chain’, and add your validator address. Both the validator index and public keys are accepted.

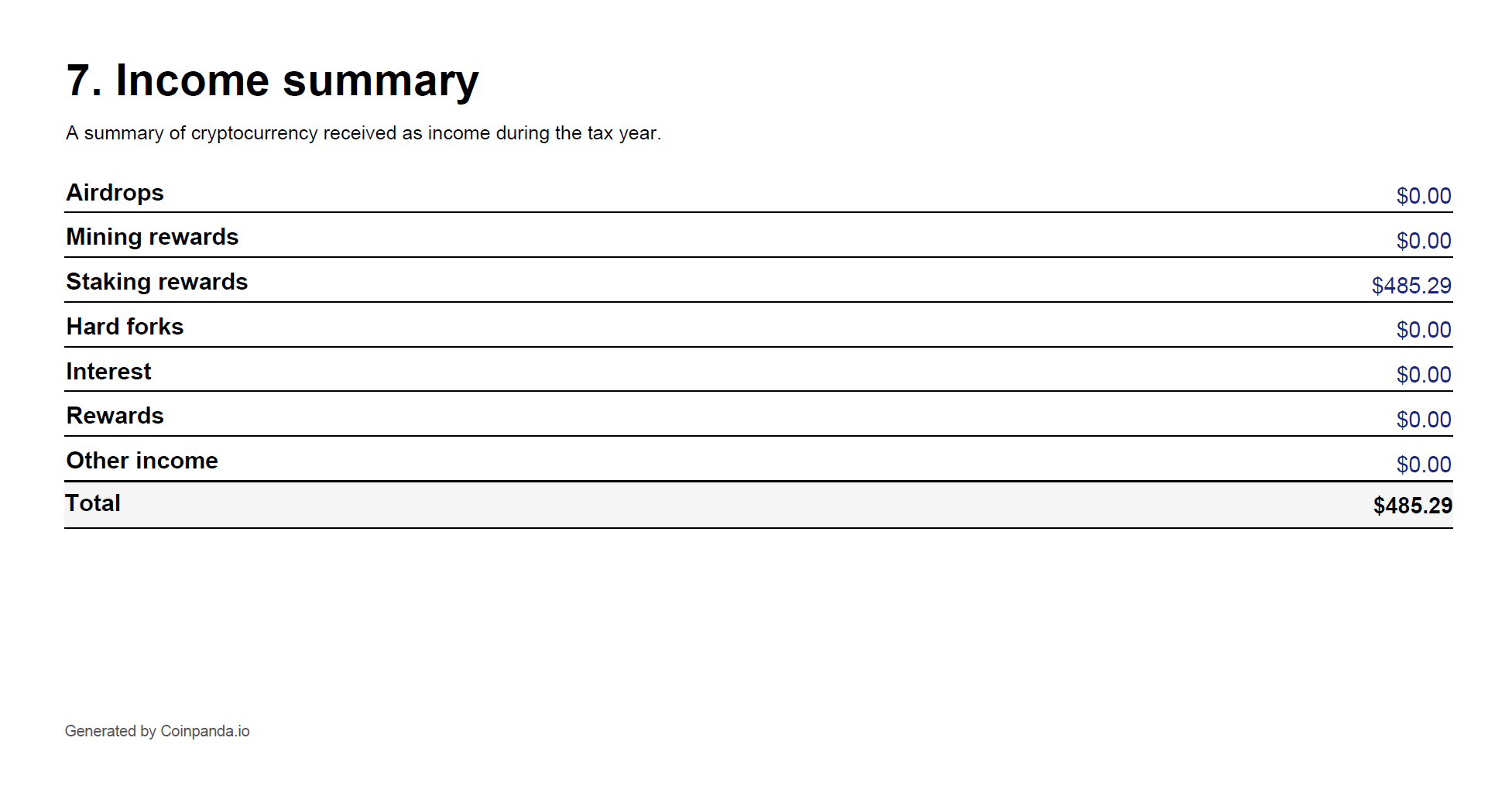

When Coinpanda has completed the import process, which typically takes less than 30 seconds, you can download all the required tax reports and documents that you need for filing your taxes. If you are above the free limit, you can upgrade to a paid plan starting from $49.

The image below shows the Income summary section from the Complete Tax Report, where the total taxable income amount from all transactions is shown. Typically, this is the income you should report in your tax return. The tax report also includes a table of all transactions considered taxable income, which can be sent to your tax accountant or used in case of an audit.

Staking as a service

Staking as a Service (SaaS) refers to a type of staking service that involves trusting a third-party operator with your 32 ETH for validator purposes that also handles the node operations. Staking with a service usually requires much less technical knowledge since a third party handles most configuration and steps involved. Such service providers typically charge a recurring monthly fee in return for their service.

Since you technically still run your own node and validator using SaaS, the same steps for calculating staking income apply as explained in the previous section for solo staking. Coinpanda lets you import all staking transactions from your validator address and can generate all required tax forms automatically, but you can also use a tool such as EthStaker to export a CSV file if you prefer the manual way.

Pooled staking

Staking pools let individuals with fewer ETH accumulate the 32 ETH necessary to activate a validator. The Ethereum protocol does not natively support this but has been created as a service by other individuals or teams. Many popular staking pools utilize smart contracts, where users first transfer their ETH tokens into a contract, and the contract autonomously records the stake and provides you with a liquidity token in return that represents the staked assets. You can then later claim the staking rewards when you decide to unstake by returning the liquidity token in exchange for your original collateral.

For staking pools that issue a liquidity token when you deposit ETH as collateral to a smart contract or protocol, you are typically not taxed on your staking rewards before you decide to unstake and when the rewards are credited to your wallet. This means that as far as tax reporting goes, it’s quite a simple process, and all you need to do is calculate the value of the ETH rewards in USD or your local currency.

On the other hand, if you have been using a centralized staking pool service that does not utilize smart contracts, how you calculate the staking income depends primarily on how and when you can access the accrued rewards. Remember that the general tax rule in most countries is that staking rewards are taxed when you receive the crypto in your wallet? This means that if you use a centralized service that allows you to both view and withdraw the staking rewards at any time, it can be argued that you should report the rewards as income daily (or as often as the rewards are credited to your account).

Centralized exchanges

The last option for staking Ethereum is to use a centralized exchange service. Many of the largest exchanges today, such as Coinbase, Binance, Kraken, and OKX, let you earn rewards by depositing your ETH into a staking product.

Most of these exchanges let you export a CSV file with your complete transaction history, including your staking rewards. You can then either calculate the total staking income manually or upload the CSV file to a crypto tax platform.

However, the easiest solution is perhaps to connect your exchange account with API to Coinpanda or another crypto tax platform that supports the exchange you use. Coinpanda supports more than 400+ centralized exchanges today and can import your Ethereum staking rewards automatically from almost all exchanges that support staking.

Reduce Ethereum staking taxes

There are several strategies that you can potentially use to reduce the tax burden from Ethereum staking. One common method is to take advantage of long-term capital gains rates. In many jurisdictions, assets held for over a year before being sold are taxed at a lower rate than those sold within a year. By holding onto staking rewards for more than a year, you might be able to reduce the amount of tax paid on any price appreciation.

Another strategy involves tax-loss harvesting. If the value of your Ethereum decreases after receiving it as a staking reward, you may be able to sell it and use the capital loss to offset other capital gains. However, such strategies require careful record-keeping and planning to be effective and may also depend on the specific tax laws in your country.

Lastly, although not directly related to Ethereum staking, consider using tax-advantaged retirement accounts if you can invest in such accounts. In some countries, investments in certain retirement accounts can be deducted from your income and potentially reduce your tax liability. If you can invest in Ethereum through such an account, it could potentially provide significant tax benefits. However, the rules around these accounts and cryptocurrencies can be complex and may not be allowed or available where you live. If you are considering investing in Ethereum through a tax-advantaged retirement account or similar, we highly recommend consulting a financial advisor or tax professional that can provide advice tailored to your individual circumstances.

How can Coinpanda help?

Coinpanda is a cryptocurrency tax software that can significantly simplify calculating and reporting taxes for Ethereum staking. The platform can automatically import transaction data from over 800+ exchanges, wallets, and blockchains and fully supports DeFi and NFTs. Coinpanda also allows you to export ready-to-file tax documents for more than 65+ countries.

Sign up for a free account!