Yes, Coinbase reports to the IRS. As of August 2023, Coinbase provides the IRS with Form 1099-MISC for any user who has received crypto income exceeding $600 during the financial year. Crypto income on Coinbase includes Earn rewards, staking, referral rewards, and other forms of income.

Key takeaways

- As of August 2023, Coinbase reports to the IRS using Form 1099-MISC for customers that have received crypto income exceeding $600 during the financial year.

- The IRS uses tax documents like 1099-MISC to assess the accuracy of a taxpayer’s return, verify the income reported, calculate the correct tax liability, and identify any discrepancies or underreporting of income.

- Earlier, it was expected that Coinbase would also issue 1099-B containing all gains and losses from trading for the 2023 tax year. This has been put on hold indefinitely but could change in the future.

- Most Coinbase users cannot get a complete tax report from Coinbase. Instead, to get an accurate report including all transactions, exchanges, platforms, and wallets, it is recommended to use a crypto tax calculator like Coinpanda.

What does Coinbase report to the IRS?

As of August 2023, the only data reported by Coinbase to the IRS is Form 1099-MISC for customers that have received crypto income exceeding $600 during the financial year. The tax document includes the total income received during any given tax year. One document copy is sent to the taxpayer and another to the IRS.

Coinbase was also issuing 1099-Ks to the IRS before 2021, but this was stopped due to the incomplete nature and little practical value of this form. The 1099-K forms issued by Coinbase earlier reported the gross proceeds from a customer’s total crypto activity during the financial year. This means that instead of reporting the actual gains or losses, the form reported a customer’s trading volume. This caused a lot of headaches and frustration for the IRS and Coinbase’s customers, and as a result, Coinbase stopped issuing 1099-K and replaced it with 1099-MISC.

What does the IRS do with tax documents?

The IRS can use tax documents to assess the accuracy of a taxpayer’s return, verify the income reported, and calculate the correct tax liability. It’s more likely than not that the IRS is examining these documents carefully to identify any discrepancies or underreporting of income that may lead to tax evasion. Depending on the document type, the IRS can use the information to determine whether various types of income, gains, and losses are accurately reported.

In previous years, the IRS sent warning letters to Coinbase users based on information from 1099 forms. For the 2022 tax year, only 1099-MISC is sent to the IRS, and the form can assist the tax agency in identifying taxpayers who are either not reporting crypto on their tax returns or underreporting.

Furthermore, these documents are maintained as part of the taxpayer’s record for three to seven years. This archive aids the IRS in auditing tax returns and enforcing tax laws, as well as serves as a reference for taxpayers who need to access their past tax information. These records can also help resolve potential disputes or issues regarding a taxpayer’s past returns.

What are 1099 forms?

Form 1099 is a series of documents the IRS refers to as “information returns.” Several different 1099 forms report the various types of income individuals may receive throughout the year other than the salary paid by their employer. This income can include earnings from self-employment, interest and dividends, government payments, and more.

Each form has its specific purpose. For instance, Form 1099-INT reports interest income, Form 1099-DIV reports dividends and distributions, Form 1099-MISC for miscellaneous income, and Form 1099-B for broker exchange transactions. The entities paying these incomes send a copy of the forms to both the IRS and the income recipient. The main purpose of 1099 forms is to aid in tracking an individual’s income for the year, ensuring the correct amount of tax is paid.

Regarding crypto, relevant 1099 forms include 1099-K, 1099-MISC, and 1099-B.

Form 1099-K

Form 1099-K, or Payment Card and Third Party Network Transactions, is used by payment settlement companies (credit/debit card networks) to report the payment transactions they process for merchants. In the context of cryptocurrency, exchanges like Coinbase sent this form in previous years to report users’ transactions if they exceeded certain thresholds (more than 200 sales transactions and over $20,000 in gross proceeds within a calendar year).

Form 1099-MISC

Form 1099-MISC, or Miscellaneous Income, is used to report payments to a person who is not an employee or to an unincorporated business. It’s typically used to report payments for services carried out by independent contractors, rental property income, and other miscellaneous income that is not employment income.

From a crypto perspective, income from staking, referrals, or rewards are examples of income that are considered “miscellaneous income” by exchanges such as Coinbase and will be included on a 1099-MISC.

Form 1099-B

Form 1099-B, or Proceeds from Broker and Barter Exchange Transactions, is used by exchanges to report to the IRS and customers the capital gains and losses from the sale of stocks, bonds, or commodities. As of the 2023 tax year, it was expected that also cryptocurrency exchanges like Coinbase would be forced to issue a 1099-B for customers who have sold crypto assets, but this has been put on hold for an indefinite time as of now.

Will I get a 1099 from Coinbase?

Yes, depending on your crypto activity, you may receive a 1099 form from Coinbase. As of the 2023 tax year, Coinbase only provides 1099-MISC forms for their customers that have transactions with cryptocurrency during the tax year.

You may receive a 1099-MISC if you fulfill the following three criteria:

- You are a registered Coinbase user

- You are a US citizen or US person for tax purposes

- You have earned $600 or more in total rewards (Coinbase Earn, staking rewards, referral rewards, etc.) during the previous tax year

When will Coinbase send a 1099 form?

Coinbase generally sends 1099-MISC forms to eligible users by January 31st of the year following the reporting period. This means that for the 2023 tax year, Coinbase will most likely send out 1099-MISC forms by January 31st, 2024. The forms are either emailed to users or made available for download from their Coinbase account.

What should I do if I receive a 1099 form?

If you receive a 1099-MISC from Coinbase, the first thing you should do is review the form for accuracy. It should reflect the total income you made on the platform during the tax year.

To ensure the income is accurate, you can either calculate the income amount manually from all your Coinbase transactions or use a crypto tax calculator like Coinpanda to calculate this automatically by importing your Coinbase transactions.

Once you have confirmed that the information on the form matches your income during the tax year, you should include it in your tax return when filing your taxes the following year.

- Self-employed: If the IRS considers your income from Coinbase to be part of a business or trade activity, you should report the income on Schedule C (Form 1040).

- Not self-employed: If you are not reporting taxes as a self-employed individual, you should report income from Coinbase on Line 8: “Other income” on Schedule 1 (Form 1040).

Can I get a complete tax report from Coinbase?

No, most Coinbase users cannot get a complete tax report from Coinbase. As of August 2023, only 1099-MISC is issued by Coinbase to its customers, and this form does not include capital gains or losses from exchanging, trading, or disposing of cryptocurrency on the platform.

Although you can download a gain/loss report from Coinbase, this report will not be accurate for any person who has traded on different exchanges, sent crypto to or from their private wallets, or dabbled in DeFi or NFTs.

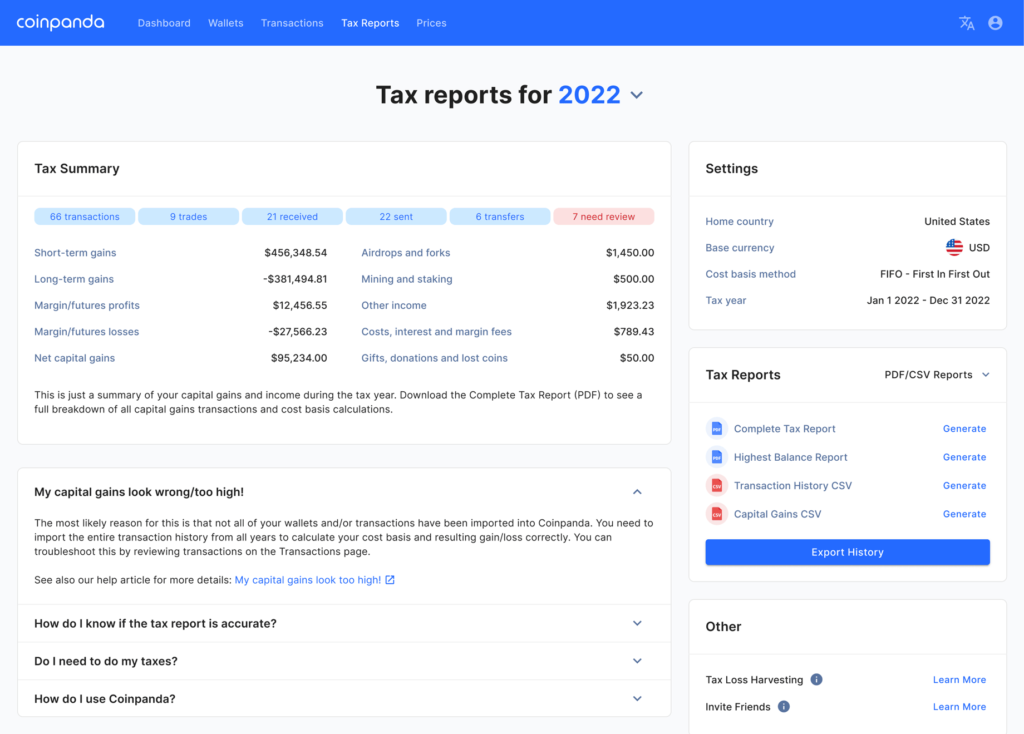

Calculating crypto tax accurately must take transactions from all exchanges, platforms, and wallets into account, and Coinbase does not know your transactions outside their own platform. For these reasons, the easiest way to get a complete tax report for Coinbase is to connect all your exchange accounts to Coinpanda which can generate a complete tax report including your transactions on Coinbase.

How to download your Coinbase tax documents

Coinbase allows you to generate a transaction history report that details all your buys, sells, sends, and receives.

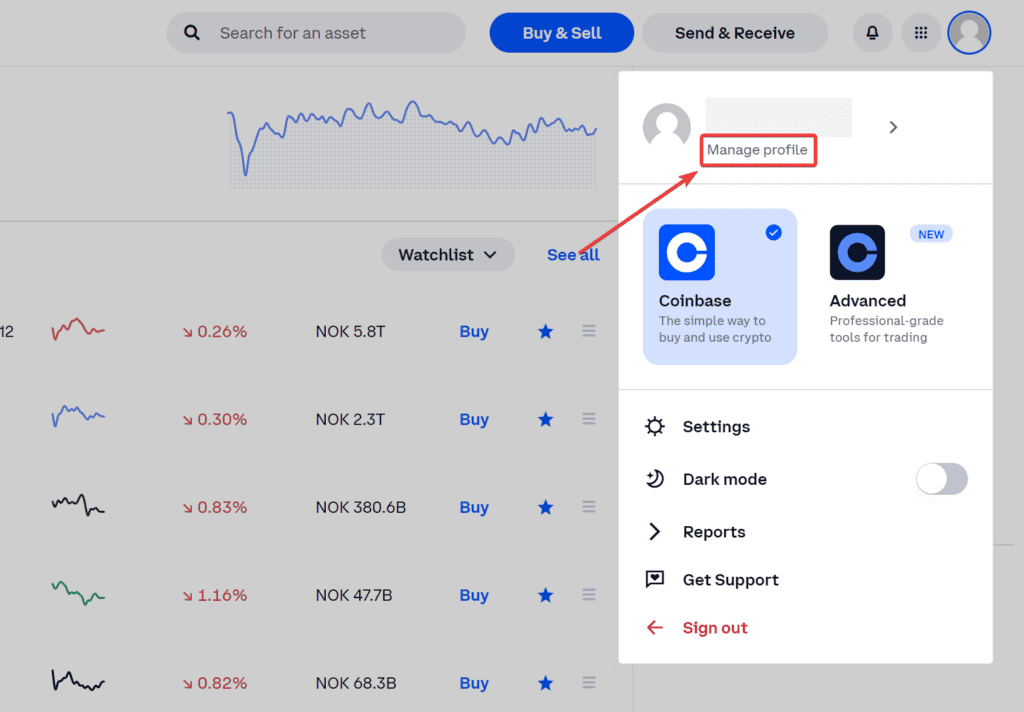

To access this, log into your Coinbase account and navigate to your profile page by clicking “Manage profile” from the user menu in the top-right corner.

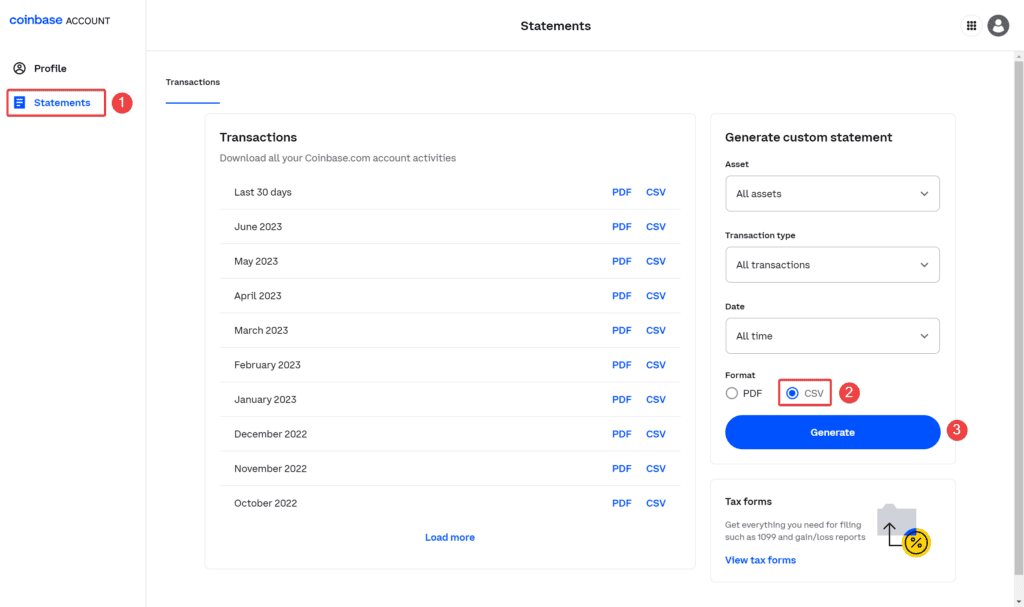

Next, select “Statements” on the left side, select a time period that includes the transactions you want to export, select CSV as format, and click “Generate“.

You can also leave the default value “All time” for the date to export a complete report of your activity since you signed up at Coinbase originally.

This file will include detailed information about your transactions, including the date, time, type of transaction, amount, and more.

You can use this file to aid in calculating your capital gains or losses, which should be included when preparing your tax return.

Alternatively, you can let Coinpanda handle all the calculations and hard work by connecting your Coinbase account with API.

Best Coinbase crypto tax calculator

The most important factor to consider when determining the best crypto tax calculator for Coinbase is the accuracy of the imported transactions. Many crypto tax platforms exist today, but only a handful can import Coinbase transactions accurately which is a prerequisite for getting an accurate tax report.

Although we might be biased in this opinion, we would argue that Coinpanda is perhaps the most accurate crypto tax calculator that integrates with Coinbase using API and CSV file upload. Coinpanda’s integration with Coinbase is continuously being improved whenever there is an update or change in the raw data exported from Coinbase. Moreover, Coinpanda is the only tax platform that accurately handles routing transfers between Coinbase and the now sunset exchange Coinbase Pro.

Sign up for a free account!

Frequently asked questions

What does the IRS do with the information Coinbase provides?

The IRS uses the information provided by Coinbase to assess the accuracy of a taxpayer’s return, verify the income reported, calculate the correct tax liability, and identify any discrepancies or underreporting of income.

Does Coinbase report to the IRS if you didn’t sell?

Coinbase reports to the IRS using Form 1099-MISC only if a user has received crypto income exceeding $600 during the financial year. Coinbase doesn’t report simply holding or buying assets.

Does Coinbase report small-time crypto traders?

Coinbase issues Form 1099-MISC to the IRS for any user who has received $600 or more in crypto income, regardless of the scale of their trading activity.

What happens if I don’t receive a 1099 form from Coinbase?

If you don’t receive a 1099 form from Coinbase, it is typically because you did not meet the threshold of $600 in crypto income. Nevertheless, you must still report your taxable activity to the IRS.

Does Coinbase send a 1099-K form?

As of 2023, Coinbase no longer sends Form 1099-K to the IRS or its users.

Does Coinbase send a 1099-MISC form?

Yes, Coinbase sends Form 1099-MISC to its users who have earned $600 or more in total crypto rewards during the tax year.

Does Coinbase send a 1099-B form?

No, Coinbase does not send Form 1099-B to its users as of August 2023, but this can likely change in the future.

Is the information in Coinbase 1099 forms accurate?

The information in the 1099-MISC form provided by Coinbase is usually accurate based on the transactions on its platform, but it does not account for transactions completed on other platforms.

Where can I download my Coinbase trade history?

You can download your Coinbase trade history from your profile page on the Coinbase platform by selecting “Statements” on the left side and generating a CSV file for the desired period.

What happens if you forget to report Coinbase taxes?

If you forget to report Coinbase taxes, you may face penalties and interest on any unpaid taxes from the IRS, and in serious cases, you could be subjected to a tax audit.