NFTs became massively popular during the last bull run, with some NFT collections appreciating more than 1000x in price. But as with all other capital assets, the CRA wants its piece of the pie. If you are a Canadian taxpayer and have invested in NFTs, you might wonder if – or how much – tax you must pay when you sell the NFTs later on.

While the current tax regulations in Canada surrounding cryptocurrencies, including NFTs, are complex with many nuances, we will try to break down all the latest tax implications in an easy-to-understand manner in this NFT Taxes Canada guide.

Key takeaways

- The CRA treats NFTs like commodities for tax purposes, and profits from their sale can be considered capital gains or business income.

- NFT transactions, like buying with cryptocurrency or selling for another cryptocurrency, are taxable, but only 50% of capital gains are taxed.

- Business income derived from NFTs is fully taxed, while capital gains from NFTs are taxed at a reduced rate.

- Accurate record-keeping of all NFT transactions, including acquisition details, sales records, and associated fees, is essential for tax reporting in Canada.

Are NFTs taxed in Canada?

Yes, NFTs are taxed in Canada. Although the Canadian Revenue Agency (CRA) has not issued tax guidance that addresses NFTs specifically, we can infer the tax treatment based on how the CRA currently taxes ordinary cryptocurrencies.

The CRA treats cryptocurrencies, which include NFTs, like a commodity for tax purposes today. If you sell an NFT at a profit, the difference between the sale price and your acquisition cost is considered a capital gain or business income.

However, most hobby-investors not conducting professional investment or trading activities will pay capital gains tax rather than business income tax on their profits during the tax year (more on this later in this guide).

To learn more about how cryptocurrencies are taxed in Canada, we recommend reading our Crypto Tax Guide for Canada:

Taxable NFT transactions in Canada

Although not all NFT transactions are subject to tax in Canada, several transaction types are indeed taxable based on the general tax guidance for cryptocurrencies.

The list below includes the most typical NFT transactions that you may need to pay taxes for:

- Buying NFT with cryptocurrency

- Selling NFT for another cryptocurrency or fiat

- Swapping an NFT for another NFT

- Minting of NFTs by paying with another cryptocurrency

The general rule is that if you purchase an NFT and later sell it at a higher price, the difference between the purchase and sale price can be taxed as a capital gain, with only 50% taxable.

Because cryptocurrencies including NFTs are not subject to sales tax such as GST, the actual NFT you buy is not taxed at the time of buying or when you are simply holding it in your wallet.

Capital gains vs. business income

We have so far only covered how NFTs may be subject to capital gains tax at the time of disposal.

Although most Canadian taxpayers will not be considered carrying on a professional-like investment or trading activity related to cryptocurrencies or NFTs, the CRA may in some cases consider your transactions as part of a business which will be subject to business income tax rather than capital gains tax.

Why does this matter? Because business income is taxed at a higher rate than capital gains tax!

While only 50% of the realized capital gain is included in your taxable income, 100% of the gains are taxed when considered business income. This can make a big difference in your total tax bill, so it’s worthwhile considering the tax implications if the CRA considers your NFT activity to be part of a business.

Although there is no crystal clear distinction between the two, the CRA determines the classification based on factors like:

- frequency of transactions

- the length of ownership

- the nature of the asset or transaction

- by which means you acquire funds to trade or invest with

- the amount of planning and effort involved

This is not a complete list, and it’s important to emphasize that the CRA will determine this case-by-case.

If you are in doubt or find yourself in a legal situation, we highly recommend consulting a tax professional in Canada that understands Canadian tax laws and can give qualified advice.

Can I save money on NFT taxes?

There are a few ways you can potentially save money by paying less tax on your NFTs.

- Ensure your NFTs are taxed as capital gains rather than business income

- Use NFT losses to offset other capital gains

- Deduct all costs and fees associated with buying or selling NFTs

- Buy NFTs with fiat instead of cryptocurrency that has appreciated in value

Coinpanda can help you harvest losses from NFTs that have declined in value since you acquired them. Many Canadians have NFTs sitting in their wallet that has lost most of their value, so taking advantage of realizing capital losses can save you thousands of dollars in owed taxes.

You can also use Coinpanda to deduct all costs and fees from NFT transactions automatically. Especially on the Ethereum blockchain can gas fees be high, offering potential huge tax savings for those who take advantage of this.

Which tax forms should I report NFTs on?

There are two tax forms to consider when reporting NFTs (and cryptocurrency in general) in Canada.

If you’ve realized capital gains from selling NFTs, they should be reported on Schedule 3, “Capital Gains (or Losses)” of your T1 Individual Income Tax Return. Only 50% of the capital gain is taxable and should be included in your taxable income on line 12700 of the T1 return.

On the other hand, if you’re earning business income rather than capital gains, you should report this income on Form T2125, “Statement of Business or Professional Activities.” This form allows you to detail your revenue and any applicable expenses, with the net business income being added to your overall income for the year.

What records do I need to report NFT taxes in Canada?

You must maintain detailed and accurate records of all NFT transactions. Here are the essential records to keep:

- Acquisition details: Document the date of purchase and the price in Canadian dollars for each NFT you acquire. Also, note any associated fees or costs.

- Sales records: For every NFT sale, record the date of sale, the sale price in Canadian dollars, and any related transaction fees or expenses.

- Exchange rates: If you conduct transactions in cryptocurrencies or foreign currencies, keep daily records of the relevant exchange rates to convert them to Canadian dollars. This ensures consistency in reporting and calculating gains or losses.

- Wallet and exchange statements: Maintain copies of statements or records from your wallets and cryptocurrency exchanges that show transaction histories.

- Proof of NFT ownership: Maintain digital or printed proofs (like screenshots or digital receipts) of your ownership of the NFT, which can be especially useful if the CRA requests verification.

- Related expenses: Keep track of any costs associated with the creation, listing, marketing, or selling of the NFT. For business income, these might be deductible.

Remember, the CRA can request records and documentation related to your tax filings for up to six years after filing. So, it’s recommended to keep all relevant NFT tax records for at least this duration.

How to report NFT taxes in Canada

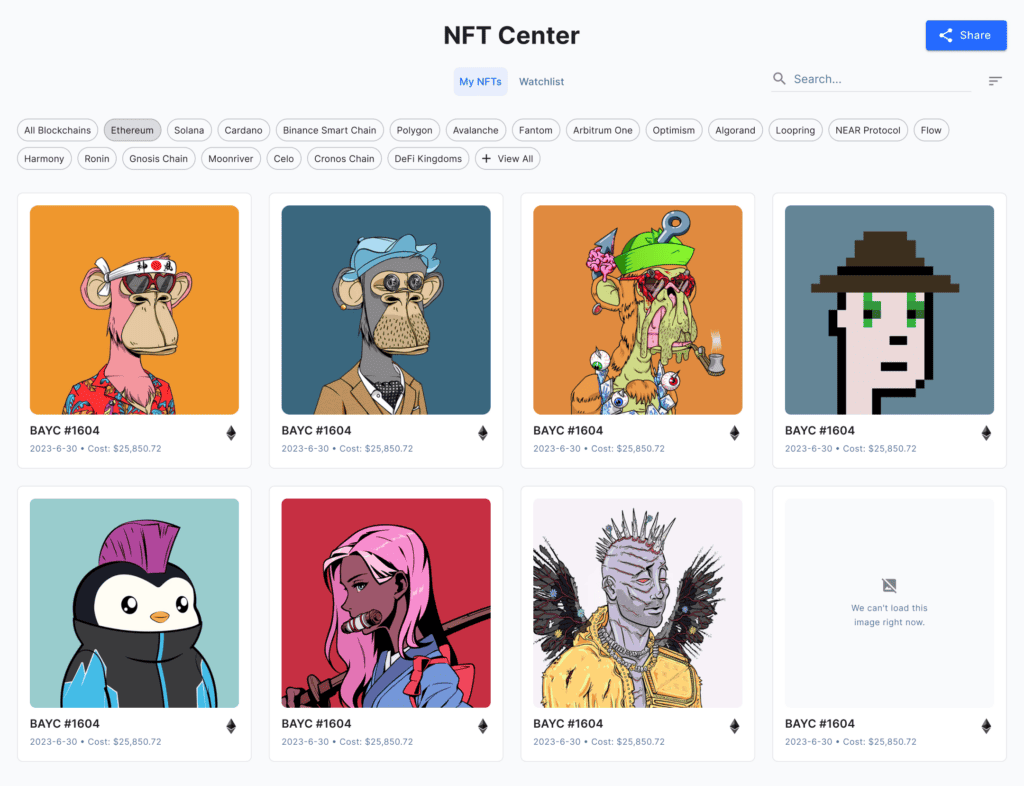

The easiest way to report NFT taxes in Canada is to use crypto tax software. Let’s see how this can be done using Coinpanda, one of the most popular crypto tax calculators in Canada.

- Sign up for a free account (ensure you select Canada as the country and CAD as the currency)

- Connect all your exchange accounts and wallets

- Wait for Coinpanda to import all transactions and crunch your tax numbers automatically

- Generate a complete tax report with all your gains and losses (or a pre-filled Schedule 3 form)

Coinpanda has full support for Canada and the superficial loss rule. Over 100,000 crypto investors have already used Coinpanda to simplify their crypto tax reporting.

Sign up for a free account!