Are you from the US and did you dispose of any cryptocurrency during the tax year? If yes, you are also required to file Form 8949 together with your tax return to the IRS.

In this guide, we will break down everything you need to know about reporting cryptocurrency on crypto tax Form 8949, including a step-by-step guide for how to enter the information for all transactions accurately.

Key takeaways

- IRS Form 8949 is the primary document for reporting cryptocurrency transactions, detailing the date acquired, date sold, proceeds, and cost basis.

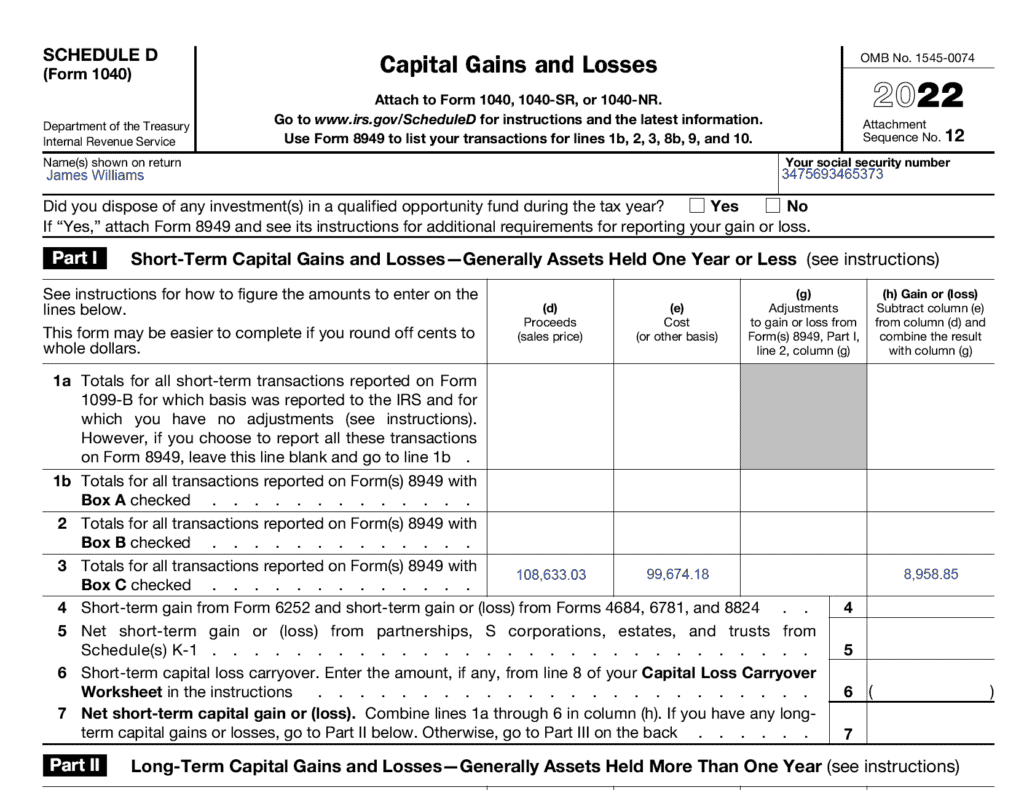

- After completing Form 8949, results are summarized and transferred to Schedule D of Form 1040.

- Cryptocurrency disposals must be categorized into short-term (held for 12 months or less) and long-term (held for over 12 months) capital gains on Form 8949.

- For a high volume of transactions, the IRS allows a consolidated summary on Form 8949 with a detailed statement attached, ensuring all transactions are accurately reported.

What tax form should I report cryptocurrency on?

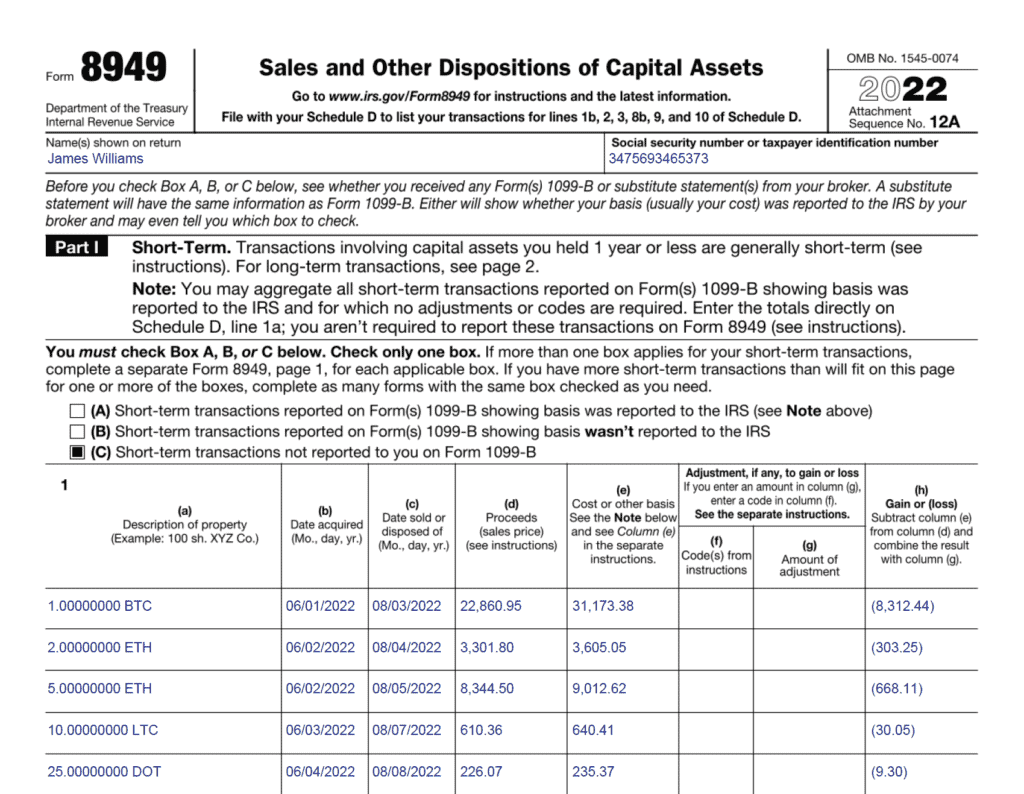

For persons in the US reporting their cryptocurrency transactions on their tax returns, the primary form to use is the IRS Form 8949, titled “Sales and Other Dispositions of Capital Assets.” This form requires users to detail each cryptocurrency transaction, including the date acquired, date sold, proceeds from the sale, and cost basis.

After completing Form 8949, the summarized results are transferred to Schedule D of Form 1040. Cryptocurrency received as income must be reported on either Schedule 1 or Schedule C and depends on your unique situation and how the IRS views your activities related to generating crypto income.

How to fill out Form 8949 for cryptocurrency

1. Export all cryptocurrency transactions

The first step is to take account of all transactions with cryptocurrency you have made. This includes all transactions on exchanges, wallets, and other platforms where you have stored or exchanged crypto assets.

This step is crucial since you must consider all transactions to calculate the cost basis and proceeds accurately in the next step. You can usually export your transaction history as a CSV file from exchanges or use block explorers to do the same for your wallet transactions.

2. Collect information and calculate gain/loss

The following information must be reported on Form 8949 for every cryptocurrency disposal made during the tax year:

- Description of the asset disposed of (ex: 1 BTC)

- The date the asset was acquired

- The date of the sale

- Proceeds (what you received in return for selling the asset)

- Cost basis (the price you paid for acquiring the asset)

- The resulting gain or loss

It can be very challenging and time-consuming to gather this data and calculate the resulting gain/loss for each transaction. Coinpanda can help with this by automating all crypto tax calculations.

3. Categorize transactions into short-term and long-term disposals

Form 8949 contains two sections:

- Part 1: Short-Term capital gains

- Part 2: Long-Term capital gains

Cryptocurrencies held for 12 months or longer before selling should be reported in the long-term section, while assets sold within 12 months of acquisition should be reported in the short-term section.

To ensure you don’t pay more tax than absolutely necessary, it’s important to categorize all transactions correctly since long-term gains are taxed at a lower tax rate than short-term gains.

4. Select the correct checkbox

On each page in Form 8949, you need to select one of three checkboxes. Since almost no crypto exchanges send Form 1099-B to their customers as of August 2023, you should most likely select box C on all pages of your Form 8949.

However, this might change later since some exchanges including Coinbase have stated they will start sending Form 1099-B to its registered US customers.

5. Report your disposals on Form 8949

Now that you have prepared all the information required, you are ready to enter the data in Form 8949. All information listed in Step 2 above must be reported for every individual crypto disposal on a separate line.

In general, all transactions where you have sold a crypto asset must be reported on Form 8949. This also includes all crypto-to-crypto transactions since this is considered disposal by the IRS.

6. Report your net gain or loss on Schedule D

In addition to Form 8949, you must also report your net gain/loss on Schedule D. This should be categorized into short-term and long-term gains similarly to how you have reported this on Form 8949.

How to generate a Form 8949

Generating Form 8949 for reporting cryptocurrency can be a time-consuming process, but there is light at the end of the tunnel! Coinpanda is a crypto tax calculator that supports tax calculations for the USA and can generate a ready-to-file Form 8949 automatically with all your transactions.

You can import transactions to Coinpanda from more than 500+ exchanges and 300+ blockchains with either API or by uploading CSV files. More than 100,000 cryptocurrency traders have already used Coinpanda to simplify their tax reporting, and our customer support team is ready to help answer all crypto tax questions!

Sign up for a free account!Form 8949 example filled out

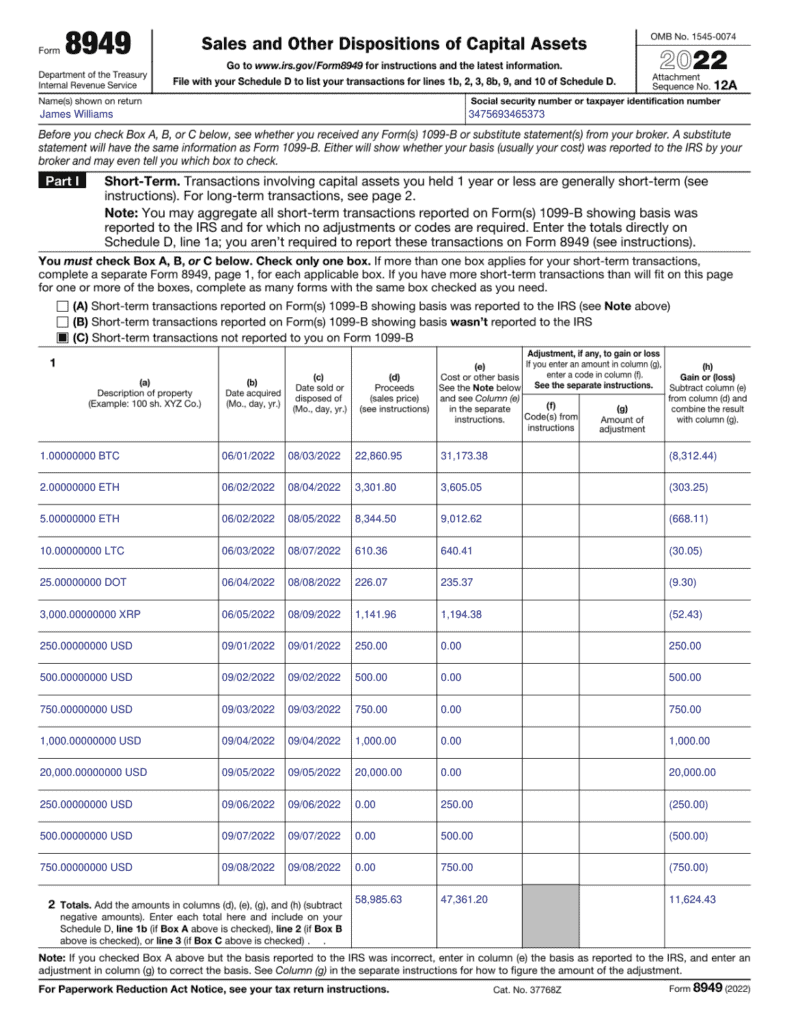

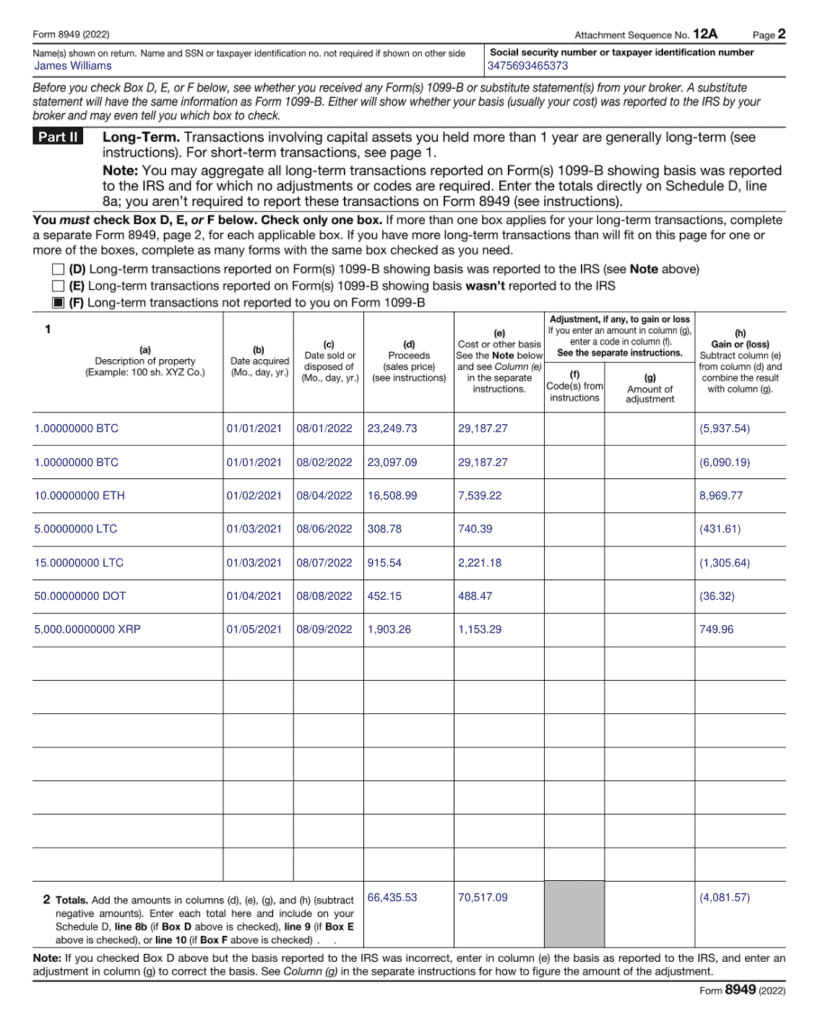

Below is an example of both the short-term and long-term sections of Form 8949.

As you can see, each transaction must be reported on a separate row and include information such as the acquisition date, proceeds, and the original cost basis.

Too many transactions on Form 8949

Many crypto traders end up with a significant number of transactions they have to report taxes on, and some tax filing platforms including TurboTax have a limit on the maximum number of transactions supported. So how can you file Form 8949 if you have more transactions than what is supported?

Luckily, there are procedures in place to manage this:

Instead of listing each individual transaction, the IRS allows for a consolidated summary for short-term and another for long-term transactions. In this case, you would write “See attached statement” in the description column of Form 8949 and then attach a separate report that provides a detailed breakdown of every transaction. This report should follow the format of Form 8949 and include all necessary details.

Coinpanda can generate a consolidated summary automatically that you can import to TurboTax or the tax filing software you are using. A separate report showing a complete breakdown of all transactions can then be mailed to the IRS.

Regardless of the method chosen, it’s crucial to ensure that all transactions are accurately reported and that all required documentation is attached to remain compliant with IRS guidelines.