In this complete guide for NFT taxes, we take a deep dive into how NFTs are taxed in the US by the IRS. We will look at which NFT transactions are taxed, if there are NFT transactions that are tax-free and different ways to reduce your tax bill for NFTs in 2023.

Toward the end, we will also look at how you can easily calculate taxes on your NFTs by using Coinpanda.

Key takeaways

- In the US, NFT transactions are subject to taxation, with profits from sales considered capital gains similar to other assets like stocks and traditional cryptocurrencies.

- The IRS currently views NFTs as property for tax purposes but has plans to potentially classify some NFTs as collectibles, which could result in a higher tax rate of 28%.

- Typical taxable NFT transactions include buying with cryptocurrency, selling for fiat or crypto, and non-free mints (paying with cryptocurrency).

- Strategies for reducing your NFT taxes include owning the NFTs for 12 months or longer to be eligible for long-term gains, buying NFTs with fiat instead of with cryptocurrency, or taking advantage of tax-loss harvesting.

What are NFTs?

NFTs, or Non-Fungible Tokens, became hugely popular in 2021 and were suddenly the most talked about theme during the last bull run. CryptoPunks were among the first collections to drive the NFT hype and were soon followed by other successful NFT drops such as Bored Ape Yacht Club and Doodles.

NFTs represent a unique digital asset verified using blockchain technology. Unlike cryptocurrencies such as Bitcoin or Ethereum, which are fungible and can be exchanged on a one-for-one basis, NFTs are distinct and cannot be exchanged on a like-for-like basis.

This uniqueness and indivisibility make them particularly suited for representing ownership of rare digital items, such as artwork, collectibles, or even virtual real estate. Profile pic (PFP) NFTs are perhaps the most common use-case, where people use NFTs as their social media avatar – in many cases to get recognition (clout) or as a status symbol.

But NFTs are so much more than just social media avatars. Some of the largest games in the world are now incorporating NFTs into their gaming universe, and brands worldwide are selling NFTs providing exclusive access or perks to their loyal customers.

With the mainstream adoption of NFTs also comes the question of tax implications. Let’s start by addressing the most important question – are NFTs taxed?

Are NFTs taxable?

Yes, NFT transactions are subject to taxation in the US. When you sell an NFT for a profit, the profit is considered a capital gain, much like profits from selling stocks, real estate, or other cryptocurrencies. Since the IRS generally taxes NFTs as property, the same rules for traditional cryptocurrencies also apply to NFTs.

The exact nature and applicable tax rate depend on local regulations and, in some countries, for how long you held the NFT before it was sold. If you are reporting taxes in a different country than the US, we recommend reading our country-specific tax guides to learn more about how NFTs are taxed in your country.

NB! It’s important to know that the IRS has declared its plans to consider some NFTs as collectibles rather than property for tax purposes. We will explain more about this later in the guide.

What NFT transactions are taxable?

Since the IRS considers NFTs property for tax purposes, each transaction where you earn or dispose of an NFT is subject to taxes. How the NFTs are taxed depends on if the IRS considers your NFTs to be part of a hobby or professional activity.

The list below includes the most typical NFT transactions that are taxable:

- Purchase NFT with cryptocurrency

- Selling NFT for cryptocurrency or fiat

- Swapping an NFT for another NFT

- Minting of NFTs paid in ETH or another cryptocurrency

Some other less common scenarios, but still taxable, include:

- NFT airdrops (assuming the NFT has a market value)

- Receive NFTs as payment for services

- Staking of NFTs for earning interest

What NFT transactions are not taxed?

NFT transactions that are typically not taxed in the US include the following:

- Purchasing NFT with fiat currency

- Free minting of NFTs

- Creating your own NFTs

- Holding NFTs in your wallet

- Transferring NFTs between your wallets

In all the cases above, no cryptocurrency or NFT has been disposed of, so the transactions are not subject to any tax.

Remember that any gas fees paid for minting or transferring NFTs are taxed similarly to selling cryptocurrency and are subject to capital gains tax in most countries including the US.

How to reduce my NFT tax

Every crypto investor probably wants to reduce their taxes as much as possible. Luckily, when it comes to NFTs, there are a few ways you can potentially reduce your tax burden:

- Tax-loss harvest NFTs that have depreciated to offset other capital gains

- Buy NFTs with fiat instead of cryptocurrency with unrealized gains

- Hold on to your NFTs for 12 months or longer to qualify for long-term capital gains

- Sell your NFTs in a year where your total income is lower

- Keep track of related gas fees that can reduce your capital gains

How to report NFT taxes

In the US, all transactions involving selling or disposing of NFTs must be reported with other cryptocurrency-related transactions in your tax return. This means all disposals must be reported in Form 8949 and the summarized results must be transferred to Schedule D of Form 1040.

To calculate NFT taxes accurately, you must start by maintaining a detailed log of all your NFT transactions, including dates, amounts, platforms used, and the price of any involved cryptocurrency at the time of the transaction. Next, calculate the capital gains or losses by subtracting the original cost (or basis) from the selling price for sales or exchanges. If you receive NFTs as rewards or payment for services, you must document the fair market value at receipt and report this as taxable income.

Doing this manually certainly involves a lot of manual work. That’s why we built Coinpanda – a crypto tax software specifically designed for NFTs and DeFi that removes the pain of calculating and reporting crypto on your taxes.

Sign up for a free account!

Investors & NFT taxes

Is buying an NFT taxable?

By itself, purchasing an NFT is not a taxable event in the US, but if you pay for the NFT with another cryptocurrency, you have made a taxable disposal that attracts capital gains tax. That means you must calculate the cost basis and proceeds of the cryptocurrency used as payment for the NFT and report the resulting capital gains in your tax return.

Buying an NFT with cryptocurrency

- You buy 5 ETH when the current price of ETH is $2,000. Your 5 ETH has a total cost basis of $10,000.

- You buy one Doodle NFT for 2 ETH on OpenSea when the current price of ETH is $2,500.

- The proceeds of the 2 ETH sold become $5,000.

- The cost basis of the 2 ETH sold becomes 2 / 5 * $10,000 = $4,000.

- The resulting capital gains of 2 ETH sold: $5,000 – $4,000 = $1,000.

You have now made a capital gain of $1,000 that must be reported on your tax return.

Is selling an NFT taxable?

Yes, selling an NFT is typically a taxable event in the US since you realize either a capital gain or loss based on the difference between your selling price and the original cost basis (the amount you initially paid for the NFT).

If the selling price is higher than your cost basis, you have a capital gain, which is subject to capital gains tax. Conversely, if you sell the NFT for less than your cost basis, you have a capital loss, which might be deductible against other capital gains.

Selling NFT example

You buy one Pudgy Penguin NFT for 3 ETH when ETH is $1,500. You paid a total of $3,000 initially for acquiring the 3 ETH earlier. Three months later, you sell the same Pudgy Penguin NFT for 4 ETH when ETH is $1,800.

All transactions are shown in the table below:

| Type | Date | Amount | Total Price | Cost Basis | Profit/Loss |

|---|---|---|---|---|---|

| Sell | 2023-04-10 | 3 ETH | $4,500 | $3,000 | $1,500 |

| Buy | 2023-04-10 | 1 PUGDY PENGUIN | $4,500 | – | – |

| Sell | 2023-07-15 | 1 PUGDY PENGUIN | $7,200 | $4,500 | $2,700 |

| Buy | 2023-07-15 | 4 ETH | $7,200 | – | – |

You have now realized a capital gain when buying and selling the NFT. The total capital gains of $4,200 must be reported on your 2023 tax return due for filing in April 2024.

Creators & NFT taxes

Minting an NFT

From a tax perspective, minting an NFT isn’t typically a taxable event as long as no costs are involved. This means that if you are minting NFTs without disposing of ETH or another cryptocurrency, no capital gains tax applies to the actual mint.

On the other hand, minting of NFTs with costs involved attracts capital gains tax on the cryptocurrency being sold. For example, if you mint an NFT and pay 0.2 ETH, you must calculate the realized capital gain on the 0.2 ETH disposed of.

Remember also that any gas fees paid are taxable and you must calculate the capital gains similarly to how you would do this for selling, exchanging, or disposing of any other cryptocurrency.

Selling an NFT

Selling NFTs is taxed similarly to selling other cryptocurrencies such as Bitcoin or Ethereum. The proceeds are calculated as how much you got paid for the NFT as part of the sale, and the cost basis is any costs associated with creating the NFT during the mint.

If you are creating or minting NFTs considered part of a professional business by the IRS, any profits will be taxed as self-employment income rather than capital gains.

Earning royalties

Royalties refer to the payments made to artists or creators for the use or resale of their creations. In the context of NFTs, many platforms allow creators to receive a percentage of sales whenever their minted NFTs are resold on secondary markets.

From a tax perspective, the IRS has not yet made any official statements about the taxation on income from NFT royalties. However, based on the current tax laws surrounding income taxation, the safest approach is to report all royalties from NFTs as income rather than capital gains in your tax return.

Regulatory updates

The rapid growth and adoption of NFTs have captured the attention of tax authorities worldwide which are now working to provide clearer frameworks for their taxation, copyright implications, and overall trade.

Regular updates are being made in many jurisdictions to address the unique characteristics of NFTs. These updates can impact how NFT transactions are classified, how profits are taxed, and how transactions with NFTs should be reported in the tax return.

At Coinpanda we keep a close eye on all tax-related developments surrounding NFTs in all major jurisdictions. Below, we summarize some recent key developments and possible changes to NFT taxation.

The IRS and taxing NFTs as collectibles

The IRS announced on March 21, 2023, that the agency plans to tax certain NFTs as collectibles rather than property for tax purposes.

Why does this matter? Because collectibles are subject to a 28% tax rate – higher than the current capital gains tax rates. This proposed change is still just that – a proposal – and the IRS has requested public feedback that you can submit on the Regulations.gov website.

The IRS notice also provides examples of when an NFT might be classified as a collectible. Likely, most NFTs representing art, creative work, or profile pics will be classified as collectibles under the proposed new tax regulation.

According to Section 408(m) of the tax code, the following items are considered collectibles by the IRS:

- Any work of art

- Any rug or antique

- Any metal or gem (with limited exceptions)

- Any stamp or coin (with limited exceptions)

- Any alcoholic beverage

- Any other tangible personal property determined a “collectible” under IRC Section 408(m)

Track your NFT taxes with Coinpanda

Have you bought, sold, or traded NFTs and are not sure how to report your NFT taxes accurately?

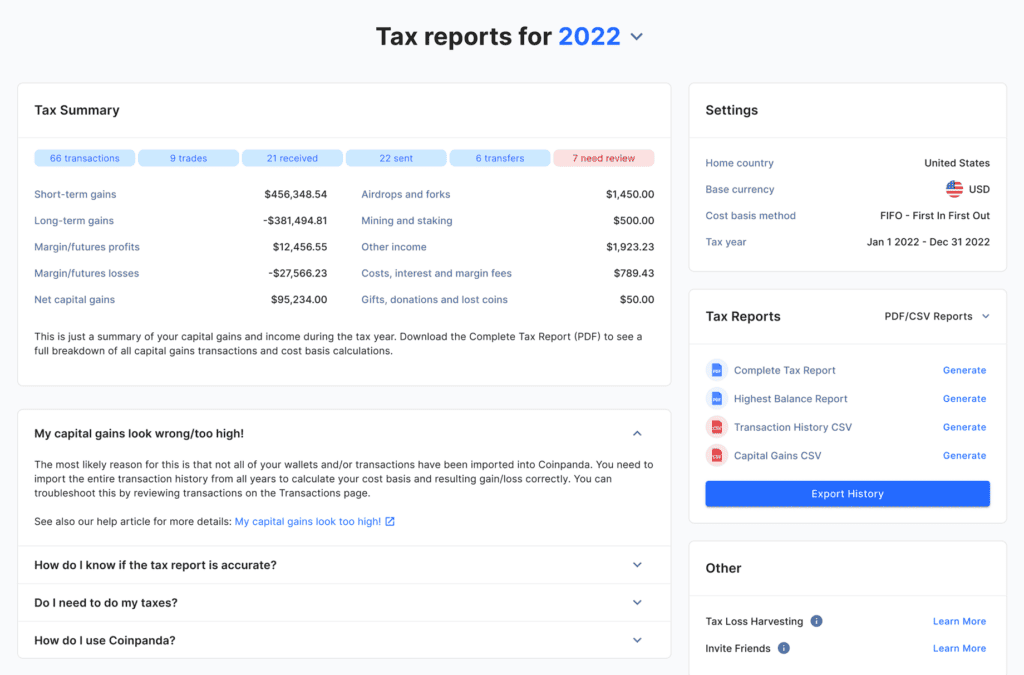

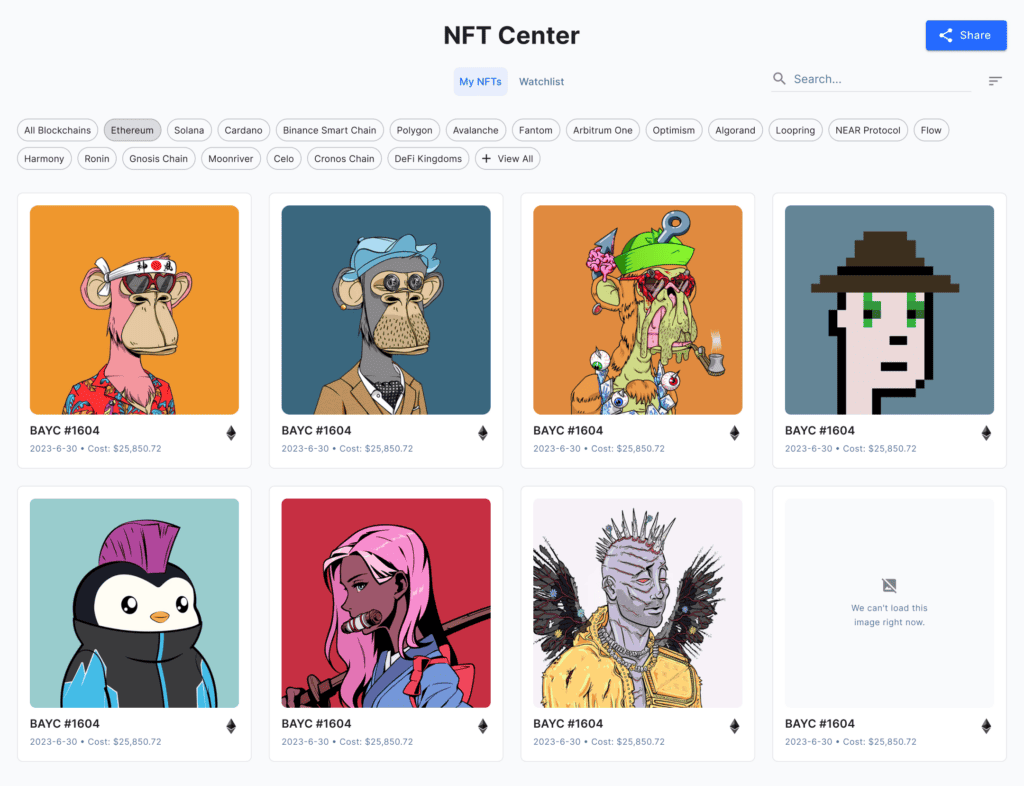

The solution is Coinpanda – a crypto tax calculator specifically built for handling the complexity of NFT taxes. You can import NFT transactions from over 80 blockchains including Ethereum, Cardano, Solana, Algorand, and most other EVM blockchains such as Avalanche, Optimism, and Arbitrum.

To get started, sign up for a free account and connect all your exchange accounts and wallet addresses securely. Next, Coinpanda will import your transactions automatically from API and do all the required calculations while you sit back and wait.

After a few minutes, you can view all your realized gains and losses for the NFTs you have sold or traded.

Coinpanda also lets you view the unrealized gains and losses of the NFTs in your current portfolio. By taking advantage of crypto tax-loss harvesting, Coinpanda can help you save a lot of money by claiming unrealized losses on your NFTs!

Sign up for a free account!Frequently asked questions

Do I have to report NFTs on my tax return?

Yes, you have to report NFT transactions on your tax return if you’ve made sales, trades, or earned income.

How much are NFTs taxed?

NFT sales are taxed as short-term or long-term capital gains in the US. The actual capital gains rates depend on your income level in the relevant tax year.

How are NFTs in play-to-earn games taxed?

NFTs in play-to-earn games are typically taxed as income when earned and capital gains when sold or exchanged in the future.

How are NFT gas fees taxed?

You must pay capital gains tax on the gains realized from gas fees. NFT gas fees can also usually be included as part of the cost basis, potentially reducing capital gains when the NFT is sold later.

How are NFT airdrops taxed?

NFT airdrops are typically taxed as ordinary income based on the fair market value at the time of receipt.

Are NFT losses tax deductible?

Yes, NFT losses can be tax deductible, offsetting other capital gains or, in some cases, other types of income.

How do I avoid NFT taxes?

Avoiding NFT taxes is not possible since NFTs are taxed as property in the US similarly to other cryptocurrencies. However, certain strategies may allow you to reduce the taxes you must pay.

How does the IRS classify NFTs?

The IRS classifies NFTs as property, similar to cryptocurrencies, making them subject to capital gains tax rules. However, this might change in the future, considering that the IRS has issued a notice that the agency plan to tax certain NFTs as collectibles instead.