Have you dabbled in cryptocurrencies and now wonder if you need to pay any taxes on your crypto in the US? The IRS has published a list of frequently asked questions that guides the tax treatment of bitcoin and other cryptocurrencies in the US. The most important takeaway is that cryptocurrencies are taxed as either Capital Gains Tax or Income Tax for most American people. In this complete tax guide, we will explain everything you need to know about crypto taxes in the US including the latest tax guidance from the IRS, how much tax you must pay on your crypto gains, when you must report income tax on crypto, and how to file your crypto tax return with ease!

Just a heads up! This guide is quite extensive due to the complex and fluctuating nature of cryptocurrency taxes. While we recommend reading this guide from A to Z the first time to ensure you don’t miss out on anything important to your situation, you can use the menu navigation on the right side to jump to any specific crypto tax question later.

We are also updating this guide regularly based on the latest tax guidelines and rules from the IRS. All updates will be listed below so that you can quickly see if anything has been updated since your last visit:

- January 27, 2023: Updated for 2023 with new tax rates and deadlines

- February 18, 2022: New section about DeFi transactions

- February 16, 2022: Updated for 2022

- October 7, 2020: Updated for 2021

- May 24, 2019: The first version published

Now grab a cup of your favorite beverage and let’s get to it!

Let’s start with the most important question of all…

Do you need to pay taxes on crypto?

Yes, you need to pay taxes on your capital gains and income from cryptocurrencies in the US. If you have sold, traded, or otherwise disposed of any crypto during the tax year, you must report this in the annual tax return. Keep in mind that there are certain ways to reduce your tax liability such as the tax-free allowance and the long-term capital gains tax rate.

With increasing attention to cryptocurrencies from tax authorities worldwide today, including the IRS in the US, it has become even more important than ever to understand the tax implications to avoid potential fines and trouble with tax authorities.

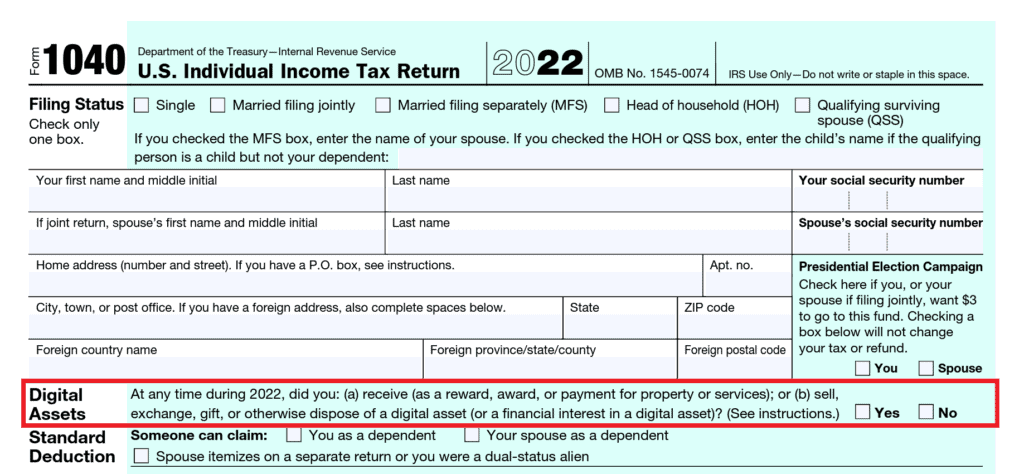

All American taxpayers have to file Form 1040 where on the first page the IRS is asking if you have received, sold, or exchanged any cryptocurrency during 2022. It has therefore become very difficult to hide from the tax authority today, and every crypto investor needs to consider what to report in this year’s tax return for 2022.

If you check “Yes” on Form 1040, the IRS can double-check that you have reported the capital gains from cryptocurrencies correctly. If you have received, sold, or traded any cryptocurrency during 2022 and you check “No“, you might get in trouble with the IRS if they discover that you have been withholding information about your tax situation.

While this might sound very frightening initially, reporting your taxes correctly and accurately might be less stressful than you think. Keep on reading to first learn more about how crypto is taxed in the US before we towards the end of this guide will explain how cryptocurrency tax software can solve your tax pain with little effort from your side!

How is crypto taxed in the US?

Bitcoin and other cryptocurrencies are a form of digital money, or virtual currency, as it is sometimes referred to. It is in many ways similar to US dollars ($) or euros (€), but the most important distinctions are:

- Cryptocurrencies are exclusively digital. No physical coins or bills exist

- A 100% decentralized form of money without any central authority

Cryptocurrency is taxed as property in most countries, including the US. This means that if you buy a cryptocurrency like bitcoin, then later sell your coins when the price has appreciated, you will need to pay capital gains tax on your gains. If the cryptocurrency depreciates after purchasing, you can sell the coins and deduct the losses against other capital gains to reduce your taxes. This means you only pay taxes on the net capital gains from all transactions with cryptocurrencies during the tax year.

This also means that owning crypto is similar to owning other assets like stocks, gold, or real estate for tax purposes. Just as you would report capital gains from buying and selling stocks, you must also report capital gains from cryptocurrency transactions.

So what are the taxes that you need to pay?

Which taxes do you pay on crypto in the USA?

There are two types of taxes you might need to pay if you own any cryptocurrency: Capital Gains Tax and Income Tax. In the US, capital gains are either short-term or long-term depending on how long you hold the asset from the purchase date until the same asset is sold in the future. Short-term and long-term capital gains are taxed at different rates in the US.

Which taxes you need to pay and how much depends on several factors:

- The type of transactions you have made (buying, selling, trading, etc.)

- If you have used cryptocurrency to pay for goods or services

- If you have received crypto from airdrops, staking, mining, interest payments, etc

- How long you held the asset before selling

- Your marital status and other income

The general formula for calculating capital gains is:

capital gains = selling price – purchase price

The selling price is simply the value of what you sold (disposed of) when you made the transaction. The purchase price is what you originally paid when you acquired the coins earlier and is also referred to as the cost basis. The cost basis should include associated costs such as commissions or trading fees.

Example

You buy 1 BTC for $30,000 plus a fee of $400. The cost basis for your 1 BTC is now $30,400. A few months later, you sell your bitcoin and receive $35,000 in return.

The capital gain is now easily found as $35,000 – $30,400 = $4,600 (assuming you don’t have any other transactions this year). This gain should be reported on your annual tax return, and you must pay short-term capital gains tax on the profits.

We will go into much more detail about calculating capital gains later in this guide, so fear not if this is still somewhat difficult to wrap your head around.

Next, we will look at how much tax you must pay on your crypto in the US for both Capital Gains Tax and Income Tax.

How much tax do you pay on crypto?

In the US, short-term capital gains and crypto income are taxed up to 37%, while long-term capital gains are taxed between 0% and 20% for the 2022 tax year. The applicable tax rates for crypto in the USA are dependent on your total taxable income, the types of transactions you have made, and for how long you held the asset before selling.

Tax rates in the USA

The two most important taxes for American taxpayers are Income Tax and Capital Gains Tax. Let’s look at both in more detail.

Income Tax

Crypto received as income is taxed at your ordinary-income tax rate which depends on your marital status and total income amount during the tax year.

The income tax brackets and tax rates for 2022 (filing in 2023) in the US are as follows:

| Tax Rate | Single | Married Filing Jointly | Married Filing Separately | Head of Household |

|---|---|---|---|---|

| 10% | $0 – $10,275 | $0 – $20,550 | $0 – $10,275 | $0 – $14,650 |

| 12% | $10,276 – $41,775 | $20,551 – $83,550 | $10,276 – $41,775 | $14,651 – $55,900 |

| 22% | $41,776 – $89,075 | $83,551 – $178,150 | $41,776 – $89,075 | $55,901 – $89,050 |

| 24% | $89,076 – $170,050 | $178,151 – $340,100 | $89,076 – $170,050 | $89,051 – $170,050 |

| 32% | $170,051 – $215,950 | $340,101 – $431,900 | $170,051 – $215,950 | $170,051 – $215,950 |

| 35% | $215,951 – $539,900 | $431,901 – $647,850 | $215,951 – $323,925 | $215,951 – $539,900 |

| 37% | $539,901+ | $647,851+ | $323,926+ | $539,901+ |

Example: Assuming you are a single tax filer with a taxable income of $45,000 during 2022, any additional income will now be taxed according to the 22% tax bracket as long as your total income does not exceed $89,075. This means that if you have received crypto from airdrops, staking, or mining, you will pay a 22% tax on the Fair Market Value (FMV) of the coins received at the time of the transaction.

Capital Gains Tax (CGT)

In the US, the Capital Gains Tax rate depends on how long you held the asset before you sold it. The gain is classified as long-term capital gains if you own a cryptocurrency for one year or longer before you sell. On the contrary, the gain is classified as short-term capital gains if you sell the cryptocurrency within one year of purchase.

Short-term capital gains are added to your income and therefore taxed at your ordinary-income tax rate discussed above. This means that depending on your other income, you will pay anywhere between 10% and 37% tax on capital gains from cryptocurrencies you held for less than one year.

If you have been hodling or invested long-term in a crypto project or token and waited more than 365 days before you sold, you are eligible for the long-term capital gains tax rate. Your long-term CGT tax rate depends on your total taxable income:

| CGT Tax Rate | Single | Married Filing Jointly | Married Filing Separately | Head of Household |

|---|---|---|---|---|

| 0% | $0 – $41,675 | $0 – $83,350 | $0 – $41,675 | $0 – $55,800 |

| 15% | $40,401 – $459,750 | $80,801 – $517,200 | $40,401 – $258,600 | $54,101 – $488,500 |

| 20% | $459,751+ | $517,201+ | $258,601+ | $488,501+ |

As we can see from this table, long-term capital gains are tax-free if your taxable income is less than or equal to $41,675 for single filers! This is certainly a huge tax advantage, so it can be a good strategy to consider your holding period before selling your bitcoin or other cryptocurrencies.

Tip: Free Cryptocurrency Tax Software

It can be very challenging to keep track of all crypto transactions and correctly calculate your short-term and long-term capital gains. That’s why most people use a cryptocurrency tax calculator like Coinpanda to handle this and generate all required tax reports and forms automatically.

With Coinpanda, you can import transactions with the click of a button from all exchanges. You will also see a breakdown of your short-term vs. long-term capital gains for each tax year. You can sign up for a free account and download your tax reports in under 20 minutes.

How to calculate capital gains on crypto

We have already defined the general formula for calculating capital gains:

capital gains = selling price – purchase price

To work out the capital gains we need to first calculate the selling price and purchase price (cost basis) for each transaction, and then classify the gain as either short-term or long-term. This can be done in four steps:

- Calculate the selling price as the fair market value (FMV) on the date of the transaction

- Calculate the cost basis using either FIFO, LIFO, or HIFO accounting method

- Subtract the cost basis from the selling price to work out the capital gain or loss

- Determine the holding period to classify the capital gain as either short-term or long-term

If you made a profit when selling, exchanging, or swapping your crypto, you have also made a capital gain. If you instead made a loss, you have made a capital loss on that transaction.

Calculating capital gains and losses is not very complicated if you only have a few transactions. However, most people that have bought cryptocurrencies have hundreds if not thousands of transactions spread on different exchanges and wallets, and that’s when things start to become a bit more complicated.

Next, we will show how to calculate capital gains with a practical example. We will consider only the First-in First-out (FIFO) cost basis method for simplicity, but you can learn more about the different accounting methods allowed in the US and how they are used in this article.

Example

Paul has been dipping his toes in the cryptocurrency world this year after creating his Coinbase account. These are his transactions in 2022:

- Bought 1 BTC for $22,000 (excl. $300 fee) on July 15th

- Sold 0.5 BTC for $12,000 (no fee) on September 1st

- Traded 0.3 BTC for 8.5 ETH on September 10th

- Received 20 XTZ from Coinbase Earn on October 5th

The fair market value (FMV) of 0.3 BTC at the time of the transaction was $6,500. The FMV of 20 XTZ on the day he received the tokens was $35. The cost basis for the 6 XTZ tokens take on the same value of $35. Paul’s transactions are summarized in the table below:

| Tx No. | Type | Date | Amount | Price | Fees | Cost Basis | Capital Gains/Income |

|---|---|---|---|---|---|---|---|

| 1 | Buy | 2022-07-15 | 1.0 BTC | $22,000 | $300 | $22,300 | – |

| 2 | Sell | 2022-09-01 | 0.5 BTC | $12,000 | – | (?) | (?) |

| 3 | Trade | 2022-09-10 | 0.3 BTC | $6,500 | – | (?) | (?) |

| 4 | Income | 2022-10-05 | 20 XTZ | $35 | – | $35 | (?) |

Paul needs to do some calculations to work out his capital gains and taxable income to report to the IRS in 2023.

- Tx 2: Cost basis for selling 0.5 BTC is 0.5/1.0 * $22,300 = $11,150. Therefore, the capital gain is $12,000 – $11,150 = $850 (gain).

- Tx 3: Cost basis for exchanging 0.3 BTC is 0.3/1.0 * $22,300 = $6,690. Therefore, the capital gain is $6,500 – $6,690 = -$190 (loss).

- Tx 4: The taxable income for 20 XTZ tokens received is equal to the fair market value of $35.

The updated table, including resulting capital gains, will now look like this:

| Tx No. | Type | Date | Amount | Price | Fees | Cost Basis | Capital Gains/Income |

|---|---|---|---|---|---|---|---|

| 1 | Buy | 2022-07-15 | 1.0 BTC | $22,000 | $300 | $22,300 | – |

| 2 | Sell | 2022-09-01 | 0.5 BTC | $12,000 | – | $11,150 | $850 |

| 3 | Trade | 2022-09-10 | 0.3 BTC | $6,500 | – | $6,690 | -$190 |

| 4 | Income | 2022-10-05 | 20 XTZ | $35 | – | $35 | $35 |

Therefore, Paul’s total capital gains are $850 – $190 = $660. This gain is classified as short-term and will be taxed according to his ordinary-income tax bracket. He will also need to report $35 of cryptocurrency income which will be added to his total income.

As we can see from this simple example, calculating capital gains and losses for your cryptocurrency transactions is relatively straightforward – as long as you don’t have too many transactions!

Next, we will look at different transaction types and taxable events for cryptocurrencies in the US.

Is buying crypto taxed in the US?

Whether or not you need to pay tax when buying crypto depends on what you are using to pay for your crypto. There are different tax rules for buying cryptocurrency with fiat currencies such as USD, or if you are buying crypto with another crypto including stablecoins.

Buying cryptocurrency with fiat currency (USD, EUR, etc)

Buying cryptocurrency with any type of fiat currency (USD, EUR, GBP, etc) is not a taxable event in the US. This means if you bought BTC and never sold it, you don’t have to worry about any taxes!

Buying crypto and paying with another crypto

Exchanging, swapping, or trading a cryptocurrency for another cryptocurrency is a taxable event in the US. The key point is that you are disposing of a cryptocurrency which is why this is considered a capital gains transaction by the IRS even though you are not receiving USD in your wallet or account.

This means that if you are exchanging BTC for ETH on an exchange, you must calculate and report the capital gains from the BTC sold (disposed of).

You need to first calculate the fair market value (FMV) of the cryptocurrency received from the transaction, and then work out the cost basis of the cryptocurrency sold. The capital gains can then be found directly as the cost basis subtracted from the value of the crypto received.

Example: you buy 1 BTC for $8,000, and later you go all-in on Chainlink and buy 1000 LINK with the 1 BTC. First, you need to calculate the FMV of 1000 LINK which we assume is $9,500 at the time of the transaction. The capital gains for disposing 1 BTC is therefore found as: $9,500 – $8,000 = $1,500 (profit).

Note: Stablecoins like USDT and USDC are considered equal to other cryptocurrencies. This means that there is no difference between trading with stablecoins or other cryptocurrencies for tax purposes.

Is selling crypto taxed in the US?

Yes, selling cryptocurrency is a taxable event in the US as stated by the IRS.

The capital gains will be considered short-term capital gains if you are selling your crypto within one year of purchasing it. Short-term gains are taxed similar to your ordinary income. If you are holding onto your coins for one year or longer before selling, you will pay long-term capital gains tax instead. The long-term capital gains tax rate depends on your total income and is anywhere between 0% and 20% for cryptocurrencies in the US.

It’s important to be aware that it does not matter if you are selling your crypto for USD, EUR, or another cryptocurrency. The transaction will be considered a taxable event by the IRS as long as you are disposing of any cryptocurrency.

Paying for goods or services

Using cryptocurrency to pay for goods or services is equal to selling and is therefore considered a taxable event.

For example, if you are buying a cup of coffee for $4.5 with bitcoin using the lightning network, you need to calculate capital gains for the bitcoin you sent to the coffee shop. The same rules also apply if you are using a crypto debit card like the MCO Visa card from Crypto.com.

There is no difference between paying for a physical good (coffee, laptop, car) or a service (flight, hotel booking, Spotify subscription) for tax purposes in the US according to the IRS.

Tax on cryptocurrency mining

Any cryptocurrency received to your wallet from mining is taxed as ordinary income in the US. There is no difference if you are mining in a pool or solo, or if you are using your own mining hardware or a cloud mining service. You need to calculate the fair market value of the coins on the day when you received them and report the total amount on your tax return the next year.

Cryptocurrency received from mining is also subject to capital gains tax when you sell the coins in the future. The cost basis is equal to the fair market value when you received the coins. In other words, you are only paying capital gains tax if the cryptocurrency has appreciated in value before being sold in the future.

Similarly, if the coin depreciates in value from the date you received the mining reward and until you sell it later, you can claim this as a capital loss and potentially offset your other capital gains.

We have written a specific guide to taxes on cryptocurrency mining if you want to learn more about this topic. This guide also covers cryptocurrency mining as a business in the US.

Tax on staking rewards

The IRS is yet to issue specific guidance on cryptocurrency staking rewards. However, most CPAs and tax professionals seem to agree that the safest approach is to report crypto received as staking rewards similar to mining rewards.

In Notice 2014-21, the IRS has laid out clear guidelines to the tax treatment of mining rewards. By applying the same guidance, a staking reward is taxable as ordinary income at its fair market value on the date you receive the coins or tokens. Similar to mining, any crypto received from staking that is later sold will be subject to capital gains tax.

What is worth mentioning is that the IRS has agreed to refund the taxes paid by an American couple for staking rewards they received from the Tezos network. This opens up the question of whether staking rewards should actually be taxed or not in the US. The outcome of this court case is still pending and we will update this guide with any news related to this case later.

Margin and futures trading

Any gains from cryptocurrency margin or futures trading are taxed in the US. Similarly, any trading loss can be used to potentially offset your other gains so it’s important to keep a good record of all your transactions.

We will break down the tax rules applicable to margin and futures trading in the US in more detail below.

Taxes on crypto margin trading

When you are trading on margin you are raising your buying power by borrowing funds to buy or sell a cryptocurrency. This means that you have an increased opportunity to make more profit, but also a higher risk of losing all your money.

No specific tax guidance has been issued by the IRS regarding taxes on margin trading for cryptocurrencies, but the general agreement among CPAs and tax professionals is that any gains should be treated as capital gains. The easiest way to account for this is to calculate the closed pnl for closed margin positions. Some exchanges can also provide this information directly as a downloadable CSV file.

Recommended reading: How to Report Taxes on Cryptocurrency Margin Trading

Taxes on crypto futures and derivatives trading

Similar to margin trading, derivatives trading can increase your buying power through the use of leverage. Instead of buying or selling the actual asset, you are trading what is referred to as derivative contracts. A contract always represents a real asset so the price will in most cases not be very different than the price on spot exchanges. There are many cryptocurrency derivative exchanges today, and you can trade contracts representing almost all of the most popular cryptocurrencies.

Because of the complicated tax environment surrounding futures and derivatives today, the conservative approach for traders is to report all gains and losses from cryptocurrency trading as capital gains similar to margin trading.

Tax on DeFi and NFTs

Both the DeFi and NFT landscape is relatively new even in the crypto universe. Everything DeFi, liquidity mining, and earning passive income from your cryptocurrency became hugely popular in the summer of 2020, which is until this day still often referred to as the “DeFi summer”.

The IRS is yet to issue specific guidance that addresses the tax treatment of both DeFi and NFTs. The best approach until then is to look at the current guidance for buying, selling, exchanging, and receiving cryptocurrency from the IRS to deduce the best approach for reporting taxes today.

As we have already covered, capital gains tax is triggered every time you are either selling, exchanging, swapping, or otherwise disposing of any cryptocurrency. Income tax, on the other hand, is generally triggered every time you receive a cryptocurrency from activities such as mining, staking, airdrops, hard forks, etc. Based on these simple guidelines, we can make the following assumptions for how the IRS most likely will consider DeFi transactions for tax purposes:

| DeFi transaction | Tax status | Comment |

|---|---|---|

| Earning interest | Income tax | Receiving new tokens is taxed as income |

| Paying interest | Capital gains tax | Capital gains tax if the interest is paid in cryptocurrency. No tax if paid in fiat. |

| Lending out cryptocurrency | Not taxed | Not taxed as long as the crypto lent out is not converted |

| Borrowing cryptocurrency | Not taxed | No tax as long as your collateral is not converted or liquidated |

| Liquidations | Capital gains tax | A liquidation is considered equal to disposing of cryptocurrency |

| Receiving staking rewards | Income tax | Most likely taxed as income. See chapter about Staking rewards for more details. |

| Depositing crypto to staking pool | Not taxed | Not taxed as long as the crypto deposited is not converted |

| Swapping crypto on a DEX (eg. Uniswap) | Capital gains tax | Considered equal to selling crypto |

| Adding/removing liquidity from a pool | Capital gains tax | Generally, capital gains tax applies every time a cryptocurrency is disposed of |

| Earning liquidity rewards | Income tax / Capital gains tax | Depends on whether you receive new tokens or if your already owned tokens accrue value instead |

| Yield farming on DeFi protocols | Income tax | Receiving new tokens is taxed as income |

| Tokens received from Play to Earn protocols/games | Income tax | Receiving new tokens is taxed as income |

Do you pay tax on NFTs in the US?

Yes, NFTs are taxed in the US since buying and selling NFTs are not any different than buying and selling other cryptocurrencies. This means that you are realizing capital gains every time you are selling or otherwise disposing of an NFT token.

You are realizing a capital gain if the NFT has appreciated in value from the date you bought it and until you sold it later. Similarly, you realize a capital loss if the NFT has depreciated in value instead. Capital gains from NFTs are taxed as either short-term or long-term capital gains tax as previously discussed in this guide.

Crypto gifts and donations

Tax on cryptocurrency sent or received as a gift

The annual gift exclusion is $15,000 for the 2021 tax year in the US. This means that if you have either received or sent gifts below this threshold, the cryptocurrency is generally not taxed for either the receiver or sender.

The annual gift exclusion is calculated per person so that you can give multiple gifts to different persons without being taxed as long as the total amount sent to any single person does not exceed the allowance of $15,000.

If you exceed the annual gift exclusion for any single person, you will pay tax between 18% and 40% depending on the total amount gifted during the tax year.

The general rule for receiving crypto as a gift is that the receiver simply acquires the sender’s cost basis including the holding period. Neither the sender nor receiver is therefore taxed on the date of the transaction, but the receiver is instead first taxed when the coins are sold later in the future.

Recommended reading: Are Cryptocurrency Gifts & Donations Taxed?

Tax on cryptocurrency donations

The IRS has clarified the taxation on donations in the latest guidance released in 2019. The guidance specifically says that you will not trigger any capital gains or income tax if you donate cryptocurrency to a registered charitable organization.

Not only are crypto donations not taxed, but you can also claim the donation as a tax deduction! How much deductions you are allowed depends on a few things:

- the original cost basis

- the fair market value at the time of donating the cryptocurrency

- for how long you have owned the asset

Keep in mind that the organization must be registered with the IRS and have a 501(c)3 status for you to be allowed to claim the tax deduction. You can check an organization’s status on the Tax-Exempt Organizations Search page.

Other cryptocurrency transactions

We have so far covered some of the most typical cryptocurrency transactions you might have to consider when it comes to taxes in the US. There are also many other different ways that you can either send or receive crypto. Below, we will comment briefly on the tax treatment of other transaction types and events not already mentioned.

Investing in ICOs/IEOs

When investing in a new project through an ICO/IEO you are always exchanging crypto for another crypto. In most cases, you will either send ETH, USDT, or BTC and receive token XYZ sometime in the future. Participating in an ICO or IEO is therefore no different than trading cryptocurrency and is a taxable event.

It is important to note that you are not taxed before you actually receive the new tokens in your wallet as clarified in the latest guidance from the IRS. This means that if you participated in an ICO in 2019 and the tokens were distributed in 2020, you should report this on your tax return for 2020 (which you file in 2021).

Token swaps

Cryptocurrencies are sometimes conducting what is called a token swap. This can happen when a project launches its own mainnet and needs to migrate all the tokens over to the new blockchain. This is usually done at a 1:1 ratio so that if you send 100 tokens you will also receive 100 tokens, or it can be a totally different ratio so that your new token balance is changed after the swap.

For example, VeChain did a 1:100 token swap in 2018 which means that you would receive a 100x amount of the coins you owned previously. Token swaps are in general not taxed, but remember that it’s important to make any necessary adjustments to your holdings if the number of coins you own has changed after the token swap event.

Hard forks

There has been a lot of confusion surrounding the taxation of hard forks in the past because of the complicated nature of how new coins are actually created. When the IRS published Rev. Rul. 2019-24 in 2019, this was finally a lot clearer to all cryptocurrency holders:

Crypto received from a hard fork is taxed as ordinary income at the time when the coins become available to you, which is usually when they were deposited in your wallet or exchange account.

What’s worth noting is that in many cases, the price of a newly forked cryptocurrency is zero right after the blockchain split occurs because no one has bought the new coin from someone else yet. In this case, you will not pay any income tax because the fair market value is essentially zero. Instead, you will only pay capital gains tax with a cost basis equal to zero when you sell the coins later.

Airdrops

Airdrops are generally taxed in a similar manner as hard forks. Because many airdrops are of negligible value and sometimes impossible to sell on an exchange, it’s still not 100% clear if you are required to report such airdrops as income or not.

Rewards, bonuses, referral commission

Some exchanges use incentives like sign-up or referral bonuses to get more customers to use their platform. Any type of bonus or reward you have received should generally be declared and taxed as ordinary income.

Sending crypto between wallets

You don’t have to worry about taxes if you are simply sending cryptocurrency between your own wallets or exchange accounts. Keep in mind that the IRS might ask you to provide a full breakdown of which addresses you have sent or received crypto from, so remember to keep full records of all your transactions.

How to calculate your crypto taxes

We have so far been focusing on how cryptocurrency is taxed in the US and what the IRS says about different crypto transactions and taxable events. We have also briefly discussed the formula for calculating cost basis and capital gains. There are essentially two different ways to go about this – either manually or using a crypto tax calculator.

Let’s look at both methods:

Calculating your crypto taxes manually

Here are the steps you must take to calculate your crypto taxes manually:

- Download the transaction history from all exchanges where you have bought, sold, received, or sent any cryptocurrency. This also includes transactions from or to your wallets.

- Calculate the cost basis for every individual transaction where cryptocurrency is sold or otherwise disposed of

- Calculate the proceeds and resulting capital gains for all transactions that are considered taxable disposals by the IRS

- Identify all transactions subject to income tax in the US

- Summarize all the calculations to find the total capital gains and your taxable income during the tax year

Remember to also keep track of both the date for acquisition and selling for every transaction since you need to report short-term and long-term capital gains separately in the US.

It is also a good idea to consult a CPA or tax professional if you are doing your crypto taxes manually since it can be very challenging to work out all the calculations correctly unless you are using very sophisticated spreadsheets that can automatically check for any errors such as missing purchase history.

Calculating your crypto taxes using crypto tax software

The best option for most people will likely be using cryptocurrency tax software to do their calculations. If you want to save both time and money, here is how you can use Coinpanda to sort out your crypto tax situation and generate all the required tax reports automatically:

1. Sign up for a 100% free account

It is 100% free to create a Coinpanda account, and you don’t need to enter any credit card information to get started. The free plan lets you explore and use all features for free.

Sign up with Coinpanda for free now!

2. Connect all your exchange accounts and wallets

Coinpanda supports more than 800+ exchanges, wallets, and blockchains today. You can easily import all your transactions by connecting your exchange accounts with API keys or uploading a CSV file with the transaction history. If you find that Coinpanda doesn’t support an exchange you have used, reach out to us so we can add the integration – usually within a few days.

3. Wait for Coinpanda to crunch all the numbers

Get yourself a cup of your favorite beverage and wait for Coinpanda’s sophisticated calculation engine to crunch all the numbers. Coinpanda will automatically calculate the cost basis, proceeds, capital gains, and taxable income for all your transactions! This might take anywhere from 20 seconds to five minutes depending on how many transactions you have.

4. Check for any reported warnings

Coinpanda will automatically display a warning if it appears that one or more transactions are missing such that the cost basis calculations will not include the total purchase price. If you see any warnings, you should double-check that you have connected all your wallets and exchange accounts.

Do you still see any warnings? Fear not! We have written an extensive list of help articles that will guide you through ensuring your crypto tax reports are as accurate as possible. If you still need any help, the best way to get in touch with our customer support and tax experts is in the live chat.

5. Download your tax reports and tax forms

When you have successfully imported all transactions, the final step is to download the tax reports and tax forms you need to file your taxes. Coinpanda’s tax plans start at $49, and you have lifetime access to all reports after upgrading.

For American tax filers, you can download Form 8949 and Schedule D for your capital gains transactions. You can also download the Schedule 1 form with your total taxable income from cryptocurrencies.

How to report your crypto taxes in the US

Taxes on your cryptocurrency should be filed together with your annual tax return. You can either file your crypto taxes using paper forms, or you can use tax apps like TurboTax or TaxAct. The deadline for reporting your crypto taxes is the same as your ordinary tax return deadline.

Crypto tax forms

There are quite many IRS tax forms today, but only a handful of these are applicable for reporting your cryptocurrency-related activity. The three most important forms you need to know about if you are from the US are:

- Form 8949: This form should include a complete list of cost basis and proceeds for all crypto disposals for both long-term and short-term holding periods

- Schedule D: A summary of the disposals entered on Form 8949 showing the total long-term and short-term capital gains

- Schedule 1: The total income from cryptocurrency should be reported on line 8z of this form

For each disposal, you must first calculate the fair market value (FMV) of the cryptocurrency received when you made the transaction. This is also referred to as the proceeds. Next, you need to determine the cost basis of the cryptocurrency sold. The gain or loss is then found as the cost basis subtracted from the proceeds.

This is how Form 8949 looks like with this information:

Form 8949 should include all your crypto disposals together with the date you acquired the crypto, when it was disposed of, your proceeds, your cost basis, and the resulting capital gain/loss. After adding all transactions, summarize the gain/loss on each page at the bottom, and transfer the total sum to your Schedule D.

This can involve much manual work and seem almost impossible if you have many transactions. Luckily, Coinpanda can help with filing your crypto taxes and being compliant by generating Form 8949 and Schedule D automatically for you.

How to report taxes with cryptocurrency tax software

Using cryptocurrency tax software to calculate capital gains can be a huge time-saver. By signing up for Coinpanda, you can save time, money, and frustration with reporting your crypto taxes.

Here is how it works:

- Sign up for a 100% free account

- Connect all your exchange accounts to import transactions automatically

- Select your preferred cost basis method and review the transactions imported

- Upgrade to a paid tax plan starting at $49 if you have exceeded the Free plan limit

- Download your tax reports and tax forms, including Form 8949 and Schedule D

- File your taxes using the downloaded forms, or use a tax app like TurboTax or TaxAct

Get started with Coinpanda for free today!

When to report your crypto taxes

The deadline for reporting taxes on cryptocurrencies in the US is the same as the deadline for your ordinary tax return which is the 15th of April the following year. In 2023, this date falls on a weekend, and the following Monday is the District of Columbia’s Emancipation Day holiday. This means that for the 2022 financial year, which runs from the 1st of January to the 31st of December 2022, the official tax deadline is April 18, 2023.

There are some exceptions to this like for US citizens living abroad (ex-pats) or for military personnel on duty outside the US. If this applies to you, the IRS will automatically grant you a 2-month extension period such that the deadline is June 15, 2023.

We recommend consulting with a tax professional if you have further questions about the tax deadline or what to do in case you have failed to report your crypto gains in your annual tax return.

What happens if I don’t report my crypto taxes?

It is a common belief among cryptocurrency traders that the government and the IRS will not get knowledge about their crypto activity such as trading on exchanges, but this is far from true.

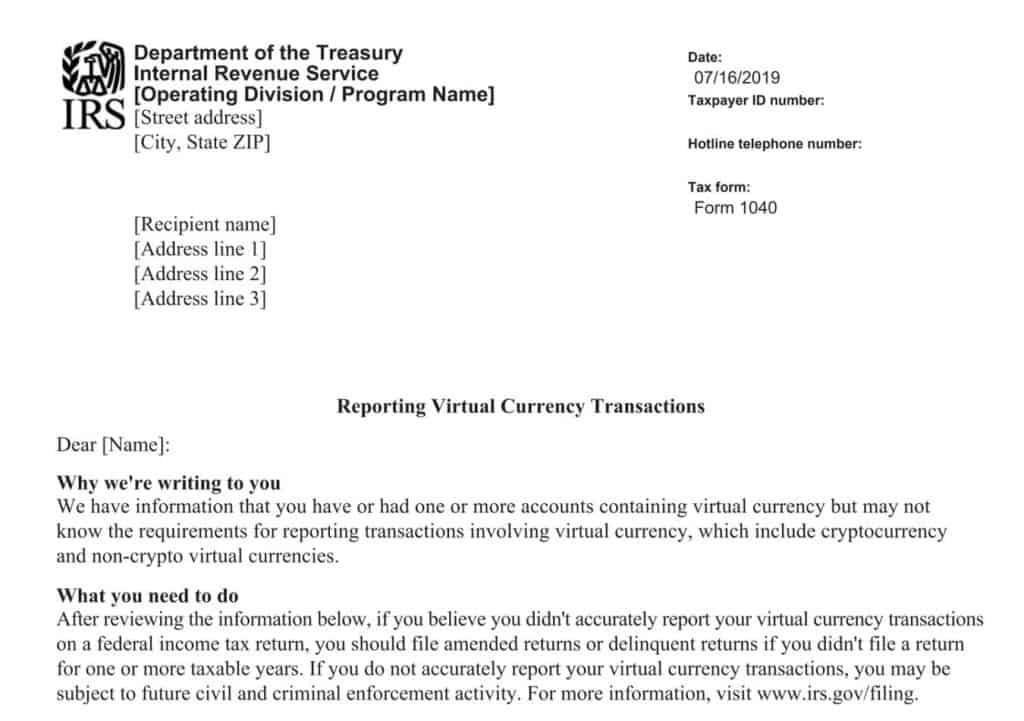

While the IRS didn’t make much effort around crypto tax reporting during the first years (up until 2016), the agency is now actively tracking down people who own or have transacted with cryptocurrencies. For example, since 2018, the IRS has received records of individuals who bought crypto on Coinbase directly from the exchange itself.

Not only that, more than 10,000 warning letters were sent in 2019 to US taxpayers who had either not correctly reported their gains from cryptocurrency investments, or ignored it completely.

It should be clear now that it’s impossible to hide completely from the IRS if you have ever bought or sold cryptocurrency. Failing to report your crypto taxes is very risky and can get you in a lot of trouble down the road including penalties or even criminal prosecution if you have been committing tax fraud.

If you have failed to report your crypto taxes for prior years, you can still amend your prior tax returns for up to three years by filing Form 1040-X. We strongly recommend consulting with a CPA or tax professional if you are in this situation to avoid potential fines from the IRS in the future.

Frequently asked questions

Do you still have any questions? Here are the answers to some of our most frequently asked questions.

Why can’t the exchange provide me with accurate tax reports?

This is one of the biggest challenges with crypto tax reporting today. As soon as you either transfer cryptocurrency from the exchange or purchase crypto on a different platform, the exchange no longer knows when, how, or at what rate you acquired all your cryptocurrencies. This information is required for tracking your cost basis and generating tax reports, which is why the only solution is to use a crypto tax app to do the job in most cases.

How can I pay less tax on my crypto?

There are two methods you can use to reduce your tax liability from cryptocurrencies:

1. Buy and hold your crypto for one year or longer for the gains to be considered long-term capital gains instead of short-term capital gains. Long-term gains are tax-free if your ordinary taxable income does not exceed $41,675 in 2022.

2. Practice wash-selling by selling any cryptocurrency currently at a loss and then buying the coins back shortly after if you still want to maintain ownership. This is normally not allowed for other asset classes like equities but is completely legal for cryptocurrencies since it is considered property by the IRS. This is also referred to as tax-loss harvesting.

Can I deduct losses if I have lost money from crypto trading?

Losses that arise from selling or trading cryptocurrency are considered capital losses and can be used to offset your capital gains both from cryptocurrencies and other assets.

If you have a net capital loss at the end of the year, the loss can be deducted from your ordinary taxable income up to the maximum allowed amount. For 2022, this amount is currently $1,500 for individuals filing as single, or as married and filing separately. If you are married and filing jointly, the maximum amount is currently $3,000.

Can I deduct losses from exchange hacks or scams?

It was possible to claim tax deductions on casualty losses in the past, but this changed after the passing of the Tax Cuts and Jobs Act in 2017. The current ruling says that you can only claim deductions if “the loss is caused by a federally declared disaster declared by the President”.

This is not the case if you have lost your crypto from an exchange hack or a scam attempt. In any case, we recommend that you consult a tax professional for advice if you are in doubt about your particular situation.

How can I report my taxes from DeFi?

The IRS has not yet issued any specific tax guidance on transactions with DeFi protocols such as Uniswap, Aave, or Compound. The best approach until then is to look at the current guidance for buying, selling, exchanging, and receiving cryptocurrency to deduce the best approach for reporting DeFi taxes today.

The general rule is that capital gains tax is triggered for all cryptocurrency disposals, while income tax is triggered each time you receive new tokens as interest, staking rewards, etc.

How is crypto taxed in countries other than the US?

Generally, most of the tax rules explained in this guide also apply to other countries. This means that you most likely have to pay both income tax on cryptocurrency received as income, and capital gains tax on your disposals from selling and trading.

The actual tax rate varies a lot between different countries and is often also dependent on your ordinary income and other capital gains. Some countries have special rules for calculating capital gains, such as the Superficial Loss Rule (Canada) and Share Pooling (the UK). See our complete list of country-specific crypto tax guides for more information: Crypto Tax Guides.

Summary

The most important take-away message from this guide should be that tax authorities around the world including the IRS are now enforcing strict measures so that individuals have to report and pay their taxes according to the law. Today, all American tax filers have to answer Yes or No whether they have dealt with cryptocurrency during the last year in their tax return. Failing to report your crypto taxes is very risky and can result in penalties, or worse.

Here are some of the key points from this guide:

- Buying (and paying with fiat currency), transferring crypto between wallets, donations, and gifting cryptocurrency is tax-free

- Selling, trading, swapping, and margin trading are taxed as capital gains

- DeFi transactions where a cryptocurrency is disposed of are taxed as capital gains

- Cryptocurrency received from mining, staking, airdrops, etc., is taxed as ordinary income

- Capital gains are considered either short-term or long-term and are taxed at different rates

- In the US, you typically have to file Form 8949, Schedule D, and Schedule 1 if you have bought and sold cryptocurrency during the tax year

If you have been using different exchanges like Coinbase or Binance, it will quickly become very challenging to report your crypto taxes manually. That’s why we built Coinanda which today has helped more than 80,000+ cryptocurrency traders solve their tax problems. Not only can you import transactions automatically from all exchanges and blockchains today, but the software also allows you to download all required tax documents including IRS Form 8949 and Schedule D.

Are you not from the US? No problem, you can also download a general international tax report since Coinpanda supports more than 65+ countries today. Sign up for a free account today and save both time and money!