Calculate your crypto and NFT taxes

Sort out your crypto tax nightmare for DeFi and NFTs easily. Get your crypto tax reports in under 20 minutes.

Support for 65+ countries

NFTs and DeFi

Free tax reports

Need help with your taxes?

Have you bought or sold crypto on different exchanges? Lost track of all your wallet addresses? Not sure how to report your taxes?

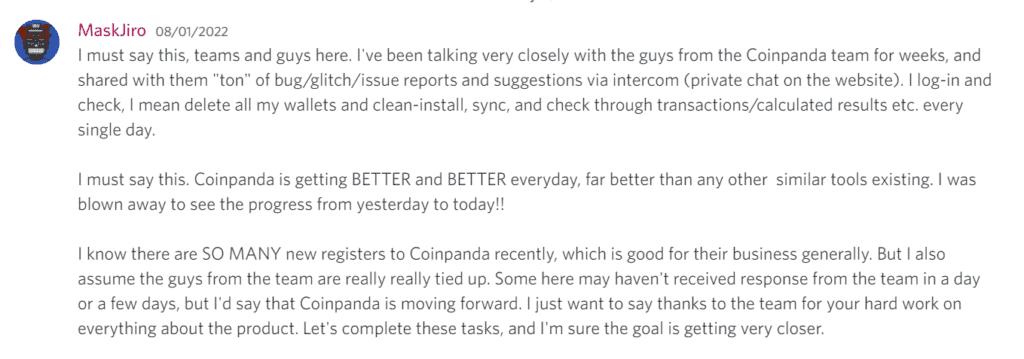

We built Coinpanda out of our frustration, so we understand your situation very well! Our support team has 7+ years of experience with crypto taxes and can answer all your questions.

Reduce your taxes

You will reduce your total capital gains by selling coins at a loss. This means you can pay less tax next year.

Coinpanda helps you minimize your taxes and maximize profits! 💰 Save time and money. Download your crypto tax reports in under 20 minutes.

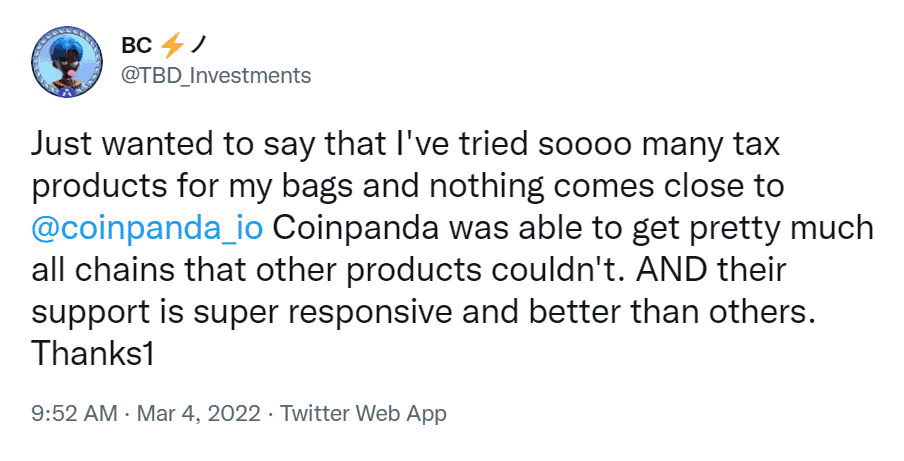

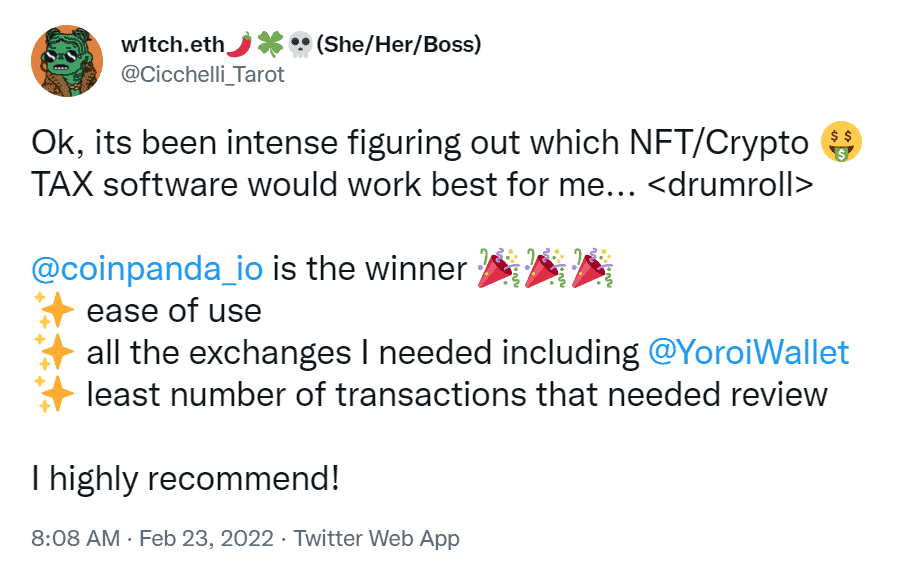

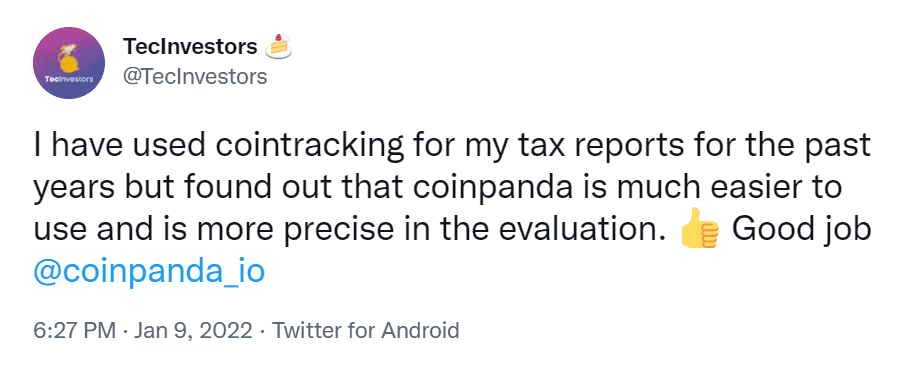

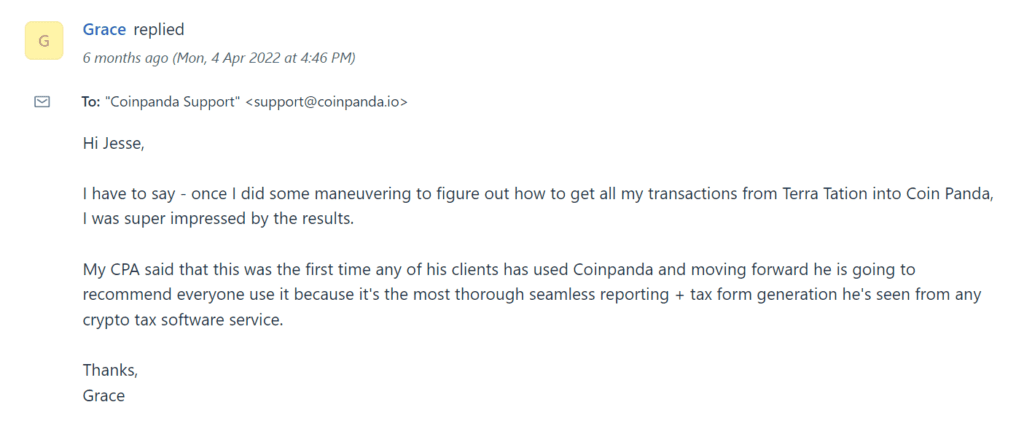

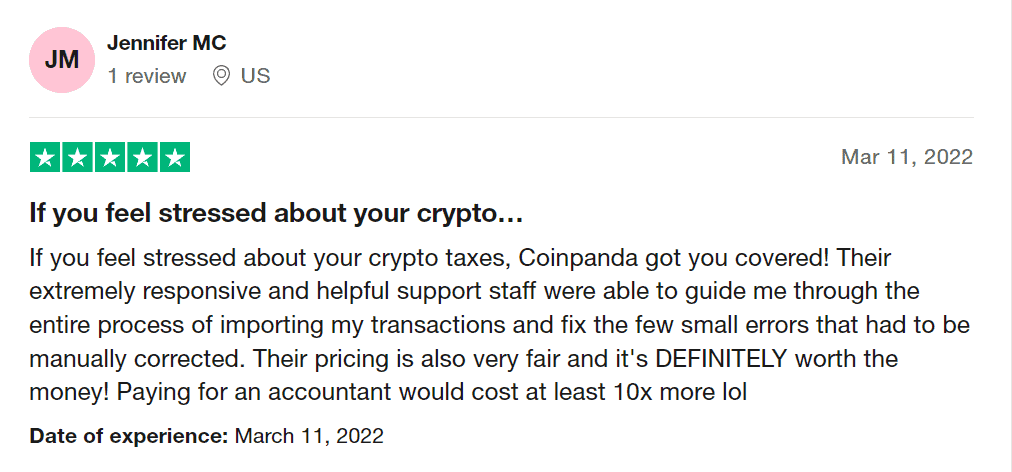

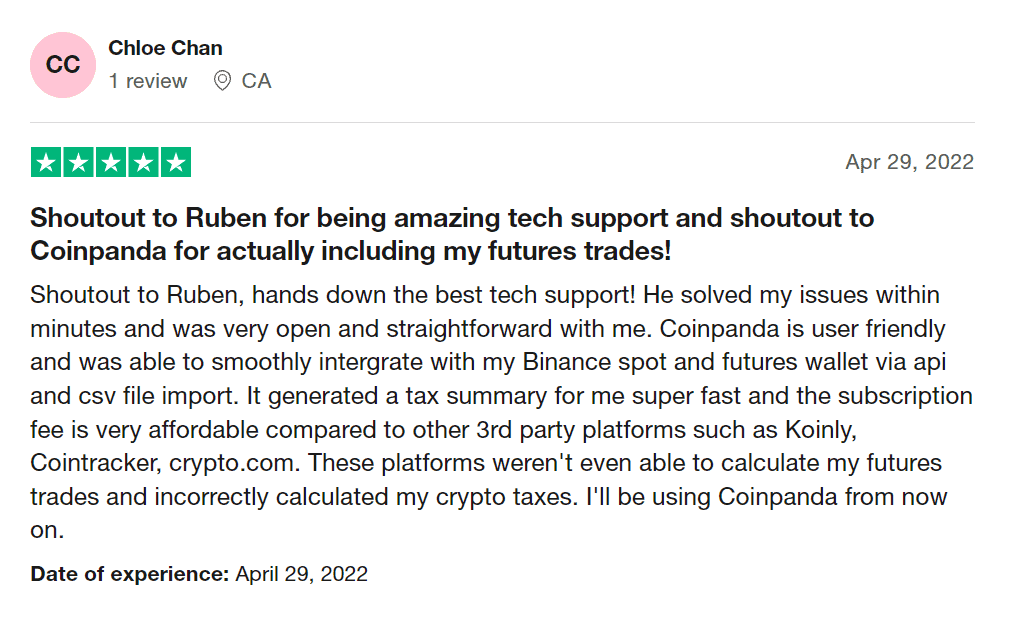

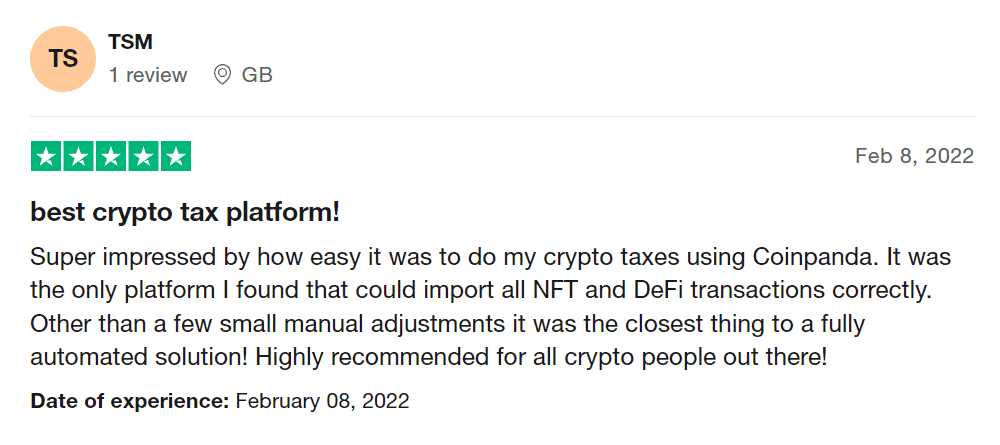

80,000+ HAPPY CUSTOMERS

POPULAR FEATURES

800+ exchanges and wallets

DeFi, NFTs, staking

Free tax report preview

Support for 65+ countries

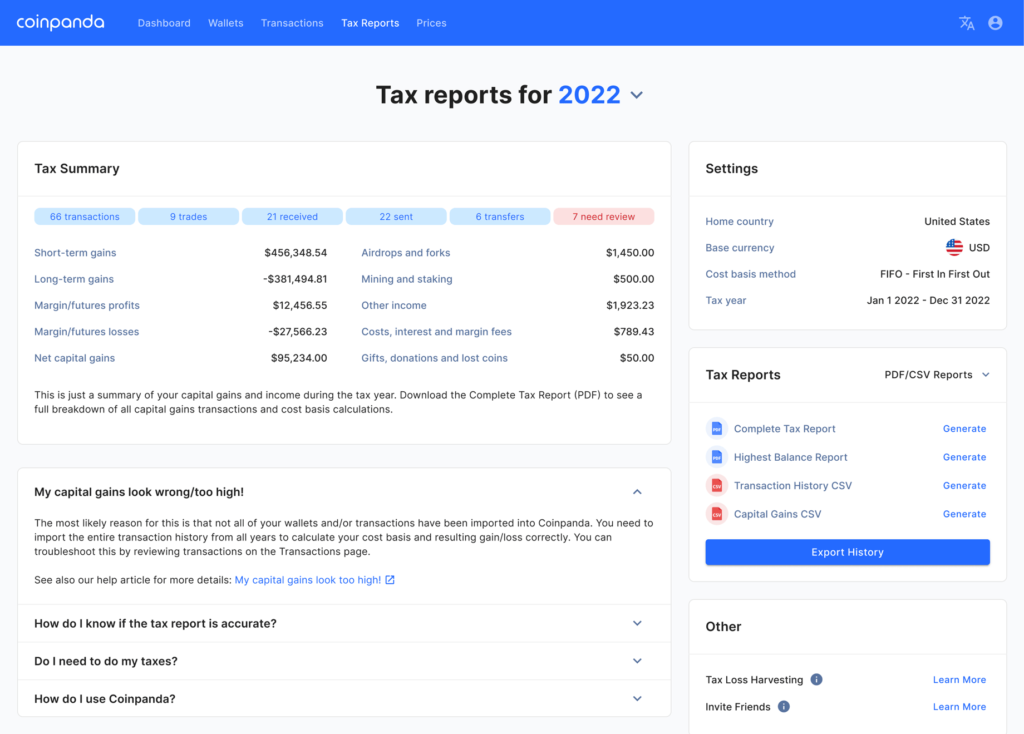

Crypto tax reports

Import your transactions and download tax reports with the click of a button. Coinpanda supports all popular exchanges and wallets.

Capital gains report

Futures and margin trading

DeFi, NFTs, and staking

Support for 65+ countries

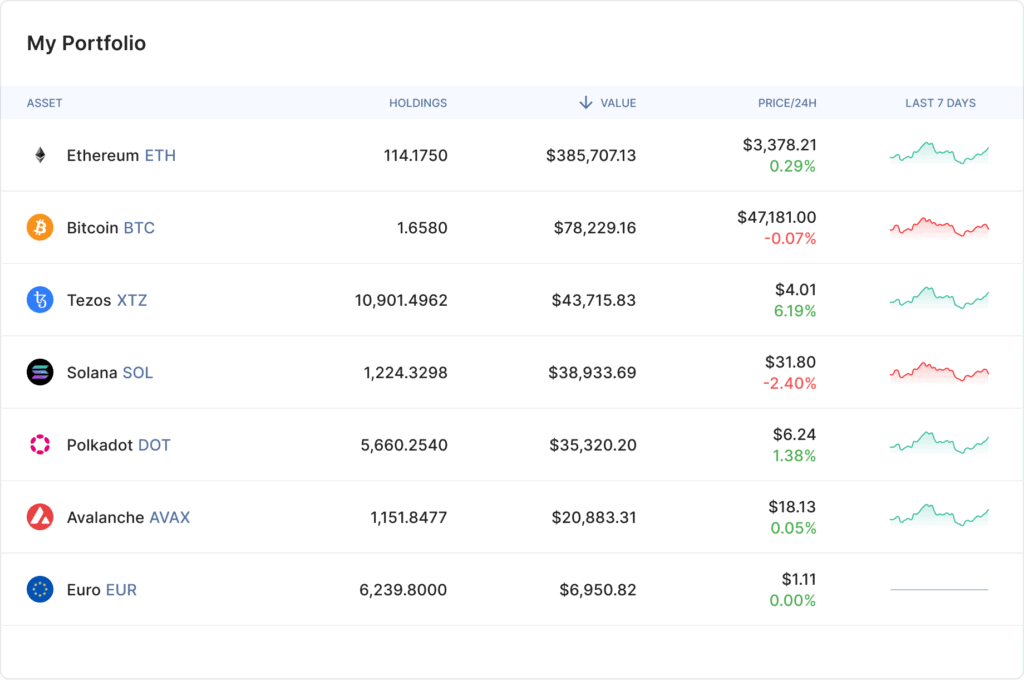

Portfolio tracking

Track your entire cryptocurrency portfolio with our powerful platform for serious investors and traders. Gain insight into your trades, and learn how to maximize your profits.

Personal dashboard

242 blockchains

Track NFTs and DeFi

50,000+ cryptocurrencies

Crypto taxes done in 3 steps

Calculate and report your crypto taxes in a few easy steps.

01

02

03

Import trades

Connect to all major crypto exchanges with API or upload CSV files. Import your transactions automatically and securely.

Preview capital gains

Coinpanda tracks all your trades and provides free detailed insight into your cryptocurrency portfolio.

Download tax reports

Generate accurate tax reports you need to file your taxes. International reports, IRS Form 8949, Schedule D, TurboTax.

Frequently Asked Questions

Get advice and answers from our team of crypto tax experts.

Do I need to pay taxes on my cryptocurrencies?

If you have traded, sold, exchanged, spent, or used any cryptocurrency to pay for goods or services, you most likely need to report and pay taxes on the realized gains. Learn more about how cryptocurrencies are taxed in various countries.

Are crypto-to-crypto trades taxed?

Yes, a crypto-to-crypto transaction is considered a taxable event similar to selling cryptocurrency for fiat currency. Stablecoins such as USDT, USDC, or DAI are treated similarly to any other cryptocurrency for tax purposes. Learn more about how crypto is taxed in our Crypto Tax Guide for 2023.

Are crypto airdrops taxed?

Generally, airdrops are considered ordinary income for tax purposes in the US and most other countries. Therefore, you must report and pay taxes if you have received a cryptocurrency airdrop.

Do I need to pay taxes on staking rewards?

In most cases, staking rewards are considered income from a tax perspective. You should report the fair market value at the time of receipt of the cryptocurrency received in your tax return.

How can I calculate taxes on NFTs?

The first step is to import all your NFT transactions to a crypto tax calculator, which will then calculate your gains and losses for each transaction. Coinpanda supports NFTs on all blockchains, including Ethereum, Solana, and Cardano.

How can I generate my crypto tax report?

Coinpanda is a cryptocurrency tax calculator built to simplify and automate calculating your taxes and filing your tax reports. Using our platform, you can export all required forms in under 20 minutes.

Can I avoid paying taxes on my crypto?

Avoiding taxes is both very difficult and usually not legal. In most countries, tax authorities are now tracking down people who own or have bought cryptocurrencies in the past. Some exchanges like Coinbase and Binance have also handed over user data to several tax agencies worldwide.

What should I do after receiving a crypto tax warning letter?

If you have received a warning letter from a tax agency, you must report your crypto holdings and taxes to avoid potential fines. Coinpanda can help you do this.