Understanding how to report cryptocurrency taxes on TurboTax accurately can seem like a complex task at first. In this complete guide, we explain everything you need to know about reporting crypto tax on TurboTax, including a step-by-step tutorial updated for 2023.

Key takeaways

- TurboTax allows users to report crypto taxes and import transactions directly from select cryptocurrency platforms, but its supported platforms are limited.

- Income from crypto activities like mining, staking, or airdrops can be reported in TurboTax, but need to be manually entered in the 'Miscellaneous Income' section.

- If TurboTax does not have a direct integration with your exchange or wallet, you will need to use a crypto tax calculator to generate a CSV report of your gains and losses, which can be manually uploaded to TurboTax.

- You will need TurboTax Premier or Self-Employed to report crypto on TurboTax as these versions support the necessary forms for reporting cryptocurrency transactions.

Can I report crypto taxes on TurboTax?

Yes, you can report crypto taxes using TurboTax. TurboTax has integrated various cryptocurrency platforms to facilitate accurate reporting of crypto transactions. This includes sales, purchases, staking income, and other crypto-related transactions. You can directly import your crypto transaction details or manually enter them, depending on your preference.

However, it’s essential to know that TurboTax only supports a handful of crypto exchanges and platforms today, and it may lack the crucial functionality required by many crypto investors for reporting taxes accurately. TurboTax may work for you if you have only made simple transactions on exchanges such as Coinbase or Gemini, but you will quickly notice the limitations if you have used non-US exchanges, need to import transactions from various cryptocurrency wallets, or if you have dabbled in NFTs or DeFi.

For these reasons, TurboTax has partnered with Coinpanda to offer a powerful yet simple-to-use crypto tax reporting tool that enables even the most advanced and seasoned crypto enthusiasts to file taxes from more than 800+ exchanges, blockchains, and wallets – entirely stress-free.

Can I import crypto transactions into TurboTax?

Yes, you can import your crypto transactions into TurboTax. This process has been made easier through TurboTax’s integration with different crypto exchanges, which lets you import your transaction data directly into TurboTax.

But as we already mentioned, the integrations supported by TurboTax are very limited, and entering your crypto transactions manually can be very time-consuming and is not a practical solution for most people.

However, Coinpanda can help with this. All you need to do is connect your exchange accounts and wallets, and Coinpanda will generate a CSV file automatically that you can upload to TurboTax.

How to enter crypto into TurboTax Online

These are all the steps required for reporting your cryptocurrency gains and losses using the online version of TurboTax as of July 2023:

1. Log in to TurboTax Online and complete the account setup

Before you can start reporting crypto in TurboTax, you need to complete the initial account setup and configuration if you haven’t done this before. Don’t worry – TurboTax will guide you through the entire process, which only takes a few minutes.

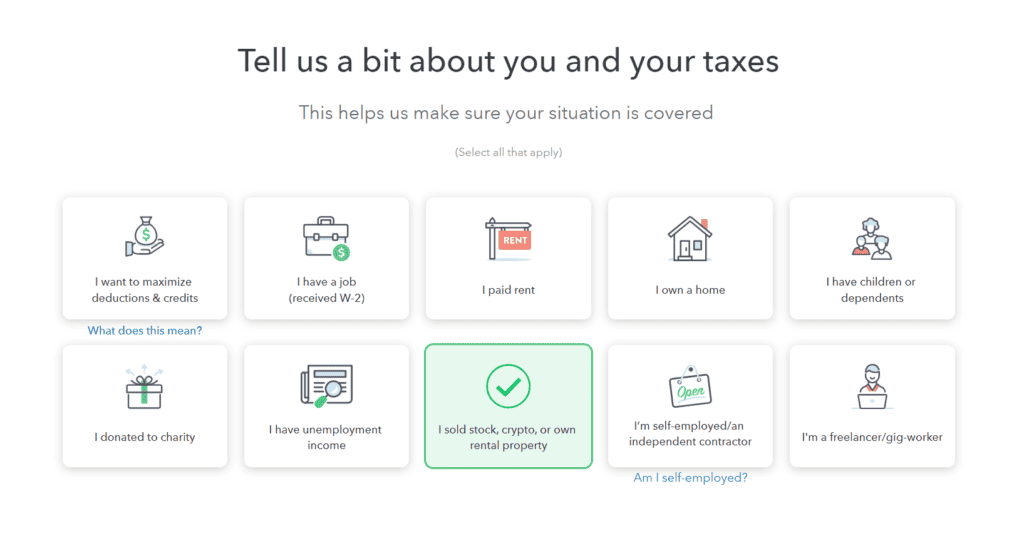

2. Select ‘I sold stock, crypto, or own rental property’

Start by selecting the box with the text ‘I sold stock, crypto, or own rental property‘ and then click the button below to proceed to the next step.

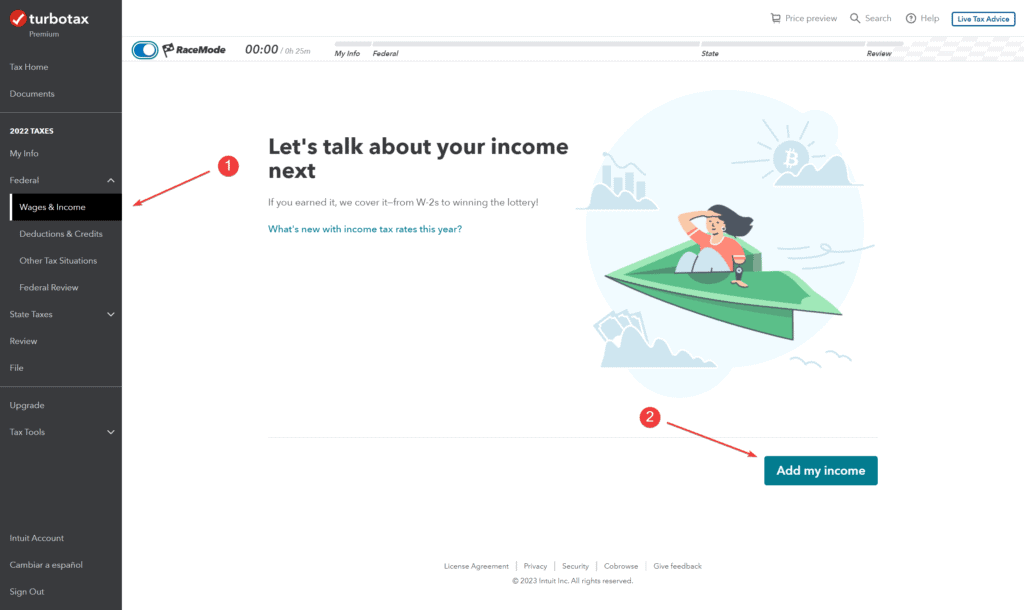

3. Navigate to the Income section

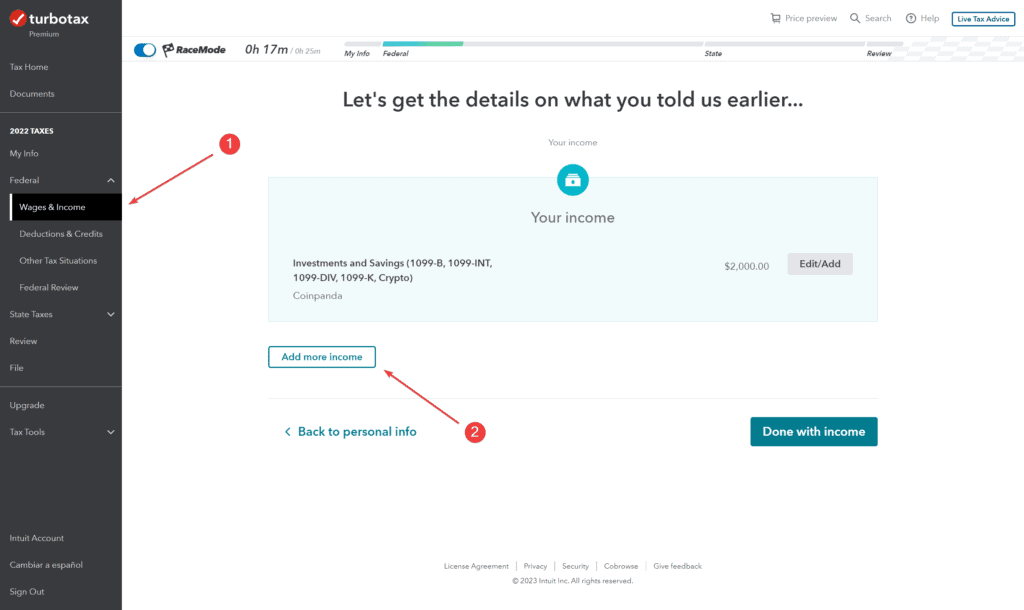

Expand the ‘Federal‘ menu on the left side, then click ‘Wages & Income‘ to open the income page. Next, click the ‘Add my income‘ button.

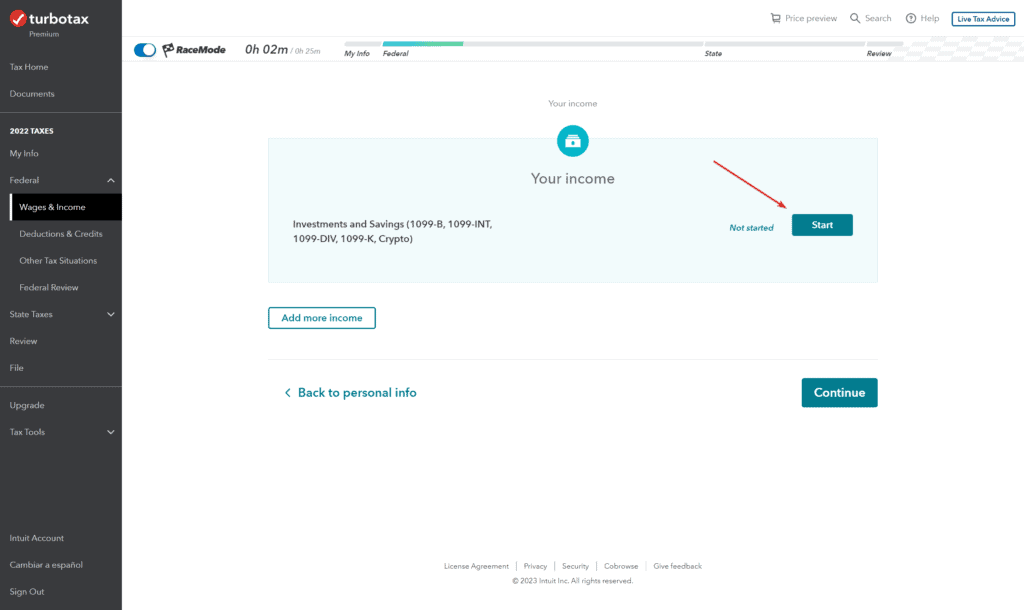

If you have used TurboTax previously, you might see the screen in the image below instead. Next to ‘Investments and Savings‘, click the ‘Start‘ button to open the cryptocurrency module in TurboTax.

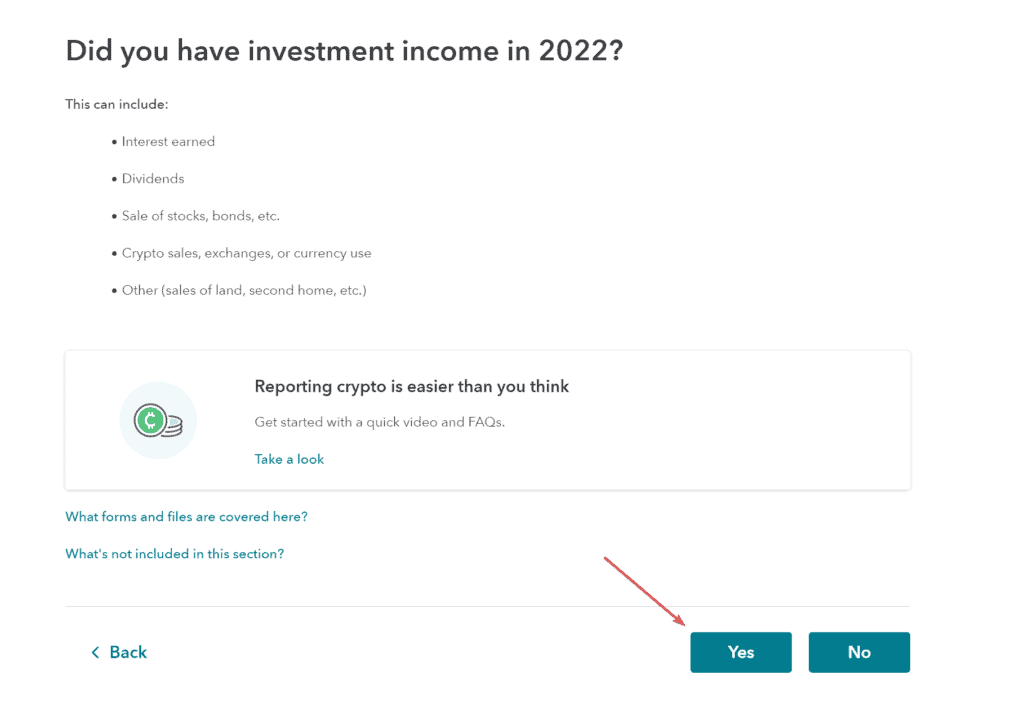

4. Select ‘Yes’ when asked about investment income

To open the page for uploading your crypto transactions, select ‘Yes‘ when asked about investment income for 2022. Note that you should do this also if you had crypto losses in 2022 since gains and losses are reported on the same page.

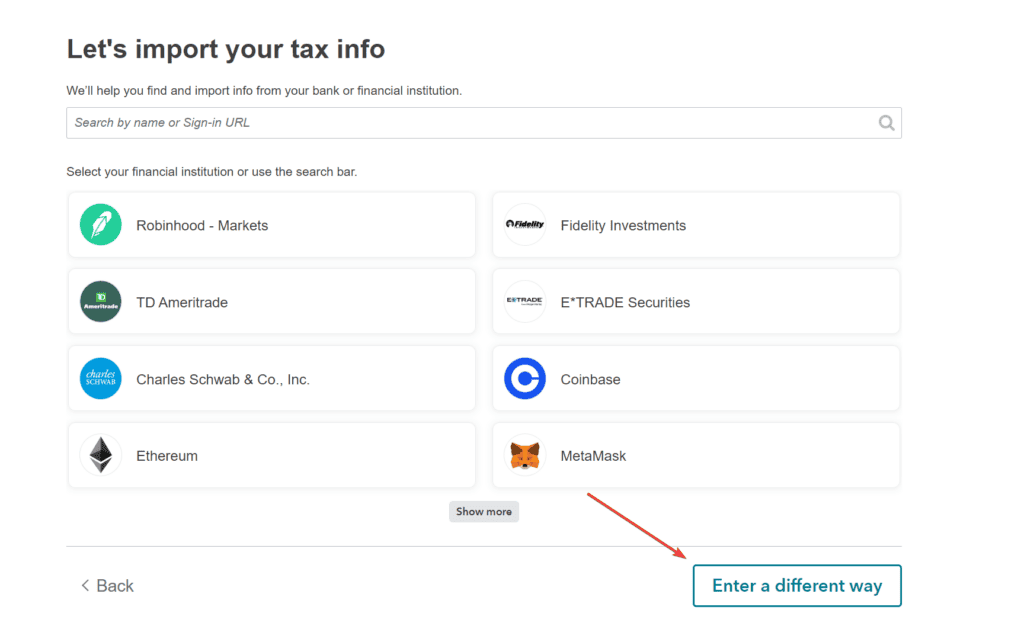

5. Select the ‘Enter a different way’ button

As mentioned, TurboTax’s integrations are limited to only a few crypto platforms so you need to click ‘Enter a different way‘ to upload a single file with all your transactions aggregated. This is required since TurboTax can’t track your cost basis properly without a complete history of your transactions.

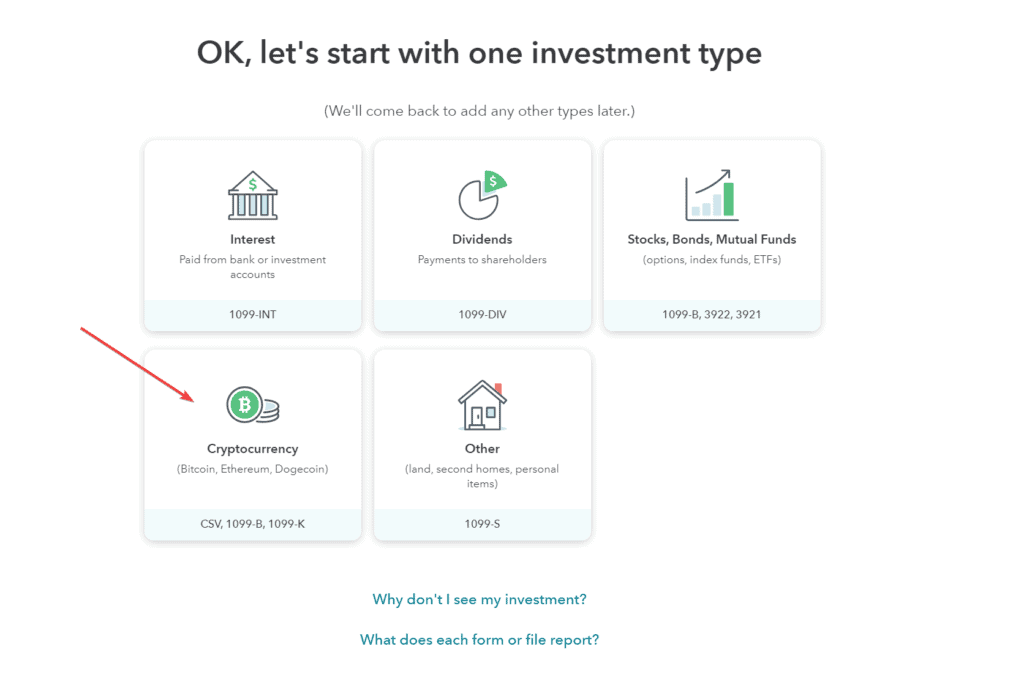

6. Select the ‘Cryptocurrency’ card

To continue to the page where you can upload your crypto transactions, select the ‘Cryptocurrency‘ card.

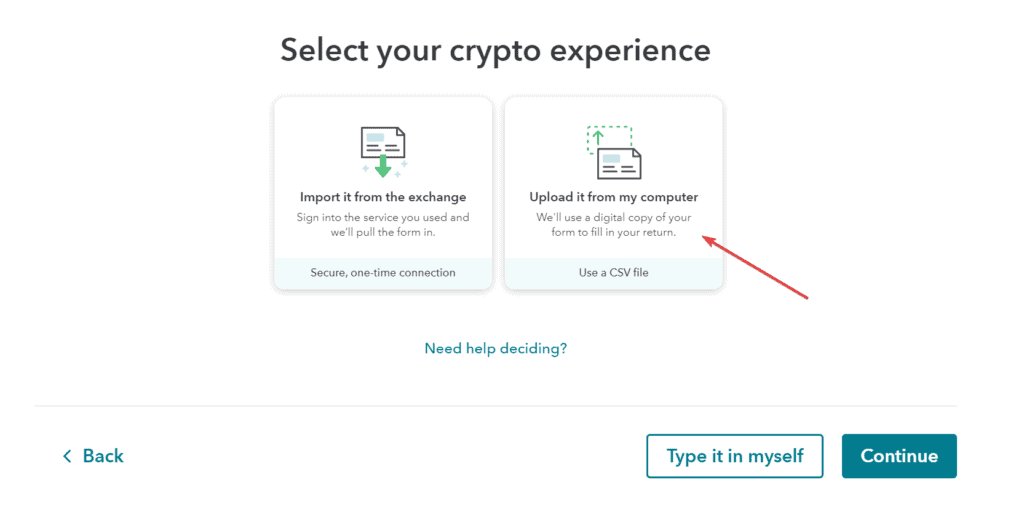

7. Select ‘Upload it from my computer’

Select the second card for uploading a file from your computer.

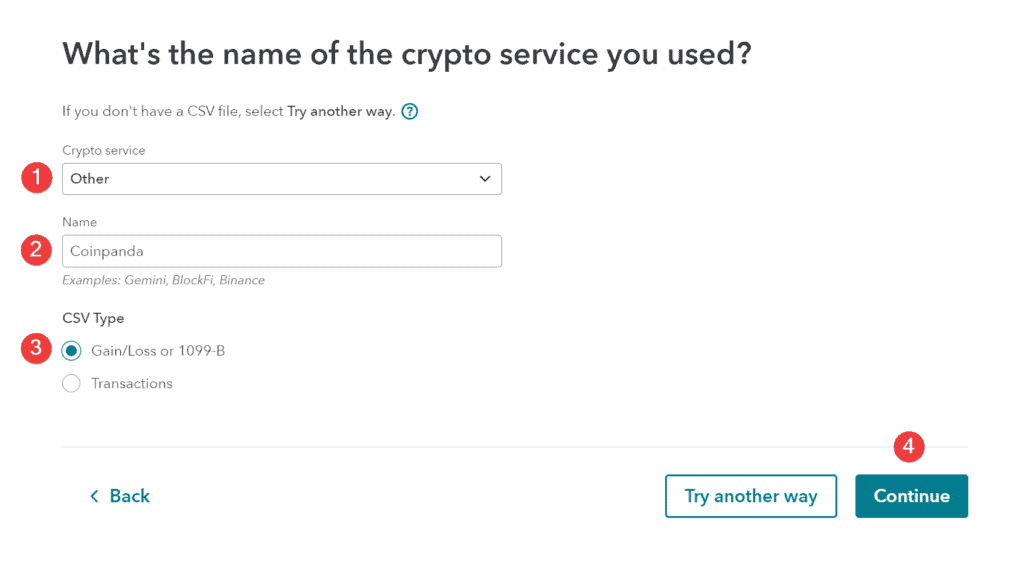

8. Select crypto service and CSV type

On this page, select ‘Other‘ in the crypto service dropdown and enter ‘Coinpanda‘ in the name field below. Under CSV type, choose the first option, ‘Gain/Loss or 1099-B‘.

Click ‘Continue‘ to proceed.

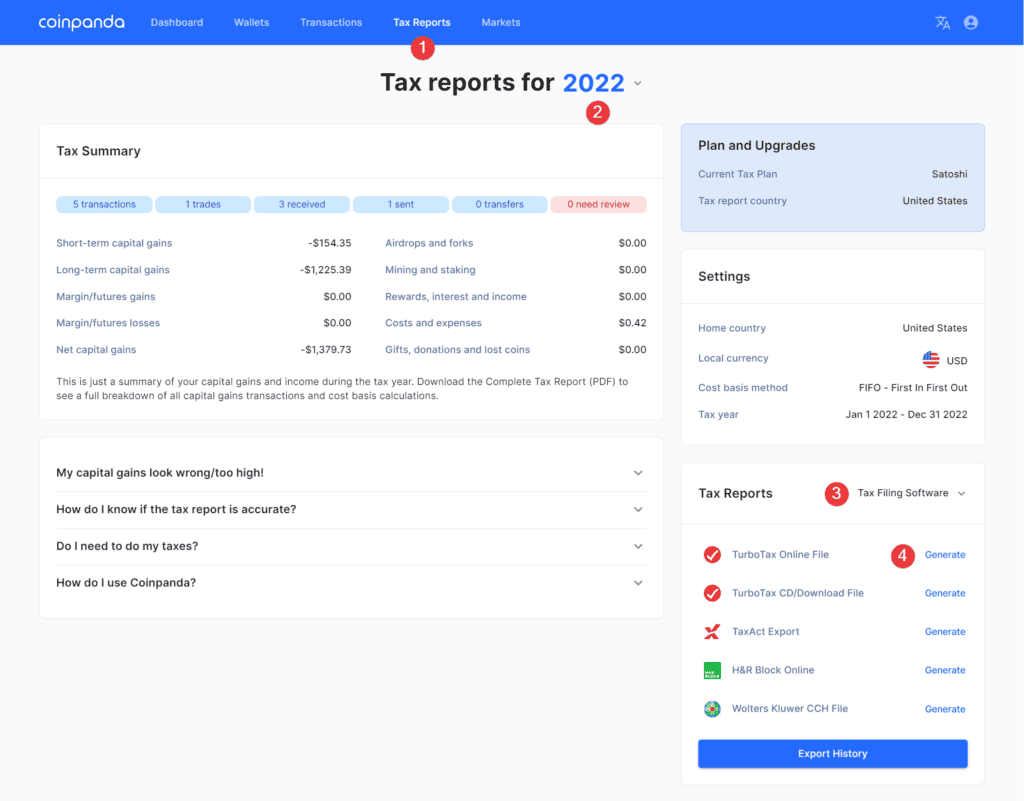

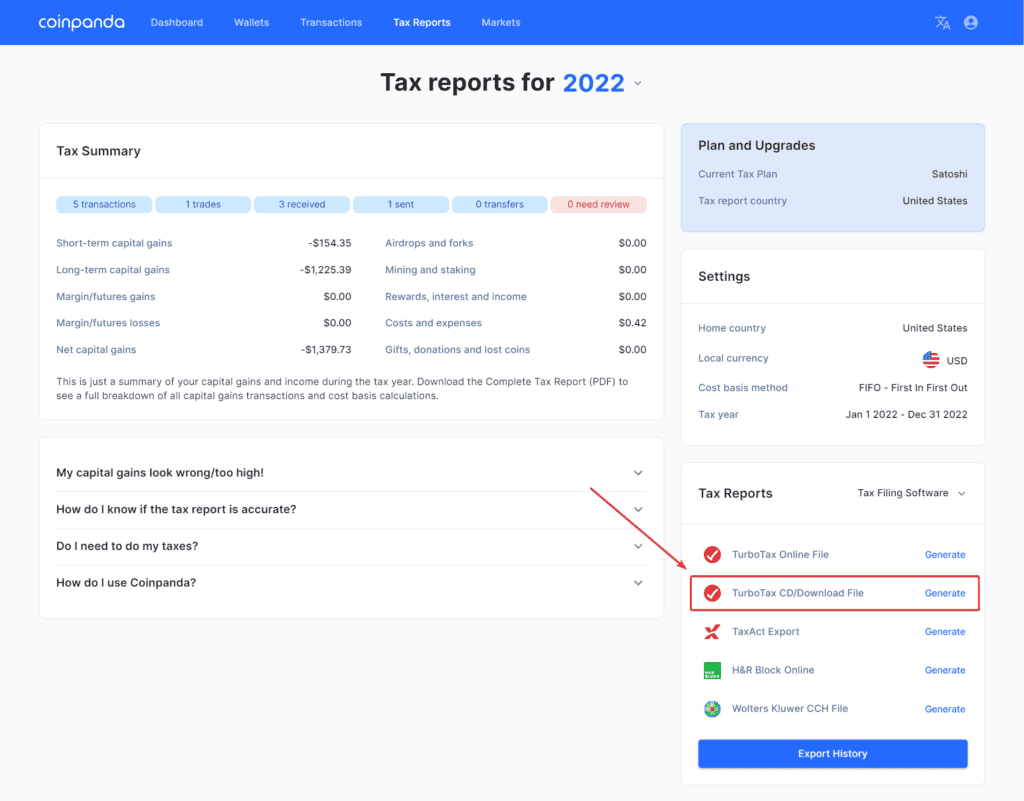

9. Export the TurboTax Online CSV file

Head over to your Coinpanda account, navigate to ‘Tax Reports‘ in the main navigation, then select the year you are reporting taxes for.

In the tax reports card, select ‘Tax Filing Software‘ and then click ‘Generate‘ to export the TurboTax Online File. You can now upload the CSV file in TurboTax.

If you haven’t prepared your TurboTax CSV file using Coinpanda yet, this might be a good time to do so! Start by creating a free account, connect all your exchange accounts and wallets, and your crypto tax reports will be ready in under 20 minutes.

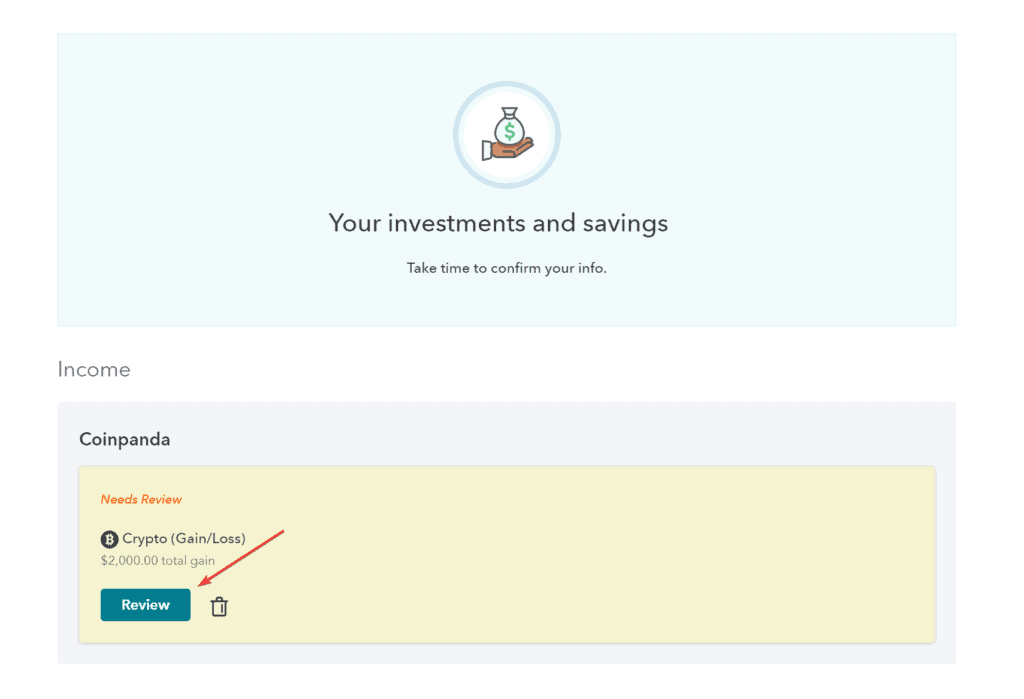

10. Review your crypto gains and losses

After uploading the file, you will see the screen below with the text ‘Needs Review’ in red. Click ‘Review‘ to open the review page.

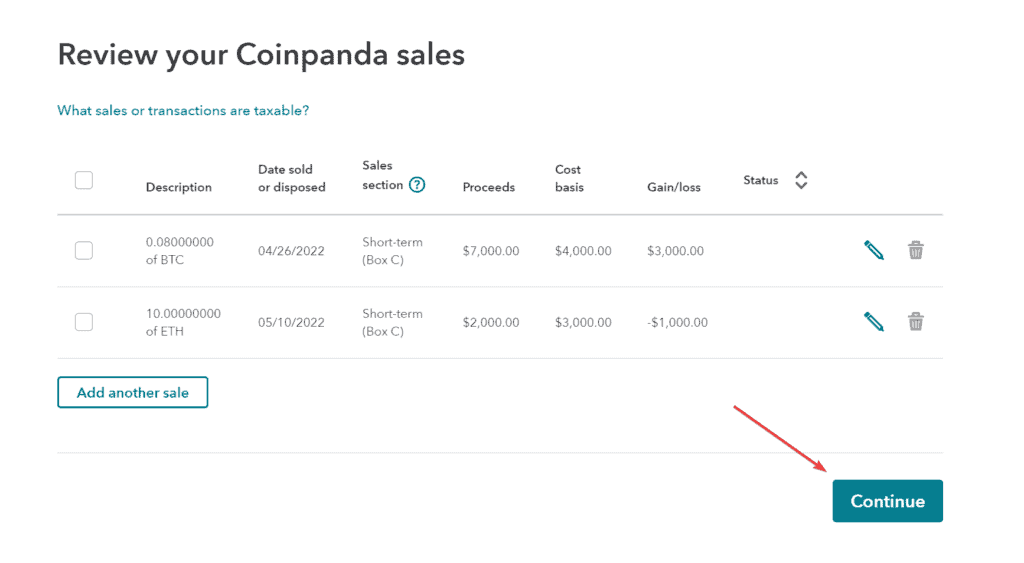

The review page in TurboTax lets you select which transactions should be considered capital gains or capital loss transactions for tax purposes. Since the file exported from Coinpanda earlier only includes taxable transactions, you should not make any changes to this.

Scroll to the bottom and click ‘Continue‘ without altering any transactions.

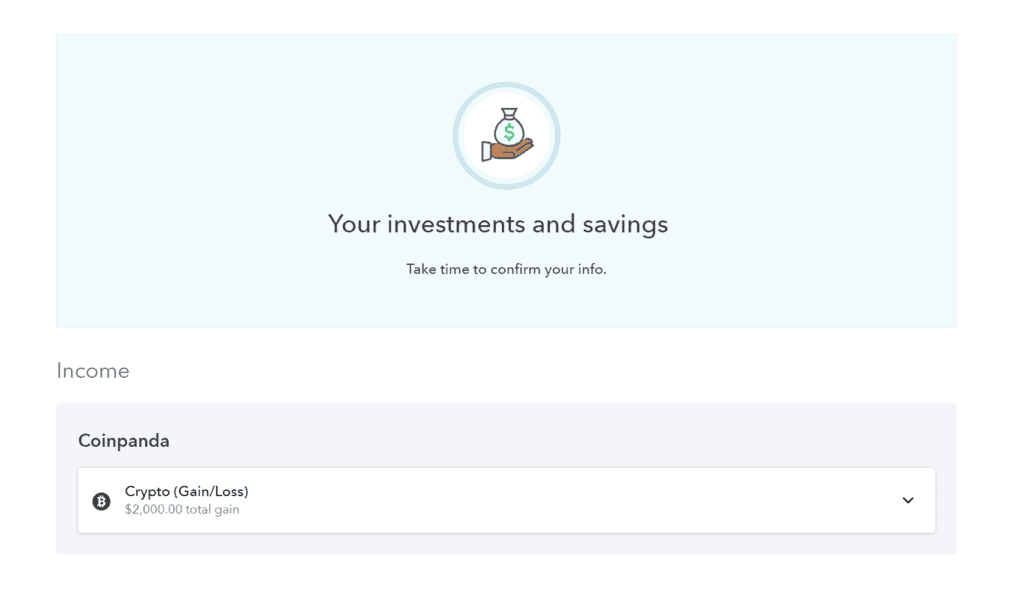

11. View the reported gains or losses

Congratulations – you have completed all the steps required for reporting crypto taxes on TurboTax! You will now see a summary of your total gains (or losses) under ‘Coinpanda’.

While crypto taxes might feel quite intimidating at first, we hope that after following this step-by-step guide for reporting cryptocurrency on TurboTax, you have learned that it’s actually not that difficult when doing it with the help of Coinpanda.

How to report crypto on TurboTax Desktop

You can also report your cryptocurrency gains, losses, and income using TurboTax desktop instead of the online version. To do this, you need to export a TXF file with your transactions which can be uploaded to the TurboTax desktop application.

The first step is to export the TXF file from Coinpanda. You can do this from the ‘Tax Reports‘ page and by selecting ‘Tax Filing Software‘ in the tax reports card.

Once you have the TXF file ready, here’s a short summary of the steps you must take:

- Open TurboTax desktop and navigate to File > Import > From Accounting Software

- Select Other Financial Software (TXF file) and click Continue

- Select Browse File and select the TXF file downloaded from Coinpanda

- Next, click Import Now

- Confirm that the uploaded file shows as a 1099-B, then click Import Now once more

- Verify that the total value for Gain/(Loss) look correct, and click Done to proceed

- On the Import Summary page, click Done to complete the process

How do I report crypto income?

You can also report cryptocurrency income in TurboTax, although there is no direct integration in TurboTax specifically designed for reporting crypto income, such as mining, staking, or airdrops. As of today, taxable income from crypto must be entered on a separate page different than where capital gains are reported.

1. Navigate to the Income section and click ‘Add more income’

Navigate to the same page where you started when reporting capital gains, and click ‘Add more income‘ to see all different income types.

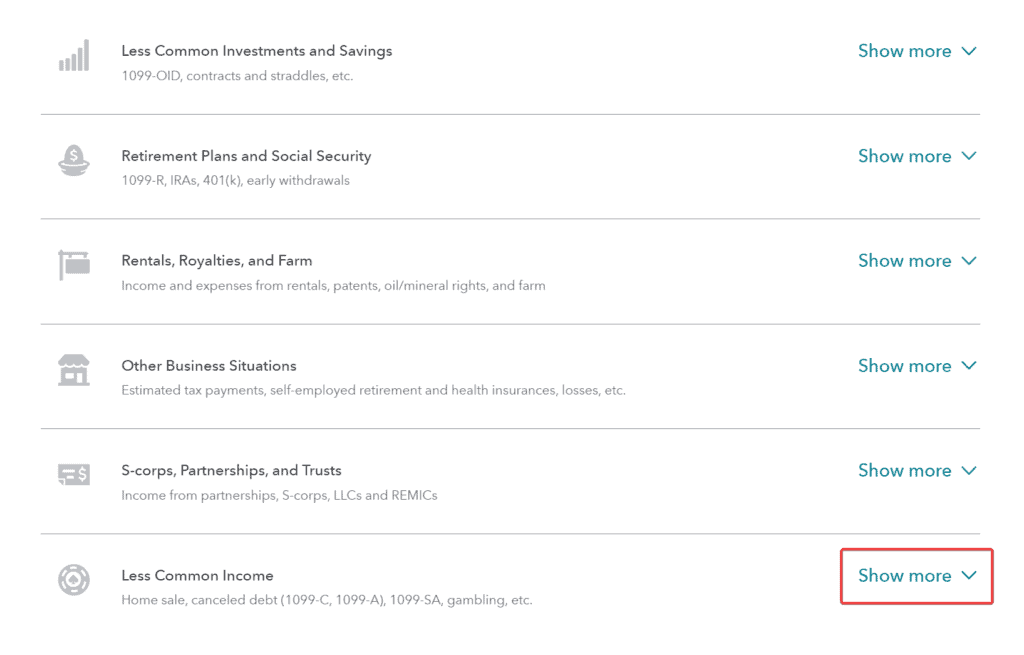

2. Expand the row for ‘Less Common Income’

Click ‘Show more‘ to see more options.

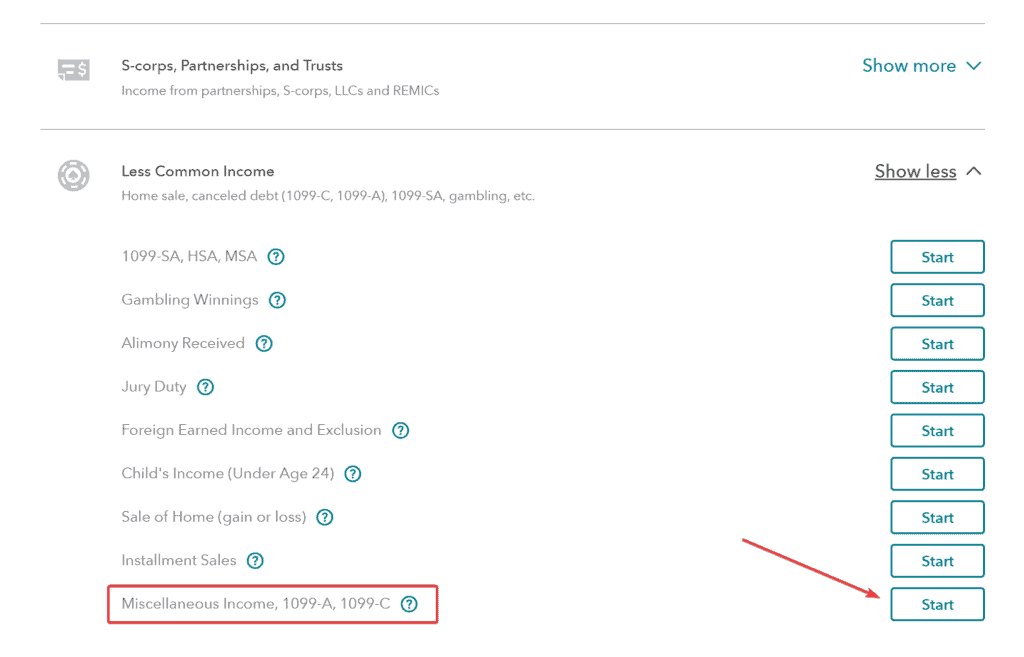

3. Select ‘Miscellaneous Income, 1099-A, 1099-C’

Click the ‘Start‘ button next to ‘Miscellaneous Income, 1099-A, 1099-C‘.

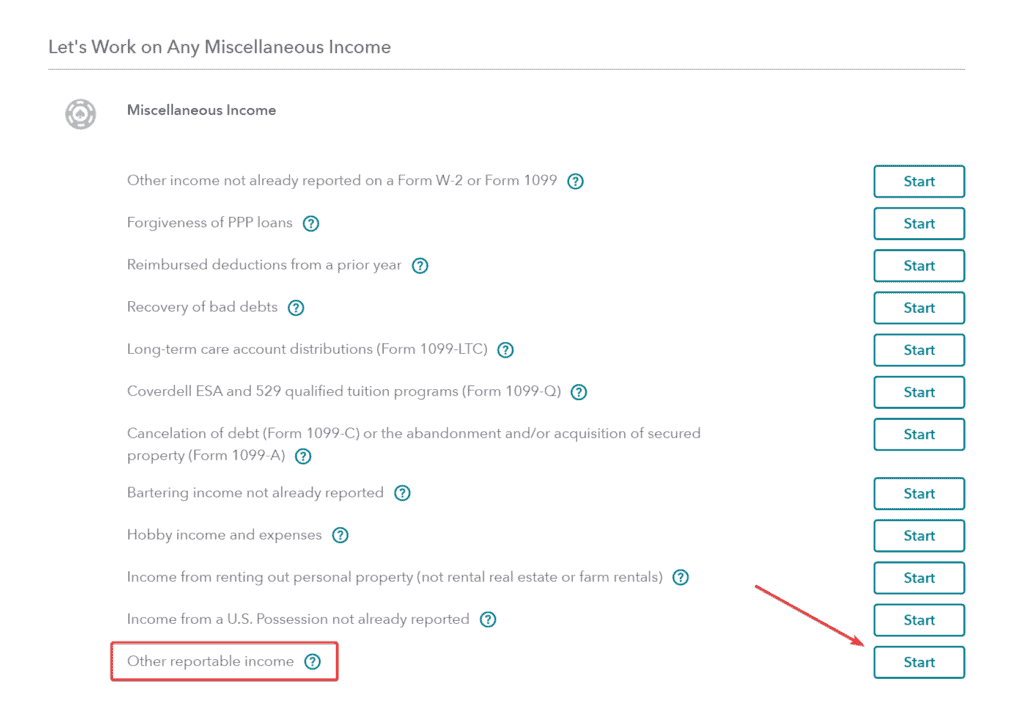

4. Select ‘Other reportable income’

Click the ‘Start‘ button next to ‘Other reportable income‘.

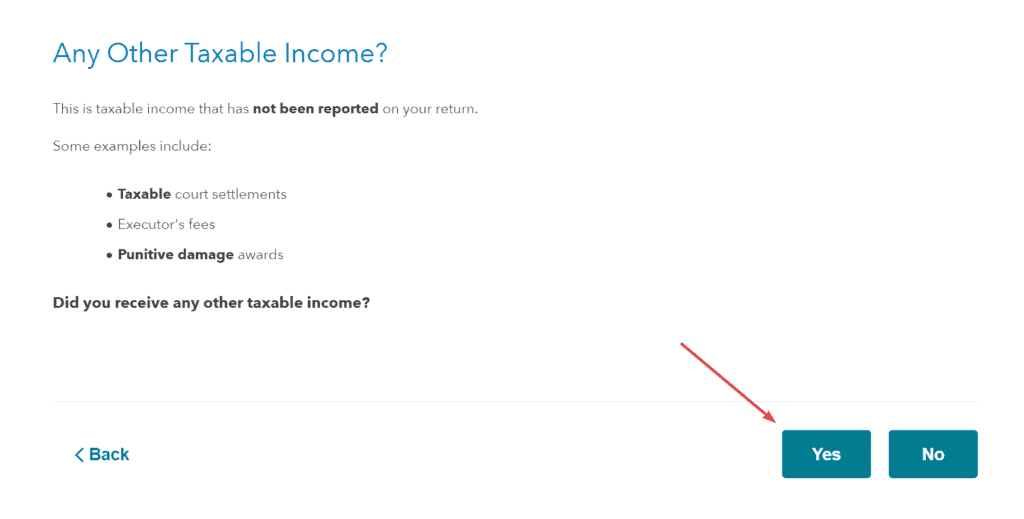

5. Select ‘Yes’ for other taxable income

Select ‘Yes‘ when asked if you have other taxable income.

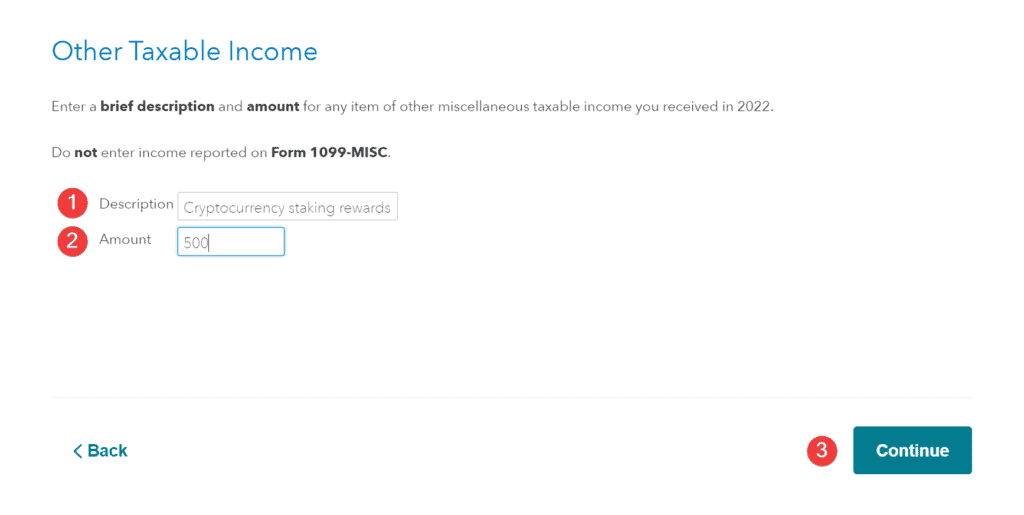

6. Enter your cryptocurrency income

You can now enter all your crypto income on the ‘Other Taxable Income‘ page. We recommend reporting all different cryptocurrency income separately. For example, if you received staking income during 2022, you can enter the description ‘Cryptocurrency staking rewards‘ and the total U.S. dollar amount below.

Click ‘Continue‘ to save and continue.

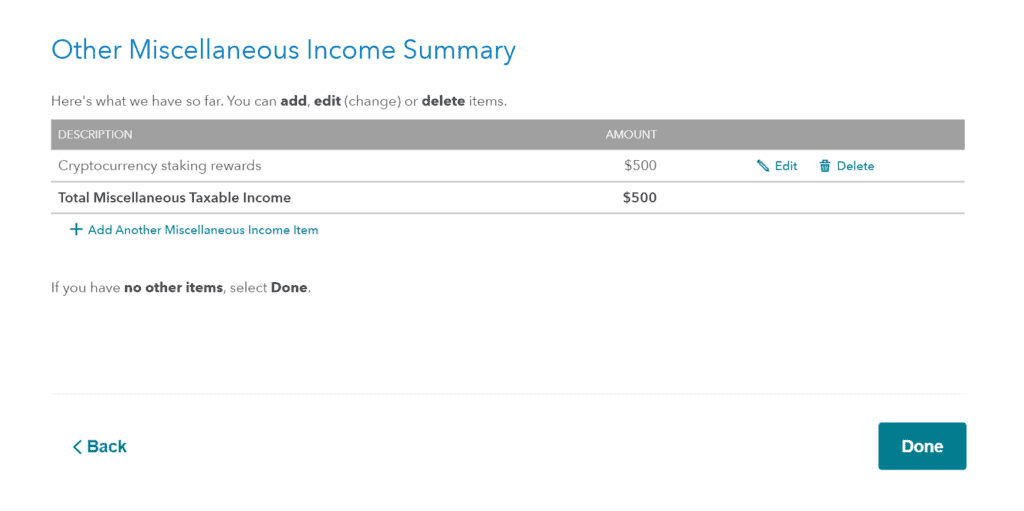

7. Review the reported crypto income

You can now review all the crypto income you have entered into TurboTax. If you want to add different crypto income separately, such as mining, staking, and airdrops, you can click ‘+ Add Another Miscellaneous Income Item‘ and repeat the previous step.

Click ‘Done‘ when you have added all crypto income you received during the tax year.

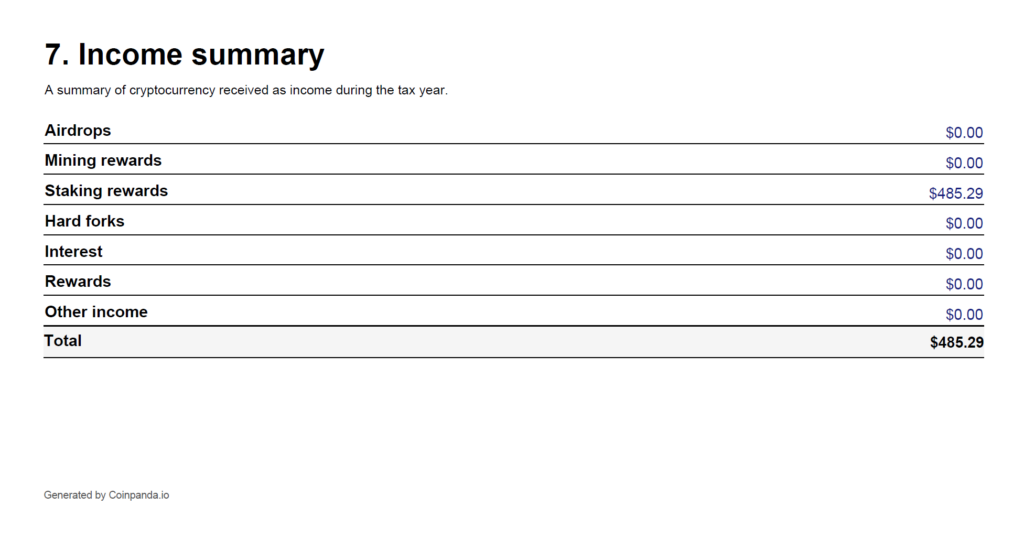

You can export the Complete Tax Report from Coinpanda and view a summary of all income from cryptocurrency in Section 7. Ensure that the income reported in TurboTax matches the income in your Coinpanda tax report unless you have other income transactions not imported into your Coinpanda account.

How do I report crypto losses?

Capital losses from crypto should be reported similarly to capital gains in the ‘Investment and Savings‘ module in TurboTax. You can find this module by logging into your TurboTax account and then navigating to ‘Wages & Income‘ under the ‘Federal‘ tab.

If you have made a net loss from crypto in 2022, you should follow the steps explained in detail in the previous section How to enter crypto into TurboTax Online. Both gains and losses from cryptocurrency are reported together when you enter cryptocurrency in TurboTax.

Remember that documenting losses accurately is vital as they can offset other capital gains you’ve had during the year, potentially lowering your taxable income. You also have the ability to carry forward a portion of these losses to future tax years if the loss exceeds the annual limit defined by the IRS.

Does TurboTax import from Robinhood?

Yes, TurboTax does support direct import of tax data from Robinhood via its crypto platform integration feature. Remember that you must import transactions from all other exchanges and wallets you have used previously in addition to Robinhood to calculate crypto gains and losses accurately.

Let’s look at an example to understand better why this is important.

Assume that you have bought 1 BTC on Kraken in 2022. Later in 2023, you decide to transfer your 1 BTC to Robinhood, and you sell the coins shortly after. After making the sale, Robinhood does not know how much you initially paid (the acquisition cost) for the 1 BTC bought on Kraken earlier. Robinhood will therefore assume a cost basis of zero which results in inflated capital gains, and you will pay more tax than you should.

This example illustrates the importance of using a crypto tax platform such as Coinpanda that will aggregate your entire transaction history from more than 800+ exchanges, blockchains, and wallets, ensuring you don’t pay more tax than necessary.

Does TurboTax import from Binance?

No, TurboTax does not directly integrate with Binance as of July 2023. If you have traded cryptocurrency on Binance, you can instead use a crypto tax calculator to generate a CSV file containing your gains and losses that can be uploaded to TurboTax.

Best crypto tax software for TurboTax in 2023

If you are looking for the best crypto tax software to use with TurboTax, you should consider the following five criteria:

- Number of exchanges and blockchains supported

- The accuracy of imported transactions data

- How user-friendly the platform is

- Functionality for reviewing transactions and fixing missing prices and cost basis

- Customer support and response time

Coinpanda is one of the most popular crypto tax solutions today and meets all criteria listed above. Coinpanda has full integration with both TurboTax online and desktop versions, making it one of the best choices for anyone who needs to report their crypto transactions on TurboTax.

Of course, we might be biased in this opinion, but we truly stand behind our product and the feedback from our users speak for itself, so why not give it a (free) try!

How can Coinpanda help?

Coinpanda is a cryptocurrency tax software that can significantly simplify the process of reporting crypto taxes using TurboTax. The platform can automatically import transaction data from over 800+ exchanges, wallets, and blockchains and fully supports DeFi and NFTs. Coinpanda also allows you to export CSV files you can upload to TurboTax in addition to ready-to-file tax documents for more than 65+ countries.

Sign up for a free account!Frequently asked questions

How do I import crypto transactions into TurboTax?

You can import crypto transactions into TurboTax directly from supported crypto platforms or by uploading a CSV file containing your transaction data.

Does TurboTax calculate capital gains and losses for crypto trades?

Yes, TurboTax calculates capital gains and losses for crypto trades once you input or import the necessary transaction data.

Can I report income from crypto mining or staking in TurboTax?

You can report income from crypto mining or staking in TurboTax as ‘miscellaneous income’, although it isn’t directly categorized as such within the software.

Which crypto platforms are supported by TurboTax for direct import?

As of July 2023, TurboTax supports direct import from a limited number of crypto platforms: Robinhood, Coinbase, Bitstamp, Gemini and Bittrex. For an up-to-date list, check TurboTax’s official website.

What should I do if TurboTax doesn’t support my platform?

If TurboTax doesn’t support your platform, you can manually enter your transactions or use a cryptocurrency tax calculator like Coinpanda to generate a CSV file that you can upload in TurboTax.

Which cryptocurrencies are supported by TurboTax?

TurboTax supports tax calculations for all cryptocurrencies as long as you provide the necessary transaction details. You can also automatically import transactions from the following blockchains: Bitcoin, Litecoin, Bitcoin Cash, Dogecoin, and Ethereum.

Can TurboTax handle DeFi and NFT transactions?

TurboTax can handle DeFi and NFT transactions, but they need to be manually entered or imported via a CSV file since TurboTax does not have direct integrations for these transactions.

How much does TurboTax cost?

TurboTax’s cost varies based on the plan you choose, ranging from a free version for simple tax situations to paid plans between $40-180 for more complex tax needs.

Which TurboTax plan do I need for reporting crypto?

To report crypto on TurboTax, you will need TurboTax Premier or Self-Employed, as these versions support the necessary forms for reporting cryptocurrency transactions.

Is there a limit to the maximum number of transactions supported by TurboTax?

TurboTax has a limit of up to 4,000 transactions for CSV files. If you have more transactions than this in a single tax year, you will need to upload a file with aggregated transactions.