Have you invested in NFTs and now wonder if any loopholes can help you save on taxes?

Although avoiding taxes on NFTs completely is not possible, several strategies exist that can help you save money by reducing your tax bill. In this article, we will explore 7 NFT tax loopholes that you can start doing today!

How do NFT taxes work?

NFTs are considered similar to other cryptocurrencies for tax purposes by the IRS. In most cases, the same tax rules apply to NFTs as other cryptocurrencies including Bitcoin and Ethereum.

This means that, depending on the nature of the transactions, you might need to pay either capital gains or income tax on transactions made during the tax year.

Capital gains tax

NFTs attract capital gains tax if you have made a sale for more than you paid to acquire the NFT initially. This is considered a capital gain and might be categorized as short-term or long-term gain depending on how long you owned the NFT before selling.

On the other hand, if you sell the NFT and it has depreciated in price, you have realized a capital loss that can be used to offset your capital gains.

For US taxpayers, short-term and long-term capital gains must be reported on Form 8949 and summarized on Schedule D of Form 1040. This also includes capital gains from selling or disposing of NFTs during the tax year.

Income tax

Cryptocurrency earned as income is subject to ordinary income tax, including NFT income. Typical examples of NFT income are NFT airdrops and royalties. The taxable income amount is calculated as the fair market value at the time of the transaction.

For more information about how NFTs are taxed, read our complete guide to NFT taxes for 2023.

7 NFT tax loopholes

While the current tax landscape surrounding NFTs can feel confusing due to the lack of clarity from the IRS, we have identified 7 ways you can potentially save thousands of dollars in taxes in 2023.

Buy your NFTs with fiat currency

Buying NFTs with another cryptocurrency may trigger a capital gains tax event if the currency sold has appreciated in value since you bought it. This might especially be the case during a bull market, but there is an alternative to this.

If you buy an NFT with fiat instead of crypto, no capital gains will be realized, and the transaction is completely tax-free since no cryptocurrency has been sold or disposed of.

Although most NFT marketplaces only accept cryptocurrencies such as Ethereum or stablecoins, one way to buy NFTs with fiat would be to convert USD to a stablecoin using an on-off ramp (such as Coinbase, Kraken, and Bitfinex) and then transfer the stablecoins to your crypto wallet of choice.

Track relevant costs and gas fees

Since NFT sales are treated similarly to the disposal of ordinary cryptocurrency, all associated gas fees and costs are fully deductible. There are two ways you can take advantage of this:

- Buying NFTs: gas fees and costs can be added to the cost basis

- Selling NFTs: gas fees and costs can be subtracted from your sales proceeds

In both cases, the fees become fully deductible from your resulting capital gains.

You can use a crypto tax calculator like Coinpanda to automate your NFT tax reporting which will ensure that all gas fees become fully deductible.

Hold your NFTs for 12 months before selling

Capital gains from selling or disposing of NFTs are considered either short-term or long-term capital gains. While short-term gains are taxed at the same rate as your ordinary income, long-term capital gains are subject to much more favorable tax rates.

In 2023, the long-term capital gains rate ranges between 0-20%. The applicable tax rate depends on which income tax bracket you fall under.

Dispose of your NFT in a low-income year

Since the applicable capital gains tax rates depend on your income during the tax year, one tax-saving strategy is to sell your NFTs in a year when your income is lower.

Although you can’t always predict what your income will be in a future year, some possible scenarios could still be if you are planning on taking time off work for various reasons, changing jobs, or going to university to study.

NFT tax-loss harvesting

Crypto tax-loss harvesting lets you realize cryptocurrencies, including NFTs, that are currently underwater and the realized loss can be used to offset other capital gains.

Not only can realized losses completely offset your capital gains, but you can also offset up to $3,000 of ordinary income annually. If you still have unused losses after this, you can luckily carry forward those losses to future years.

Currently, the wash sale rule that applies to stocks and equities in the US does not apply to cryptocurrencies. You can safely buy back the cryptocurrency or NFT shortly after selling if you want to maintain ownership and still claim the loss, although this might change later if the wash sale rules become applicable also to cryptocurrencies.

Gift an NFT to friends or family

You can gift NFTs to friends or family without triggering a taxable event in most cases. This might be something to consider if you struggle to come up with ideas for birthday or Christmas gifts – and hopefully, the NFT won’t become worthless before it reaches the new owner!

Remember that if you gift an NFT worth more than $16,000 at the time of gifting, the IRS requires you to complete a gift tax return as documentation.

Use NFTs as loan collateral

Several platforms exist today that let you use NFTs as collateral for taking out a crypto loan, such as NFTfi and Arcade. The biggest advantage to this is that you can access more liquidity without realizing any capital gains in the process.

Although there are inherent risks with using NFTs as collateral given their volatile nature, and not to mention that you must pay interest on the loans, it could still offer tax-strategic advantages if done right.

How to report NFT taxes

Have you bought, sold, or traded NFTs and are not sure how to report your NFT taxes accurately?

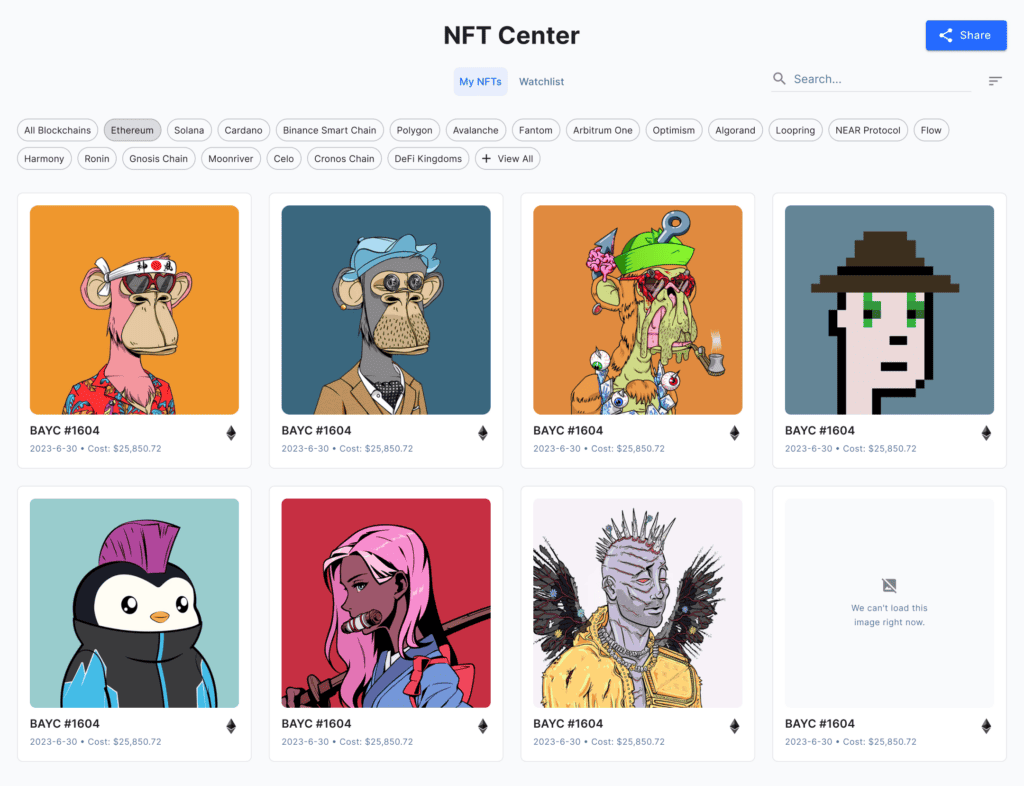

The solution is Coinpanda – a crypto tax calculator specifically built for handling the complexity of NFT taxes. You can import NFT transactions from over 80 blockchains including Ethereum, Cardano, Solana, Algorand, and most other EVM blockchains such as Avalanche, Optimism, and Arbitrum.

To get started, sign up for a free account and connect all your exchange accounts and wallet addresses securely. Next, Coinpanda will import your transactions automatically from API and do all the required calculations while you sit back and wait.

After a few minutes, you can view all your realized gains and losses for the NFTs you have sold or traded.

Coinpanda also lets you view the unrealized gains and losses of the NFTs in your current portfolio. By taking advantage of crypto tax-loss harvesting, Coinpanda can help you save a lot of money by claiming unrealized losses on your NFTs!

Sign up for a free account!